UPDATE:

Dow closes down 1,100-plus in biggest single-day point loss ever

CNBC

Feb. 5, 2018

The Dow traded more than 1,500 points lower at one point before swinging back to close down more than 1,100 points.

The Dow traded more than 1,500 points lower at one point before swinging back to close down more than 1,100 points.

The S&P 500 lost more than 4 percent, with health care and energy lagging. The broad index had traded positive earlier Monday as the tech sector briefly rose. The Nasdaq declined by more than 3.5 percent, also off its earlier low.

“Breaking the early lows of the day means the correction could go on for longer,” said Art Cashin, a UBS director of floor operations.

“We’re not used to getting washouts like this anymore,” said Quincy Krosby, a chief market strategist at Prudential Financial. “The buy-the-dip mentality that has taken over hasn’t allowed for that.”

“This sell-off, in the bigger scheme of things, is not that big. But it is very important in psychological terms,” Krosby said.

Frantic Wall Street brokers during 2008 crash.

The Dow fell 665.75 points, or 2.5 percent, Friday, notching its biggest one-day sell-off since June 2016. The S&P 500 had its worst one-day performance since Sept. 2016, and the Nasdaq posted its worst session since August 2017.

Stocks were pressured by a fast rise in interest rates last week. The benchmark 10-year yield rose to its highest levels in four years. Overnight, it reached 2.88 percent before trading around 2.84 percent.

The major indexes also capped off their worst weekly performance in two years Friday after a steep sell-off. The Dow and S&P 500 pulled back 4.1 percent and 3.9 percent, respectively, last week. The Nasdaq lost 3.53 percent.

“What we noticed in January was that stocks and bond yields wanted to run through their year-end targets” to start off 2018, said John Augustine, a chief investment officer at Huntington Private Bank. “I think both markets just need to take a breather.” He also noted these pullbacks in bonds and stocks should be viewed as buying opportunities by investors.

Stocks began the new year ripping higher. The Dow and S&P 500 had their best monthly gains since March 2016 last month. The Nasdaq posted its biggest one-month gain since October 2015 in January. The major indexes had also notched record highs.

Equities benefited from strong economic data and solid corporate earnings growth at the start of the year. But increasing inflation concerns have sent interest rates higher recently, rattling Wall Street.

The CBOE Volatility index (VIX), widely considered the best gauge of fear in the market, hit 21.75 — its highest level since November 2016 — when it reached 23.01.

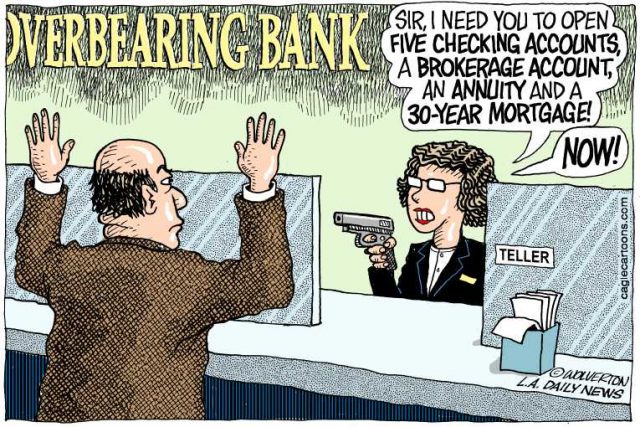

STOCKS FALL FURTHER AS BANKS SINK; WELLS FARGO PLUNGES AFTER FAKE ACCOUNTS EXPOSED

By Marley Jay, Associated Press

Feb. 5, 2018

Jeffersonian Apts. have been sold to suburban developers Joe Barbat and Arie Liebowicz. Huge rent and parking increases, along with new water/sewerage and other charges may force many residents out.

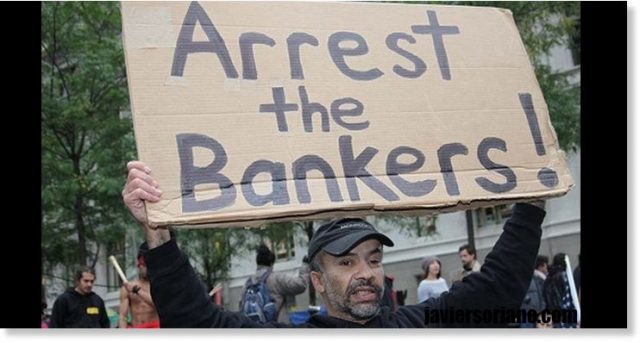

VOD commentary: Detroit’s economic “boom” may go “bust” along with the stock market, as unbridled development of upscale retail, entertainment, and residential complexes, from downtown Detroit, going east on Jefferson, and in the so-called “Mid-City” (formerly “Cass Corridor”) neighborhoods continues. Such development is financed by bank loans as well as HUD grants and is pushing long-time residents, particularly Blacks, senior citizens and those on fixed-incomes, out of their homes.

