On March 7, dozens of Detroiters conducted a blockade of southbound !-75 beginning at Eight Mile. Here they are stopped by state troopers close to downtown, pulled over and ticketed, but their point was made. SAY NO TO AN EFM! INTERRUPT COMMERCE!

State Governor Snyder to appoint emergency manager next week

Residents fight back, call on nation for support

By Diane Bukowski

March 8, 2013

State cops pull cars protesting EFM over near downtown March 7, 2013.

DETROIT – Detroit, the world’s largest Black-majority city outside of Africa, is battling for its right to self-determination and home rule. Michigan Gov. Rick Snyder announced March 1 that he will appoint an “emergency financial manager” (EFM) to take control of the city’s assets, land, finances, services, workers, and residents.

Sources say the appointment will come in the latter part of next week.

Michigan Gov. Rick Snyder

Snyder called his action a move for “a bright and shiny new future” for the city. It was a response to a scathing report on the city’s finances from a “Financial Review Team” (FRT) appointed by Snyder, which concluded the city’s Black leaders cannot run Detroit. The team represented corporations such as Miller Buckfire, now part of Stifel Financial, and Pricewaterhousecoopers, which face lawsuits for fraud across the nation and the globe.

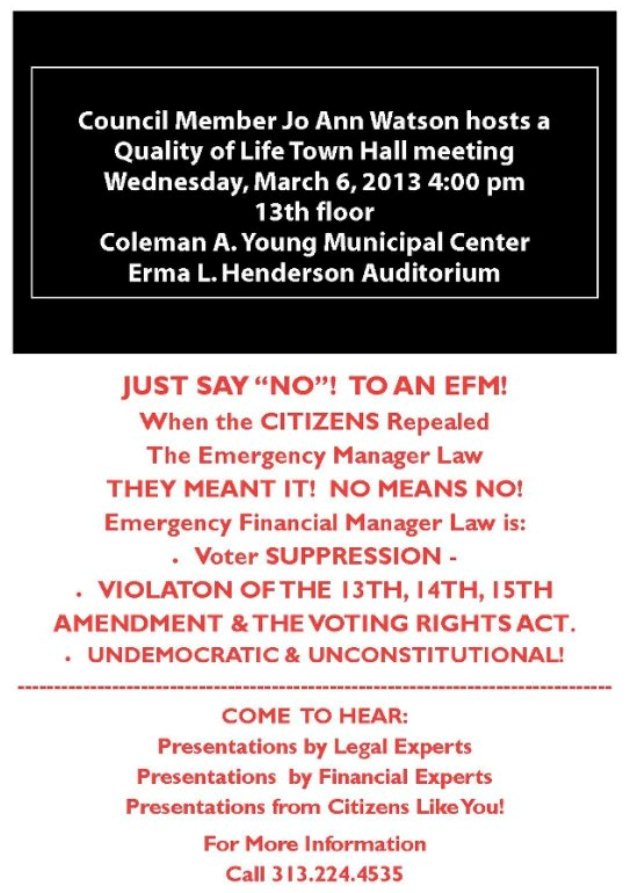

“Detroit of all cities,” City Councilwoman JoAnn Watson said at a public hearing March 6. “Detroit is the center for Black national pride, the home of the Nation of Islam, and the Shrine of the Black Madonna. Many people here have their lives connected to the blood of the city, and they will never say die.”

Detroit, the birthplace of the Nation of Islam in 1930, needs its own Million Men, Women and Children March. Shown here, the NOI’s Mllion Man March Oct. 16, 1995.

The Detroit City Council voted March 6 to appeal Snyder’s declaration, at a hearing conducted by Snyder or his designate, to take place March 11 in the state’s capital, Lansing. Detroit Mayor Dave Bing refused to join them.

If the Council loses, it can appeal to the circuit court. However, the body’s majority has colluded with both Snyder and State Treasurer Andy Dillon since 2012, meeting with them in secret in Detroit and Lansing. They passed a draconian “consent agreement” last April that gave the power of the city’s elected leaders to a “Financial Advisory Board” and Snyder-appointed officials, agreed eventually to turn over many city assets including the fabled Belle Isle, and trashed union contracts.

