“Crisis is not an excuse to abandon the rule of law. It is a summons to defend it”–Justice Lloyd Karmeier, Illinois Supreme Court

Pensions are promised by state–Sangamon Circuit Court Judge John Belz

Wall Street responds by downgrading Chicago bonds to junk level

“One more reason we should keep fighting”– Bill Davis, Pres. DAREA, Detroit retiree

DAREA meeting Wed. June 3, @ 5:30 pm/Sts. Matthew & Joseph Episcopal Church, 8850 Woodward at Holbrook; appellant Atty. Jamie Fields to speak

By Diane Bukowski

May 30, 2015

DETROIT – “It’s one more reason we should keep on fighting,” Bill Davis, president of the Detroit Active and Retired Employees Association (DAREA), said of a unanimous Illinois Supreme Court decision rendered May 8. It passionately declared unconstitutional a $105 billion legislative cut to pension benefits for half a million public workers.

“The people of Illinois give voice to their sovereign authority through the Illinois Constitution,” Illinois Justice Lloyd Kormeier wrote for the court. . . . “Article XIII, section 5, of the Illinois Constitution . . . expressly provides that the benefits of membership in a public retirement system ‘shall not be diminished or impaired.’ Through this provision, the people of Illinois yielded none of their sovereign authority. They simply withheld an important part of it from the legislature because they believed, based on historical experience, that when it came to retirement benefits for public employees, the legislature could not be trusted with more.”

The ruling said that economic crises like that cited by the legislature as cause for the cuts have come and gone since 1917 in Illinois, including during the Great Depression.

“Crisis is not an excuse to abandon the rule of law,” Karmeier wrote. “It is a summons to defend it.”

The Supreme Court thus upheld an earlier ruling by Sangamon County Circuit Court Judge John Belz.

He said, “The state of Illinois made a constitutionally protected promise to its employees concerning their pension benefits. Under established and uncontroverted Illinois law, the state of Illinois cannot break this promise.”

No appeal to the U.S. Supreme Court is planned, according to Illinois State Attorney General Lisa Madigan, who represented the state in the case.

Read full Illinois Supreme Court decision at Illinois Supreme Court pension ruling.

Davis said DAREA will likely file an amended appeal of Detroit’s Chapter 9 bankruptcy plan in U.S. District Court citing the Illinois ruling. DAREA is one of eight entities that appealed the Detroit Chapter 9 bankruptcy plan to the U.S. District Court of Southeastern Michigan.

Davis said DAREA will likely file an amended appeal of Detroit’s Chapter 9 bankruptcy plan in U.S. District Court citing the Illinois ruling. DAREA is one of eight entities that appealed the Detroit Chapter 9 bankruptcy plan to the U.S. District Court of Southeastern Michigan.

Another group, Ochadleus et. al, has already done so.

“Here in Michigan, the racist apartheid state government overrode the people’s will when the Detroit bankruptcy plan slashed city workers pension benefits and health care,” Davis said. “Detroit is like two cities now. I think Snyder is trying to start a race riot in Detroit by treating Black folks the way he does. If the U.S. attorney general was doing his job, Snyder would be in jail.”

Over 51 percent of Michigan’s African-American population lives under dictatorial emergency manager (EM) rule, under Public Act 436. Detroit’s unelected EM Kevyn Orr, hired by Snyder, filed the Chapter 9 case. Former U.S. Attorney General Eric Holder refused to investigate Public Act 4, PA 436’s predecessor, as a violation of the Voting Rights Act.

Detroit is the largest Black-majority city in the U.S., with predominantly African-American public workers.

The bankruptcy plan also seized most city assets, unprecedented under Chapter 9. They include the Detroit Water and Sewerage Department, which covers six counties, is the third largest system in the country, and employs large numbers of Black and women workers, including those in the skilled trades.

Davis invited all city workers to attend DAREA’s next general membership meeting, Wed. June 3 at 5:30 p.m. at St. Matthew and St. Joseph Episcopal Church, 8850 Woodward at Holbrook to discuss the Illinois victory and future plans. The guest speaker will be attorney and city retiree Jamie Fields, who represents the Ochadleus group.

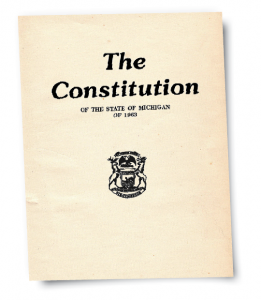

The Illinois decision “supports our fundamental contention that art. IX, section 24 of the Michigan Constitution prohibits reducing accrued vested public pension benefits,” Ochadleus et. al. say in their amended appeal. “The Illinois Constitution’s ‘Pension Clause’ is substantively undifferentiated from art. IX, section 24 of the Michigan Constitution. . . The Illinois Supreme Court said that ‘if something qualifies as a benefit of the enforceable contractual relationship’ that results from an employee’s membership in a public pension or retirement system, ‘it cannot be diminished or impaired.’”

