Mayday march against Detroit bankrutpcy plan occupied streets, banks downtown May 1, 2014, calling for a NO vote on POA4.

Under Chapter 9, Plan of Adjustment #4 cannot be “crammed down” if it “discriminates unfairly” against Black and poor retirees and residents

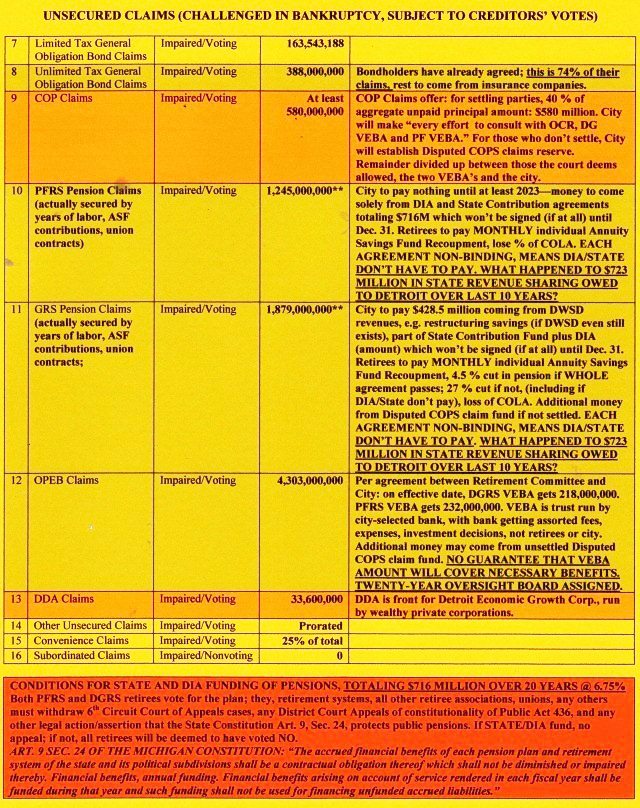

Bank debt to be paid first out of city general fund before other needs

State/DIA “grand bargain” package: $716 M over 20 years to cover $3.2B claims; not binding, not to be signed until Dec. 31, 2014

For “grand bargain,” retirees must vote Yes, revoke appeal rights re: Ch. 9 eligibility, state pension protection, EM law PA 436 constitutionality

Pension fund “investment” oversight board for 20 years, bank-run health care VEBA trust: billions more for wealthy

Thousands of marchers descended on Michigan Gov. Rick Snyder’s home outside Ann Arbor on MLK Day, 2011 to demand an end to racist EM laws.

By Diane Bukowski

May 20, 2014

Analysis

DETROIT—As the Detroit Chapter 9 bankruptcy debacle unravels, the corporate media and voluntary “retiree associations” are focusing only on what retirees and city workers will do about Detroit’s alleged debt crisis. In one-sided stories regarding the Fourth Plan of Adjustment (POA4), and YES vote recommendations, they are ratcheting up the pressure on these tens of thousands of seniors, who are least able to afford cutbacks.

Leaders of Michigan AFSCME Council 25, meanwhile, are telling retirees and workers to hold off on voting on the plan until the State and the Detroit Institute of Arts have agreed

This includes threatening a “cramdown” if retirees vote NO, despite the fact that Chapter 9 provides in part, “Under ‘cram down,’ if all other requirements are met except the § 1129(a)(8) requirement that all classes either be unimpaired or have accepted the plan, then the plan is confirmable if it does not discriminate unfairly and is fair and equitable.”

An analysis by VOD of POA4 shows that POA4 does in fact discriminate grossly against Black and poor retirees, workers, and residents of Detroit, based on income, race, and gender.

