Orr wants $11 million a month released; about $170 million a year

Moratorium NOW, Voice of Detroit calling instead for cancellation of predatory billions in related debt to UBS AG and BOA

Sign petition to Justice Dept. for investigation of predatory UBS AG $1.5 billion POC loan

By Diane Bukowski

July 6, 2013

DETROIT — Detroit Emergency Manager Kevyn Orr trumpeted July 5 that the city has won a “temporary restraining order” forcing U.S. Bank NA to release $11 million a month in casino taxes. According to the Wall Street Journal, this is part of his strategy to negotiate a deal with UBS AG and Bank of America Merrill Lynch to pay them 70 cents on the dollar for a related $340 million secured loan. Orr thus left the impression that he is going to war against the banks, at the same time he is attacking the city’s pension funds and other assets worth billions more.

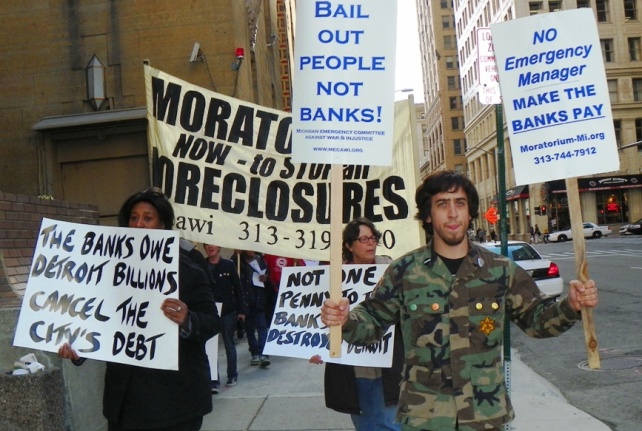

The Moratorium NOW Coalition and the Voice of Detroit are calling instead for the complete cancellation of the related $1.5 BILLION pension obligation certificates (POC) loan from UBS AG and Siebert, Brandford and Shank brokered in 2005 by the city, plus billions more in penalties, swap agreements including those with BOA, and Wall Street ratings downgrades.

Wayne County Circuit Court Judge Annette Berry temporarily granted the city’s request for release of the casino taxes during a hearing July 5. She ordered that US Bank NA’s insurer Syncora must “show cause” at a hearing July 26 before Judge Jeanne Stempien why the injunction should not become permanent.

“Syncora was interfering with the city’s ability to restructure,” emergency manager Orr said in published remarks. The city’s lawsuit says, “Syncora has asserted rights it does not have over collateral it does not need for the purpose of holding the City hostage for ransom.”

“Syncora was interfering with the city’s ability to restructure,” emergency manager Orr said in published remarks. The city’s lawsuit says, “Syncora has asserted rights it does not have over collateral it does not need for the purpose of holding the City hostage for ransom.”

The Wall Street Journal reported July 5, “The city sees the insurer as a roadblock to a proposed deal to pay UBS AG and Bank of America Merrill Lynch more than 70 cents on the dollar on nearly $340 million in secured debt, according to people familiar with the matter. In exchange, the city would get back $11 million a month in tax revenue from the city’s three casinos originally used as collateral to back the debt.”

Moratorium NOW demands cancellation of Detrot debt to the banks May 9, 2012 after protesting at BOA.

The WSJ article adds, “Mr. Orr has said Detroit needs significant and fundamental debt relief to shore up the city’s finances and avoid bankruptcy.” To read full WSJ article, click on Detroit Sues Bond Insurer Amid Effort to Reach Deal With Creditors WSJ 7 5 13.

Orr admitted in his “Proposal to Creditors” June 14 that ‘The City has identified certain issues related to the validity and/or enforceability of the COPS that may warrant further investigation.” COPS, or Certificates of Participation, is another term which refers to the POC loan.

Voice of Detroit is calling for a federal investigation of the questionable circumstances under which the loan was negotiated, and has initiated a petition to the U.S. Justice Department at http://www.change.org/petitions/jeffrey-knox-usdoj-criminal-fraud-division-investigate-criminal-bank-ubs-ag-for-predatory-1-5-billion-loan-to-detroit.

Voice of Detroit is calling for a federal investigation of the questionable circumstances under which the loan was negotiated, and has initiated a petition to the U.S. Justice Department at http://www.change.org/petitions/jeffrey-knox-usdoj-criminal-fraud-division-investigate-criminal-bank-ubs-ag-for-predatory-1-5-billion-loan-to-detroit.

Among various possibly criminal improprieties involved in the loan: then Detroit CFO Sean Werdlow took a top position with SBS shortly after the deal, and Wall Street ratings agencies Standard and Poor’s and Fitch came to the table to push for the loan, a blatant conflict of interest. The USDOJ has sued both UBS and Standard and Poor’s for fraudulent practices. It won a $1.5 Billion settlement from UBS and is suing S & P for $5 billion.

Meanwhile, Orr said he plans to take 25 of the city’s bank and insurance creditors on a D-DOT bus tour of the devastated neighborhoods of Detroit July 10, allegedly to pressure them to agree to lower their terms for debt repayment.

Abayomi Azikiwe, aof Moratorium NOW!, said earlier that the same banks are responsible for the condition of those neighborhoods.

“The banks destroyed the City of Detroit by foreclosing over 150,000 families in seven years,” Azikiwe said during a protest June 6 outside Greater Grace Temple, the site of Orr’s no-show public meeting. “They wreaked havoc and destroyed our tax base and our neighborhoods. We must have the complete elimination of fraudulent bank deals with the City. We don’t have decent buses, street lights and streets. Our schools are closed. The future holds nothing but more austerity and destruction. We built this city. We must demand no more payments to the banks.”

Related articles:

http://voiceofdetroit.net/2013/05/16/detroit-em-orrs-report-envisions-a-nightmare-future/

Excellent article. The swaps were predatory loans where city pays over 6% interest to banks on bonds where real interest rate is .5%. And UBS and Merrill Lynch aka bank of america are criminal subprime lenders who owe Detroit billions for destruction they caused.