Council vote expected April 2 or 9; body’s last chance to stand up for Detroit, espouse Dr. Martin Luther King, Jr.’s dream

Major federal lawsuit against new EM Act 436 filed March 28 as protesters march, occupy Coleman A. Young Municipal Centr.

By Diane Bukowski

March 31, 2013

Dr. Martin Luther King leads freedom march in Detroit, 1963. It was the first time he gave his “I Have a Dream” speech.

DETROIT – Detroit’s City Council has one last chance to stand up for the people against the bankers’ seizure of the country’s largest and poorest Black majority city March 25.

They blew earlier chances nearly a year ago April 4, 2012, the anniversary of Dr. Martin Luther King’s assassination, with the 5-4 passage of a disastrous consent agreement. Most recently the Council failed to pursue its legal right to challenge Michigan Gov. Rick Snyder’s appointment of Emergency Manager Kevyn Orr in court.

Now, Council President Pro-Tem Gary Brown is pushing for the Council to approve a contract with Orr’s previous employer, the Jones Day law firm, according to inside sources. He wants the Council to vote Tuesday, April 2 at its regular session, but the vote may be delayed until April 9.

Snyder and Detroit Mayor Dave Bing tapped Jones Day, the world’s third largest law firm, to become the city’s “re-structuring counsel” under newly-minted Public Act 436. Orr worked for the firm from 1984 until his alleged resignation to take over as EM.

“I look forward to meeting [Orr] sometime today and talking about . . . how do we reduce crime in the city of Detroit,” Brown told WWJ radio March 25, the day Orr took office in the Coleman A. Young Center next to Detroit Mayor Dave Bing. Bing refused to fight the EM appointment. Orr’s spokeman is William Nowling, a former campaign aide to Snyder.

Brown did not address what may be the biggest crime in Detroit’s history. That crime will reap huge profits for Jones Day and its client banks, which hold most of the City of Detroit’s $16.9 billion debt, a key factor cited in the takeover.

These include UBS AG, which just paid a $1.5 billion fine to the U.S. Department of Justice for interest-rate rigging, Citigroup, which just settled another lawsuit brought by cities and pension funds for $730 million, Goldman Sachs, Bank of America’s Merrill Lynch, and Muriel Siebert and Co., an affiliate of the SBS Financial Group. Their role is confirmed by debt documents obtained through a Freedom of Information Act request by the Moratorium NOW! Coalition, and postings on the Jones Day website.

Debt documents are available at https://docs.google.com/folder/d/0BwEVDvudxHBTX1lMcXFLdzNOSEU/edit?usp=sharing&pli=1

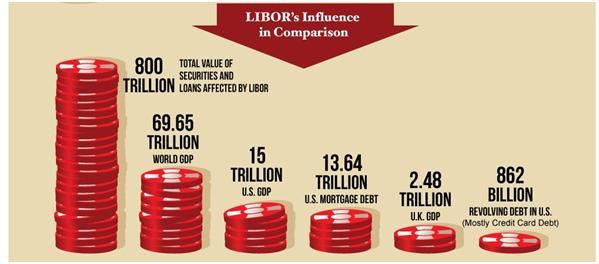

Most of the banks are also defendants in lawsuits world-wide brought by cities, states and investors, which claim they manipulated the “London Interbank-Offered Rate” (LIBOR), to increase their profits while defrauding public and private investors. It is estimated that $800 to $1000 TRILLION worth of securities and loans were affected.

“A lawyer shall not represent a client if the representation of that client will be directly adverse to another client . . .” say the Michigan Rules of Professional Conduct, section 1.7(a), Conflict of Interest.

Attorney Jerome Goldberg of The Moratorium NOW Coalition Against Foreclosures, Evictions, and Utility Shut-offs earlier said that the role of Jones Day clients in Detroit’s economic collapse is indeed “directly adverse” to that of Detroit’s people.

“[Michigan State Treasurer Andy] Dillon is fully aware of the real basis for the city’s deficit,” Goldberg said. “He and the city’s first financial review team concluded that without interest payments to the banks, the city would have more than enough revenue to fund its expenses. Their report showed the city owes a total debt of over $16.9 billion, with $4.9 billion in interest. The banks’ fraudulent lending procedures, including a $1.5 billion pension obligation certificates (POC) loan [by UBS AG and SBS] in 2004, forced the city to pay an additional $1 billion to hedge funds for betting the wrong on which way interest rates would go.”

