LARGEST USDOJ BANK SETTLEMENT SINCE 2008 CRASH

NO CRIMINAL PROSECUTION OF EXECS

BOA PART OF FRAUDULENT POC DEAL CITED BY EM KEVYN ORR IN DETROIT BANKRUPTCY FILING

- Former Detroit CFO Sean Werdlow (l) at City Council hearing on $1.5 B COPs loan Jan. 31, 2005. Speaking in support of deal in Joe O’Keefe of Fitch Ratings. Bill Doherty of SBS is in center. After demurring for a while, the Council okayed the loan unanimously. Photo: Diane Bukowski

(VOD: Bank of America is the principal backer of one lender involved in Detroit’s fraudulent $1.5B “Certificates of Participation” loan in 2005-06, which Detroit EM Kevyn Orr cited as a prime factor in his bankruptcy filing. BOA backed SBS Financial, whose current COO Sean Werdlow took his job with them shortly after he negotiated the deal as Detroit CFO under Mayor Kwame Kilpatrick.

The city defaulted on the loan three times after the 2008 global market crash, largely caused by predatory mortgage lending. The lenders are still demanding the city pay them $2.5 billion, including interest and penalties, as part of a bankrupty settlement. Even Detroit EM Kevyn Orr called that loan “void ab initio, illegal and unenforceable” in a lawsuit filed Jan. 17 in the city’s bankruptcy case. Judge Steven Rhodes has yet to hear that suit and likely never will.)

By PETE YOST and MARCY GORDON

WASHINGTON (AP) – The government has reached a $16.65 billion settlement with Bank of America over its role in the sale of mortgage-backed securities in the run-up to the financial crisis, the Justice Department announced Thursday.

The deal calls for the bank, the second-largest in the U.S., to pay a $5 billion cash penalty, another $4.6 billion in remediation payments and provide about $7 billion in relief to struggling homeowners.

The settlement is by far the largest deal the Justice Department has reached with a bank over the 2008 mortgage meltdown. In the last year, JPMorgan Chase & Co. agreed to a $13 billion settlement while Citigroup reached a separate $7 billion deal.

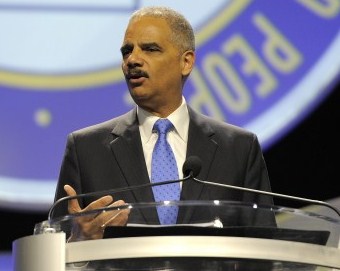

At a news conference, Attorney General Eric Holder said the bank and its Countrywide and Merrill Lynch subsidiaries had “engaged in pervasive schemes to defraud financial institutions and other investors” by misrepresenting the soundness of mortgage-backed securities. The penalties, Holder said, go “far beyond the cost of doing business.”

According to one example laid out by the government, Bank of America knew that a significant number of loans packaged into $850 million in securities were experiencing a marked increase in underwriting defects. Notwithstanding the red flags, the bank sold these residential mortgage-backed securities to federally backed financial institutions, the government said in a 30-page statement of facts that is part of the settlement.

In California, Countrywide concealed from investors the company’s use of “shadow guidelines” that permitted loans to riskier borrowers than Countrywide’s underwriting guidelines would otherwise allow, according to the statement of facts.

In addition, over a period of years, “Countrywide and Bank of America unloaded toxic mortgage loans on the government sponsored enterprises Fannie Mae and Freddie Mac with false representations that the loans were quality investments,” said Preet Bhara, the U.S. attorney for the southern district of New York.

The government said the civil settlement, the largest reached with a single entity, does not release individuals from civil charges, nor does it absolve Bank of America, its current or former subsidiaries and affiliates or any individuals from potential criminal prosecution.

Bank of America CEO Brian Moynihan said in a statement that the company believes the settlement “is in the best interests of our shareholders and allows us to continue to focus on the future.”

Of the $16.65 billion, almost $10 billion will be paid to settle federal and state civil claims by entities related to residential mortgage-backed securities, collateralized debt obligations and other types of fraud.

An independent monitor will determine whether Bank of America is satisfying its obligations under the settlement.

“In the run-up to the financial crisis, Merrill Lynch bought more and more mortgage loans, packaged them together and sold them off in securities — even when the bank knew a substantial number of those loans were defective,” said U.S. Attorney Paul Fishman, whose jurisdiction covers New Jersey.

“The failure to disclose known risks undermines investor confidence in our financial institutions,” Fishman added.

The Bank of America settlement will resolve allegations that the bank and companies it later bought misrepresented the quality of loans they sold to investors. Most of the problem loans were sold by Countrywide Financial and Merrill Lynch before Bank of America bought them during the 2008 financial crisis.

Consumer advocates say previous settlements show that the amounts announced in enforcement actions can overstate their actual costs to the companies being penalized.

- Eric Holder promised independent monitor in Chase settlement, but money not handed out to homeowners.

In the deal with JPMorgan in November, the Justice Department had a clear message for homeowners: Billions of dollars’ worth of help was coming. Holder at the time described the appointment of an independent monitor who would distribute $4 billion set aside for homeowner relief.

The actual relief is more complicated than cash handouts, however.

Both Citigroup and JPMorgan earn credits under the settlement from a “menu” of different consumer-friendly activities, according to settlement documents. The options are effectively an update of the consumer relief previously provided through the national mortgage servicing settlement, a 2012 deal between state attorneys general and the major banks.

JPMorgan probably will earn its $4 billion in credits under the settlement through a total of $4.65 billion of activities that qualified as relief, according to a report by Enterprise Community Partners, a nonprofit run by executives from low-income housing groups and major banks.

More than half will come from principal reductions, with the rest earned through actions such as writing new loans in distressed areas, donating foreclosed properties to community groups and temporarily suspending payments on some loans.

Associated Press writer Jeff Horwitz contributed to this report.