The video above was authored by a newly-formed group of Detroit youth called “Project #Save Detroit 2013.” Facebook page at https://www.facebook.com/#!/groups/136630999850728/

Federal lawsuit planned, civil disobedience training March 23, 10 a.m.

EM’s law firm Jones Day represents most banks holding Detroit debt

By Diane Bukowski

March 22, 2013

Detroit, regional and national leaders (l to r) Attorney Herb Sanders, U.S. Cong. John Conyers, Rev. Jesse Jackson, Detroit Councilwoman JoAnn Watson, Wayne Co. COmmissioner Martha Scott, AFSCME Council 25 Pres. Al Garrett March 22, 2013

DETROIT – Detroit leaders, with Rev. Jesse Jackson of Rainbow PUSH, announced today that they will conduct “major, mass non-violent direct action” protests in the city as a joint state/bank takeover begins. The protests will be coordinated with the filing of a complaint in federal court citing violations of the National Voting Rights Act, expected to occur next week.

The press conference, held in the Erma Henderson Auditorium of the Coleman A. Young Municipal Center, was spearheaded by Detroit City Councilwoman JoAnn Watson, the leader of opposition to Michigan’s municipal take-over laws since 2010. Those laws have been directed almost exclusively against the state’s majority-Black cities.

Along with Rev. Jackson, it included speakers U.S. Congressman John Conyers, Wayne County Commissioner Martha Scott, and attorney Herbert Sanders, and Mayoral candidate Krystal Crittendon.

Rev. Jesse Jackson said Snyder is transforming Michigan government into a “plantocracy,” and that immediate federal intervention, which has been requested by Congressman Conyers (D-Detroit), is needed.

“We cannot allow Detroit to be the site of a giant rummage sale,” he said. “If the governor of Michigan can take over Detroit and sell off assets like the water department, public lighting and Belle Isle, than why can’t other governors do the same to majority-Black cities in other states? There is a financial crisis in Birmingham, Alabama right now, with the collapse of the steel mills. Can the governor of Alabama now disenfranchise the people of Birmingham? What about Chicago, which just announced the closing of 54 schools due to $l billion in debt? This is a dangerous precedent.”

Attorney Herb Sanders said details of a federal lawsuit being filed by the Sugar Law Center, AFSCME Council 25, and others would be made available the following day, Sat. March 23 at 10 a.m. at the Historic King Solomon Baptist Church, located at 6100 14th Street. Civil disobedience training will also take place then.

“I agree we need federal intervention,” Sanders said. “But we are going to need mass protests and civil disobedience to make the federal government do what they are supposed to do. Our efforts in court will not be successful unless the judge can look out his window and see thousands of people in the streets. As Dr. Martin Luther King, Jr. said, this is not the time for cooling off, but the time for getting hot, heated and upset, the time to take action. It is time for drastic measures.

One activist at the press conference said 40 civil disobedience actions are in the works.

Sanders said Detroit’s crisis began with the elimination of city worker residency requirements by the state, escalated to Gov. Snyder’s elimination of revenue-sharing to the cities and a $6 billion tax cut for the corporations, and culminated with predatory lending both in the mortgage and municipal bond markets.

Michigan Gov. Rick Snyder appointed Kevyn Orr as emergency financial manager of the country’s largest majority-Black city March 14, to take office March 25. Michigan’s new Emergency Manager law, Public Act 436, was enacted during the legislature’s lame duck session at the end of 2o12, after Michigan voters overwhelmingly repealed its predecessor Public Act 4 in Nov. 2012.

PA 436 takes effect March 27. Orr and emergency managers from majority Black cities and schools districts across Michigan will be grandfathered in under the new law.

Orr’s former law firm, Jones Day, will function as the city’s “restructuring consultant.” Jones Day represents many of the world’s largest banks, including those who hold the majority of the city’s debt load, and have used predatory lending and illegal foreclosures to force 250,000 residents out.

Orr said his takeover of Detroit will involve an “Olympics of restructuring.”

“Everything—leasing, sale/leaseback, privatization, 99-year leases with a reversion to the city—everything’s on the table,” he told the Detroit Free Press. He specifically cited Detroit’s Water and Sewerage Department, which is the third largest in the country, the city’s pension funds, worth $6 billion, and Belle Isle, the largest public island park in the U.S.

ORR’S FIRM JONES DAY REPRESENTS MOST BANKS HOLDING CITY DEBT

Detroit debt instruments obtained by the local Moratorium NOW! Coalition indicate Jones Day clients hold the lion’s share of the city’s debt. They include global banks UBS AG, JP Morgan Chase, Goldman Sachs, Bank of America’s Merrill Lynch, Citigroup, and Muriel Siebert & Company, an affiliate of SBS Financial Products.

