By Darrell Preston dpreston@bloomberg.net

September 13, 2012

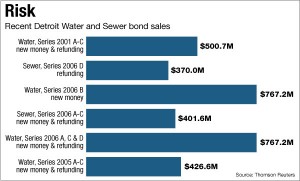

JPMorgan Chase & Co. (JPM), the third-largest muni-bond underwriter, stood to gain more than just its share of $7.8 million in fees by helping Detroit’s water and sewer (87962MF) unit issue new debt after the city staved off insolvency.

- AFSCME Local 207 Secretary-Treasurer Mike Mulholland pickets with large group of DWSD workers at DWSD Huber plant Aug. 15, 2012.

The municipal department’s $659.8 million June bond sale let it pay more than $300 million to banks, including JPMorgan, to end interest-rate swap agreements while raising its borrowing cost. The utility, with 1,978 employees, plans to fire four of every five workers, while debt service has climbed to more than 40 percent of revenue, internal documents show.

As cash-strapped cities from San Bernardino, California, to Harrisburg, Pennsylvania, grapple with insolvency, the Detroit example shows that Wall Street banks never lose. That’s especially true when it comes to arranging transactions to escape distressed debt and swaps initially sold by the lenders. Along with the fees, the deal helped banks such as UBS AG (UBSN), once an underwriter of the debt, recover payments to terminate swaps.

“Interest-rate transactions that have gone horribly wrong”

- During an orgy of Wall Street predatory lending before the big bust in 2008, Detroit also borrowed $1.5 BILLION in pension obligation certficates from UBS and Siebert, Brandford and Shank. It has several times defaulted on the debt, and ended up having to commit to another $1 billion to UBS to stave off complete economic collapse, according to a report from the Detroit Financial Review Team appointed by Michigan Governor Rick Snyder under Public Act 4. The Swiss-based UBS is one of six banks being sued by Britain, the city of Baltimore, and other municipalities across the U.S. in the LIBOR interest-rate fixing scandal.

“They’re paying huge amounts of money for interest-rate transactions that have gone horribly wrong,” said Michael Greenberger, an expert on derivatives at the University of Maryland’s law school. “If this is a strategy that makes sense to do, then you do it, and you hire a banker. You can’t just walk to the corner store to underwrite bonds.”

Costly Swaps

Municipal borrowers from the Metropolitan Water District of Southern California (MWDSCZ) in Los Angeles to Italian towns and Harvard University in Cambridge, Massachusetts, have paid billions of dollars to banks to end interest-rate swaps that didn’t protect taxpayers from unforeseen changes in interest rates. In the bets on borrowing costs, a municipal issuer and another party exchange payments tied to interest-rate indexes.

Obligations linked to swaps initially sold by Wall Street banks as hedges to save tax dollars have cost the Detroit utility more than $500 million to unwind, an amount added to its debt. Before paying $314 million to end some of the agreements in June, it spent $222 million raised in a December 2011 bond sale to end others.

The money used to unwind the swaps would almost cover the utility’s $571.7 million in planned capital spending for the five years through June 2016, according to bond documents. Or it would be enough for the sewer system’s $519.8 million fiscal 2013 budget, with millions to spare.

Separate Entity

The department, while a part of a city that’s under state fiscal oversight, operates as a separate entity with its own board and serves areas outside the municipality. It provides water to 3.8 million people in Detroit and 124 other communities, as well as sewerage to 2.8 million people in the city and 76 more cities and towns.

Beyond the utility’s cost to end the swaps, it bought back auction-rate securities at a premium from proceeds of its bond sale in June and is paying a higher interest rate on the debt it sold to raise the money for the purchases. Trading in the bonds shows that the borrowing through a deal lead-managed by Goldman Sachs & Co. (GS) cost the city more than was necessary, because the price was too low.

- AFSCME Local 207 President John Riehl (l) and Vice-President Lakita Thomas (r) consult with another member during protest at Coleman A. Young Municipal Center. Locals 207 and 2920 are taking strike votes Sept. 25 and 26.

“Detroit has a bad history in the bond market,” said John Riehl, president of the local public-workers union and a senior sewage plant operator for the utility. “They’ve done some foolish things over the years.”

No Comments

Naomi Patton, a spokeswoman for Mayor Dave Bing, didn’t immediately respond to a request for comment on Detroit’s borrowing history and referred questions about the June sale to utility officials.

Matthew Schenk, the utility’s chief operating officer, and James George, assistant finance director, didn’t respond to at least two telephone calls seeking comment on the deals. Tiffany Galvin, a Goldman Sachs spokeswoman, and Elizabeth Seymour of New York-based JPMorgan, also an underwriter, both declined to comment.

Karina Byrne, a UBS spokeswoman, didn’t respond to a request for comment. Another swap counterparty whose agreement was terminated in June was Loop Financial Products.

The transaction in June added to the utility’s financial pressures at a time when Detroit was trying to avoid insolvency that could have forced it to default on its debt. The city’s predicament added to the department’s reasons to get out from under the swaps.

Termination Triggers

Under terms of the derivative deals, appointment of a review team by the state to oversee the city’s finances was one event that could trigger termination and require the utility to make payments to unwind its swaps, according to bond documents.

