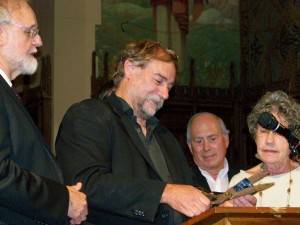

UAW Pres. Bob King and FLOC Pres. Baldemar Velasquez at podium; Rev. David Bullock of Rainbow PUSH second from left, Attorney Vanessa Fluker second from right

Demand two year moratorium on foreclosures, FLOC negotiations

In a show of determination, they cut up Chase credit cards during the press conference. Public assistance recipient Orrie Johnson even offered to cut up her bridge card because Chase gets a fee every time the social services card is swiped for funds, but was told she did not have to go that far.

“Chase banksters are nothing but gangsters!” declared Pastor D. Alexander Bullock, chair of the Detroit chapter of Rainbow PUSH. “We want Chase to own up to its responsibility for destroying our communities. We are sick and tired of being sick and tired, and of dealing with belligerent banks.”

In addition to Bullock, the leaders included International United Auto Workers (UAW) President Bob King, Baldemar Velasquez, President of the Farm Labor Organizing Committee (FLOC), attorney Vanessa Fluker of the Moratorium NOW! Coalition, and the Rev. Ed Rowe of the Central United Methodist Church.

They demanded that Chase declare a two-year moratorium on foreclosures in Michigan, and force R.J. Reynolds Tobacco to negotiate humane working and living conditions for farmworkers in North Carolina. Chase is one of the lead banks in a consortium of lenders that has invested $498 million dollars in Reynolds American, one of the largest tobacco companies in the U.S.

“We have spent all week with lawyers from Chase asking them to change their practice of destroying our communities by foreclosing on homes, but they were totally unreasonable,” King said. “Property values for every person in Michigan have plummeted, and this means less money in taxes for our schools and public services. If people of conscience do not stand together, this will never change.”

King said he and Velasquez had just returned from touring R.J. Reynolds tobacco farms in North Carolina.

“Farmworkers spend 12 to 14 hours a day in the hot sun, only to go back to decrepit, unclean housing where half the beds don’t have mattresses, and the ones that do are infested with bedbugs,” King said. “To make matters worse, they have to pay the company to live in these ramshackle huts. We demand that R.J. Reynolds sit down and negotiate with FLOC.”

He said the amount the UAW is withdrawing from Chase will amount to “hundreds of millions of dollars.”“

Labor leaders say the fortunes of banks and unions are linked more than people realize,” the New York Times reported in March. “Wall Street manages union pension portfolios worth hundreds of billions of dollars. Much of that is invested in financial institutions, giving unions a loud voice as shareholders.”

That month, the International AFL-CIO organized over 200 marches on banks in cities across the country, calling for new taxes on the banks to be used to finance a jobs creation program.

“They [the banks] played Russian roulette with our economy, and while Wall Street cashed in, they left Main Street holding the bag,” the Times quoted International AFL-CIO President Richard Trumka. “They gorge themselves in a trough of taxpayers’ dollars, while we struggle to make ends meet.”

At the press conference, Velasquez said, “Chase Bank is using our tax dollars to exploit us, who are at the bottom of the supply chain. We have 20,000 workers in those fields being treated like dogs, like slaves.”

He said farmworkers don’t have the right to file complaints with the National Labor Relations Board.

“In the 1930’s when the NLRB was established, Southern Democrats ran Congress,” Velasquez explained.. “Back then, agricultural workers were all Black, and as a result, farmworkers have been excluded from the NLRB to this day.”

Attorney Vanessa Fluker (l) and Rubie Curl-Pinkins demonstrate against her eviction by Bank of America

Attorney Fluker explained that a moratorium on foreclosures would mean that homeowners would go before a judge to establish affordable rents for the term of the moratorium, instead of being evicted. She said the U.S. Supreme Court upheld the State of Michigan’s right to declare such a moratorium in the 1930’s.

“The court ruled that the rights of the people supercede contract rights!” Fluker declared. “Right now, it is more lucrative for the banks to throw people out of their homes than to modify loans as they promised to do when they got their bail-outs.”

Fluker said mortgages are insured by Fannie Mae and Freddie Mac, and banks and lenders get the full value of the mortgage if the homeowner defaults, then get insurance if the home is vandalized.

“For example,” she said, “if your home is now worth only $10,000, but there is a mortgage on it for $200,000, the lender gets the $200,000 paid out of our tax dollars.”

The Moratorium NOW Coalition Against Foreclosures, Evictions and Shut-offs, which Fluker represents, was established in Detroit three years ago, and is now seeing its demand for a two-year moratorium being taken up on a national scale.

King announced that individuals can support the Chase divestment campaign by going to FLOC’s website at http://supportfloc.org/default.aspx. to tell Chase they are closing their accounts and credit cards, or send a message of support if they don’t bank with Chase. They can also contact UAW Public Relations Director Michele Martin at 313-926-5291.