Documents are available at https://docs.google.com/folder/d/0BwEVDvudxHBTX1lMcXFLdzNOSEU/edit?usp=sharing&pli=1

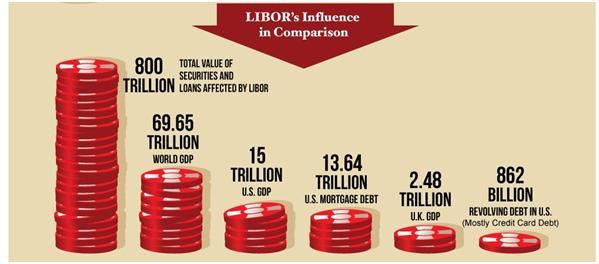

Those banks are also defendants in various lawsuits and world-wide charges involving interest-rate rigging through the London Interbank Offered Rate (LIBOR).

Those banks are also defendants in various lawsuits and world-wide charges involving interest-rate rigging through the London Interbank Offered Rate (LIBOR).

UBS AG just paid a $1.5 billion Libor-related fine to the U.S. Justice Department and other governments for damage caused to municipalities, school districts, state governments, student loans, and even business investors by their fraudulent actions.

Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard and Poor’s push UBS loan at City Council Jan. 31, 2004

Wall Street bond ratings agency Standard and Poor’s lauded the state takeover of Detroit, although they themselves face a $5 billion lawsuit for fraudulent ratings practices filed by the U.S. Department of Justice. S & P representative Stephen Murphy came to the Detroit City Council table in 2004 to get the body to approve a controversial $1.5 billion loan from UBS and Siebert, Branford and Shank, on which the city has twice defaulted, causing huge additional costs.

In an article entitled, “Only Wall Street Wins in Detroit Crisis, Reaping $474 Million Fee,” Bloomberg Businessweek quoted David Sole of the Moratorium NOW Coalition.

“We have no lights, no buses, poor streets and now we’re paying millions of dollars a year on our debt,” Sole said. “The banks said they need to be paid first.” His coalition advocates a moratorium on Detroit debt payments, an idea first raised by former Detroit Mayor Frank Murphy during the Great Depression.

Bloomberg said Wall Street debt sales of nearly $15 billion to Detroit have cost $474 million in underwriting expenses, bond-insurance premiums and fees for wrong-way bets on swaps. Detroit’s budget deficit is allegedly $327 million, but that figure has fluctuated drastically as it comes from various sources.

“This crisis was caused by the same folks who are taking over Detroit,” said AFSCME Council 25 President Al Garrett said at the press conference. “The city’s obligation to pay its debt has trumped the needs of the people. We need the federal government to look at what’s happening with municipal financing. The primary purpose of the Emergency Manager laws is to ensure the banks get paid. These are the same scoundrels who have carried out foreclosures based on predatory loans, and then won’t pay property taxes on the foreclosed properties.”

U.S. Congressman John Conyers wrote to U.S. Attorney General Eric Holder in Dec. 2011 to ask for a DOJ investigation of Michigan’s Public Act 4 for violation of the Voting Rights Act, but no action was taken.

“This time, we are going to meet with him to demand action,” Congressman Conyers said.

Detroit’s former Corporation Counsel Krystal Crittendon, who is running for Mayor this year, said no financial crisis in Detroit would exist if the state and corporations would pay the hundreds of millions of dollars they owe the city.

She said State Treasurer Andy Dillon has acknowledged the state owes Detroit at least $224 million in revenue-sharing funds, and that corporations owe another $800 million in taxes.

“There has been no discussion in the legislature about paying that money back,” she said. “Instead, they said we are going to take your right to vote for because of what we did to you. The governor calls it ‘help,’ but I know the difference between help and what they are doing. We are not asking for a hand-out, just for them to pay us what they owe.”

Rev. Jackson said that instead of the state takeover, plans to assist Detroit must include investment in the city’s 100,000 vacant houses, rebuilding them instead of tearing them down to displace the population.

“There must be a plan for urban reconstruction,” he said. “Redevelopment banks must be set up to provide long-term low interest loans. There are no Black-owned auto dealerships in Detroit; dealerships must be opened up.”

Rev. Jackson and the other speakers skirted a question about conducting a boycott of Michigan businesses including the auto companies, and the absence of the state’s industrial unions like the United Auto Workers, from the coalition being formed.

Pingback: Is this what democracy look like? | Left Labor Reporter