Brown’s cousin Ty Pruitt interviewed on CNN in video above

The usual M.O. in the Police States of America: blame the victims

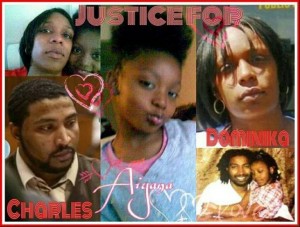

Aiyana Jones’ family was similarly tortured and punished in Detroit

Holiday appeal for funds for her family

St. Louis police target youth who participated in rebellion as well; refuse to charge killer of Vonderrit Myers, Jr.

_________________

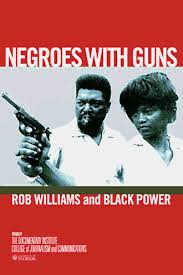

“I made a statement that if the law, if the United States Constitution cannot be enforced in this social jungle called Dixie, it is time that Negroes must defend themselves even if it is necessary to resort to violence.

That there is no law here, there is no need to take the white attackers to the courts because they will go free and that the federal government is not coming to the aid of people who are oppressed, and it is time for Negro men to stand up and be men and if it is necessary for us to die we must be willing to die. If it is necessary for us to kill we must be willing to kill.” – Freedom fighter Robert Williams, author of “Negroes with Guns”

http://www.pbs.org/independentlens/negroeswithguns/rob.html

By Diane Bukowski

Andrew Brady, Korey Haulcy, Cedric James: more Black youth targeted by St. Louis Police– IT IS RIGHT TO REBEL!

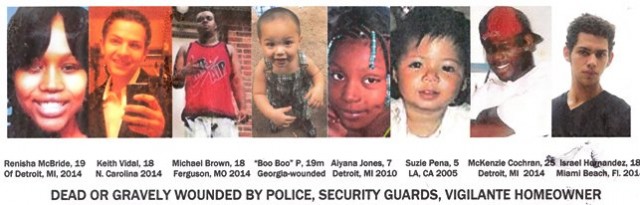

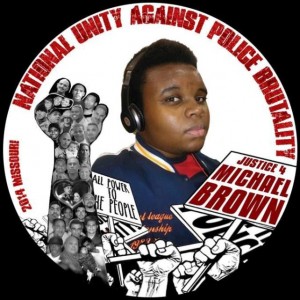

Update: In the wake of the outrageous grand jury decisions in the murders of Michael Brown and Eric Garner, St. Louis-area police are pursuing charges not only against Brown’s family members, but against dozens who participated in rebellions against his murder and the grand jury decision.

See links below this article. They include three young men charged with throwing items at police (photo above) another man charged with interfering with police radio dispatches, (at left) who was beaten up during his arrest, and at least 24 others.

Two possible witnesses in the grand jury case, Shawn Gray and De’Andre Joshua, have been found dead in suspicious circumstances as well. The St. Louis Police Department has also refused to bring charges against the officer who killed Vonderrit Myers, 18.

Commentary

December 3, 2014

DETROIT – Now the torture begins again for the family of Michael Brown.

On May 16, 2010, a Detroit police SWAT team raided the home of Aiyana Jones, 7. Officer Joseph Weekley, Jr. instantly blasted her in the head with an MP5 submachine gun as she lay sleeping on her family’s couch. Her brains and blood flew out across the couch and floor.

The first question a mainstream reporter asked at a press conference several days later was, “Didn’t Charles Jones [Aiyana’s father] give the gun to Chauncey Owens?” She referred to the killing of JeRean Blake, 17, on May 14, 2014. It was information that could only have been leaked by police. Wayne County Prosecutor Kym Worthy did not charge the child’s father with first-degree murder until 17 months later.

Killer cop Weekley freed; Aiyana’s father imprisoned

Weekley is now free as a bird, after two mistrials, never having spent a day in jail. But forensics experts testified at his trial that his gun could not have gone off accidentally. The medical examiner said it is possible that the gun was placed directly against Aiyana’s head. Other officers said the gunshot rang out only seconds after entry, and that they are thoroughly trained not to put their finger on the trigger unless they plan to shoot.

Charles Jones is serving 40-60 years in prison on trumped-on charges in the Blake case, brought to justify the police raid on his mother’s flat, an address not named in the original search warrant. A police video at his trial showed Owens naming another man, not Charles, as the provider of the gun. No witnesses except two jailhouse snitches testified that Jones gave Owens the gun. No eyewitnesses saw such an act.

Meanwhile, the Detroit police continue to harass other members of this very large extended and impoverished family, still suffering from the unimaginable and ongoing horror that began four and a half years ago, as the holidays approach. Charles Jones is not there to help care for his six other children, two of whom were in the house along with him and their mother Dominika Jones, when Aiyana was killed.

Below: video of Mertilla Jones’ courtroom testimony on witnessing killing of her granddaughter Aiyana Jones

History repeats itself for Michael Brown’s family

On Aug. 9, 2014, Ferguson police officer Darren Wilson chased and shot Michael Brown, 18 and unarmed, at least six to eight times as he held up his hands in surrender. So said eyewitnesses closest to the scene, including one young woman only feet away from the police, and two white construction workers, one of whom imitated what Brown had done, holding his hands up in the air as police swarmed the area.