The Illinois decision “supports our fundamental contention that art. IX, section 24 of the Michigan Constitution prohibits reducing accrued vested public pension benefits,” Ochadleus et. al. say in their amended appeal. “The Illinois Constitution’s ‘Pension Clause’ is substantively undifferentiated from art. IX, section 24 of the Michigan Constitution. . . The Illinois Supreme Court said that ‘if something qualifies as a benefit of the enforceable contractual relationship’ that results from an employee’s membership in a public pension or retirement system, ‘it cannot be diminished or impaired.’”

The Illinois Supreme Court earlier struck down reductions in health care benefits to public workers as well. Detroit public workers have lost a large portion of their health care benefits before and since the confirmation plan signed by U.S. Bankruptcy Judge Stephen Rhodes.

Applicable Michigan and Illinois constitutional pension protection clauses read:

“Michigan Const. 1963 Art. IX, Section 24: The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby.”

“Illinois Const. 1970, Art. XIII, Section 5: “Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

Illinois Public Act 98-599, signed into law by former Illinois Governor Pat Quinn in 2014, raised the retirement age for some employees, capped pensionable salaries, and limited cost-of-living increases. It cut annuity savings for members belonging to the state’s system before Jan. 1, 2011.

DAREA and supporters demonstrate outside big business luncheon honoring EM Kevyn Orr and bankruptcy judge Steven Rhodes Feb. 25, 2015. DAREA and other groups have demanded cancellation of Detroit debt to the banks instead of cuts to workers and residents. After bankruptcy, Detroit now owes over $3 BILLION in debt; prior to bankruptcy it owed $1 billion.

The Detroit bankruptcy also did its greatest damage to retirees by drastically slashing existing annuity savings fund payments for those who retired in 2003 or afterwards, claiming they were based on interest rates that were not compatible with market rates.

Both the Illinois circuit and Supreme Courts struck down all cuts, including those involving annuities, saying everything in the pension plans was constitutionally inviolate.

The Illinois We Are One Coalition reacted joyously to the Supreme Court decision.

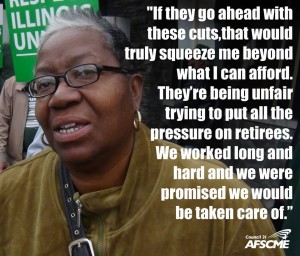

“We are thankful that the Supreme Court has unanimously upheld the will of the people, overturned this unfair and unconstitutional law, and protected the hard-earned life savings of teachers, police, fire fighters, nurses, caregivers and other public service workers and retirees. . . . Because most public employees aren’t eligible for Social Security, their modest pension—just $32,000 a year on average—is the primary source of retirement income for hundreds of thousands of Illinois families. While workers always paid their share, politicians caused the debt by failing to make adequate contributions to the pension funds.”

The We Are One Coalition includes nearly all state unions representing public workers.

Chicago Mayor Rahm Emanuel, U.S. Pres. Barack Obama’s former education cabinet member, counterposed with one of chief opponents, Chicago teachers, who have struck to stop school closings and other cuts.

Chicago’s Mayor Rahm Emanuel is also attempting steep cuts to the pension benefits of active and retired city employees who participate in the Municipal Employees Annuity and Benefit Fund (MEABF) and the Laborers Fund, under SB 1922.

“We had hoped that a ruling with such a high degree of clarity on SB 1 would persuade Mayor Emanuel to forgo his attempts to make similar changes to City of Chicago pensions,” Council 31 Executive Director Roberta Lynch said in a release. “Unfortunately, the mayor immediately issued a statement asserting that SB 1922 is based on different premises and therefore can pass constitutional muster.”

The Council 31 release continued, “We believe the Supreme Court’s ruling leaves no room for doubt that Chicago’s pension cuts also violate the plain language of the pension clause. In light of that decision and the city’s credit downgrade, we urge Mayor Emanuel to stop wasting time and money in a futile attempt to defend these unconstitutional cuts, and instead work with us to develop fair and constitutional solutions to funding city retirement plans.”

City retirees including Bill Davis, Cecily McClellan and Ezza Brandon confront AFSCME Council 25 Pres. Al Garrett July 31, 2014 after he announced the union would withdraw its 6th Circuit Court appeal of Detroit bankruptcy.

