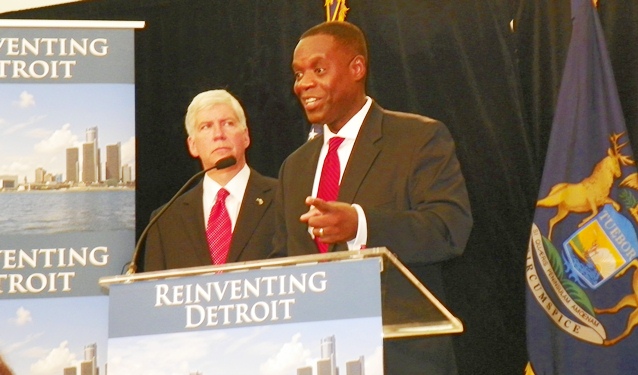

- Detroit EM Kevyn Orr (r) appointed by Michigan Gov. Rick Snyder (l) under PA 436, discusses bankruptcy filing at press conference July 19, 2013. Photo by Diane Bukowski

A coalition of organizations is asking Detroiters and their supporters to pack U.S. Bankruptcy Court at 231 W. Fort Mon. Jan 13, at 9 a.m., for the closing arguments on the swaps giveaway to Bank of America, UBS. For further info: https://www.facebook.com/#!/events/503611456421560/

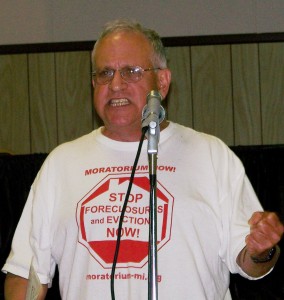

Jerome Goldberg questions EM Kevyn Orr over giveaway to Bank of America, UBS, on Jan. 3, 2014

(VOD story on Orr’s direct testimony coming shortly. This transcript is from http://detroitdebtmoratorium.org/jerome-goldberg-questions-em-kevyn-orr-over-giveaway-to-bank-of-america-ubs-on-jan-3-2014/)

January 6, 2014

Attorney Jerome Goldberg, appearing on behalf of City of Detroit retiree David Sole, questions Emergency Manager Kevyn Orr regarding the interest rate swaps deal, viewed by many as another gift to the very banks that destroyed Detroit’s neighborhoods using subprime mortgages and that have been charged and convicted of fraud of all sorts.

Click on image to launch audio

Unofficial transcript:

Orr trial cross by JG.01032014

Unofficial transcript from audio file by KH

- Attorney Jerome Goldberg, who represents city retiree David Sole in bankruptcy hearings. March 26, 2012 Photo by Diane Bukowski

Jerome Goldberg appearing for Interested Party David Sole.

JG: For the court ordered mediation for December 23 and 24, isn’t it true that Judge Rosen mandated that the parties have individuals there with settlement authority?

KO: Yes.

JG: And isn’t it true that you testified in your deposition that in fact Judge Rosen informed you that the banks did not have anyone there with settlement authority on December 23rd?

KO: Yes, at least one of them, yes.

JG: And that he had threatened to hold them in contempt of court just to get them to agree to this settlement, is that not true?

KO: He threatened to enter a default judgment.

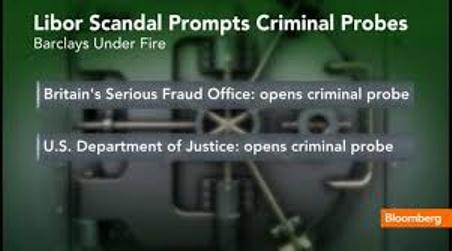

- Barclays and UBS AG, one of the original lenders in the Detroit $1.5 billion Pension Obligation Certificates predatory loan of 2005-06 and in related swaps, have both been charged with massive fraud in numerous venues globally, related to manipulation of the London-Interbank-Offered Rate (LIBOR) interest rates.

JG: I apologize. A default judgment. Just to be clear, this $165 million termination loan with Barclays, was subject to similar terms to the original swap termination loan?

KO: Yes.

JG: So the interest rate would be anywhere from 5.5 to 8.5 percent?

KO: Yes, whatever was on the chart. Yes.

JG: Once bankruptcy is over and the loan becomes due the interest rate goes up an extra 2 percent, right?

KO: well there’s a mechanism by which the interest rate can go up, yes.

JG: So it can go up from 5.5 up to 8.5 percent, right?

KO: Yes if that’s the math, right.

JG: And the loan is secured against income tax revenue?

