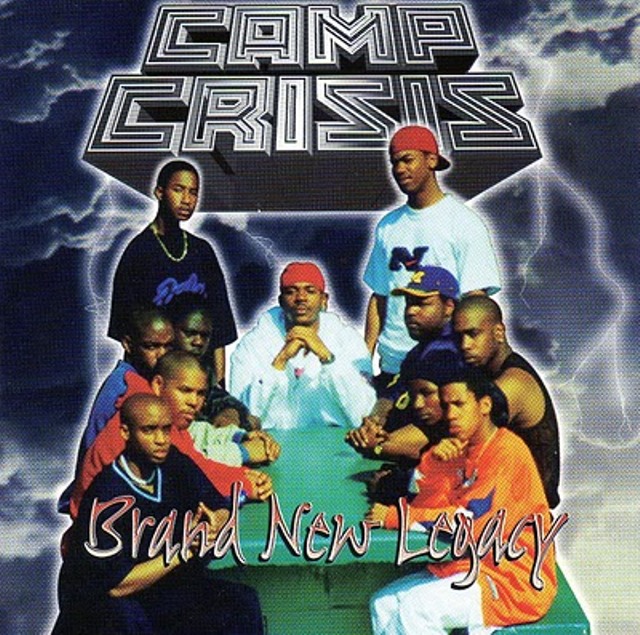

Stockton, CA group Brand New Legacy's 1999 album is apropos of the situation for the city's Black population

Posted: 02/29/12 02:37 AM ET | Updated: 02/29/12 08:42 AM ET

By Jim Christie

SAN FRANCISCO, Feb 28 (Reuters) – Stockton, California’s city council approved a plan late on Tuesday night for the city to skip some bond payments in an effort to restructure its precarious finances and avoid becoming the biggest U.S. city to file for bankruptcy.

Along with defaulting on about $2 million of debt payments through the end of its current fiscal year, the city located about 85 miles east of San Francisco will seek mediation with its major bond holders to try to get a break on its debt to help tackle a budget gap projected to range from $20 million to $38 million.

A state law approved after Vallejo, California’s 2008 bankruptcy requires negotiations in front of a mediator that could last up to 90 days with creditors, bond insurers, public employee unions and retired government employees before a local government can file for bankruptcy.

While Stockton officials say they hope to avert bankruptcy, the city of 292,000 people in California’s Central Valley has hired an attorney who represented much smaller Vallejo, which drew national attention to financial problems of local governments in the most populous U.S. state.

Stockton’s attorney, Marc Levinson, said mediation could keep the city from following in Vallejo’s footsteps and suffering the stigma of bankruptcy.

“This is really the city’s last and best chance to avoid a bankruptcy case,” Levinson said.

But Stockton residents who have seen hard times grip their city in recent years are bracing for the possibility it will land in bankruptcy court despite its financial restructuring plan.

“That’s the end of the plank – and we’re on that plank,” 68-year Stockton resident Rosalio Estrada told Reuters.

Stockton has long been a commercial hub for California’s rich agricultural industry and during the state’s recent housing boom the city became an affordable bedroom community for the San Francisco Bay area.

But the housing downturn devastated Stockton’s economy, sending local unemployment and foreclosure rates soaring and the city’s revenue tumbling, forcing local officials to slash spending and city payrolls.

Stockton’s finances have also been hurt by two decades of poor management, generous retirement benefits for city workers, unsustainable labor contracts and too much debt, said City Manager Bob Deis, who last week made public the default and mediation plan.

Deis said Stockton can neither afford more cuts to its services to save money nor raise revenue with tax increases due to the city’s weak economy, leaving the city little option but to ask its major bond holders for a break on some its debt.

Wall Street reacted swiftly to Deis’ default plan by cutting Stockton’s credit rating.

Moody’s Investors Service on Friday lowered Stockton, California’s general fund-supported debt ratings to below investment grade, a move affecting about $341 million in debt, and Standard & Poor’s Ratings Services cut its issuer credit rating on the city to speculative grade.

Fitch Ratings on Monday downgraded by several notches its underlying ratings on four series of Stockton Public Finance Authority water revenue bonds, leaving each at BBB-, the firm’s lowest investment grade rating. Fitch does not rate the city.

Investors holding Stockton’s bonds subject to default – variable-rate debt and two series of lease-revenue bonds – would still receive some payment as the debt is largely insured or can be paid from a reserve fund.

Even so, Moody’s said in a note that by suspending debt payments Stockton would show a “significantly reduced willingness, if not ability, to make full and timely debt service payments.”

Stockton officials may be using default and talk of bankruptcy to try to wring concessions from city labor units to further cut expenses, said Matt Dalton, chief executive of Belle Haven Investments in White Plains, New York, which has more than $1 billion in municipal bond assets under management.

“They need to fire a shot across the bow so that everybody knows they’re serious,” Dalton said.

Neil Hokanson of Hokanson Associates, a wealth management firm in Solana Beach, California that oversees about $420 million in assets, doubts Stockton is angling for an advantage because the city’s economy is in the dumps.

Nearly one in five Stockton residents live below the poverty level, according to the U.S. Census Bureau, and the city’s unemployment rate in December was 15.9 percent, down from 18.1 percent a year-earlier but well above the national average of 8.3 percent and California’s lofty 10.9 percent that month.

“It’s not just gamesmanship. I think their hand is really being forced,” Hokanson said. (Reporting By Jim Christie; Editing by Eric Walsh)

you’re a good webmaster. The site packing velocity is amazing. It seems that you do any distinctive strategy. In addition, Your contents tend to be masterpiece. you have done a magnificent task on this matter!