VOD: Detroit EM Kevyn Orr made a flash announcement during a press conference held with little notice today at 6:15 p.m. that Gov. Rick Snyder has authorized the City of Detroit to file for bankruptcy. He and Snyder are to hold a press conference tomorrow, Friday, July 19 at 10 .m. with more details. Meanwhile, click on Detroit petition for bankruptcy for text of bankruptcy petition filed Thursday. VOD will publish an analytical article on this matter as soon as possible, that will be more “fair and balanced” than the Fox News coverage below.

One dangerous note: this bankruptcy filing is unlike previous filings in Stockton, CA and other cities, because an unelected official, Kevyn Orr, with no accountability to the people of Detroit, will represent the city in bankruptcy court. In other cities that have filed for municipal bankruptcy, their elected officials have in many cases fought for the rights of the cities’ retirees. Orr’s intent in filing is to bypass state law which protects retirees’ pensions, and seek a precedent-setting decision in federal court that would equate retirees with giant global banks and corporations.

Detroit filed for the largest municipal bankruptcy in U.S. history Thursday after steep population and tax base declines sent it tumbling toward insolvency.

The filing by a state-appointed emergency manager means that if the bankruptcy filing is approved, city assets could be liquidated to satisfy demands for payment.

Kevin Orr, a bankruptcy expert, was hired by the state in March to lead Detroit out of a fiscal free-fall, and made the filing Thursday in federal bankruptcy court.

“Only one feasible path offers a way out,” Gov. Rick Snyder said in a letter to Orr and state Treasurer Andy Dillon approving the bankruptcy. The letter was attached to the bankruptcy filing.

“The citizens of Detroit need and deserve a clear road out of the cycle of ever-decreasing services,” Snyder wrote. “The city’s creditors, as well as its many dedicated public servants, deserve to know what promises the city can and will keep. The only way to do those things is to radically restructure the city and allow it to reinvent itself without the burden of impossible obligations.”

Gov. Snyder marches in Benton Harbor Blossomtime Parade last year to jeers from hundreds of protesteres.

Snyder had determined earlier this year that Detroit was in a financial emergency and without a plan to improve things. Snyder hired Orr in March, and he released a plan to restructure the city’s debt and obligations that would leave many creditors with much less than they are owed.

Orr was unable to convince a host of creditors, including the city’s union and pension boards, to take pennies on the dollar to help facilitate the city’s massive financial restructuring.

Some creditors were asked to take about 10 cents on the dollar of what the city owed them. Underfunded pension claims would have received less than 10 cents on the dollar under that plan.

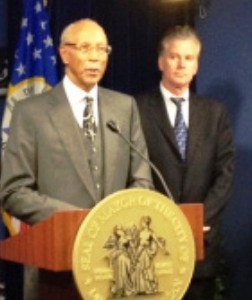

Detroit EM Kevyn Orr at press conference announcing his appointment by Gov. Rick Snyder (in background).

A team of financial experts put together by Orr said that proposal was Detroit’s one shot to permanently fix its fiscal problems.

The filing leads to a 30 to 90 day period that will determine whether or not the city of Detroit is eligible for Chapter 9 protection, and define the number of claimants who may compete for Detroit’s limited settlement resources. The petition seeks protection from unions and creditors who are renegotiating $18.5 billion in debt and liabilities, according to the Detroit Free Press.

“The President and members of the President’s senior team continue to closely monitor the situation in Detroit,” White House spokeswoman Amy Brundage said in a statement Thursday.

“While leaders on the ground in Michigan and the city’s creditors understand that they must find a solution to Detroit’s serious financial challenge, we remain committed to continuing our strong partnership with Detroit as it works to recover and revitalize and maintain its status as one of America’s great cities,” the statement read.

ROBERT WOLF, WHILE HEAD OF THE GLOBAL SWISS BANK UBS AG’S AMERICAS DIVISION, WAS ONE OF THE BIGGEST FUNDRAIDERS FOR PRES. BARACK OBAMA’S CAMPAIGN, ACCORDING TO THE NEW YORK TIMES. UBS AG FOISTED A PREDATORY $1.5 BILLION POC LOAN ON DETROIT IN 2005, WHICH THE CITY HAS DEFAULTED ON THREE TIMES, CAUSING ITS CREDIT RATINGS TO DROP AND ITS CASINO TAXES TO BE HELD HOSTAGE TO PAY OFF THE DEBT.

(VOD: Click on http://dealbook.nytimes.com/2012/07/19/wolf-to-leave-ubs-to-form-new-firm/ to read entire NYT Dealbook article on Detroit creditor UBS AG’s role in funding Pres. Barack Obama’s campaign. The President to date has ignored pleas from Michigan’s Black residents to have the Justice Department investigate the fact that Emergency Manager Acts have disenfranchised more than half of them. Until today, he has not weighed in on the Emergency Manager takeover the nation’s largest Black-majority city, Detroit.)

Sen. Carl Levin, D-Mich., remained positive about Detroit’s outlook in spite of the major blow that bankruptcy delivered:

Protesters at airport during Kevyn Orr’s meeting with creditors June 14 demanded: CANCEL THE CITY’S DEBT.