- In this Nov. 2, 2011, photo Cassandra Cabil stands in shadows cast from her home as she looks out into her street illuminated by house lights in Highland Park, Mich. The 2.2 -square-mile city, unable to pay its $80,000 per month light bill has worked out a deal with DTE Energy to have the electricity provider turn off and remove nearly a third of Highland Park’s overhead street lights. (AP Photo/Carlos Osorio)

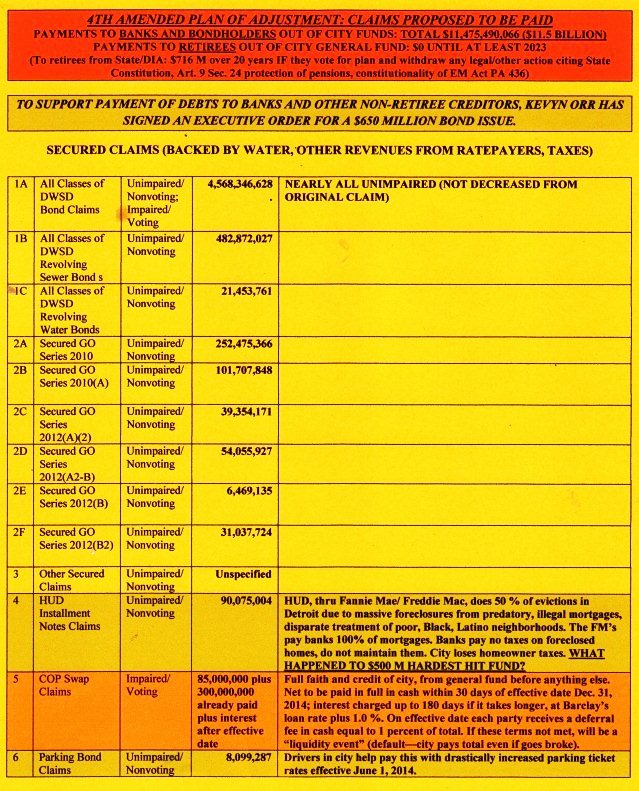

The charts below, compiled by VOD from information in POA4, show that Detroit Emergency Manager Kevyn Orr proposes to pay bank/bondholder creditors a total of $11.5 BILLION out of the city’s general fund. This includes payment of at least $945 million on the 2005-06 Certificates of Participation (COPS) debt and swaps deals to UBS and Bank of America, if they consent to take 40 percent of the original deal. Orr declared these “void ab initio, illegal and unenforceable” in a Jan. 17, 2014 lawsuit in bankruptcy court.

Under terms of POA4, the banks get their debt payments FIRST, prior to the provision of city services for the residents of Detroit. What about street lights, garbage pick-up, reconstruction of Detroit neighborhoods devastated by illegal and predatory bank lending and foreclosures, and jobs for the youth in the public sector, which “Mayor” Mike Duggan is rapidly privatizing?

Meanwhile, Orr and his vulture partners from Jones Day and other law firms purporting to represent Detroit are slating $0 from the city’s general fund for pensions. The State if Michigan and the Detroit Institute of Arts have allegedly promised to provide a measly $716 million over 20 years to fund pension claims which amount to over $3.124 BILLION. The city will contribute NOTHING from its general fund towards any pension obligations until at least 2023. Nothing is said in the plan about the $723 million in state revenue-sharing that Detroit lost over the last ten years, according to a recent Michigan Municipal League report.

The State and DIA deals will not be signed, if at all, until Dec. 31, 2014, the effective date of the plan, but Orr wants retirees to vote by July 11, 2014. The deals state in plain language that they are “non-binding,” and there are numerous loopholes for the DIA and state to renege. In exchange for the puny offering, the City of Detroit will hand over all the art it owns at the DIA, likely worth billions of dollars, to a vaguely defined “trust,” the coup de grace for the city’s privatization of DIA operations in the 1990’s.

Leaders of Michigan AFSCME Council 25 meanwhile have told their members including retirees to hold off voting on the plan until the State and DIA deals are signed, which creates a problem for Orr since he has set a voting deadline of July 11.

(PRINT COPY BY CLICKING ON DB Claims chart; it is also easier to read the charts at a 100% size by clicking on the document itself. Also click on GRAND THEFT OR Grand Bargain 2 to read summary of pro’s and con’s on POA4 by Detroit Concerned Citizens, Active Employees, and Retirees.)

Once the plan takes effect, all is not over by a long shot.

It says, “Post-Effective Date Governance 20 years: Prior to or on the Effective Date, a financial oversight board shall be established pursuant to and in accordance with State law now in effect or hereafter enacted to ensure that, post-Effective Date, the City adheres to the Plan and continues to implement financial and operational reforms that should result in more efficient and effective delivery of services to City residents. The financial oversight board shall be composed of individuals with recognized financial competence and experience and shall have the authority to, among other things, impose limits on City borrowing and expenditures and require the use of financial best practices.”

