2011 MLK Day march in Detroit at Dr. Martin Luther King, Jr. High School: Detroit Public Schools have been destroyed by state takeovers.

By Detroit City Councilmember JoAnn Watson

(VOD: Councilmember Watson’s article is particularly appropriate since Gov. Rick Snyder said on the Mildred Gaddis show March 4 that he is likely looking for a revised consent agreement, thus using the threat of an EM to bludgeon Council once again.)

Feb. 28, 2013

Councilwoman JoAnn Watson was part of delegation that demanded PA4 be put on the ballot at State Court of Appeals.

Detroit’s structural deficit, which has set the stage for serious financial challenges, is driven by root causes, which will not be mitigated by the imposition of an emergency financial manager (EFM) — a post created by a law that Michigan citizens overwhelmingly repealed four months ago. EFMs not only subvert the Republic form of government — the right of citizens to be represented by officials whom they select — their existence also turns the Voting Rights Act of 1965 on its head.

Furthermore, there exists irrefutable evidence that EFMs imposed by the state of Michigan in municipalities and school districts predominated by people of color have not solved financial deficits. EFMs have actually increased deficits, deepened fiscal crises and de-stabilized governmental infrastructures, while robbing citizens of assets, services, access to decision-making, voter representation and accountability.

Maureen Taylor carries sign re: DPS during protest against banks’ role in decay of Detroit and its schools May 9, 2012.

For example, Detroit Public Schools had a $93 million surplus in 1994 and 180,000 students when the state take-over of the schools was put in place — not coincidentally following citizen approval of a $1.5 billion school improvement bond, which was immediately seized by state operatives who removed local elected and appointed officials, while rewarding contracts to political cronies.

With the state takeover in place for 16 of the last 19 years and a governor-appointed EFM still in place, the Detroit Public Schools’ fiscal status has plummeted to a $300 million deficit, the student enrollment has decreased by 140,000, dozens of schools have closed (threatening the survival of neighborhoods) and the state of Michigan is currently seeking, once again, to remove local members of the elected school board who have taken sworn oaths to govern the district.

Pontiac, Flint, Benton Harbor, Highland Park and other predominantly Black cities have also had EFMs appointed for the alleged purpose of addressing fiscal crises — but in these cases the financial deficits have grown much worse, populations have downsized, assets have disappeared and the dissolution of Union contracts and public safety have been the order of the day.

Detroit Project Management Director Kriss Andrews and Mayor Dave Bing at press conference Dec. 7, 2012. Andrews, appointed under the consent agreement, can override decisions of Mayor and City Council.

On April 4, 2012, Gov. Rick Snyder implored Mayor Dave Bing and the Detroit City Council (in a controversial 5 to 4 vote) to approve a consent agreement deal (under the auspices of the EM Law, Public Act 4, which was repealed by the voters Nov. 6, 2012), which authorized Snyder to exercise authority over the city of Detroit; including the appointment of a program manager, a chief financial officer, a financial stability agreement review board, the power to impose sanctions on existing bargaining agreements and other measures that would purportedly arrest the financial crisis.

Under Gov. Snyder’s oversight via the consent agreement/state control, the city’s crisis has worsened. One of the most significant cost-saving measures addressed by the mayor, City Council and the city’s bargaining units was an agreement to achieve $105 million in concessions. But, this historic, unprecedented accord reached by the city and all of its labor unions was disallowed by the governor, inexplicably, in early 2012.

Under Gov. Snyder’s oversight via the consent agreement/state control, the city’s crisis has worsened. One of the most significant cost-saving measures addressed by the mayor, City Council and the city’s bargaining units was an agreement to achieve $105 million in concessions. But, this historic, unprecedented accord reached by the city and all of its labor unions was disallowed by the governor, inexplicably, in early 2012.

The bottom line? Neither consent agreements nor EFMs have any credible record of “stabilizing” budgets and there have been no successful reports of EFMs addressing root causes like the issues that drive Detroit’s crisis. Examples of root causes:

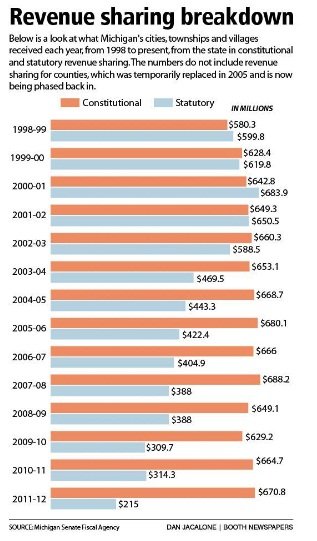

– Michigan’s $700 million reduction in revenue-sharing allocated to Detroit, during the last decade

– State of Michigan’s $224 million default on a revenue-sharing agreement reached by Gov. John Engler and Mayor Dennis W. Archer

– Population exodus from the city of Detroit and the private sector exodus from the city of Detroit has eroded the tax base, catalyzed in part by a state-imposed law in 1999 prohibiting the city from mandating the residency policy for city employees. The tax base loss annually has been $8.82 million per year since ’99, impacting neighborhoods, schools and small businesses

– The foreclosure crisis that has gripped the state and the nation has hit the city of Detroit in epidemic proportions; as mortgage firms have prospered and tax-paying families have been victimized by predators who have largely not suffered consequences, while decimating many of the city’s neighborhoods. There must be a moratorium on foreclosures issued statewide

Mike Illitch, owner of Red Wings, Detroit Tigers, and numerous other businesses in Detroit, owes large sums to Detroit.

– State Treasurer Andy Dillon has acknowledged that more than $800 million is owed to the city. A collaborative effort between the state, the city and key partners could garner these resources to stabilize the fiscal shortfall while structural cost-saving measures are mandated to insure that the city is not over-spending

– The city must attract new citizens, respect and retain its current citizens; attract new businesses, respect and retain existing businesses and foster a climate (including expanded rapid transit), which promotes Michigan’s largest municipality. Twenty-first century reinvention of cities requires not just cost-cutting but demands strategic investments for long-term growth and development. EFMs can point to no success toward that end. In fact, they present barriers to growth

– The city’s debt must be re-negotiated so the city’s operating budget is not prioritizing corporate, private sector firms, while employees and citizens bear the brunt of the sacrifice.