Homes of Black Brush Park residents burn in previous years.

Plan for new Brush Park, controlled by Dan Gilbert’s Bedrock Real Estate

Duggan has no right under state law to order Brush Park Plan

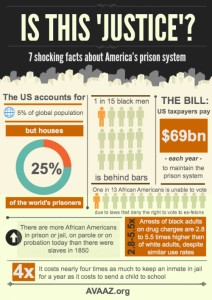

State and city bureaucrats destroyed BLACK Brush Park:

Historic homes and enterprises demolished, set on fire

At least 800 residents left homeless, with no relocation funds

By Ron Seigel

June 25, 2015

Detroit “Mayor” Mike Duggan, billionaire developer Dan Gilbert.

A few weeks ago Detroit Mayor Mike Duggan held a well-publicized press conference about an urban renewal project he claims will restore the historic Detroit area of Brush Park. That project is dominated by multi-billionaire Dan Gilbert’s Bedrock Real Estate.

The problem is that it is against the law for the Mayor or any city department to approve such a plan. Any city council member who votes for the plan or for that matter any urban renewal plans in any area whatsoever will be breaking the law.

State Act 344 Section (a)(6) states “A local commission, public agency, [such as a city]] or legislative body of any municipality shall not approve any development unless there has been consultation between…the officials responsible for the development” and the citizens district council (CDC) representing residents and businesses in the area where the development is taking place.

Detroit’s former EM Kevyn Orr with Michigan Gov. Rick Snyder at side announces plan for bankruptcy which has destroyed Detroit, on July 19, 2013. Orr abolished CDC’s on Sept. 22, 2014.

This is impossible, because in his closing days as Detroit’s emergency manager Kevyn Orr, appointed by Governor Rick Snyder, abolished all CDCs.

Neither Orr nor the Snyder Administration had any legal right to do so.

It may be arguable that under the recent legislation rammed through by Snyder’s Republican Party, Orr did have the authority to repeal every law in the City of Detroit whenever he wanted to. However, citizen district councils were established under state law. Orr, as a creature of state government, had no more legal power to interfere with state laws than his boss Governor Snyder has to shut down the state legislature. One might ponder whether the former emergency manager and the governor behind him need a lesson in high school civics.

A more compelling question is whether they have something they are desperately trying to hide.

Orr’s spokesperson, Bill Nowling, justified Orr’s actions by saying “It was felt CDCs represented an unnecessary level of bureaucracy that was hindering future development by revitalization efforts.”

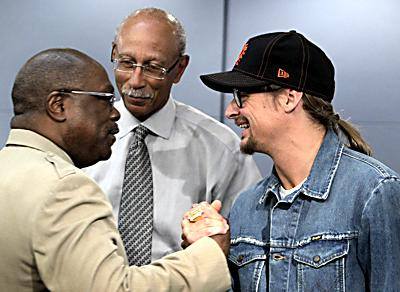

Gwen Mingo (r), formerly chair of Brush Park CDC, talks with Jimmy Cole at Call ‘Em ‘Out dinner Feb. 25, 2012.

Actually citizen district councils had no power to stop or even delay any development whatsoever. The law set them up as an advisory body so those in the area have a chance to voice their concerns about what the government was doing to their area.

They could in no way be considered a bureaucracy.

What probably frightened Orr and Snyder was that CDC’s could occasionally try to use the influence of private citizens with their elected representatives to prevent the real bureaucrats, the ones in government, from doing whatever they wanted whenever they wanted. Perhaps most frightening of all, under state law the private citizens had the right to know what the bureaucrats were doing.

Historically in past urban renewal projects it was the state and city bureaucrats which ruined Brush Park. As Father Norman Thomas, Pastor of the nearby Sacred Heart Church, said, “It’s the most terrible thing I’ve ever seen.”

The government bureaucrats committed illegalities all along the way. The Brush Park CDC’s asked for an investigation by a federal grand jury. It seems clear why the bureaucrats may not want them around. Looking at the record:

STATE OFFICIALS DESTROYED THE AREA’S BUSINESSES

Paradise Theater in Paradise Valley.

Several decades ago Brush Park had a prosperous business district on Hastings Street and a popular entertainment district called Paradise Valley. The owners just happened to be Black.

“It was a high period of Black culture,” Dorothy Robinson, a playwright and the owner of a theatrical group, said regarding the area’s entertainment district. “There would always be excitement and a variety of things going on. ”

She added, “When we had anything, white people came to see it. They were not so prejudiced that they did not enjoy Black entertainment.” State officials just happened to build the Chrysler Expressway (I-75) right in the middle of the Black business area.

455 Alfred as it looks today. Formerly residence of Douglas Fuller.

In an interview 10 years ago William Worden, then Director of the Detroit Historic Advisory Board, stated, “The common view is that this was not done inadvertently.”

Douglas Fuller, a lifelong Brush Park resident, said, “The kids don’t know the pride we had or how it felt. There is no more evidence of where we came from or what we did here.”

The businessmen authorized to “revitalize” Brush Park are not the ones who were displaced, but a new group of outsiders.

The Orr-Snyder Machine may call this free enterprise, but it seems more like free loading.

BUREAUCRATS ILLEGALLY DESTROYED HISTORIC BUILDINGS

City Cab registered logo for historic Black-owned Detroit cab company.

