Detroit’s Mayor Wants Union Pay Cuts, Layoffs: MyFoxDETROIT.com

Mayor Bing uses shadowy E & Y report to demand city cutbacks

CUT DEBT TO THE BANKS, NOT WORKERS AND SERVICES!

By Diane Bukowski

November 14, 2011

DETROIT – Ernst & Young, author of the secret report on Detroit’s finances that Mayor Dave Bing is brandishing like a cudgel over the heads of workers and residents, faces lawsuits by the states of New York and New Jersey for actively helping Lehman Brothers cook their books over a seven year period.

Lehman, worth $600 billion, collapsed in 2008 in the largest bankruptcy filing in U.S. history. Its collapse was a key factor in the Wall Street’s subprime mortgage meltdown.

Despite Ernst & Young’s reputation, Bing is demanding heavy concessions from city workers and residents, after meeting in an illegal secret session with the entire City Council Oct. 26 to discuss the firm’s report. He plans to address the city as a whole about city finances Nov. 16 at 6 p.m. at the Northwest Activities Center.

Mayor Dave Bing listens approvingly to Wayne County Executive Robert Ficano discussing cutbacks during interview at 2009 Mackinac Island conference

Bing met with leaders of the city’s 40 plus union s Nov. 8 and gave them a two week deadline to comply with his demands.

Leamon Wilson, president of Local 312 of the American Federation of State, County and Municipal Employees (AFSCME), said Bing specifically refused to give union leaders at the meeting the Ernst & Young report.

“He said the city will be broke by late April and he wants to cut $64 million,” Wilson reported. “He wants to eliminate furlough days and instead institute a 10 percent pay cut, replace overtime with straight time, get rid of the pension multiplier, totally privatize maintenance at DDOT, and lay-off 1000 workers. He ended the meeting with only four questions from us. He also said he doesn’t want to be the city’s emergency manager, that he was elected to be Mayor.”

Regarding Bing’s stance on becoming Detroit’s EM, Nolan Finley of the Detroit News commented Nov. 13, “The emergency manager law allows for public officials to ask for a consent agreement from the state that bestows on them certain powers of a state-appointed manager, without surrendering local control. That includes the ability to revise contracts to reduce budget-busting pension and health care obligations.”

Bing additionally demanded that city workers pay 30 percent of the cost of their health care, up 10 percent, saying the cuts in total would result in $118 million annually in savings. (Click on BINGS-UNION-DISCUSSION-POINTS[1] for copy of document Bing gave to the union leaders.)

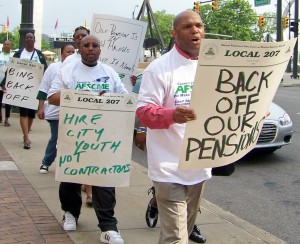

Union leaders left the meeting enraged.

Al Garrett, president of Michigan AFSCME Council 25, said, “Cuts and more cuts and more cuts, with little regret for the families of those who work for the city! At the end of the day he is saying your jobs still won’t be safe, but while you’re waiting to become unemployed, you’re going to make less, pay more for your health care, and decimate whatever pensions you’re going to get, and that’s life in Detroit.”

The Oct. 26 City Council agenda says the closed session on the Ernst & Young report was held to “discuss a privileged and confidential memo submitted by the Law Department dated October 21, 2011 entitled Report by Ernst & Young, LLP, Concerning the City of Detroit’s Cash Flow Analysis in the General Fund Area Beginning May 1, 2011 through August 26, 2011 as it Relates to the Emergency Financial Manager Legislation Otherwise Known as ‘The Local Government and School District Fiscal Accountability Act.’”

Council Pres. Pro-tem Gary Brown, Member Saunteel Jenkins, Pres. Charles Pugh; all have endorsed worker cuts

On the same day, the Council held another closed session to discuss another “privileged and confidential” matter: “The Necessity of Emergency Procurement for the Detroit Public Lighting Department for the Installation of New Lighting and Repair of the Grid System.” It later voted 5-4 for a three-quarter million dollar contract with DTE to fix 500 street lights out of 12,000 that are out.

The Council has also scheduled a Nov. 16 closed session “to discuss privileged and confidential legal opinions submitted by RAD and the Law Department entitled (1) Legal Rationale for Proposed Amendment of the Privatization Ordinance dated October 26, 2011; (2) City of Detroit Privatization Ordinance dated October 3, 2011; and (3) Documents Supporting the Proposed Ordinance to Amend Article V, Chapter 18 of the 1984 Detroit City Code, Finance and Taxation, Purchased and Supplies, Division 8, Privatization of Certain City Services, commonly known as the “Privatization Ordinance.”

Closed sessions of bodies like the City Council, by state statute, are narrowly limited to discussions of matters like lawsuits.

All Council members were contacted for their response on whether they voted for the secret session on the Ernst & Young report, whether they believed it was legal, and their stance on Bing’s demands to the unions. No council members had responded by press time.

The Voice of Detroit and the Detroit Free Press have filed Freedom of Information Act requests for the Ernst & Young report, which cost $1.7 million of taxpayer funds, with the city’s Law Department.

VOD also contacted Ernst & Young’s media director Charles Perkins for comment on the New York and New Jersey lawsuits, with no response before press time.