KO: Yes.

JG: And that amounts to about $4 million per year, correct?

KO: Yes.

Protesters rally against swap deal outside Coleman A. Young Municipal Center Oct. 21, 2013. The City Council then voted not to approve the deal.

JG: And do you recall that in the city’s motion, the city’s income tax revenue for this year, pledge secured against income tax revenue and in fact that amounts to $48 million per year, $4 million per month times 12, right?

KO: Yes.

JG: Do you recall that in the city’s motion it said the city’s income this year was approximately $232 million?

KO: If that was in the motion, I’ll stand by it, yes.

JG: So what we’re taking about basically is that for the next four years about 20 percent of income tax revenue will go to pay off this deal with UBS and Bank of America through Barclays, is that not correct?

KO: Roughly, yes.

JG: And in fact $165 million at 8.5 percent interest would be approximately $30 million in interest, up to $195 million over the next four years and city tax revenues will be diverted to pay off Bank of America and UBS through Barclays?

KO: It could, yes.

JG: OK. And in fact, those payments will be going on long after you’re done as emergency manager and have left Detroit, is that not true?

KO: There’s an expectation that there would be an exit facility financed.

JG: But as of now there’s no exit facility in place.

KO: That is correct.

JG: In contrast, I believe the testimony in both depositions was that the swap payments, the hedging payments from 2008 to 2012 totaled $247 million?

KO: Approximately that amount of money.

JG: I could show you the deposition, but we’re in the ballpark?

KO: Yes, mmhmm.

JG: And 2013 would be about another $45 million to $50 million. Is that a fair statement?

KO: That’s a fair statement.

JG: So we’re talking about $300 million having been paid to UBS and Bank of America since 2008 on the hedging derivatives, on the interest rate swaps.

KO: Since when?

JG: Since 2008.

KO: Roughly that amount.

JG: And in addition to that, if the City was successful in its litigation, in recovering, in getting the swaps declared void ab initio as you testified, potentially that amount could be recovered, correct?

KO: Yes.

JG: And in fact any termination amounts moving forward, in the neighborhood of $200 million, could be eliminated?

KO: Yes.

JG: So rather than paying $165 million, we could be recovering up to $300 million?

KO: Yes.

JG: I want to go into a little bit, and you testified quite well, about the claims the city is making. One of them is fraud based on problems with the Libor as documented relative to UBS, is that not correct?

KO: Yes.

$1.5 billion UBS/SBS POC debt pushed on Detroit City Council Jan. 31, 2005 by (l to r) former Detroit CFO Sean Werdlow, now COO of SBS, Bill Doherty of SBS, Joe O-Keefe of Fitch Ratings, Stephen Murphy of Standard and Poor’s, and former Deputy Mayor Anthony Adams, during Kilpatrick administration. Photo: Diane Bukowski

JG: Another one was that the counterparties, and I’m talking about the equitable claims, about fraud, breach of contract based on implied breach of the fair dealing, and unjust enrichment claims. And another that the counterparties had superior knowledge to the city when they entered into this complex financial transaction with the city and had a duty to make it clear to the city?

KO: Yes.

JG: That they misrepresented that there was a low risk of default and termination in connection with swaps?

KO: Yes.

JG: That they did not explain to the city the potential dangers that a termination event would mean for the city, that they could have called in tens of millions or hundreds of millions in interest payments, correct?

KO: Interest payments and the termination fee, yes, correct.

JG: And the city was a ticking bomb, as you described it, based on a lowering of the city’s bond rating based on the city’s financial history?

KO: Yes.

JG: Are you aware that representatives of Fitch rating service and Standard & Poors were at the table when the swaps were being voted on or being debated in city council?

KO: I didn’t know it was Fitch and S&P but I know the ratings agencies were present.

JG: And that they encouraged the city, they were supportive of the transactions?

KO: I don’t know that.

JG: And in fact it was these same ratings agencies that triggered the default in 2009 by the lowering of the city’s bond rating, correct?

KO: I know the ratings were lowered. I don’t know if it was S&P and Fitch.

JG: OK. You testified earlier that the CFO of the city Sean Werdlow took a job with SBS and that was approximately five months after the swaps were completed?

KO: Yes.

JG: And you testified that that raises a red flag, correct?

KO: It raises concern, yes.

JG: You testified that you spoke with the SEC about their involvement in investigating these matters and I believe in your deposition you said they were willing to have further discussions. Is that correct?

KO: Yes.

