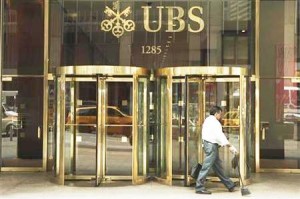

At City Council table Jan. 31, 2005: (l t r) CFO Sean Werdlow, UBS representative (in background), Stephen Murphy of Standard & Poors, Joe O’Keefe of Fitch Ratings, Deputy Mayor Anthony Adams push for (then) $1.2 billion pension obligation certificate deal with USB, minority partner.

- UBS is member of US Dollar LIBOR panel that manipulated rates

- Banks also under criminal investigation by DOJ, SEC, CFTC and others; UBS already cited by DOJ for $18 billion tax cheat scandal

- Detroit should join anti-trust action, initiate moratorium on debt, instead of punishing workers, poor

By Diane Bukowski

July 22, 2012

(Note: the author reported on the Detroit POC deal beginning in 2005, while writing for the Michigan Citizen, and has exposed its fall-out repeatedly in the Voice of Detroit.)

DETROIT – In 2005, former Detroit Mayor Kwame Kilpatrick and former Chief Financial Officer Sean Werdlow cut a deal with Swiss-based global giant UBS Financial Services and its minority partner Siebert, Brandford, Shank & Co. to borrow $1.2 BILLION in so-called “pension obligation certificates” (POC’s) from their firms.

Due to subsequent re-financings, that amount has now become $2 BILLION.

Kilpatrick said the city had a $300 million deficit and threatened to lay off 2,000 workers if the deal was not approved. There was broad opposition from four City Council members, both pension boards, and the city’s unions.

“This is a very risky transaction,” former Councilwoman Sharon McPhail told Kilpatrick.

“Your own people at your economic forum called this [POC borrowing] one of the seven deadly sins of municipal finance,” McPhail explained. “If the deal doesn’t do what is expected, we could face receivership under the local government Fiscal Responsibility Act. If the stock market does well, that $1.5 billion in unfunded pension liability could go away, but we’d still owe it in bonds.”

“So what?” Kilpatrick responded.

UBS, S&P, Fitch came to Council table

UBS, Standard and Poor’s and Fitch Ratings all sent their representatives to the Council table on Jan. 31, 2005 to push for a yes vote (see top photo taken by this author). The ratings agencies threatened negative action against Detroit if the deal did not go through.

Despite objections, the Council approved the deal 8-0 on Feb. 4, 2005.

At Wall Street’s insistence, Kilpatrick afterwards laid off 1,396 workers anyway. Shortly after his election that year, he closed 22 recreation centers along with other cuts. But Standard & Poor’s shrugged even at that, downgrading Detroit’s debt to BBB-, a step above junk level. Downgrades this year have sunk Detroit’s rating to C-, below junk level, the lowest rate for any major city in the country.

“The administration’s hesitancy to cut positions, as well as the inability to adjust union contracts to gain savings, has deepened the budget gap for fiscal 2006,” S & P said at the time. They also cited the city’s “high level of debt,” which ironically included the $1.2 billion POC deal.

- Former Detroit CFO Sean Werdlow, now a managing partner with Siebert, Brandford, Shank & Co., one of lenders in Detroit POC deal.

Werdlow left the administration after the election. He is now a managing partner with Siebert, Brandford, Shank & Co. Former Mayor Dennis Archer likely also benefited, since he was a lobbyist for UBS. Neither has faced charges despite the ongoing federal criminal case lodged against Kilpatrick and four others related to water department and pension board contracts.

Detroit POC deal part of world-wide predatory lending orgy

It is now apparent that the POC deal was part of an orgy of predatory lending by banks in the U.S. and world-wide, which resulted in the historic 2008 economic collapse, when “the bubble burst.”

The story of that orgy is laid out in the 2010 movie, “Inside Job,” by Academy Award nominated filmmaker Charles Ferguson.

In 2009, Detroit defaulted on the POC loan. UBS and other parties demanded a $400 million payment, one-third of the city’s budget. To stave off the default, former Mayor Kenneth Cockrel, Jr. agreed to hand over all the city’s casino income taxes to US Bancorp as trustee, and increase the total amount, to ensure payment of the deal.

McPhail’s words turned out to be prophetic, as Detroit is now indeed in the grips of the successor to the Local Government Fiscal Responsibility Act, Public Act 4.