Goldberg said that money should be spent instead on the people of Detroit, including jobs, affordable housing, street lighting and other services. He called for the city to declare a moratorium on its debt payments, an action which working and poor people across the globe have demanded, protesting by the millions, as banks exact draconian austerity measures.

Opponents including the Rev. Al Sharpton of the National Action Network filed a federal lawsuit against PA 436 March 27, which if successful would negate Orr’s appointment and that of other EM’s, almost exclusively in Michigan’s majority Black cities. The lawsuit says PA 436 is returning African-Americans in the state to virtual conditions of slavery. It cites discrimination based on race and wealth, and violations of the National Voting Rights Act and the 13th and 14th Amendments guaranteeing due process. (See separate article on lawsuit. Click on EM lawsuit 3 27 13 for full text.)

Over 200 protesters then marched on the federal court building in downtown Detroit, and occupied the Coleman A. Young Municipal Center for two hours demanding to meeting with Orr.

“We are fighting for our children, we shall not be moved, just like a tree that’s standing b the water, we shall not be moved,” the occupiers sang. Sharpton promised that thousands more will descend on the city after NAN’s national conference next week.

“There will be a threat to everyone in this nation if the emergency manager in Detroit stands,” Sharpton said. “If they get away with it in Detroit, they can do it all over the country. . . . This is not a march, it is a walk to file a lawsuit. When we march, there will be thousands. We will engage in non-violent civil disobedience, and fight until this is overturned. . .”

Meanwhile, Gov. Snyder and Wall Street ratings agencies celebrated the takeover.

“Moody’s Rating Service today announced that it has revised the State of Michigan’s Rating Outlook for all bonds to Positive from Stable,” a March 28 release from State Treasurer Andy Dillon’s office said. “Moody’s also affirmed Michigan’s General Obligation Credit Rating of “Aa2.”

Snyder and Dillon met with all three ratings agencies in New York the previous week, according to the release.

“This is great news for Michigan, on the heels of our recent visit and on-going discussions with credit rating agencies,” Snyder said. “We have been optimistic that Wall Street would recognize all of the hard work we have put in, to get Michigan’s fiscal house in order. This is yet another sign that Michigan is the comeback state.”

The release added, “Earlier this month, Moody’s indicated that expanded oversight of Detroit’s finances by Emergency Manager Kevyn Orr under Public Act 436 of 2012 would ‘help expedite the city’s progress towards financial and operational stability.’ . . . The EM’s ability to amend the current year budget…could be a first step toward imposing fiscal stability and improving the city’s illiquid cash position.”

Standard and Poor’s, which is facing a $5 billion fraud lawsuit by the U.S. Department of Justice, chimed in earlier.

“The appointment of an (emergency manager) allows the city to move forward in a more efficient manner, continuing to make the types of adjustments necessary to regain structural balance,” S&P credit analyst Jane Hudson Ridley said in a statement.

Standard & Poor’s, banks responsible for “predatory lending” to Detroit.. Here Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard and Poor;s (center) press UBS $1.5 billion debt on City Council Jan. 31, 2004.

Meanwhile, however, S&P is keeping Detroit’s general obligation debt at junk level, citing budget deficits, cash-flow problems, and long-term liabilities including pension and retiree health benefits. Amazingly, they also mentioned potential payments on interest rate swaps. Ironically, keeping Detroit’s ratings downgraded provides more interest for the banks on new loans.

Representatives of S&P and Fitch Ratings pressed for the UBS AG $1.5 billion POC loan at the City Council table in 2004, despite objections from residents, pension board and union leaders that the loan represented tremendous risk if the market “went south,” as it indeed did in 2008.

In addition to their role in representing criminal banks, Jones Day represents clients far right wing clients opposed to Voting Rights Act, contraception, and corporate regulation, and the major media, including McClatchy, which owns the Detroit News and Detroit Free Press. They are one of the major law firms which represented the tobacco industry against the states in a 1998 master settlement agreement, and continues to pursue action on their behalf to diminish payments under that agreement. (For details on these issues, click on http://voiceofdetroit.net/2013/03/27/detroiters-march-in-cleveland-tell-jones-day-and-banks-get-out/.)

For history of the disastrous $1.5 billion pension bond deal, written largely by this author in the pages of the Michigan Citizen, click on Pension bond stories MC.

Pingback: Voice of Detroit requests investigation by US Dept. of Justice, no response yet » Cancel Detroit’s Debt To The Banks!