Above: Arizona Vaughn speaks at Call ’em Out’s Sambo dinner Feb. 27, 2020 about pending eviction from her small east-side home of 26 years.

ARIZONA VAUGHN’S HOME AT 5210 MARLBOROUGH

The next day, Call ’em Out activists shut down City of Detroit’s CAYMC, to demand that city repay $600 million in overassessed property taxes.

Tax auction purchaser of Ms. Vaughn’s home is shady LLC, North American Investments, not licensed to do business in Michigan, which bought it for $0 according to Register of Deeds

Criminal collusion among Wayne Co. Treasurer, EFA Holdings of Miami, non-profit UCHC in initial home theft?

U.S Supreme Court has ruled that tax evictions violate 5th Amendment: home equity minus taxes must be re-paid to owners immediately

By Diane Bukowski

March 19, 2020

Above: more than 100 protesters occupy the Coleman A. Young Center Feb. 28, 2020 to demand repayment of $600 million in overassessed taxes.

Editor’s note: The facts reported below are backed up from Arizona Vaughn’s extensive collection of documents related to her homeownership, which VOD has copied.

Editor’s note: The facts reported below are backed up from Arizona Vaughn’s extensive collection of documents related to her homeownership, which VOD has copied.

DETROIT—“How can they take MY home?” Arizona Vaughn asked a packed crowd at a dinner sponsored by Call’em Out Feb. 27, 2020, during which attendees demanded that Detroit Mayor Mike Duggan re-pay $600 million in taxes resulting from overassessments to Detroiters, an amount identified in a Detroit News investigation by reporter Christine McDonald. (See story linked below.)

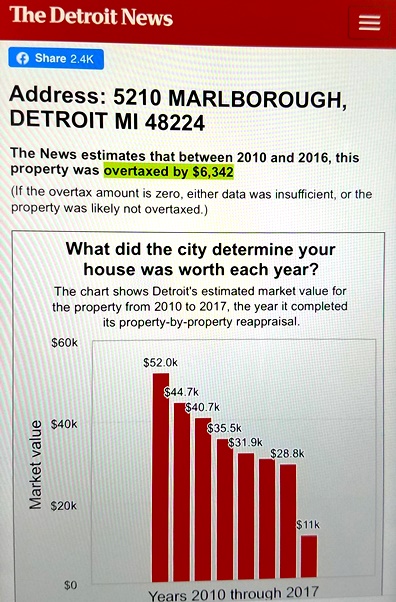

Ms. Vaughn’s home had been over-assessed a total of $6342 from 2010 to 2016 according to the News.

Ms. Vaughn’s home had been over-assessed a total of $6342 from 2010 to 2016 according to the News.

The next day, Call ’em Out occupied the Coleman A. Young Municipal Center, arriving in busloads. They shut it down for over an hour. Call ‘em Out Steward Agnes Hitchcock was arrested and dragged out of the building in the process.