It says, “Post-Effective Date Governance 20 years: Prior to or on the Effective Date, a financial oversight board shall be established pursuant to and in accordance with State law now in effect or hereafter enacted to ensure that, post-Effective Date, the City adheres to the Plan and continues to implement financial and operational reforms that should result in more efficient and effective delivery of services to City residents. The financial oversight board shall be composed of individuals with recognized financial competence and experience and shall have the authority to, among other things, impose limits on City borrowing and expenditures and require the use of financial best practices.”

Indefinite bankruptcy court oversight

Additionally, POA4 says that the Bankruptcy Court shall retain oversight of its provisions indefinitely, and anything at all within them may changed at the discretion of the court. It also retains jurisdiction over union contracts.

“Pursuant to sections 105(c), 945 and 1142(b) of the Bankruptcy Code and notwithstanding entry of the Confirmation Order and the occurrence of the Effective Date, the Bankruptcy Court will retain exclusive jurisdiction over all matters arising out of, and related to, the Chapter 9 Case and the Plan . . . to the fullest extent permitted by law, including, among other things, jurisdiction to . . . Enforce the term (maturity) of the collective bargaining agreements identified on Exhibit II.D.5 of the Plan, notwithstanding any state law to the contrary. . . Approve any modification of the Plan or approve any modification of the Confirmation Order or any contract, instrument, release or other agreement or document created in connection with the Plan or the Confirmation Order. . . .”

It is unclear, actually, how Judge Rhodes is still wielding power, since according to Judgepedia, he retired Dec. 31, 2013 and is to be replaced by newly-appointed Bankruptcy Judge Mark Randon, the court’s first Black judge.

Bios of Rhodes state different dates for his original appointment as a bankruptcy judge, ranging from 1986 to 2009. The 1986 date indicates he was appointed under the Ronald Reagan regime.

It is unclear from the bios whether he was serving as a bankruptcy judge July 17, 2013 when the bankruptcy case was filed. He was appointed by U.S. Sixth Circuit Court Chief Judge Alice Batchelder, another Reagan appointee, to handle it, with glowing recommendations from U.S District Court Chief Judge Gerald Rosen, a member of the ultra right-wing Federalist Society who Rhodes appointed as mediator in this case.

Perhaps he was already planning to retire but was resurrected by Batchelder et al to do the bidding of the banks and corporations on the Detroit bankruptcy.

Retiree health insurance actually protected by Chapter 9

Orr has already imposed drastic health care out-of-pocket costs additionally that will put thousands in poverty. Such benefits are actually protected under Chapter 9, which declares any cuts must be “fair and equitable.” (Click on Ch9 US Code Payment of Insurance Benefits to Retired Employees. )

Orr did NOT take the steps required by Chapter 9 listed in the US Code before cutting retiree health care benefits, another reason to challenge the legality of POA4. He has bragged that Federal law “trumps” state law but evidently ignored these provisions.

Click on CH 9 US CODE CONFIRMATION OF PLAN to read about required conditions of fairness and equity. That section also states that impaired creditors like city retirees should receive at least the amount of the value of their holdings as if they had been liquidated (i.e. $6 billion from the pension plans.)

“To me, the choice is the devil and the deep blue sea with a large stone around our neck, and Orr dropping buckets of blood in the water to draw sharks,” Water Department retiree Keith Davis said. “If I vote no, at least we have a chance with the legal [appeal]. If [we] vote yes, you’ll all say, you took it yourselves, don’t whine to us. I would be voting NO!”

A YES vote requires that the retirement systems, unions and others with cases pending before the Sixth Circuit Court of Appeals challenging the city’s eligibility for bankruptcy, which are backed by strong amicus briefs from retirement systems nationally, including California’s CalPERS, the largest in the nation, have to withdraw their appeals. Other cases pending before the U.S. District Court and state courts which challenge the constitutionality of Public Act 436, which put Orr in place would also have to be withdrawn.

Under terms of POA4, a YES vote from retirees would cancel out their rights to legal challenges to the pension and health care cutbacks, in particular any challenge citing the Michigan State Constitution’s protection of public employee pensions:

Article IX, Sec. 27 : “The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby.”