New York Attorney General Andrew Cuomo filed that state’s suit against Ernst & Young in December, 2010.

WPP CEO Sir Martin Sorrell gestures next to Ernst & Young CEO and chairman James S. Turley during a session untitled "What Is the New Economic Reality?" on the opening day of the World Economic Forum annual meeting on January 26, 2011 in Davos. AFP PHOTO / FABRICE COFFRINI)

In a release, he said Ernst & Young engaged in accounting fraud for seven years, explicitly approving the surreptitious removal of tens of billions of dollars in liabilities from Lehman’s balance sheet, transferring it temporarily to overseas banks, in order to deceive the public and the market about the company’s true financial condition.

“This practice was a house-of-cards business model designed to hide billions in liabilities in the years before Lehman collapsed,” Cuomo said in a release. “Just as troubling, a global accounting firm, tasked with auditing Lehman’s financial statements, helped hide this crucial information from the investing public. Our lawsuit seeks to recover the fees collected by Ernst & Young while it was supposed to be using accountable, honest measures to protect the public.”

(Click on http://www.ag.ny.gov/media_center/2010/dec/dec21a_10.html for copy of full statement. Click on www.ag.ny.gov/media_center/2010/dec/ErnstYoungComplaint.pdf. for copy of lawsuit.)

The Wall Street Journal reported in October, 2010 that the state of New Jersey had re-instituted legal action against the company.

“New Jersey’s investment division, which manages pension- and retirement-plan funds for over 700,000 state workers, including teachers, police and firemen, pumped $385 million into Lehman, purchasing a combination of stock and notes from the investment bank before its collapse,” said the WSJ. It said New Jersey lost $192 million on its Lehman investment.

“[Ernst & Young’s] review reports were false, as E&Y knew or should have known that Lehman’s quarterly financial statements were not prepared in accordance with ‘generally accepted accounting principles,’” the WSJ quotes from the suit. “E&Y had no reasonable basis for issuing its clean audit and review reports.”

One of the Big Four accounting firms, Ernst & Young is headquartered in London, UK, and has member companies in over 140 countries, with global revenues of $22.9 billion. In 2010, Forbes magazine ranked it as the ninth largest private company in the U.S.

It has offices all over the world, including one on Wall Street and a spanking brand new green glass building glowering over downtown Detroit.

It is part of the global cabal of banks, mortgage companies and professional services firms which created the current economic crisis. They are now demanding that workers and poor people suffer for their actions.

Crains’ Detroit Business reported from an interview with the City Council’s fiscal analyst Irvin Corley in April of this year that the city cannot borrow more money to shore up its finances.

“The city can’t fund its deficit with borrowed money,” Corley said according to the article. “Detroit’s low credit rating makes short-term borrowing too expensive, long-term borrowing would require state legislation, and the city lacks a revenue stream to pledge as security for another bond sale.”

In June, Fitch Ratings downgraded Detroit’s Unlimited General Obligation bonds to BB- and its Limited General Obligation Bonds to B+, “outlook negative.” (Click on Fitch Downgrades Detroit bond ratings June 2011 for full report. It states essentially that Detroit’s decline was caused by the national economic crisis, which of course in turn was caused by Lehman Bros., Ernst & Young, Fitch Ratings, et. al.)

Among other reasons Fitch cited for the downgrade:

“The debt burden is exceptionally high, offset somewhat by a sizable amount of pension obligation bonds that result in well-funded pension plans.” Detroit borrowed $1.2 BILLION in pension obligation bonds in 2006. How that debt “offsets” the city’s other debt remains to be seen.

(L to r) Detroit CFO Sean Werdlow, Stephen Murphy of Standard & Poors, Joe O'Keefe of Fitch, and Deputy Mayor Saul Green urge City Countil to borrow $1.2 billion in pension bonds in 2006

Ironically, Fitch representative Joe O’Keefe recommended in 2006 that Detroit borrow that money, despite heavy opposition from some City Council members, who had to be forced to the table by police to make up a quorum.

At the time, O’Keefe said Fitch rated the city “A,” with a negative outlook if the city did not enact lay-offs and service cutbacks to deal with a $300 million budget deficit.

The Kwame Kilpatrick administration and the City Council borrowed the money. In 2009, the lender, UBS Financial Services, called in the debt, which would have caused total economic collapse in Detroit. The lender, among whose agents was former Mayor Dennis Archer, compromised by agreeing that bank trustees would directly receive Detroit’s casino tax revenues and state-revenue sharing funds so that the $1.2 billion debt would be paid before all else.

Therefore, according to recent reports, half of the city’s vendors, including those who supply parts for its buses, are going unpaid, and the city is threatening payless paydays for its workers.

According to Detroit’s 2010 Comprehensive Annual Financial Report, the city’s total debt is approximately $7.7 billion, including the $1.2 billion pension obligation certificates.

Also according to the 2010 CAFR the city was scheduled to pay a total of $433,691,964 in debt to the banks in 2011. Of that, $216,418,043 was to be in interest alone. THE INTEREST ALONE IS FAR GREATER THAN THE CITY’S DEFICIT!

The U.S. government has bailed out the banks to the tune of trillions of dollars–time for the banks to put their heads on the chopping block, not the workers and people of Detroit.