Michael Brown’s body lay in the street for over four hours in the hot sun as his blood and brains poured out of his head and his family begged police to cover him.

Below: video of account from Dorian Johnson, who was walking with Michael Brown when he was killed.

On Nov. 24, 2014, a grand jury which inappropriately heard four and a half hours of unbridled testimony from Wilson, refused to indict the killer cop. During his testimony, Wilson referred to Brown as “it,” a “demon” and “Hulk Hogan.”

St. Louis County Prosecutor Robert McCulloch was in charge of presenting the case. In an on-line commentary, an attorney noted “the ‘prosecutor’ presented the case as if he were REPRESENTING THE DEFENDANT. . .Why did the prosecutor do this? …because he is a police force advocate. There’s a long history on this. His dad was a police officer killed by a black suspect; his brother, nephew, and cousin are also officers; his mother worked for the force for 20 years. (Click on The unethical use of a grand jury to defend defendant Darren Wilson for full remarks.)

As crowds of youth massed in the streets outside Ferguson police headquarters, the news hit like the stun grenade police threw into Aiyana Jones’ home. Eventually a large part of Ferguson’s commercial section was burnt to the ground.

Michael Brown’s mother Lesley McSpadden, back from testifying before the United Nations, stood on a car in those streets, shouting out her sorrow and despair, then broke down weeping uncontrollably. Her husband, Michael’s stepfather Louis Head, jumped up to hold her tightly in his arms. His shirt read on the back, “I am Mike Brown,” with a picture of Brown in his high school graduation gown on the front.

Astonishingly, even commentator Nancy Grace, known as a conservative defender of cops, blasted Darren Wilson and the grand jury decision on national TV.

“Burn this b—- down”

As someone in the crowd shouted, “Fuck the police,” he turned around and cried out in grief and anger, “Burn this bitch down.”

Like pit bulls trained to kill, Missouri government officials and police now are after Louis Head for allegedly inciting a riot. It’s not enough that Wilson, like Weekley, is free as a bird, after committing outright murder. They want MORE blood, not just Michael’s.

Police have launched an investigation of Head, speaking first to other individuals before talking to him. Missouri’s Lieutenant Governor has called for him to be charged. Head and his wife have been placed in the outrageous position of having to DEFEND his words and will likely face other investigations, as happened with Aiyana Jones’ family.

The mainstream media piously declares that Head’s remarks, and Ty Pruitt calling Wilson a murderer, were inappropriate and slanderous. During Weekley’s trial earlier this year, Detroit News reporter George Hunter tweeted piously that this reporter’s depiction of Weekley as a “killer cop” was unjust.

Never mind that Missouri police killed two other Black youth only weeks after Mike Brown was gunned down like an animal. Never mind that the United Nations Committee on Torture condemned the U.S. as a whole for hundreds of incidents of police killings and brutality committed against Blacks in particular, on Nov. 20, just before the grand jury verdict was handed down. Eighty-nine Blacks killed in Chicago alone over the last five years, and 300 shot.

THIS IS WAR. What are Blacks and other people of this country supposed to do to defend themselves? The people of Ferguson have been accused of “burning down their own community.” They didn’t burn their homes; they burned stores run by people of other ethnicities. In two cases, phone calls to the police by store clerks for petty incidents may have precipitated the police MURDERS of Mike Brown and Kaijeme Powell.

YES THEY WERE MURDERS, AND YES, BLACK PEOPLE IN THE POLICE STATES OF AMERICA HAVE THE HUMAN RIGHT TO DEFEND THEMSELVES AND FIGHT BACK!

Fortunately, a multinational movement comprised of both Black and white youth has developed out of Michael Brown’s racist murder, with thousands of demonstrators occupying freeways and shopping malls across the U.S. since the grand jury verdict. May this movement develop until it reaches the scale of the civil rights and Black Power movements of the 1960’s, and go beyond them until this entire system is burnt to the ground and replaced with one devoted to the people, not police, and not profit.

“We Will Not Be Satisfied Until Justice Rolls Down Like Water and Righteousness Like a Mighty Stream” – Dr. Martin Luther King, Jr.

Related:

*******************************************************************

VOD APPEAL FOR HOLIDAY FUNDS FOR AIYANA JONES’ FAMILY: Aiyana Jones’ extended family, including numerous young children whose parents have had difficulty finding employment, has nothing for the holidays. VOD is appealing to the community not to forget them. Checks and money orders should be made out to “Mertilla Jones” (Aiyana’s grandmother), and sent c/o Voice of Detroit, P.O. Box 32684, Detroit 48232.

(The family’s civil lawsuit has not been heard during the pendency of the Detroit bankruptcy. Lawyers representing the family will likely have a difficult time if trial does begin, due to the unjust conviction of Aiyana’s dad, who along with Dominika Jones, represents her estate. Any trial will likely take years.)