______________________________________________________________

U.S. Pres. Barack Obama celebrates auto industry “rescue” at temporarily closed Ford plant in Wayne, MI. Jan 7, 2015.

FEDERAL GOVT. LOST $9.26B ON AUTO RESCUE

http://www.allwebsolutions.net/business/autos/federal-government-lost-9-26b-on-auto-rescue/

David Shepardson,

The Detroit News

December 30, 2014

Washington — The U.S. government lost $9.26 billion on the auto industry rescue, according to the final accounting released late Monday.

Washington — The U.S. government lost $9.26 billion on the auto industry rescue, according to the final accounting released late Monday.

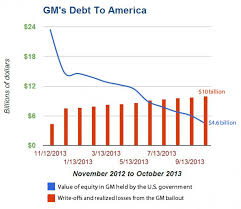

In its report, the U.S. Treasury Department said it recovered $70.43 billion of the $79.69 billion it gave to General Motors Corp., Chrysler LLC and auto lending arms Ally Financial Inc. and Chrysler Financial. The government was repaid through a combination of stock sales, partial loan repayments, dividends and interest payments.

The books are closed on the program because the Treasury, on Dec. 19, sold its final 11.4 percent stake in Ally, the Detroit-based auto lender and bank-holding company formerly known as GMAC. The bailouts began in December 2008 under President George W. Bush with $25 billion in aid to GM, Chrysler and their lending arms. President Barack Obama added about $55 billion to the total.

“We’ve now repaid taxpayers every dime and more of what my administration committed, and the American auto industry is on track for its strongest year since 2005,” Obama said at a press conference that day.

Under government accounting rules, the U.S. Treasury actually lost $16.56 billion on paper on the auto bailout. As tallied under those rules, taxpayers lost more because interest and dividends paid by borrowers — in this case, the automakers and finance companies — aren’t applied toward the principal owed.

A homeowner, for example, who borrows $100,000 doesn’t get credited with interest payments in paying off the mortgage. That largely explains the difference between the government’s larger accounting loss and the $9.26 billion net loss. In the case of GM and Ally, the government swapped most of what it was owed for stock in the companies. More than $7 billion recovered was in the form of dividends and interest payments.

The government recouped $19.6 billion on the $17.2 billion Ally bailout — $2.4 billion more than it invested. But it recovered just $39 billion of the $49.5 billion given to GM; and $10.67 billion of the $11.96 billion that went to Chrysler.

Still, the government’s losses were far less than the Obama administration originally feared. In early 2009, it projected a loss of $44 billion — an estimate it reduced to $30 billion in December 2009.

In 2010, the Treasury proposed creating a new tax on large banks to pay for losses from the $700 billion bailout program, but Congress hasn’t agreed to approve it. It would raise $90 billion over 10 years. Then-Treasury Secretary Timothy Geithner told Congress in May 2010 the Obama administration didn’t think “it was necessary or appropriate” to apply the tax to the automakers.

The Treasury Department declined to comment on the report Monday.

In December 2013, the Treasury sold its final shares in GM. The Treasury ended its ownership stake in Chrysler Group LLC in July 2011, incurring a $1.3 billion loss on a $12.5 billion bailout. Chrysler — part of Fiat Chrysler Automobiles NV — returned to trading on the New York Stock Exchange on Oct. 13.

The Ann Arbor-based Center for Automotive Research and others have argued that government losses paled in comparison to the impact that would have followed a collapse of GM and Chrysler. That could have sent much of the U.S. auto supplier sector reeling as well. A December 2013 study said failure of GM could have sacrificed 1.2 million U.S. jobs, cut personal income by $79.5 billion and eliminated $17 billion in income taxes and Social Security taxes in 2009. It could have also boosted government spending by $6.5 billion.

Others have estimated fewer job losses connected with a failure of GM and Chrysler. The biggest unknown remains if — and how long — it would have taken surviving automakers like Ford Motor Co. and other foreign firms to make up the lost production from GM and Chrysler. Ford did not take a government bailout.

Also unknown is if U.S. auto suppliers could have survived the massive disruption of a collapse of GM or Chrysler. Former auto czar Steve Rattner said that the disappearance of GM could have pushed the state of Michigan into bankruptcy. Another big cost would have been the likely assumption of GM and Chrysler’s underfunded pension plans by the Pension Benefit Guaranty Corp., the government-owned pension insurer.

Also unknown is if U.S. auto suppliers could have survived the massive disruption of a collapse of GM or Chrysler. Former auto czar Steve Rattner said that the disappearance of GM could have pushed the state of Michigan into bankruptcy. Another big cost would have been the likely assumption of GM and Chrysler’s underfunded pension plans by the Pension Benefit Guaranty Corp., the government-owned pension insurer.

Treasury Secretary Jack Lew told reporters before Christmas that the overall $700 billion Troubled Asset Relief Program — which was used to rescue banks and a major insurance company, AIG, in addition to GM and Chrysler — will make money overall.

Lew said that in total, the government invested $426.4 billion in the bank, auto and insurance bailout package, and recovered $441.7 billion. But under government accounting rules, Treasury has had $35 billion in losses.

“At the peak, more than 700 institutions were in the TARP bank program. Today just 35 remain,” Lew said.

The industry rescue became a key part of Obama’s re-election and remains a staple of the president’s speeches.

“This program was a crucial part of the Obama administration’s effort to … protect the economy from slipping into a second Great Depression,” Lew told reporters. “This program worked.”