The department’s June bond sale stalled after Fitch Ratings put the city’s credit score into junk status, citing a potential default on a bond payment due that month. A lawsuit pitting Detroit against Michigan over a financial rescue plan also threatened to interrupt state aid.

The legal dispute involved a challenge to the fiscal plan brought by Krystal Crittendon, the city’s corporation counsel. Governor Rick Snyder’s administration said that if Crittendon’s suit wasn’t dropped, the state would withhold $80 million, which may have led to a default. The lawsuit was dismissed June 13, and the water and sewer utility sold its bonds June 18.

The utility needed to borrow the money because cuts to Detroit’s ratings also had made it possible for the swap counterparties to force the utility to make termination payments. The counterparties decided to allow the department some time to raise the money, according to bond documents.

Too Cheap

Some of the debt initially issued may have been sold too cheaply, according to data compiled by Bloomberg. Prices of the bonds rose by as much as 8 percent in the weeks after the sale, as yields fell, according to the data, which come from the Municipal Securities Rulemaking Board.

A $292.8 million portion maturing in July 2039 priced at par to yield 5.3 percent on June 18. By July 18, it was trading at as much as 108 cents on the dollar, for an average yield of about 4.4 percent. Yields, which move inversely to price, fell on more than two-thirds of the bonds within a month of the sale, according to the data.

Even though some of the debt was backed by Assured Guaranty Ltd. (AGO), parts were priced at higher interest rates than similarly rated debt. The $50 million insured portion maturing in 27 years offered a yield of 5 percent, even though generic 30-year bonds with three years longer to mature were priced at about 4.28 percent, or 0.72 percentage point lower. One month later, the yields on the generic bonds had fallen to 4.18 percent. At the same time, yields on AAA munis fell from 3.54 percent on June 18 to 3.35 percent on July 18.

Auction-Rate Debt

Part of the bonds refinanced were so-called auction-rate securities, a long-term debt with interest rates that reset at weekly or monthly intervals. The issuer accepted tenders for about $51 million of about $70 million of the securities, paying 90 cents on the dollar, according to related bond documents.

Before the buyback, the bonds traded from 61.3 cents to 71.7 cents on the dollar, according to trade data compiled by Bloomberg. In a tender offer, investors tell the issuer what prices they’re willing to take to sell back their securities.

The auction-rate debt had been converted in January from traditional fixed-rate bonds with a 4.33 percent yield, according to data compiled by Bloomberg. After the conversion, the auctions failed as no buyers stepped forward, while the securities reset to yield less than 1 percent, under terms of the transactions.

Higher Costs

Subsequent to the refinancing, the utility has been paying yields of 1.7 percent to 5.3 percent on the new debt, part of which was used to retire the auction-rate securities. The new bonds, issued to take out the debt with rates that reset periodically, have increased the department’s costs.

Yields on 10-year top-rated municipals at 1.75 percent fell below interest rates of comparable-maturity Treasuries yesterday for the first time since mid-May, data compiled by Bloomberg show. Treasury 10-year note yields rose to a three-week high of 1.76 percent at 5 p.m. yesterday in New York trading, according to Bloomberg Bond Trader prices.

The water and sewer department is moving ahead with a plan to restructure the utility as recommended by EMA Inc., a St. Paul, Minnesota, consulting firm, the city announced on Sept. 11. Proposed in August, the plan would cut employment to 374 from the current 1,978 through outsourcing and redesigning jobs. The changes would save more than $138 million a year.

Overhaul Needed

The overhaul is needed because of increasing debt and personnel costs, a reduction in the system’s reliability and the loss of customers, Sue McCormick, the utility’s director, said in a presentation in August. Increased rates for customers aren’t part of the plan, according to the presentation, which suggests that current prices are higher than the industry norm.

“We have a huge mortgage on the system based on capital borrowing,” McCormick said. “We have a compelling case to reduce our costs.”

The cuts in the number of workers will likely curb performance by the utility, said Riehl, the union president.“Service to the community will go down,” he said.

The new debt from the cost of unwinding swaps is a“burden,” said Maryland’s Greenberger.

“Banks are not charitable, but this deal probably stops the bleeding,” Greenberger said.“They never should have entered these deals in the first place.”

Following are pending sales:

OMAHA PUBLIC POWER DISTRICT in Nebraska plans to sell $550 million of tax-exempt bonds as soon as next week to refund debt, data compiled by Bloomberg show. (Updated Sept. 12)

CONNECTICUT is set to issue $570 million of general-obligation debt as soon as next week for capital projects, according to offering documents. (Added Sept. 12)

To contact the reporter on this story: Darrell Preston in Dallas at

Related articles:

http://voiceofdetroit.net/2012/07/20/libor-scandal-could-turn-ugly-as-cities-begin-to-sue-banks/

Pingback: Voice of Detroit requests investigation by US Dept. of Justice, no response yet » Cancel Detroit’s Debt To The Banks!

Put “LIBOR” in search engine for VOD at top of this page and it will bring up two articles on the LIBOR scandal, the Baltimore suit, and UBS.

she is executive secretary II in the finance dept. and was interested in the baltimore class action suit. please help point her in the right direction if there is one. thanks , cindy darrah 313 414 5181; cindydarrah@gmail.com

she, jennifer , did not write this; i did. cindy darrah