- Retirees at N’namdi’s meeting. The Detroit Concerned Citizens, Active Employees and Retirees meets there, at 12150 Woodward in Highland Park, every Monday at 11 a.m.

POA4 even says that voters must agree that the clause does NOT apply in this case, despite the fact it was included in the Constitution during the 1963 Michigan Constitutional Convention and cannot be negated without the will of the people.

At a recent meeting of the Detroit Concerned Citizens, Active Employees and Retirees, (DCCAEER) one retiree pointed out that actuarial figures used to compute the amount of pension and annuity cuts for each individual retiree, including the retiree’s expected life span, are race-based and therefore also discriminatory.

(Ironically, POA4 says the figures are based on THREE different actuarial reports, from Milliman, Inc., Gabriel, Roeder and Smith, the city’s official actuary, and a third company hired by the Retirees Committee. According to testimony at the bankruptcy trial from Kevyn Orr and Charles Moore of Conway McKenzie, the Milliman report, which claimed the retirement funds were $1.5 billion underfunded, was never completed. The Gabriel, Roeder and Smith report estimated an approximate total of $800,000 underfunding. So the estimates used in individual ballots of cuts to retiree pensions and annuities are highly questionable.)

(Ironically, POA4 says the figures are based on THREE different actuarial reports, from Milliman, Inc., Gabriel, Roeder and Smith, the city’s official actuary, and a third company hired by the Retirees Committee. According to testimony at the bankruptcy trial from Kevyn Orr and Charles Moore of Conway McKenzie, the Milliman report, which claimed the retirement funds were $1.5 billion underfunded, was never completed. The Gabriel, Roeder and Smith report estimated an approximate total of $800,000 underfunding. So the estimates used in individual ballots of cuts to retiree pensions and annuities are highly questionable.)

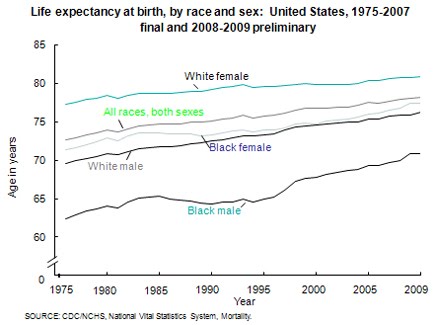

According to the site, http://www.worldlifeexpectancy.com/usa/life-expectancy-african-american, Black males in Michigan have a life expectancy of 68.1 years while white males can expect to live to 76.29. Life expectancy for Michigan’s Black females is 76.8 while white females live to an average age of 81.12.

This is not to mention the fact that Public Act 436, under which Detroit’s EM Kevyn Orr was appointed and eventually declared bankruptcy, has been applied almost exclusively to majority-Black cities, in this case to the nation’s largest Black-majority city.

New investment committee, VEBA represent additional windfall for banks

The DGRS held a membership meeting Sept. 25, 2012 at Fellowship Chapel but did not rally its retirees. Many of trustees shown are no longer on the board.

The retirement systems’ silence on POA4 can be explained by the fact that their trustees’ positions are retained in the document, unlike POA3 which replaced them with appointees who were not allowed to be city employees or retirees, union members or leaders, or anyone else related to the pension systems. POA4, however, sets up an “Investment Management Committee” composed of members similar to the POA3 description, along with an “Investment Manager,” who will have oversight over the retirement boards. They will not only make investment decisions, they will have the power to control distribution of assets to retirees.

What power the elected trustees will retain remains unclear, but likely they will still get a chance to take their little trips to retirement system conferences around the world, in exchange for selling out their memberships.

The two Voluntary Employee Benefit Associations (VEBA’s) for the DGRS and the DPFRS which are proposed to handle the city’s health care obligations to its employees likewise represent huge profits for the banks. The city will choose ONE bank to run the systems as a trust. It will have broad decision-making powers over the administration of retiree health care as well as investments of the funds the city contributes, namely

The VEBA language in the proposal says in Sec. 2.4: “No Guarantee. Nothing contained in the Trust or the Plan shall constitute a guarantee that the assets of the Trust Fund will be sufficient to pay any benefit to any person or make any other payment. The obligation of the Plan to pay any benefit provided under the Plan is expressly conditioned on the availability of cash in the Trust to pay the benefit, and no plan fiduciary or any other person shall be required to liquidate the OPEB Claims Notes or any other Plan asset in order to generate cash to pay benefits.”