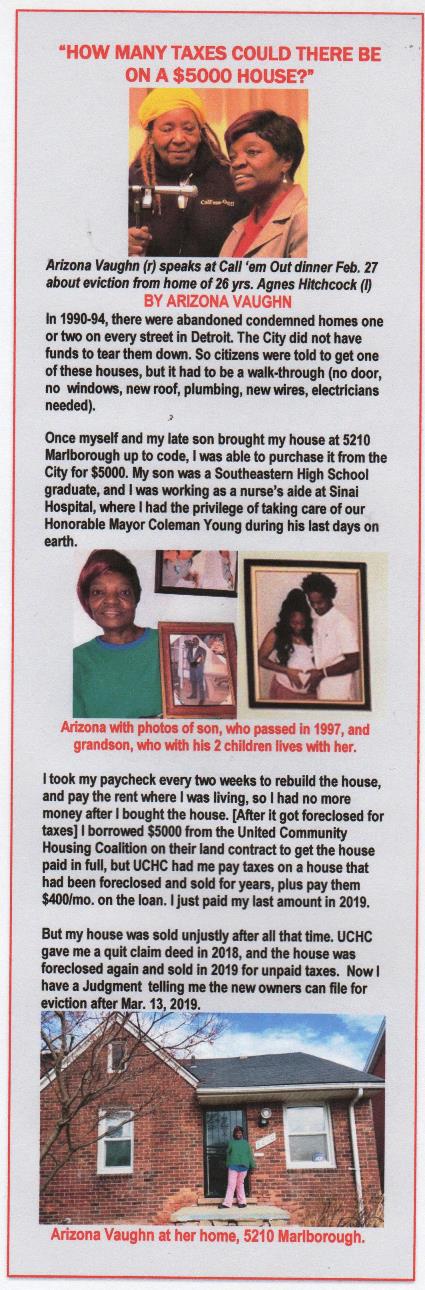

Ms. Vaughn has been asking “How can they take MY home” since she first began repairing the demolished home at 5210 Marlborough in 1993, on a promise from the city that she could buy it on completion of repairs, for $4000. (See article from Metro Times linked below this story.)

Ms. Vaughn’s son Charlie, who had worked with her to rehab the home, was shot to death in 1997, leaving her nearly suicidal with grief, alleviated partly when she took in his infant son Charlie to raise.

“This house is a piece of him,” Vaughn told the Metro Times of her son. “We worked hard on this house. I can’t leave it now — it would be losing a piece of him. It’s all I have.”

In 2003, the City attempted to evict Ms. Vaughn and her 5-year-old grandson from the beautifully re-furbished home, demanding payment of over $17,000 based on a city inspector’s revised estimate of the home’s value, which included Ms. Vaughn’s extensive improvements to the home.

After a battle, with the help of Attorney Bob Day of the Legal Aid and Defender Association (LADA) and the City Council, she finally won a Quit Claim Deed from the City in 2004, for $4000, which she paid off.

Working as a nurse’s aide after moving from Mississippi with her infant son in 1979, she spent her paychecks to accumulate the funds so she and her grandson would have a permanent home. He and his children still live with her. While working at Sinai Hospital, she said ministered to the late Mayor Coleman A. Young in his final days.

“He told me to keep fighting for my home and most importantly for my land,” she told VOD. “He said it is all a battle about the land.”

Rear of Vaughn home. Ms. Vaughn also required to install new wiring outside and inside home, including overhead wires.

Side of Vaughn home. Ms. Vaughn had to install all new windows, doors, plumbing, new roof (see photo at right).

But Ms. Vaughn’s struggles to keep the home she had paid for and repaired, essentially rebuilding it from scratch, have continued to the present day. She has been additionally stressed during this period because she is a cancer survivor who takes medication for chemotherapy, and repeatedly has to return to the hospital for treatment when she has relapses.

Records from the Wayne County Register of Deeds show that her property was most recently foreclosed July 15, 2019 after an earlier foreclosure September 17, 2010. It was bought at tax auction by North American Investments, LLC (not registered to do business with the State of Michigan) after the 2019 foreclosure. The deed shows the company paid $0 for the property. See http://voiceofdetroit.net/wp-content/uploads/QUIT-CLAIM-DEED-for-5210-Marlborough-North-American-Investments-LLC.pdf

Arizona Vaughn and grandson Charlie at 5 years old when the city was trying to evict her in 2003.

After the earlier 2010 foreclosure, the property was bought at a tax auction by EFA Holdings of West Palm Beach, Florida, for the price of $500.

Edward Azar, the agent for EFA Holdings, had created a group called “Detroit Progress” notifying homeowners of the company’s purchase of their properties and providing options to them including “Rent to Own” (land contracts.) EFA Holdings then quit claimed the property back to Ms. Vaughn for the exorbitant amount of $5000, according to the Register of Deeds website.

Ms. Vaughn then entered into a Land Contract with United Community Housing Coalition for $5000, with interest of 7%, to be paid back in 18 months, dated 6/23/2011. She just obtained a copy of the land contract last week, after she and advocate Alicia Jones demanded that UCHC ED Ted Phillips produce it. (See link to UCHC Land Contract at end of story.)

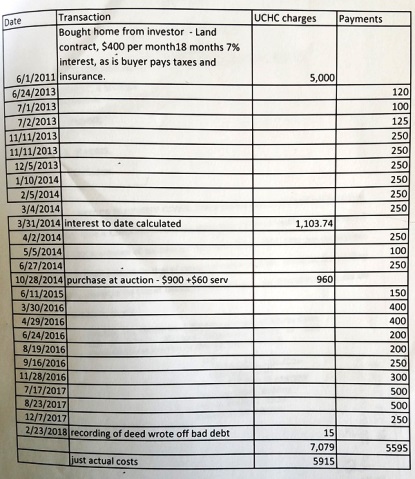

UCHC chart with record of Arizona Vaughn’s payments on land contract.