Meanwhile, Wayne County’s “mortgage fraud” unit sent Detroit senior citizen Mary Stafford to prison for a year and is now demanding that she pay over $75,000 to Wells Fargo on falsified charges related to a mortgage she was not party to. Wells Fargo has given her sworn affidavits saying she owes them no money.

New York – U.S. stocks are continuing to sink Monday afternoon as banks and health care and energy care companies slip. Wells Fargo is plunging after the Federal Reserve hit the bank with new sanctions over a scandal that involved opening millions of phony consumer accounts.* The market erased a portion of its early losses following a mid-morning report showing more evidence of economic strength in the U.S economy. Bond yields stabilized after moving sharply higher Friday.

Keeping score: The Standard & Poor’s 500 index lost 27 points, or 1 percent, to 2,734 as of 1 p.m. The Dow Jones industrial average gave up 308 points, or 1.2 percent, to 25,201. Early on, it fell 355 points. The Nasdaq composite fell 45 points, or 0.7 percent, to 7,191. The Russell 2000 index of smaller-company stocks was down 15 points, or 1 percent, to 1,531.

Mary Stafford

The S&P 500 is down about 4.5 percent from its latest record high, set January 26.

Investors are worried about evidence of rising inflation in the U.S. Increased inflation might push the Federal Reserve to raise interest rates more quickly, which could slow down economic growth by making it make it more expensive for people and businesses to borrow money. Rising bond yields are also making bonds more appealing to investors compared with stocks.

Wells Fargo plunges: Wells Fargo dropped $4.96, or 7.7 percent, to $59.11. Late Friday the Fed said it will freeze Wells Fargo’s assets at the level where they stood at the end of last year until it can demonstrate improved internal controls. The San Francisco bank also agreed to remove four directors from its board.

Waking up: The stock market has been unusually calm for more than a year. The combination of economic growth in the U.S. and other major economies, low interest rates, and support from central banks meant stocks could keep rising steadily without a lot of bumps along the way. Experts have been warning that that wouldn’t last forever, and after big gains in the first three weeks of January, that stretch might be over.

Stocks haven’t suffered a 5 percent drop since the two days after Britain voted to leave the European Union in June 2016. The market hasn’t gone through a 10 percent drop since early 2016, when oil prices were plunging as investors worried about a drop in global growth that would hurt demand. U.S. crude hit a low of about $26 a barrel in February of that year.

Brexit caused $2 trillion loss from global markets.

Sweetened offer: Chipmaker Broadcom raised its offer for competitor Qualcomm to $121 billion in cash and stock, or $82 per share, and called the bid its best and final offer. It had offered $103 billion for Qualcomm, and that company says it will review the bid. Broadcom rose $4.86, or 2.1 percent, to $240.34.

However Qualcomm dipped $2.27, or 3.4 percent, to $63.80 after analysts said Apple may end a deal with Qualcomm and have Intel make chips for futures iPhone models instead. Intel gained 65 cents, or 1.4 percent, to $46.80.

Energy: Benchmark U.S. crude slid $1.15, or 1.8 percent, to $64.30 a barrel in New York. Brent crude, used to price international oils, fell 72 cents, or 1 percent, to $67.86 a barrel in London.

Exxon Mobil lost $3.51, or 4.2 percent, to $81.02 and Chevron gave up $2.33, or 2 percent, to $116.25. Both companies reported disappointing fourth-quarter results on Friday and are coming off their biggest losses in years.

Banks and mortgage companies created 2008 economic crisis, not Mary Stafford.

Market leaders losing: Almost three-fourths of the stocks on the New York Stock Exchange traded lower. Some of the largest losses went to companies that have done exceptionally well over the last year. Alphabet, Google’s parent company, lost $19.81, or 1.8 percent, to $1,099.39. Chipmaker Nvidia fell $6.i94, or 3 percent, to $226.58. 3M skidded $4.40, or 1.8 percent, to $240.77.

Bonds: Bond prices held steady after moving sharply higher on Friday. The yield on the 10-year Treasury was unchanged at 2.84 percent.

Currencies: The dollar fell to 110.02 yen from 110.28 yen. The euro slipped to $1.2425 from $1.2451.

