“Swap termination” would amount to one-third of city’s 2012 budget

Massive lay-offs, severe wage cuts, gutting of city services, drastic increases in water rates, taxes, and sale of assets likely under EM

By Diane Bukowski

December 19, 2011

DETROIT – According to reports from Moody’s and Fitch bond ratings services, banks plan to rob Detroit of $400 million, one-third of its 2012 budget, if an emergency manager is installed by Michigan Governor Rick Snyder.

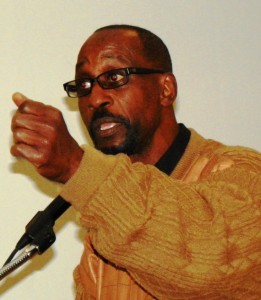

(Center) Stephen Murphy of Standard and Poor's and Joe O'Keefe of Fitch Ratings are flanked by then Detroit CFO Sean Werdlow (l) and Deputy Mayor Anthony Adams in 2005 as they bludgeon City Council into borrowing $1.5 billion in pension obligation certificates, a debt that is repeatedly coming back to haunt Detroit.

“The state appointment of an emergency manager would in turn trigger a termination event [default] under the city’s swap agreements,” Moody’s said Dec. 13. The “swap agreements” relate to $1.5 billion in pension obligation certificates the city borrowed in 2005 during the Kwame Kilpatrick administration, from Zurich-based UBS AG and New York’s Siebert Brandford Shank & Co. (SBS).

The city defaulted once before on that debt, in 2009. Then Mayor Ken Cockrel’s administration forestalled a likely bankruptcy by agreeing to have Detroit’s casino taxes go directly to a bank trustee to ensure payment of the debt. A trustee was already overseeing its revenue-sharing taxes.

MGM Grand, one of Detroit's three casinos; a bank trustee rakes in all of Detroit's casino tax revenues to ensure debt pay-off.

Detroit’s Channel 7 interviewed Pat O’Keefe, of O’Keefe and Associates (see video above.)

“Since they [Detroit] have been struggling for so long,” O’Keefe said, “they have a number of bond agreements that cause acceleration in some of the debts if an emergency financial manager is appointed. As a consequence it is almost a self-fulfilling prophecy that will cause the city of Detroit to continue to hemorrhage even more cash because of the accelerated payments on some of these bonds.”

Wall Street is not waiting for an emergency manager, however, to shake Detroit down.

On Dec. 15, it raked in $211.6 million on a water bond sale of $484 million, according to the Wall Street Journal (click on Detroit Sells Muni Bonds at a Price WSJ, 12/15/11 and on http://dwsdupdate.blogspot.com/2011/12/emergency-financial-manager-appointment.html for more complete information).

The ratings agencies said Detroit Water and Sewerage Department (DWSD) bonds, which previously had up to AAA ratings, are under scrutiny because DWSD belongs to the city. They said buyers were more willing to invest in the bonds after U.S. District Court Judge Sean Cox’s November 11 decision severing much of Detroit’s control over the DWSD, but only at a hefty price.

What does this mean for the people of Detroit, the largest majority-Black city in the world outside of Africa, and the country’s poorest city? What are the implications for its its surrounding suburbs?

First of all, the water bond sale portends a hefty increase in water rates for one-third of Michigan’s population, which is served by DWSD, and more shut-offs for those who cannot afford them, this spring. Further lay-offs and service cutbacks will also result.

Since the Board of Water Commissioners, newly reconstituted under a consent agreement with Cox in February, must have a supermajority of its seven votes to approve rates and contracts, its three suburban representatives have veto power over both.

The chair of the BOWC is James Fausone, who is already connected with a waste-to-energy conversion contractor like Synagro. It is likely that other Commissioners will hand out more costly private contracts to their friends, further depleting DWSD funds and putting the burden on its customers. (Click on http://voiceofdetroit.net/2011/11/10/cox-axes-detroiters-control-over-water-department/ for further information.)

Cutting one-third of Detroit’s budget of more than $1.2 billion is virtually unimaginable.

According to the Crain’s article cited earlier, the city administration had great difficulty getting its creditors to agree to take control of its casino tax revenues instead of calling in $4oo million then.

French demonstrators march against pension cutbacks earlier this year; Fitch just downgraded France's bond ratings as well.

Where will they turn now to avoid economic disaster? The city’s pension funds, worth $6 billion, are likely the first target, low-hanging fruit for UBS and SBS. Mayor Bing earlier targeted them for a takeover by the Municipal Employees Retirement System, based in Lansing.

Faced with similar economic distress, other municipalities and companies have eliminated health benefits for retirees, and in the case of bankruptcy, even halved their pensions, a solution the city of Vallejo, California resorted to. (Click on http://www.huffingtonpost.com/2011/01/31/vallejo-bankruptcy_n_816060.html for complete information.)

If an emergency manager takes over, he would also have the power to sell DWSD, the third largest water and sewerage system in the county, lock, stock and barrel. (Click on dwsd_fact_sheet[1] for complete description of DWSD assets.)

Pontiac’s emergency manager Louis Schimmel just put on the auction block 11 water-pump stations, five fire stations, the public library, the police station, two community centers, two landfills, and two cemeteries.

Schimmel told Kathleen Gray of the Detroit Free Press that because he is required to hold a public hearing anytime the city has assets to sell, he might as well put everything on the list. No one showed up for the public hearing he held Dec. 20.

“We just want the option,” the Free Press quoted Schimmel. “We don’t want to come back piece by piece.”

Fitch Ratings put the city between a rock and a hard place, squarely on the back of its workers and residents, many of whom already live below the poverty level.

Fitch red flagged the movement to repeal Public Act 4, which has gained steam since Snyder began a state financial review Dec. 6, the first step in the appointment of an EM. As noted in the article above, a Jan. 2 town hall meeting in Detroit has been called by City Councilwoman JoAnn Watson and U.S. Representatives John Conyers and Hansen Clarke, which will focus on ramping up the signature-gathering.

“If Act 4 is suspended, avenues for addressing the city’s financial difficulties in the near term will narrow,” Fitch said, indicating that it will not let up on its ratings war against Detroit no matter which route is taken.

The need for a massive fightback by working and poor people against the reign of the nation’s banks over basic needs like water, food, housing, utilities and jobs is now more than ever glaringly apparent.