While city bureaucrats may talk of restoring city buildings, it was the bureaucrats who were responsible for illegally destroying them. Some were private houses. Some had significance in Black history, like the original stand for the first African-American taxi cab company in Detroit, and buildings in the entertainment district. They also destroyed one building that once belonged to the infamous Purple Gang.

On hearing about this, one man quipped,”They don’t even have respect for fellow gangsters.”

In 2003 state bureaucrats joined in the demolition with funds from the Michigan Department of Environmental Quality (MDEQ) under the pretext of its Clean Energy Program.

The Brush Park CDC wrote to MDEQ, “It is criminal, outrageous, and an abomination to demolish these properties.”

Former Mich. Gov. Jennifer Granholm lays down the first EM law in State of the State address.

At a time when so many neighborhoods were pleading in vain for the demolition of vacant houses that they considered eyesores or positively dangerous, why were taxpayer dollars being used to demolish houses in the one area where residents wanted them to stay?

When spokespersons for state and city officials were asked about this, they promptly passed responsibility to those on other levels. Liz Boyd, spokesperson for former Michigan Governor Jennifer Granholm, said this was a matter for the MDEQ.

MDEQ spokesperson Patricia Spetzley stated, “The City of Detroit prioritizes what is torn down with state tax dollars. The residents should go to the Mayor. ” Ironically, professed concern from the Granholm administration about cities setting priorities did not prevent Granholm a few years later from advocating that state appointed managers of local governmental bodies be given powers beyond financial issues and control all policies — paving the way for the reign of Kevyn Orr.

Call ’em Out Sambo award was presented to Kwame Kilpatrick.

Just as ironically the spokesperson for Detroit’s mayor, then Kwame Kilpatrick, indicated that it might not be any use for residents to go to his boss. Kilpatrick’s spokesperson Howard Hughey said the Mayor did not care to know where state environmental funds were going, but was leaving these things up to the city’s Planning and Development Department (P&DD).

Hughey declared, “It’s not a mayoral issue, but a P&DD issue. The P&DD submits their plan for making the city cleaner. The Mayor has perfect confidence in those he put in leadership positions. It doesn’t go from the top down, but from the bottom up.”

This left voters who put Kilpatrick in office below the bottom level with no place to go.

When P&DD press secretary Lona Reeves was interviewed, she promised to look up the position of her department, but failed to call back. Actually appropriate officials substantiated the Brush Park CDC statement that the demolition of historically designated houses was criminal.

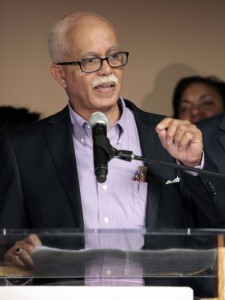

William Worden today/Facebook

Worden from the Historic District Commission, said before a historic building can be torn down, the commission had to hold a hearing and grant a permit. The city’s own Historic District Ordinance said a private owner who did not follow such procedures would be subject to fines and imprisonment.

The Detroit City Planning Commission under the Detroit City Council said this violated federal law, Section 100 of the National Historic Preservation Act.

The Brush Park CDC sent resolutions charging the city with “perpetrating fraud for failing to carry out objectives listed in its own urban renewal plan to preserve historic buildings.” It called for a criminal investigation over their use of funds.

In its 2003 letter to the MDEQ, the CDC speculated on the reason for this historic vandalism of Detroit’s history. It said that if the historic buildings were preserved, as the law specified, developers could not take the land. With the buildings out of the way, the developers could get the land “at low cost or no cost.” In short, the taxes paid for such illegal demolition was assisting “rich developers” in “destroying a historic district.”

Looking at what the city and state bureaucrats have done to historic buildings, how much faith can we have that the ones under Duggan and Snyder will preserve anything?

BUREACRATS TOOK BRUSH PARK RESIDENTS’ HOMES

Even more compelling, state and city bureaucrats took people’s homes away.

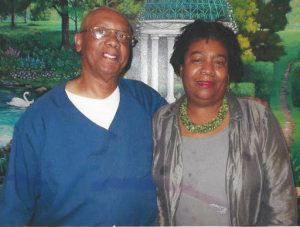

Gwen Mingo lives in her Brush Park home to this day, despite terror tactics that drove most of her neighbors out.

Gwen Mingo, former head of the Brush Park CDC, said, “They tried to kill you from the inside just like they tried to destroy the buildings . They threw the people out, smashing them to the ground like a piece of trash.”

Originally the stated legal purpose of urban renewal was to clear away slums and to “provide a decent home for every American family.” It expanded to allow government to seize the property of the poor and middle class in order to bring in big business and richer folks under a sociological process called “gentrification. ” This moved people into slums and created greater homelessness for many American families.

Homeless.

Jackie Green declared, “We became homeless for a long time. You had to sleep here and there in vacant houses.”

In this case too there have been violations of the law. Urban renewal programs have received federal funding from the U.S. Department of Housing and Urban Development (HUD ). Part of the legal mission of HUD is to “address the challenge of homelessness,” and that would mean not creating homelessness. Another part of the legal purpose is “to move people from renting to home ownership.” HUD-funded urban renewal has moved people out of the homes they own into a place they can rent, if they can find one.

BLATANT RACIAL DISCRIMINATION

There have been other violations. Continue reading →