Orr threatened Detroit firefighters over their actuary’s claim that their system is 96.1 percent funded. Here they protest outside first bankruptcy hearing July 24, 2013.

Detroit’s Current Pension Assumptions Fall Within Standards: Morningstar

By Caitlin Devitt, The Bond Buyer | August 2, 2013 |

A new analysis from Morningstar weighs in on the debate over the size of Detroit’s pension liability, suggesting that current pension fund assumptions fall mostly within accepted industry standards.

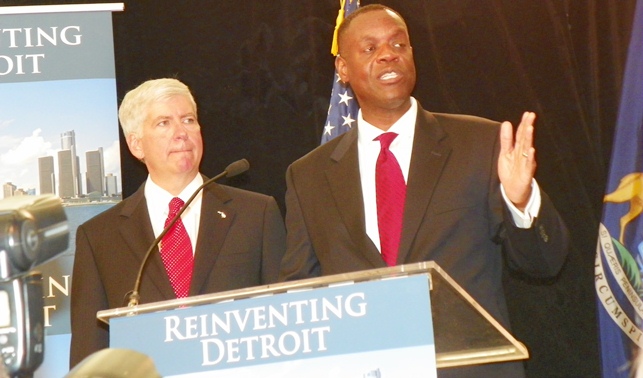

Detroit EM Kevyn Orr announced July 19 at this press conference that he would propose “retirees committee” to subvert role of pension systems in bankruptcy filing. Photo: Diane Bukowski

The fate of the city’s pension benefits will be a key battle if Detroit enters into Chapter 9 bankruptcy. Pensions are protected under the Michigan constitution, but Detroit emergency manager Kevyn Orr and Gov. Rick Snyder have proposed dramatic cuts, and whether or not federal bankruptcy will trump state law could have reverberations beyond Detroit.

The debate over the size of the pension debt began a month before the July 18 bankruptcy filing, when Orr warned that a new analysis showed that the size of the unfunded liability totals $3.5 billion. That’s five times larger than previous estimates of $650 million.

Orr said he came up with his new number by using a different set of actuarial assumptions than the current ones, which he has said are overly optimistic.

Orr’s revised figures make the pension debt the city’s second-largest debt, behind a $5.7 billion retiree healthcare tab.

Representatives from the city’s two retirement systems say Orr is exaggerating the size of the debt.

“The pension liability is highly contested and could have wide reaching implications,” Morningstar analyst Rachel Barkley said during a webcast the company held Thursday on the city. “How these benefits are treated in the bankruptcy may set a precedent for how pensions are treated going forward, especially by distressed municipalities.”

In a recent commentary, Municipal Market Advisors also noted that how the bankruptcy court ends up sizing the city’s pension liability could lend some clarity to the thorny issue of determining pension liabilities.

Detroit’s pensions funds have long been considered relatively well funded, at around 91%, largely because of a $1.5 billion pension certificate borrowing in 2005 and 2006.

Orr bases his contentions on Detroit’s pension funds on an unpublished report by Milliman. Inc. Here, their top officers meet with officials in Dubai, where they are setting up shop. They stayed in the world’s most expensive hotel there.

Orr has called into question the current funds’ assumption of an 8% annual return on investment, its seven-year smoothing period — the period over which a pension fund recognizes market returns — and its 30-year amortization rate.

Orr has not revealed his revised assumptions, though he has said that a 7% return on investments, down from 8%, is more realistic.

Morningstar said it considers the current pension assumptions to mostly fall within industry standards.

“We feel an 8% investment return may not be conservative but definitely would be defensible by the city,” Barkley said.

A 30-year amortization rate is also well within typical standards, Barkley said.

But the city’s current use of a seven-year smoothing period falls outside the norm, Barkley said. Five years is more typical.

Until Orr reveals his own set of assumptions, it is difficult to judge which liability is more accurate, Barkley said.

“The validity depends on his assumptions,” she said.

Morningstar also analyzed recent trading on Detroit bonds, saying yields show the market is differentiating between types of security and bond insurer.

Limited-tax general obligation bonds backed by a pledge of distributable state aid, which is accompanied by a statutory lien, is seeing lower yields than insured unlimited-tax or limited-tax GO bonds, said Jeff Westergaard, director of municipal analysis for Morningstar.

The city’s water and sewer revenue bonds are also trading with lower yields than the insured GO debt.

“Clearly in our opinion the market is placing a credit risk benefit to the bonds that are secured by either the enterprise revenues or the DSA revenues, so that security pledge is definitely showing up in terms of what’s going on in market activity,” Westergaard said.

On the insurer side, buyers are favoring Detroit bonds that carry Berkshire Hathaway insurance over Assured Guaranty or MBIA Inc., according to the Morningstar analysis.

For more information on related topics, visit the following:

Ohio State Teachers’ Post 13.7% Return in FY 2013

Massachusetts’ Pension Reaches 12.7% Return, $53B Assets

North Carolina Pension Heralds 9.25% Return for FY ‘13

Oakland County, Mich., Sets OPEB Deal Despite Detroit Turmoil

Chicago Faces Investors After Its Steep Downgrade

VOD related articles:

http://voiceofdetroit.net/2013/07/06/orrs-phony-victory-on-casino-taxes-and-u-s-bank-na/