A UCHC schedule of her payments to them states “Bought home from investor – Land contract, $400 per month 18 months, 7 % interest, as is, buyer pays taxes and insurance,” dated 6/1/2011.

The schedule shows she paid a total of $5595 from 6/23/2011 through 12/7/2017 to UCHC after already paying $4000 to the City for her home and incurring great expenses bringing the house up to code.

During that period, she was also held liable for property taxes which turned out to be over-assessed to the tune of $6,342 from 2010 to 2016. As of 12/1/2o13, court documents showed her property taxes for 2010, 2011, and 2012 totalled $5754.56. Her assessments did not drop until 2017.

She also has a NOTICE TO QUIT—POSSESSION OF PROPERTY, signed by UCHC ED Ted Phillips, dated 5/26/2017, stating she must move by 7/3/2017, adding severe stress after she had a lung removed due to her cancer. She nevertheless scraped together more funds to pay UCHC under the terms of what appears to have been a bogus land contract, inappropriate for a non-profit organization meant to protect tenants and homeowners.

After the sale of her home to North American Land Investments, she consulted with attorneys at Lakeshore Legal Aid, which happens to have an office down the hall from UCHC’s new headquarters at 2727 Cass. The attorney assigned to her case, Elisa Gomez, asked her obtain the land contract from UCHC. When she asked Phillips for it, he sent it directly to Gomez, leaving Ms. Vaughn to get it from the receptionist at Lakeshore Legal Aid.

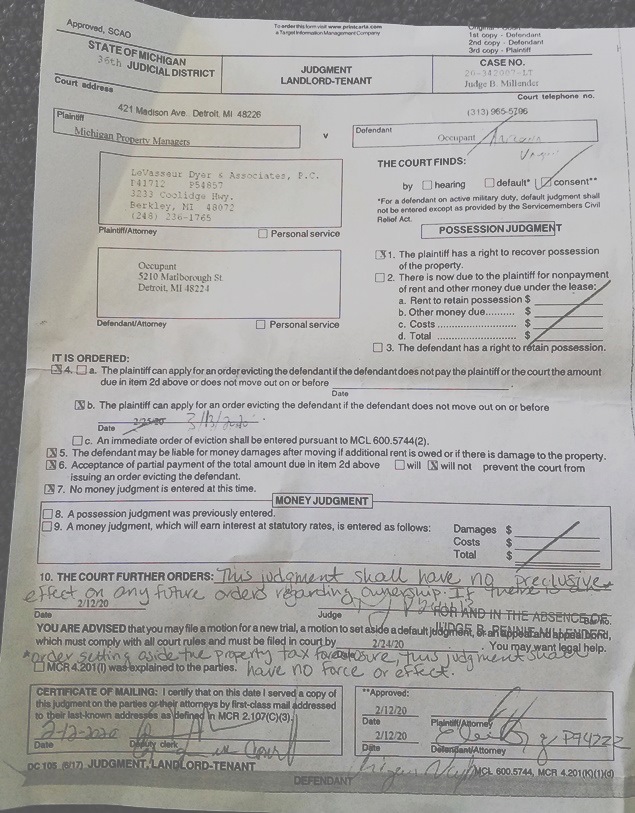

Gomez later told Ms. Vaughn that she had no case because the land contract specified that she had to pay taxes, and negotiated the Landlord-Tenant “Possession Judgment” below in 36th District Court, signed by Judge B. Pennie Millender. The judgment, however, specifies that it “it shall have no preclusive effect on any future orders regarding ownership. If there is an order setting aside the property tax foreclosure, this judgment shall have no force or effect.”

Gomez later told Ms. Vaughn that Lakeshore Legal Aid had closed her case with them.

Land contracts are notorious because all debts associated with the property accrue to the tenant, prior to the tenant’s ownership of the property, as well as being unregulated with regard to amounts of principal and interest charged, among other matters.

