![]() GRS Review of Milliman’s City of Detroit Retirement System Studies

GRS Review of Milliman’s City of Detroit Retirement System Studies

May 2, 2013

Gabriel, Roeder, Smith & Company (GRS) is the retained actuary for both the General Retirement System of the City of Detroit and the Police and Fire Retirement System of the City of Detroit. GRS is a Michigan based company with a national practice, and is a leader in Public Sector Retirement Consulting. Recently, the City of Detroit engaged Milliman, Inc., a Seattle based consulting firm, to perform certain actuarial analyses of the City of Detroit’s Retirement Systems in connection with the April 2012 financial stability agreement between the State of Michigan and the City of Detroit.

GRS performs an actuarial valuation of both Retirement Systems each year. The actuarial valuations develop the liabilities and funded ratios of the plans as of the valuation date. They also develop the City’s contribution rates for the fiscal year that starts one year after the valuation date, based on established funding policies. The reports typically present information that allows the reader to understand the extent to which contribution rates may be expected to increase (or decrease) in the future and may provide recommendations on the operation of the System.

An article in the February 26, 2013 Detroit Free Press “Police, fire pension costs could crush Detroit’s finances, study shows” asserts that Milliman has “audited” our 2010 valuation reports and found that “the GRS numbers … don’t hold water.” Milliman’s work for the City was confidential and not available to us or to the Retirement Systems at the time the Detroit Free Press article appeared. Consequently, our ability to respond was very limited. We have since obtained a copy of the study which was dated July 6, 2012 and have reviewed it. Nowhere does the study contain the statement that “the GRS numbers … don’t hold water.” The study does, however imply that our calculations may be biased and it contains the following statement on page 2:

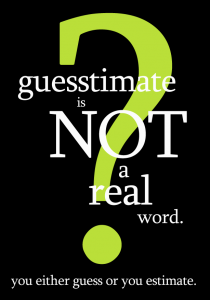

“The following table contains our very rough preliminary guesstimates (“VRPG”) of the potential actual state of the [City of Detroit Retirement] systems. Please note that these VRPGs are based on a high level analysis using rules of thumb and knowledge from general experience are not based on any detailed calculations”

The study goes on to present figures that are remarkably different from the actuarial calculations that experienced public sector actuaries at GRS prepared using detailed data on the operation of the Systems and robust actuarial software. GRS work, which was not based on “VRPG”, complies with relevant pronouncements of the Governmental Accounting Standards Board (GASB) and actuarial standards of practice.

Different actuaries can draw different conclusions from the same set of facts, just as different physicians could provide different advice to the same patient. While the Milliman firm is free to disagree with our analysis of the financial position of the City’s retirement systems, we believe that such disagreement must not be based upon VRPG and rules of thumb, but rather on detailed actuarial calculations performed by actuaries with significant experience with public sector retirement.

Different actuaries can draw different conclusions from the same set of facts, just as different physicians could provide different advice to the same patient. While the Milliman firm is free to disagree with our analysis of the financial position of the City’s retirement systems, we believe that such disagreement must not be based upon VRPG and rules of thumb, but rather on detailed actuarial calculations performed by actuaries with significant experience with public sector retirement.

We are disappointed with the Detroit Free Press for publishing the “don’t hold water” comment, which was nowhere to be found in the Milliman report, and for not mentioning that all of Milliman’s figures were clearly disclosed as very rough preliminary guesstimates (“VRPG”). Indeed, Milliman’s report cautioned that “…any third party recipient of this report should be aided by its own actuary or other qualified professional when reviewing the report”.

We are also disappointed with Michigan’s Emergency Financial Manager (EFM) Law (PA 436), which adds power to the EFM in cases where a retirement system is less than 80% funded. First, the 80% figure itself is arbitrary. A system that is less than 80% funded can be in good financial condition and a system that is more than 80% funded could have problems.

Second, the law provides the Emergency Financial Manager with very different powers over a retirement system that is 79.9% funded versus one that is 80.1% funded, which can lead to distracting arguments over minor differences in judgment regarding actuarial techniques or assumptions that affect the computed funding level. Finally, the law potentially requires the exclusion of certain assets from the calculation of the funded percent that would not normally be excluded in valuations that comply with GASB standards.

The City of Detroit has well known and very significant financial problems. Those problems were caused by a loss of industrial tax base, a very large drop in the City’s population, and obviously the credit crisis. The City’s Retirement Systems in total have about half the active members they had in 1983 and approximately twice as many retired people as active members.

With the market value of Retirement System assets dropping, and the payroll and tax base already having dropped, there is indeed a risk that the contribution needs of the Retirement Systems may rise to levels as a percentage of payroll that will be difficult for the City to afford. Indeed, both Milliman and GRS have produced projections showing similar results regarding future contribution needs. This means that the issues that the Retirement Systems face are, for the most part, a consequence of the City’s problems, and not a cause of those problems.

Contrary to the title of the Detroit Free Press article, it is not the Retirement Systems that will crush the City. Both the City and its Retirement Systems are being harmed by external forces.

The problems that the City and its two Retirement Systems face will not be solved with poorly conceived newspaper articles, VRPG’s, and secret reports that are not made available to the Retirement System or the Retirement System’s public sector actuary in a timely manner.