JG: And I’m not going to try to do a big impeachment here, I mean you know I asked you about that on August 30 and you testified that there hadn’t been discussions as of that date.

KO: Right.

JG: So these discussions must have taken place between August 30th and the present date?

KO: I believe that’s fair.

JG: I asked you before, in Exhibit 1328, which has been admitted, is the July 31, 2012 SEC report on municipal securities market. You’re not sure that you read that report?

KO: That’s correct.

JG: Are you aware that the report documents seven enforcement actions by the SEC against municipalities in similar situations to Detroit including Jefferson County, Alabama, and Orange County, California, both cities that entered bankruptcy?

KO: As I said I haven’t read the report. I’m aware there were enforcement actions.

JG: And are you aware that there were five other settled enforcement actions by the SEC against major financial institutions including Bank of America, UBS, JPMorgan, Wachovia and GE Funding?

KO: I’m aware the SEC had settled several other investigations, yes.

JG: OK. Have you familiarized yourself with the 2011 SEC final judgment against UBS, where one of the judgments in that had to do with the Detroit Water Board? Are you familiar with that? I did raise that to you in your previous deposition.

KO: Yes you did. Yes, sir you did. I’m not aware of that one in particular.

JG: OK. Are you aware that that judgment specifically raises some of the issues that you raised, the fact that [violation of] the duty to disclose by a financial institution includes not disclosing relevant information to a municipality in connection with an interest rate swap because of the uneven knowledge of the parties?

KO: I’m aware of the concept, but not that particular investigation.

JG: Are you aware that pursuant to the Bankruptcy Code that the SEC had a right to intervene in a Chapter 9 bankruptcy?

KO: Yes.

JG: If the SEC was to intervene both in this bankruptcy and in the litigation, then it would dramatically lower the cost of litigation on behalf of the city, would it not?

KO: It might or it might not.

JG: Well the SEC is a government agency and has people with expertise in litigating these areas. We would agree to that, would you not?

KO: Yes, but sometimes agencies don’t necessarily represent the same interest as the principal litigant.

JG: OK. And the SEC, just to be clear, can actually intervene not just in a lawsuit, but in the bankruptcy proceedings where on fairness the question of equitable subordination could be addressed, is that not correct? [Then some low mumblings.]

KO: I believe the SEC has the ability to intervene as interested party, I don’t know in particular to your question.

JG: OK, that’s a good answer. You probably know more than I know about it. The Obama administration has people assigned to work with you in terms of lending support in conjunction with the emergency management and getting out of bankruptcy, is that not true?

KO: The federal government has assigned a specific Treasury officer as a liaison for the federal government as part of the operational restructuring. I don’t know if his role or specific delegation of authority includes the authority to involve themselves in the bankruptcy.

JG: And who is that individual?

KO: Don Graves.

JG: Don Graves. Have you spoken with him about potential federal involvement or SEC involvement in the question of trying to recover interest rate swaps?

KO: Ah, not that particular question.

JG: OK. You had acknowledged that the gap between the floating interest rate and the fixed interest rate that’s the basis for the derivative payment dramatically changed in approximately 2008. Is that not correct?

KO: Yes, 2008, 2009, yes.

JG: And that was due to a precipitous drop in interest rates?

KO: Yes, there were a number of reasons, but yes, that is why.

JG: And in fact what happened at the time was the Libor rate at that point and since that point has been around .5 percent, .34 percent margin, it’s the difference between that and the 6.3 percent fixed interest rate that the city pays the banks that leads to the pension obligation interest rate payments, correct?

KO: Ah, generally the concept, ah, the numbers are approximate in terms of where the Libor was versus the rate of the interest, yes.

JG: Right. Are you familiar with interest rate swaps, with the machinations of them?

KO: Ah, I am now, yes.

JG: And generally speaking, the idea, under the best circumstances, would be that a floating rate and a fixed rate stayed relatively stable so the fixed rate so the parties don’t face this calamitous change that occurred in 2008 in the city of Detroit?

KO: Ah, I suppose for stability, but it depends on which way, which side of the swap you’re on.

JG: No question about it. And we were on the wrong side of the swap.

KO: We were on the right side for a little while and then we were very much on the wrong side.

JG: Right. And would you agree with me that the precipitous drop in interest rates since 2008 was a product of the financial crisis that occurred throughout the U.S. with the collapse of Goldman Sachs, the subprime mortgage crisis and just generally the financial crisis that occurred in the country in 2007, 2008?