A 2019 article, “Black Poverty is Rooted in Real Estate Exploitation,” by Mike Whitehouse of Bloomberg, says that after banker and government discrimination against Blacks in obtaining mortgages,

A 2019 article, “Black Poverty is Rooted in Real Estate Exploitation,” by Mike Whitehouse of Bloomberg, says that after banker and government discrimination against Blacks in obtaining mortgages,

“. . . Blacks had to find other ways to obtain shelter. One was ‘contract for deed,’ [another term for land contract], an arrangement usually offered by speculators who bought properties expressly for the purpose. It required a down payment and regular monthly installments from the occupant, but that’s where the similarities to a mortgage ended. The sale price and effective interest rate tended to be wildly inflated. The “buyer” assumed all the responsibilities of a homeowner, including repairs and taxes, while the “seller” retained title, along with the power to evict for missing even a single payment. As a result, families who bought ‘on contract’ didn’t accumulate equity, and faced a long and precarious path to ownership.”

(See full article at http://voiceofdetroit.net/wp-content/uploads/BLACK-POVERTY-IS-ROOTED-IN-REAL-ESTATE-EXPLOITATION.pdf.)

Asked to respond to VOD’s questions about UCHC’s handling of Arizona Vaughn’s situation, Phillips claimed that Bob Day of LADA was responsible for negotiating the $5000 terms of the 2011 land contract, although Day in fact was only involved with Ms. Vaughn up to 2003. He claimed Day would not have colluded with EFA Holdings and the Treasurer on the 2011 deal–no, it appears that Phillips and UCHC may have. He also said that $5000 was an appropriate buy-back rate at the time, and that UCHC paid that amount to EFA Holdings. However, the Wayne County Register of Deeds shows no such transaction. Phillips spoke of

City Council Nov. 19, 2013: Developers from 1214 Griswold, LLC, (l), displacing mostly Black, older Griswold Apt. tenants, grin as Ted Phillips of UCHC (R) supports their tax abatement. They were connected to Dan Gilbert. Phillips said, “We are thankful that this is not a situation where low-income tenants are bringing down profits for businesses.” UCHC later had downtown Czar Dan Gilbert speak at its annual dinner. See http://voiceofdetroit.net/2013/12/15/city-council-state-feds-non-profits-in-bed-with-developers-destroying-black-detroit/

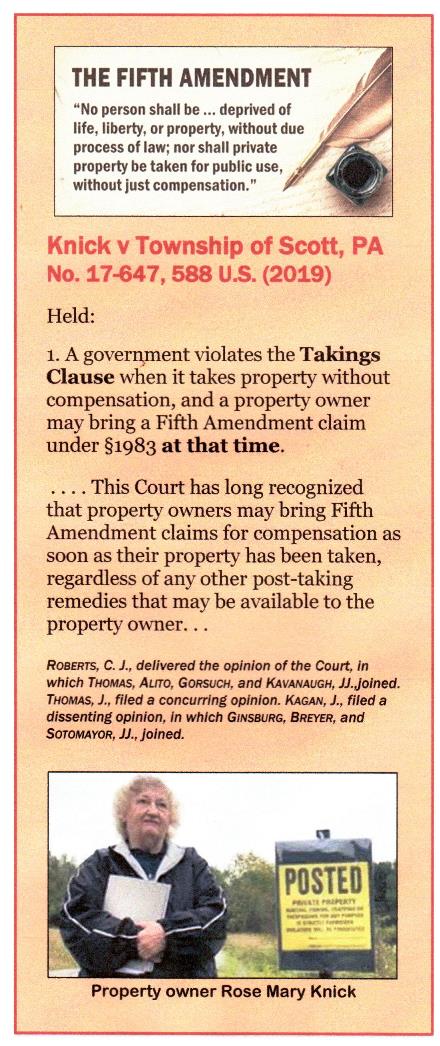

U.S. SUPREME COURT SAYS PROPERTY TAX FORECLOSURES UNCONSTITUTIONAL, VIOLATING 5TH AMENDMENT ‘TAKINGS CLAUSE’

The Land Contract with UCHC began in 2011. Instead of trusting the Treasurer’s figures, UCHC would have done better fighting to eliminate the tax auctions.

The Land Contract with UCHC began in 2011. Instead of trusting the Treasurer’s figures, UCHC would have done better fighting to eliminate the tax auctions.

They are now being challenged in 80 Michigan countries and across the country after a landmark decision in June, 2019 by the U.S. Supreme Court in Knick vs. the Township of Scott.

The U.S. Supreme Court held that county foreclosures on homeowners are unconstitutional, saying, “A government violates the Takings Clause when it takes property without compensation, and a property owner may bring a Fifth Amendment claim under §1983 at that time.”