NO EFM blockade reaches Davison Freeway March 7, 2013,

Detroit community leaders and residents have called on U. S. President Barack Obama and the entire nation to join them in their battle. They blockaded a city freeway March 7, stressing the need to affect commerce, and have been rallying throughout the city. They say they plan to educate and organize the city’s people, particularly the youth, by taking the battle to its neighborhoods.

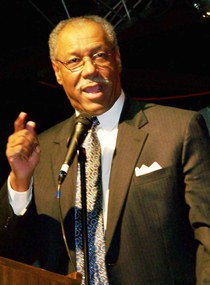

Rev. David Bullock of Rainbow PUSH calls on Pres. Obama and AG Holder to intervene to save Detroit outside-federal offices March 7 2013.

“Detroit is Ground Zero,” said the Rev. David Bullock of Rainbow PUSH at a rally outside the Detroit offices of U.S. Attorney General Eric Holder at the conclusion of the freeway blockade. “If they get away with this attack here, they will come to the rest of the nation’s Black cities.”

Snyder has appointed emergency managers almost exclusively in Michigan’s majority-Black cities. Rainbow PUSH and the National Action Network are calling on Holder to investigate whether the governor’s actions violate the National Voting Rights Act. An earlier appeal to Holder by U.S. Rep. John Conyers (D-Detroit), made in Dec. 2011, was ignored.

Councilwomen Brenda Jones and JoAnn Watson at NO EFM rally March 6, 2013, Councilman Kwame Kenyatta was ill.

Snyder appointed the FRT under the provisions of Public Act 72, which the state’s website says is “repealed” and “outdated,” after Michigan voters overwhelmingly repealed the hated Public Act 4 at the polls in November.

“There exists irrefutable evidence that EFM’s imposed by the state of Michigan and municipalities and school districts predominated by people of color have not solved financial deficits,” Councilwoman Watson declared earlier. “EFM’s have actually increased deficits, deepened fiscal crises and de-stabilized governmental infrastructures, while robbing citizens of assets, services, access to decision-making, voter representation and accountability.”

Tyrone Travis and former School Board member Marie Thornton at rally against EFM March 6 2013.

During the March 6 rally, one resident demanded, “If an emergency manager comes to town, arrest him and put him in the Wayne County Jail with the rest of the fellows.” Long-time activist Tyrone Travis and many others demanded, “Take it to the streets,” particularly to the city’s impoverished youth.

Attorney Jerome Goldberg of the Moratorium NOW Coalition against Foreclosures said,

“The emergency manager laws’ sole purpose is to guarantee the city’s debt payments to the same racist banks which drove 250,000 people out of Detroit through predatory lending and foreclosures, at the expense of necessary services for the people. Detroit paid $600 million in debt to the banks last year. It’s time to take our city back from the banksters who are calling the shots.”

The global bank UBS AG holds one of the city’s largest debts, a predatory $1.5 billion loan taken out in 2004 before the global economic collapse of 2008. The U.S. Department of Justice just fined UBS $1.5 billion for interest-rate rigging related to the LIBOR (London Interbank Offered Rate) scandal.

The global bank UBS AG holds one of the city’s largest debts, a predatory $1.5 billion loan taken out in 2004 before the global economic collapse of 2008. The U.S. Department of Justice just fined UBS $1.5 billion for interest-rate rigging related to the LIBOR (London Interbank Offered Rate) scandal.

Wall Street ratings agency Standard and Poor’s sent a representative to the Detroit City Council table to push the UBS loan. Standard and Poor’s now faces a $5 billion fraud lawsuit brought by the USDOJ, but neither UBS nor Standard and Poor’s are being forced to pay reparations to Detroit.

At the rally, mayoral candidates Krystal Crittendon, the city’s former Corporation Counsel, and Tom Barrow, an accountant and financial expert, stressed that even under Public Act 72, there is no legitimate financial or legal reason for the takeover.

Rally to save Belle Isle Sept. 22, 2013. BELLE ISLE IS BLACK LAND!