Survey says: Stocks perked up somewhat after a strong report for the service sector. The Institute for Supply Management released a survey that showed January was the best month for the service sector since 2005 as production, new orders, hiring and new export orders all grew faster in January. Private service companies dominate the U.S. economy and the ISM’s index has showed growth every month for the eight years.

Bitcoin woes: Bitcoin prices and futures continued to sink. According to Coindesk, the price of bitcoin fell 13 percent to $7,082. It reached a high of almost $20,000 in December, and traded under $1,000 in early 2017. Many financial pros warn that bitcoin is in a speculative bubble that could burst anytime. On the CME, bitcoin futures plunged 15.5 percent to $7,255. They tumbled 15 percent to $7,230 on the Cboe.

German coalition talks: Stocks in Europe also fell as German political parties struggled to form a government. Chancellor Angela Merkel’s conservative Union bloc and the center-left Social Democrats originally set a Sunday deadline to wrap up talks on extending their alliance of the past four years but budgeted two extra days as a precaution when formal negotiations started Jan. 26.

Britain’s FTSE 100 lost 1.5 percent while France’s CAC 40 slid 1.5 percent. The DAX in Germany shed 0.8 percent.

Asia: Japan’s benchmark Nikkei 225 tumbled 2.6 percent and the South Korean Kospi shed 1.3 percent. Hong Kong’s Hang Seng index sank 1.1 percent.

*Federal Reserve Restricts Wells Fargo’s Growth in Unprecedented Punishment after Fraud Scandal

BY Jessica Chia

NEW YORK DAILY NEWS

February 2, 2018

Janet Yellen lowered the boom on Wells Fargo on her last day as chairman of the Federal Reserve

The Federal Reserve on Friday imposed an unusually harsh punishment on Wells Fargo for the “widespread consumer abuses” uncovered in the bank’s fraud scandal.

Wells will not be allowed to grow beyond the $1.95 trillion in assets it had at the end of last year “until it sufficiently improves its governance and controls,” the Fed said in a statement.

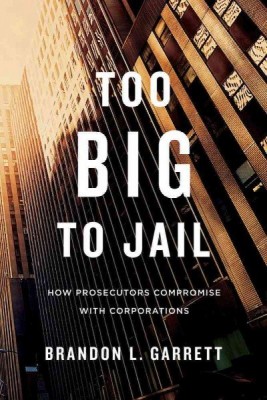

Regulators have rarely intervened directly in a bank’s operations in the past, and it is unprecedented for the Fed to order a bank to stop growing altogether, officials said.

But Wells Fargo’s aggressive business strategy prioritized growth over effective risk management, leading to serious compliance breakdowns, the central bank said.

In 2016, Wells Fargo forked over a hefty $185 million settlement after employees opened 3.5 million unauthorized bank accounts and credit cards without their customers’ consent.

The Federal Reserve announced it was punishing Wells Fargo on Janet Yellen’s last day as chairwoman of the Federal Reserve.

The employees, pressured by internal sales targets, used fake email addresses and forged signatures in the widespread practice known as “sandbagging.”

The bank also sold auto insurance to customers who did not need it and admitted its mortgage bankers unfairly charged customers fees to lock in interest rates.

Timothy Sloan, Pres. and CEO of Wells Fargo, testifies before Congress.

Wells Fargo also overcharged their corporate clients on foreign exchanges and levied unusually high transaction fees, according to a Wall Street Journal report in November.

In a cease-and-desist order on Friday, the Federal Reserve blasted the bank’s board of directors for failing to oversee the bank, and ordered three members to be replaced by April.

A fourth board member will be replaced by the end of the year, according to the Fed, without releasing specific names.

The announcement was made on Janet Yellen’s last day as chairwoman of the Federal Reserve.

“We cannot tolerate pervasive and persistent misconduct at any bank and the consumers harmed by Wells Fargo expect that robust and comprehensive reforms will be put in place to make certain that the abuses do not occur again,” Yellen said.

The bank must now submit a plan to the Fed within 60 days, detailing how it has enhanced oversight from its board of directors and improved compliance and risk management functions, and how it plans to improve further.

Once the Fed approves those plans, Wells will hire third-party consultants to review them and monitor its progress until the regulator is satisfied.

Wells Fargo’s balance sheet expanded steadily from the end of 2013 to 2016, but growth slowed dramatically last year as it battled to address the issues raised by the scandal.

The news on Friday sent Wells Fargo shares tumbling by 6.1 percent to $60.10 in after-hours trading.

Time for the banks to leave the scene.

No Excuses will cover their abuses.

What ever happened to accountability.