The high court thus allowed foreclosed homeowners to bring suit directly and immediately at the federal level to recoup the equity in their homes, with the counties allowed only to keep overdue taxes and fines.

County governments are strenuously fighting against lawsuits which say they have been illegally keeping the profits from the sales of foreclosed homes to fund public services. A Michigan State Supreme Court ruling is pending in Rafaeli, LLC, and Andre Ohanessian v. Oakland County and Andrew Meisner.

Previously, local and state governments depended largely on taxing banks and corporations for their operating revenues, but huge corporate tax breaks have drained their coffers. Here in Michigan, those tax breaks skyrocketed under the administration of Gov. John Engler and have been continued through both Republican and Democratic successor administrations. So the existing situation is that governments are now preying like vultures on the ruins of neighborhoods through foreclosures, and the impoverishment of the people as a whole.

STATE LEGISLATORS CALLING FOR MORATORIUM ON EVICTIONS, FORECLOSURES

(L) Michigan State Reps. Jewell Jones (D-Inkster) and (seated) Isacc Robinson (D-Detroit.)

The American Human Rights Council reported March 13, “As more cases of the coronavirus are reported in Michigan, Michigan State Representatives Isaac Robinson (Detroit) and Jewell Jones (Inkster) are calling on the Michigan Legislature to pass an immediate moratorium on evictions, foreclosures and utility shut-offs. The legislation would place a 90-day moratorium on evictions, foreclosures and utility-shut-offs.

Leaders and advocates supporting moratorium and legislation being drafted by Robinson and Jones include: Reverend David Alexander Bullock, Change Agent Consortium, Imad Hamad, American Human Rights Council, Tonya Myers Phillips, Attorney with Sugar Law Center and Public Policy Advisor to Michigan Legal Services., Jim Schaafsma, Housing Attorney Michigan Poverty Law Program Meeko Williams, Chief Director, Hydrate Detroit and Theo Broughton, Hood Research.”

The Coalition for a Moratorium on Foreclosures, Evictions and Utility Shut-offs has been calling for such an action for decades now, as Detroit and other majority-Black cities in Michigan and elsewhere, in particular, have fallen victim to an all-out global campaign to maximize corporate profits through plant shut-downs, privatization of public services, seizure of public assets implemented illegally under bankruptcy declarations, and massive destruction of communities and neighborhoods through mortgage and tax foreclosures and evictions.

Foreclosed and vacant housing near Arizona Vaughn’s home.

Arizona Vaughn’s neighborhood has long shown the effects of that war on poor and Black people. It is strewn with foreclosed and vacant homes and apartments, but some families remain.

“My neighbors come to me to ask what is happening with my case,” says Ms. Vaughn, and adds that she has been trying to mobilize them to fight back since the city’s first attempt at evicting her in 2003. Then, she began a petition campaign calling for all vacant and foreclosed homes to be turned over to immediate neighbors and community members for rehabilitation and recruitment of new families to fill them, according to the Metro Times.

The Moratorium NOW! Coalition marches in downtown Detroit Aug. 28, 2013 in anniversary celebration of Dr. Martin Luther King’s 1963 March in Detroit.

Other related stories:

DETROIT NEWS STORY ON $600 MILLION PROPERTY TAX OVER-ASSESSMENTS: https://www.detroitnews.com/story/news/local/detroit-city/housing/2020/01/09/detroit-homeowners-overtaxed-600-million/2698518001/.)

METRO TIMES STORY ON ARIZONA VAUGHN: https://www.metrotimes.com/detroit/home-runaround/Content?oid=2175412.)

U.S. SUPREME COURT RULING KNICK V. TOWNSHIP OF SCOTT, JUNE, 2019: http://voiceofdetroit.net/wp-content/uploads/USSC-knick_v_township_of_scott_opinion.pdf

UCHC LAND CONTRACT WITH ARIZONA VAUGHN: http://voiceofdetroit.net/wp-content/uploads/AVaughn-LC-w-UCHC-min.pdf

https://www.michiganradio.org/post/lawsuit-michigan-tax-foreclosure-laws-unconstitutional

It Is A Crime And A Shame That Here In 2020 Blacks And Other Minorities Are Still Fighting The Same Battles We Fought Back In The 50s and 60s Only The Faces On The Other Side Of The Counter Are “BLACK”.

“WHAT HAPPENED”????