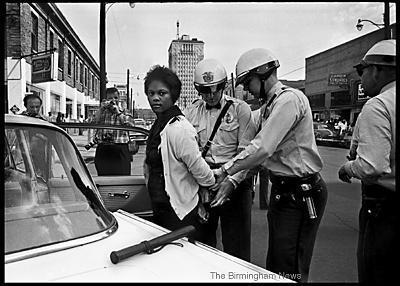

“Just because a city is economically depressed does not mean we do not have the right to self-determination,” Crittendon said. “People owe us money and they must pay it. We stand on the shoulders of thousands of others, many of whom faced down police dogs and the lash of the whip.”

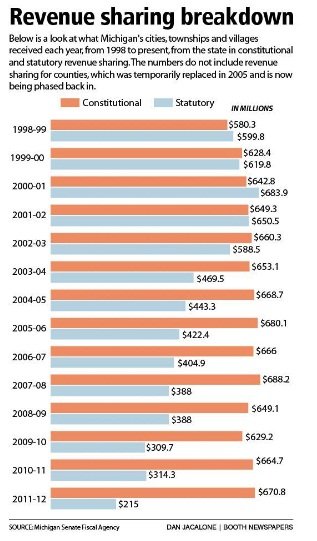

Crittendon earlier sued the state to void the Consent Agreement, saying the state of Michigan owes Detroit over $300 million, including $224 million in revenue-sharing dollars. The state itself is currently running a large surplus but has refused to provide financial help to Detroit, even withholding most of a $137 million state loan the city took out in April, to force the city to agree to Treasurer Dillon’s conditions.

Mayoral candidates Tom Barrow and Krystal Crittendon joined forces at rally against EFM March 6, 2013.

After Crittendon declared that she could not ethically recommend the Council vote for the state’s demands, calling them extortion, she was ousted from office.

Councilwoman Watson has compiled other figures showing that major corporations among others owe Detroit $800 million in taxes and other fees.

Barrow took part in a meeting with Councilwoman Watson and Dillon earlier in the week, to defend the city’s handling of its finances.

Speakers line up at rally against EFM March 6, 2013.

“After reviewing the city’s Comprehensive Annual Financial Report, the Financial Review Team report, and other documents, I find that the State of Michigan is using misdirection and a contrived financial emergency,” Barrow said. “I wholly reject the existence of such an emergency in either the short or the near term.”

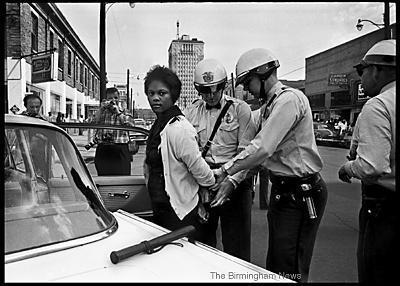

May 7, 1963: Birmingham Police arrest Parker High School student Mattie Howard in front of the Carver Theatre. Youths became an integral part of the civlil rights movement when the Children’s Crusade began on May 2. The plan was for college and high school students to demonstrate, but many came with their younger brothers and sisters. Howard’s arrest came during Day 6 of the Children’s campaign. Photos of her arrest appeared in several publications outside of Alabama. (Norman Dean, Birmingham News file)

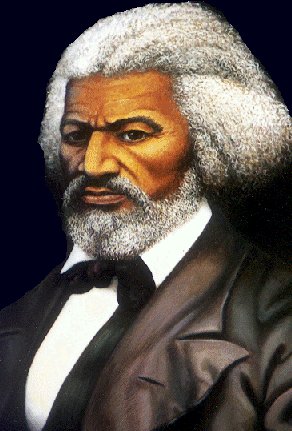

He declared earlier, “In the spirit of Frederick Douglass, I call upon my fellow Detroiters, activists and citizens alike, to let’s meet to plan our actions to combat this abrogation of democracy. It may require civil disobedience in the name of all Americans who love freedom and democracy; it may require us to choose economic targets to boycott; strategic locations to disrupt; facilities to protect symbolically, and a plan of communication to our nation to show our outrage.”