The fighting stances displayed by Illinois unions vary greatly from those of Michigan’s unions, and Detroit retirement systems and associations, which earlier withdrew their Sixth Circuit appeals of Rhodes’ decision affirming Detroit’s bankruptcy eligibility. They later agreed to a bankruptcy plan that forbade appeals, including any based on state constitutional protections, of huge cuts to public workers and to city assets.

Meanwhile, the Ohio Supreme Court ruling caused anger and panic on Wall Street.

As punishment, Wall Street ratings agencies downgraded the city of Chicago’s bonds to junk level. (See video below.)

The Illinois government itself did not suffer the brunt of Wall Street’s wrath.

“The state government faces $111 billion of unfunded pension liabilities, the leading factor in driving the state’s bond ratings down to an A-minus level across the board, with negative outlooks hinting at further downgrades,” an article in the Bond Buyer said.

The Bond Buyer quoted Standard & Poor’s analyst John Sugden, “This action coupled with the implementation risk of the current fiscal 2016 budget proposal and second round of pension reform introduced by the Governor underscores the profound credit challenges facing the state from a budget and liability standpoint.”

Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard & Poor’s press $1.5 billion “pension obligation” debt on Detroit City Council Jan 31, 2015. Despite declaring the debt “void, illegal and unenforceable,” the city paid it off in the bankruptcy confirmation plan through bonds and release of city assets, while cutting workers, retirees and the poor. Photo: Diane Bukowski

A spokesman for Illinois newly-elected Governor Bruce Rauner said he plans to put a proposal for cuts to future benefits to the voters.

“What is now clear is that a constitutional amendment clarifying the distinction between currently earned benefits and future benefits not yet earned, which would allow the state to move forward on common-sense pension reforms, should be part of any solution,” he said in a statement. “Lawmakers must approve putting such a question to voters, making it unlikely the process could be completed in time to impact the fiscal 2016 budget.”

Whether Illinois voters would be likely to approve such cuts is questionable, given that 79 out of 83 Michigan counties previously rejected the first Emergency Manager Act, PA 4, in a referendum won by a coalition of unions and community groups. Much of the arguments for emergency managers focused on allegedly unaffordable public pension costs.

Voters in Cincinnati, Ohio overwhelmingly rejected a ballot initiative to change the public pension system there in 2013, and an effort in Tucson, Arizona was knocked off the ballot after a lawsuit.

The people were behind the Illinois Supreme Court decision, as well as a recent Oregon Supreme Court decision banning COLA cuts for retirees.

In New Jersey, Gov. Christie’s pension cuts are about to be considered by that state’s Supreme Court.

Meanwhile, across the U.S. and the world, banksters convicted of massive financial crimes are pushing austerity programs on retirees, workers, the unemployed, children, seniors and families so they can be paid back the gargantuan debt including huge rates of interest that governments have accrued globally.

From Greece to France to England to Third World countries, the people are rising en masse to stop the war of the International Monetary Fund, which represents the global banks, though general strikes, massive street protests, direct action, military encounters, and other tactics.

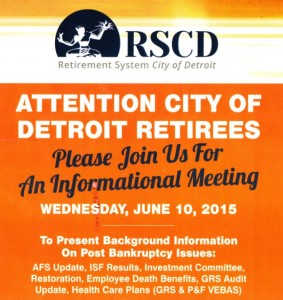

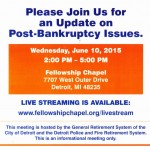

Below is notice of Detroit Retirement Systems meeting June 10; VOD does not endorse their betrayal of Detroiters, workers and retirees, but this may be an opportunity to pressure them to rescind that action, and to gain useful information.

Related story regarding the above meeting:

Sampling of other VOD stories on bankruptcy, pension cuts:

I AGREE WITH YOU ONE HUNDRED PER CEN

So AFSCME backed IL workers but stabbed us in back. And now they have pissed away VEBA money. I have been asking and not getting figures for monthly lawyer and admin fees for our VEBA. Makes me want to puke. They took Joe Louis Arena, Tunnel, parking garages, all assets that produce income and we the largest creditor got NOTHING, oh and they swindled residents out of DIA and we here they may sell a painting or 2 now for $400-$800 million. What do we have to do? Storm CAYMB?

“I” LOVE IT !!!!! 🙂

Diane you deserve an investigative reporter award. You have done your home work and as a pensioner, I appreciate your work.

How refreshing to see that someone upholds the law for a change. It’s too bad that we in Detroit got royalty screwed because of our pathetic leaders.