The problems can be solved with all parties working together in a spirit of cooperation and in an environment of transparency.

Twenty Thousand retirees depend on the Retirement Systems for their financial security. These are people who have devoted their entire lives to the people of the City of Detroit. They deserve our best.

Statement from the Police and Fire Retirement System of the City of Detroit regarding Pension Funding Levels.

From Matt Gnatek, Chairman, Board of Trustees, Police and Fire Retirement System of the City of Detroit

March 21, 2013

The Police and Fire Retirement System of the City of Detroit is appalled and dismayed at the media coverage of our funding levels based on a study by a party that made no attempt whatsoever to verify any pension funding facts. Media reports in The Detroit Free Press, Detroit News and on WDIV TV in recent weeks have cast a negative light on the funding levels of the Police and Fire Pension Fund. As far as we can tell all of these media reports have been based on excerpts of a report by the Milliman company.

Let me state emphatically that these reports have been false, misleading and at best grossly misrepresent the current status of the funding levels of the Police and Fire Retirement System. We do not care to speculate as to the motives of those who would leak a preliminary report to various media that was based on wild assumptions, guesses as well as outdated information and data. The media citations of preliminary “guesstimates” as fact regarding funding levels has needlessly caused great confusion and consternation among retirees.

The Police and Fire Retirement System and its 12,000 active and retired first responders, their families and beneficiaries deserve better than this shoddy report and shallow, onesided media reporting. Let me state emphatically that the pension fund is on solid ground and is projected to do very well by any reliable measure well into the next decade and beyond.

The PFRS fund is 96.1 percent funded. With respect to funded status, the PFRS Pension Fund is in the top 10 percentile of public pension funds with $1 billion or more in assets. What this means is the PFRS pension fund‘s level of funding is better than 90% of public pension funds in the entire nation. The PFRS fund has nearly $3.1 billion in assets and is being managed with great efficiency.

But you need not take our word for it. We have available copies of our latest actuarial study performed by the nationally recognized firm of Gabriel Roeder and Smith Company. This prestigious and accredited firm has been performing the pension fund’s actuarial studies for 70 years. It should be further oted that the accounting firm of Plante Moran has also audited the pension funds and has issued clean unqualified opinions.

Let us revisit the so-called Milliman report. On Page two at the very top it says in bolded language:

The following table provides our very rough preliminary guesstimates (“VRPG”) of the potential actual state of the systems. …and are not based on any detailed calculations.” –

We do not know if “Very Rough Preliminary Guesstimates” are part of the actuarial code ofconduct. Our very rough preliminary guesstimate is they are not.

The table Milliman refers to – which the media has widely reported – is based on grosslymisleading information that does not impact funding levels. In Item “E” for instance the report cites removing Pension Obligation Certificates from the pension funding status levels. It should be pointed out that first, the pension funds are separate legal entities from the City of Detroit; second, that the City issued POC’s in 2005 in the amounts of $740 million (General Retirement) and $630 million (Police and Fire) to pay its pension liabilities to the funds, despite the fact that the pension funds objected to the city borrowing money to pay these obligations.

Nevertheless, the money has already been paid into the pension funds. The debt obligation of the POCs is the City’s debt not the pension funds. Example: if you borrow money to pay a bill to another party and cannot afford to pay the interest on your loan, that has no bearing on the party to whom you did pay your debt.

But let’s go back to the essence of the Milliman report. It is located on the bottom of the Page 9 letter to the City’s CEO. It reads in its entirety and I think this is the only worthwhile paragraph in the Milliman report, quote:

“No third party recipient of Milliman’s work product should rely upon Milliman’s work product. Such recipients should engage qualified professionals for advice appropriate to their own specific needs.”

At the PFRS we couldn’t agree more. It seems clear that the Milliman report resembles a desired result and clearly is not an objective evaluation of the actuarial status of the pension funds. It also says just a few paragraphs above: “Milliman’s work may not be provided to third parties without Milliman’s prior written consent.”

For a complete look at the Police and Fire Retirement System’s annual reports and actuarial studies you may visit our website where we demonstrate transparency, openness and facts: www.pfrsdetroit.org

The final report for the last fiscal year ending June 30, 2012, is expected to be published within two to four weeks when finalized by Gabriel Roeder Smith and approved by the Board.

According to the Wall Street Journal most private corporations are facing pension challenges as well with J.P. Morgan estimating companies now hold only $81 for every $100 promised pensioners. The article goes on to say “putting a value on pension liabilities is a tricky business.”

We respectfully request that you evaluate pension issues in the future fairly, responsibly and with context – not from a “preliminary report” whose methods and conclusions are the height of trickery.

Sincerely,

Matt Gnatek,

Chairman, Board of Trustees

Police and Fire Retirement System of the City of Detroit

VOD editor’s note: Michigan’s constitution states the following:

Article 9, Section 24: “The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby. Financial benefits arising on account of service rendered in each fiscal year shall be funded during that year and such funding shall not be used for financing unfunded accrued liabilities.”

As Attorney Michael Van Overbeke, spokesperson for the Detroit General Retirement System (DGRS), told VOD earlier, the only way to change a provision of the state Constitution is through a general vote of the electorate. Orr does NOT have the power.

Also read Detroit General Retirement System President Susan Glaser’s response to the report at grs news editorial response.