The attack on Detroit comes in the wake of the legislature’s conversion of Michigan to a “Right to Work” state in December. Many at the time called on the state’s unions to conduct a general strike in protest, but that has not happened.

Sitdown at GM plant in 1930’s.

The United Auto Workers was born in Detroit and Flint, another majority-Black city which has been under an EFM since 2008 But the union’s reaction to the pending takeover of Detroit has been virtually nil.

It issued a statement declaring, “The governor’s announcement last week of his planned appointment of an emergency financial manager for Detroit was disheartening to say the least. Frankly, it is further evidence of his intent to erode democracy for the citizens of Michigan in general, and the city of Detroit in particular.”

Some UAW members participated in protest against Wisconsin Gov. Scott Walker when he came to Troy, MI, but protests have not stopped the devastation of Detroit, the poorest city in the country. It’s time to “disrupt commerce” as UAW workers did in the 1930’s.

It called for no action whatsoever, let alone a general strike, to defend the interests of at least half of the state’s Black residents who have been disenfranchised, as well as public workers who stand to lose their jobs and pensions under emergency managers.

Earlier, it took no action on behalf of tens of thousands of Michigan families Snyder permanently cut off public assistance in 2011. Neither did Rev. Jesse Jackson of Rainbow PUSH, who told this reporter that an economic boycott of the state in response was out of the question.

Campaign against PA 4 EM law succeeded.

The American Federation of State, County and Municipal Employees (AFSCME) Council 25, which represents most municipal workers, led the campaign to repeal Public Act 4 and is currently active in pursuing a federal lawsuit against its successor act. However, when workers at the city’s mammoth Water and Sewerage Department, which serves six counties, struck Sept. 30, 2012 to protest an ongoing takeover of the department, Council 25 representatives sabotaged the strike, passing out a federal judge’s “back-to-work” order on the picket lines and telling workers to return.

During the March 6 rally, however Local 207 secretary-treasurer Mike Mulholland, one of the strike’s leaders, said, “We fought back against the takeover of Detroit’s largest department, hoping the rest of the unions would grab it and spread it. They did not, but there will be other opportunities. Imagine what would have happened if the rest of the union movement had walked out when we did.

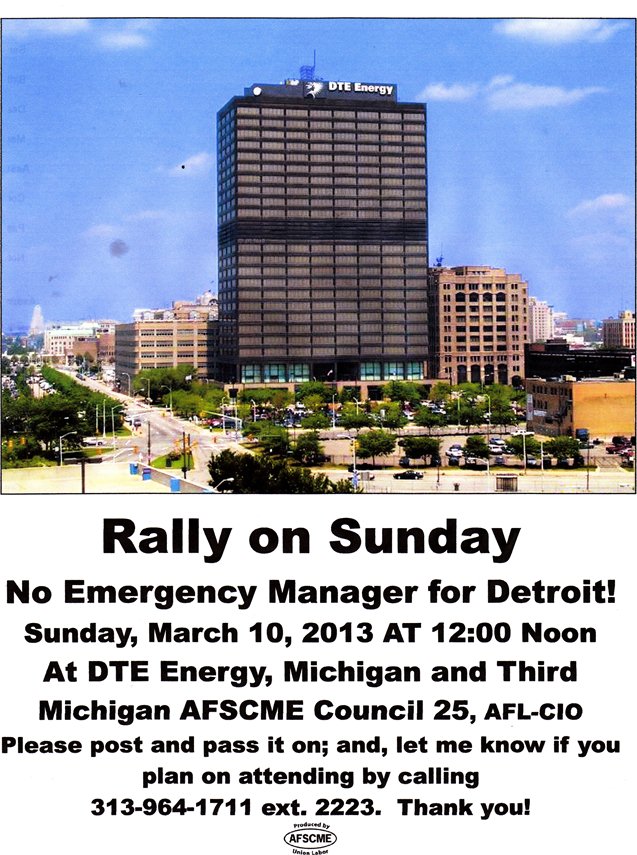

DTE Energy owes millions to the City of Detroit.