AFSCME Locals 457 and 273 from the now defunct Detroit Health Dept. marched in Washington against the first U.S. war on Iraq in 1991. Local 457 Pres. Al Phillips is at right being interviewed, member Denise Cranford (in hat) listens.

Sec. 2.5 adds: “No Interest. Detroit shall not have any legal or equitable interest in the assets of the Trust Fund at any time, including following the termination of the Trust.”

Sec. 5.9 addresses Bank Compensation: “The Bank will apply the assets of the Trust Fund to pay its own fees in the amounts and on the dates [set forth in Exhibit A]. The Bank’s compensation shall constitute a lien on the Trust Fund.”

The VEBA agreement says, “The Mayor of Detroit shall appoint three (3) voting members, both (sic) of whom shall be residents of the State of Michigan and neither of whom may be an employee, contractor, agent or affiliate of the City or any labor union representing employees of the City, a member of any such labor union, or a Participant.”

Other members are to be selected by The Detroit Retired City Employees Association (DRCEA) and the Official Committee of Retirees in the case of the DGRS VEBA, and the Detroit Retired Police and Firefighters Association (DRPFFA) and the Official Committee of Retirees in the case of the DPFRS VEBA. Both associations are voluntary and completely non-representative of the total membership of the DGRS and the DPFRS.

No wonder Dentons, PLLC on behalf of the Official Retirees Committee, the DRCEA and the and the DRPFFA sent out letters recommending a YES vote on this horrendous, racist theft of the little that Detroit’s retirees and active employees have to keep from being homeless and starving. SHAME!

Dentons, US LLP, which identifies itself as counsel for the Official Committee of Retirees appointed by the court AND THE CITY, announced with little notice that it is holding town hall meetings at Cobo Hall Wed. May 21, 2014 and Fri. May 23, 2014, with morning sessions from 10 am to 12 noon and afternoon sessions from 1 to 3 p.m. This is the first time Denton’s, which argued strenuously AGAINST bankruptcy eligibility, has said it represents the City (i.e. Kevyn Orr as recognized by Judge Rhodes).

- Rev. Wendell Anthony embraces Kid Rock, who used Confederate flags on stage during his performances.

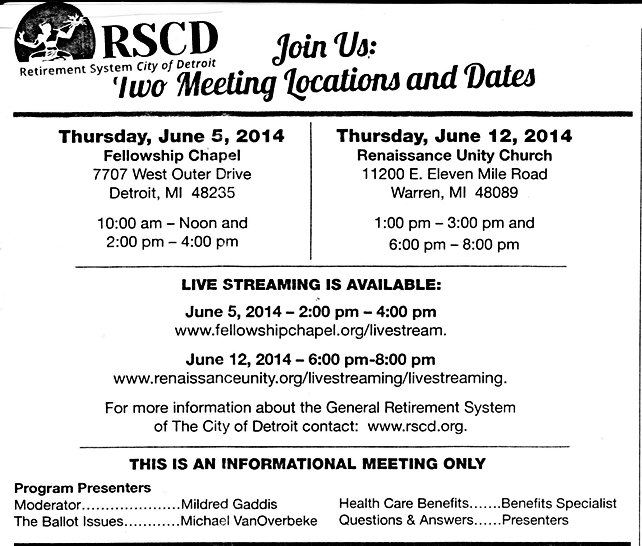

The city’s retirement systems are holding meetings at Rev. Wendell Anthony’s Fellowship Chapel (notice below). The notice stresses that the meetings are “informational” only, meaning it is likely that remarks from retirees themselves will be extremely limited. Anthony sits on the DGRS board, which voted to approve POA4, saying it was “the best” they could get.

The Detroit Concerned Citizens, Active Employees and Retirees is sending the following message by postcard to the DGRS and plans to be at all the meetings to campaign vigorously for a NO VOTE!

To read the entire POA4 and its Disclosure Statement, click on

4th amended Plan of Adjustment http://www.mieb.uscourts.gov/sites/default/files/detroit/docket4392.pdf

4th amended Disclosure Statement http://www.mieb.uscourts.gov/sites/default/files/detroit/docket4391.pdf.