“I know firsthand, because I live in Detroit, that our city is on the rebound in some key ways, and I know deep in my heart that the people of Detroit will face this latest challenge with the same determination that we have always shown,” the Senator said in a statement released Thursday.

A number of factors — most notably steep population and tax base falls — have been blamed on Detroit’s descent toward insolvency.

Detroit was once synonymous with U.S. manufacturing prowess. Its automotive giants switched production to planes, tanks and munitions during World War II, earning the city the nickname “Arsenal of Democracy.”

Detroit lost a quarter-million residents between 2000 and 2010. A population that in the 1950s reached 1.8 million is struggling to stay above 700,000. Much of the middle-class and scores of businesses also have fled Detroit, taking their tax dollars with them.

Detroit’s budget deficit is believed to be more than $380 million. Orr has said long-term debt was more than $14 billion and could be between $17 billion and $20 billion.

Click for More at the Detroit Free Press

The Associated Press contributed to this report.

Historic Day: Detroit Files For Bankruptcy

July 18, 2013 5:51 PM

Reporting Vickie Thomas

DETROIT (WWJ) – After years of hand wringing over the state of affairs in the rust belt hub that has struggled in recent years perhaps more than any other large city in America, it’s official: Detroit has filed for Chapter 9 bankruptcy protection.

Motown, the gritty place that pioneered automobiles, modern manufacturing and soul music, now has the largest municipal bankruptcy case in U.S. history.

The 16-page filing was submitted to federal U.S. Bankruptcy Court Thursday afternoon with no announcement from the city or state.

Detroit has been struggling, crushed under billions of dollars in debt following decades of mismanagement, population flight and loss of tax revenue. The city lost a quarter-million residents between 2000 and 2010. Detroit now has an estimated 700,000 residents; down from 1.8 million in the 1950s.

No Federal Government Bailout In The Works For Detroit

Detroit City Councilwoman JoAnn Watson speaks at rally calling for moratorium on Detroit’s debt to the banks May 4, 2013. She has also called for a federal bail-out and a $10 billion Marshall Plan for Detroit.

For weeks, emergency manager Kevyn Orr has been working to try to lower the city’s debt as he slashes budgets, works with unions, and make sense of Detroit’s disjointed financial records.

A city official notably said the federal government should bail out Detroit, though the president has made no indication that’s a possibility.

Orr’s options were these: File for bankruptcy or cut the biggest bond restructuring deal of all time.

The latter didn’t happen.

Said Orr, in a written recommendation hand-delivered Tuesday to Gov. Rick Snyder and state Treasurer Andy Dillon:

“Based on the current facts and circumstances, I have concluded that no reasonable alternative to rectifying the city’s financial emergency exists other than the confirmation of a plan of adjustment for the city’s debts pursuant to chapter 9 of the bankruptcy code because the city cannot adopt a feasible financial plan that cant satisfactorily rectify the financial emergency outside of a chapter 9 process in a timely manner.” [View a copy of Orr’s letter].

Gov. Snyder on Thursday approved the bankruptcy

“Only one feasible path offers a way out,” Snyder wrote in a letter to Dillon and Orr.

“The citizens of Detroit need and deserve a clear road out of the cycle of ever-decreasing services,” Snyder said. “The city’s creditors, as well as its many dedicated public servants, deserve to know what promises the city can and will keep. The only way to do those things is to radically restructure the city and allow it to reinvent itself without the burden of impossible obligations.”

“Despite Mr. Orr’s best efforts, he has been unable to reach a restructuring plan with the city’s creditors,” Snyder said. “I therefore agree that the only feasible path to a stable and solid Detroit is to file for bankruptcy protection.” [View a copy of the letter].

According to sources talking to WWJ City Beat Reporter Vickie Thomas, city officials were preparing the filing earlier Thursday. Federal Court spokesman Ron Hansen confirmed the filing shortly after 4 p.m.

Meantime, one mayoral candidate says Orr’s numbers are not adding up.

Krystal Crittendon, an attorney for the city, is criticizing the math in Orr’s latest financial report. She said the Washington-based bankruptcy attorney’s numbers do not add up.

“The whole foundation that brings him here is false,” Crittendon said. “We do not have a $15 [billion] or a $20 billion debt problem. We have less than a $2 billion short-term debt problem that we could manage if we just went out and collected revenues that are owed to the city; stop giving, you know, tax abatement to people who can actually afford to pay taxes.”

Orr was hired by the state in March after a financial emergency was declared in Detroit.

Following a meeting last month with Wall Street creditors, Orr estimated Detroit’s budget deficit at $380 million, and the city’s long-term debt at $20 billion. Creditors are being asked to take about 10 cents on the dollar of what’s owed to them. [VIEW THE PROPOSAL HERE]

At that time, Orr gave the city a 50-50 chance of avoiding bankruptcy.

Bankruptcy expert Douglas Bernstein, with West Bloomfield’s Plunkett Cooney Law Firm, said the filing will kick-start a multi-month period where a federal judge and consultants would determine whether Detroit is eligible for Chapter 9 protection.