KO: Ah, yes, there was a financial meltdown for a number of reasons that have been written about, including that I suppose.

JG: And in fact the reduction of interest rates to near zero was part of the Federal Reserve’s bailout of the banks, in order to stimulate the banks and keep them moving during that period. Do you agree with that?

KO: Yes, the last few months of ’08 and ’09 I think the federal government bought back $1.75 trillion of securities. A QE 1.

JG: Are you aware that the City of Detroit experienced 67,000 mortgage foreclosures between 2005 and 2007, according to a City of Detroit report?

KO: Ah, I did, I read that report somewhere, I’m not sure where I read it, and I think you and I have discussed it before, too.

JG: And in fact the report notes that the 73 percent of all mortgage loans entered into in the city during that period were subprime loans, meaning they were at least 3 percent above the prime rate?

KO: I think that’s general correct.

JG: And in fact it was the subprime crisis, the imposition of so many subprime loans that in part precipitated this foreclosure epidemic in Detroit?

KO: I read reports that demonstrated there were disproportionate foreclosures in the city of Detroit.

JG: OK. Are you aware that the report noted that of the 67,000 properties foreclosed between 2005 and 2007 as of January 2009, 65 percent remain vacant?

KO: I don’t know if I know those specific numbers, but I remember hearing that there are obviously a lot of vacant properties, yes.

JG: Have you considered as part of the equitable challenge to UBS and Bank of America in connection with the swaps, that both of them had tremendous involvement in the subprime lending crisis and in fact they ended up benefiting from their own misdoings in that essence by causing the crisis that led to this drop in interest rates to which they have now profited to the tune of $300 million?

KO: Uh, I’m aware of allegations in that regard.

JG: OK. As the emergency manager, and especially when you enter into an agreement like this, I believe Judge Rhodes put it that it’s your duty and it’s examined to see if it’s in the best interest of the estate or the debtor, which is the City of Detroit.

KO: Yes.

JG: And of course the City of Detroit is the residents of Detroit, correct?

KO: That includes the residents of Detroit.

JG: Primarily it includes the residents, even over creditors, is it not?

KO: The interest of the residents is of great concern, yes.

JG: Don’t you think the residents would stand to benefit more from a potential $500 million recovery than to see 20 percent of their tax dollars turned over to two banks that helped contribute to the destruction of their neighborhoods?

KO: Um, if the claims were successful and you were able to achieve that kind of result that would certainly provide a benefit but in the meantime you might not have stability in revenue stream that you need to help reinvent and restructure the city.

JG: But in fact the revenue stream is going to be decreased over the next four years just by paying off this swap termination.

KO: The revenue stream will be dedicated to pay off some of the debt, the money was borrowed to deal with swap termination but it will free up other revenue that we can use to go forward.

JG: OK. Give me a moment; I’m almost done. [PAUSE]

JG: I found it interesting, your testimony that under PA 436 you would have potentially had the authority to abrogate the contracts that allowed UBS to track revenue in connection with interest rate swaps, is that what you would testify to?

KO: Yes, the irrevocable letters of instruction.

JG: And you indicated that you didn’t pursue that or didn’t act on that because of your concerns of litigation over it?

KO: Well, it’s part of the overall settlement that was one of the issues that we were concerned about.

JG: In fact, though, there are numerous contracts that as emergency manager you have acted within your power to abrogate, is that not correct?

KO: Um, um, I’ve abrogated some, yes.

JG: I mean there are union contracts that were abrogated because you’ve taken the position and won the position in this court that you have the right to even go after pensions, despite the guarantees of the Michigan constitution.

KO: I’m not trying to go after pensions. I’m trying to rationalize the environment so that we can pay them on a going forward basis on a reasonable number.

JG: I can appreciate that. But I’m just saying that there’s been a tremendous amount of litigation on that issue, has there not?

KO: Yes.

JG: I have no further questions.

Jerome Goldberg, David Sole, Abayomi Azikiwe, Maureen Taylor, Diane Bukowski and their active supporters are owed an immense debt of gratitude for creating the most useful record and roadmap to recovering a significant portion of the enormous criminal plunder of Detroit by the bankers and their faux elite collaborators, who have pushed

Detroit into this contrived, forced bankruptcy that is designed to steal the heritage of our city. We must all do, within however limited our power, all that each of us can do, to support them and ourselves by rising up angry, in every Militant, NON-VIOLENT yet devestating HALT to their plunder, in advance of our recovery, calling on the support of all persons of good will everywhere. AMEN