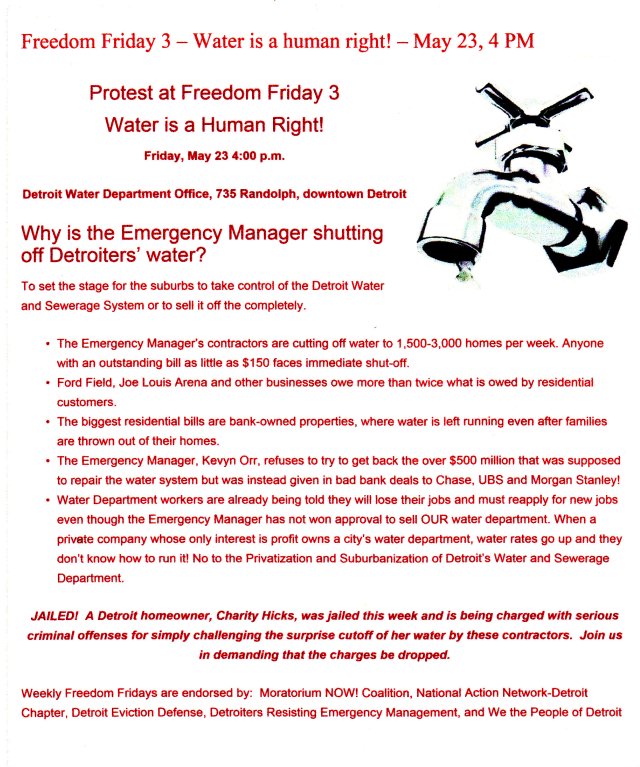

ATTEND ‘FREEDOM FRIDAYS’ AT 4 P.M. EVERY FRI

Read it and weep, then sing along with Nina Simone, substituting for Mississippi, DETROIT GODDAM. THEN VOTE NO IF YOU HAVE ONE OUNCE OF SELF-RESPECT LEFT IN YOUR BODY.

ATTEND ‘FREEDOM FRIDAYS’ AT 4 P.M. EVERY FRIDAY TO BUILD MOVEMENT AGAINST PHONY BANKRUPTCY, OTHER AUSTERITY Go to http://moratorium-mi.org/ for more information. This Friday, May 23:

MEETINGS OF THE DETROIT CONCERNED CITIZENS, ACTIVE EMPLOYEES, AND RETIREES EVERY MON. 11 A.M. AT N’NAMDI’S CAFE, 12150 Woodward, Highland Park

MEETINGS OF THE STOP THE THEFT OF OUR PENSIONS COMMITTEE EVERY MON. 7 P.M. AT 5920 Second Avenue, Detroit, Phone 313-680-5508

RELATED ARTICLES:

http://voiceofdetroit.net/2014/05/14/state-bills-target-detroit-assets-in-bankruptcy/

http://voiceofdetroit.net/2014/05/12/dccr-update-on-pensions-in-detroit-bankruptcy-plan-vote-no/

http://voiceofdetroit.net/2014/05/05/aarp-joins-other-groups-in-legal-support-for-detroit-retirees/

http://voiceofdetroit.net/2014/04/11/vietnam-is-sentencing-corrupt-bankers-to-death-by-firing-squad/

http://voiceofdetroit.net/2014/03/28/detroit-declares-war-on-pensioners-proposed-cuts-amount-to-70/

And many more over the past two years on VOD: put Detroit bankruptcy or related terms in search engine.

My brother suggested I might like this web site.

He was entirely right. This publish actually made

my day. You cann’t consider simply how so much time I had

spent for this information! Thanks!

If you had bothered to look up what ICLE is, you would see that its “contributors” describe and advertise their own credentials and achievements. Click on “Who we are” on their website. Hardly an unbiased source. I suppose you didn’t bother to read the Plan of Adjustment, either. Hopefully you are not a city retiree, because you’ll get a rude awakening if it goes through.

I’m pretty skeptical of any source ending in -pedia. Still, I read judgepedia and found the claim, “Rhodes retired on December 31, 2013.[1]” The source for that claim is http://www.icle.org/modules/directories/contributors/bio.aspx?PNumber=P19394 which makes NO MENTION OF RETIREMENT. It’s rather difficult for me to take this article seriously when it makes claims it cannot backup with facts. Disappointed with the integrity of your research and stopped reading at that point.