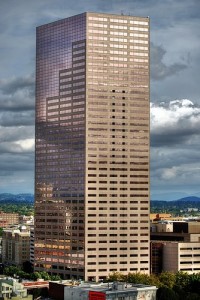

- US Bancorp’s HQ in Portland, Oregon. As US Bank NA, they are trustee over all of Detroit’s casino tax and state revenue-sharing income.

US Bancorp also gets all of the Detroit’s state revenue-sharing funds, along with a hefty service fee for sending them along to UBS and other creditors. Those funds are now additionally controlled by State Treasurer Andy Dillon under the April 4, 2012 “Fiscal Stability [consent] Agreement.”

Cities, states, investors sue UBS, other banks

On Aug. 5, 2011, the City of Baltimore lodged a class-action anti-trust lawsuit against Bank of America, Barclays Bank, Citibank NA, HSBC Holdings PLC, J.P. Morgan Chase, Lloyds Banking Group PLC, Westlb AB, and UBS AG for rigging rates in interest swaps, causing the city of Baltimore and others to lose up to billions of dollars that should have been spent on services for their residents, among other damages.

They alleged that the defendants’ conspired to “unlawfully manipulate the London Interbank Offered Rate for the U.S. dollar (‘LIBOR’) from August 1, 2007 through such time as the effects of the Defendants’ illegal conduct ceased . . . .”

The banks named were all members of the U.S. Dollar LIBOR panel, which set global borrowing rates.

“Defendants devised and executed their scheme to manipulate LIBOR in order to benefit their financial positions,” says Baltimore’s initial suit. “Throughout the Class Period, Defendants sold financial products which tied rates of return to LIBOR. By manipulating LIBOR, Defendants paid lower returns to customers who bought those financial products.”

“Defendants devised and executed their scheme to manipulate LIBOR in order to benefit their financial positions,” says Baltimore’s initial suit. “Throughout the Class Period, Defendants sold financial products which tied rates of return to LIBOR. By manipulating LIBOR, Defendants paid lower returns to customers who bought those financial products.”

Regarding UBS, the suit says, “Defendant UBS AG (“UBS”) is a Swiss company based in Basel and Zurich, Switzerland. During the class period, UBS was a member of the British Bankers’ Association’s U.S. dollar LIBOR panel.”

It thus alleges that while UBS was hounding the City of Detroit for its money, it was criminally violating the Sherman Anti-Trust law and profiting from the proceeds.

The suit has mushroomed into a mammoth federal class action, “IN RE LIBOR-BASED FINANCIAL INSTRUMENTS ANTITRUST LITIGATION,” Docket No. 11-md-2262. The U.S. Judicial Panel on Multidistrict Litigation consolidated 21 lawsuits filed by cities, states, investors and other plaintiffs against the banks into the action, for pre-trial purposes.

In addition to the banks cited by the City of Baltimore, defendants now include Credit Suisse Group AG, Credit Suisse Securities (USA) LLC, the Royal Bank of Scotland Group PLC, Deutsche Bank, and the Norinchukin Bank.

U.S. District Judge Naomi Reice Buchwald of the Southern District of New York state is hearing the case.

On June 29, the defendants except for Barclays and UBS, which are expected to file separate motions, moved to dismiss the claims. The plaintiffs have not yet responded, and no dates for hearings have yet been set.

U.S., Japan, UK, others conducting criminal investigations

Numerous governmental investigations are also underway in the U.S. and abroad. The U.S. Department of Justice (DOJ), the Commodities Futures Trading Commission (CFTC), and the Securities Exchange Commission (SEC) are among those involved.

- Robert Wolf, outgoing president of UBS in the United States, one of U.S. President Barack Obama’s major campaign contributors.

Judge Buchwald has ruled that the government agencies do not have to turn over their investigative documents for use in the civil case, despite demands by the litigants. Due to government ties with the banks involved, including U.S. President Barack Obama’s ties to UBS, one of his largest campaign contributors, it is likely government officials are trying to minimize the impact of the lawsuit.

Attorneys with Sedgwick, LLC of the United Kingdom authored a summary of the case published July 5, 2012. They wrote that Barclays has already been fined, although not criminally charged:

“The record-breaking £59.5 million fine imposed on Barclays by the Financial Services Authority (FSA) and $360 million penalty imposed by the U.S. Commodity Futures Trading Commission and Department of Justice in connection with the improper submission of London InterBank Offered Rate (Libor) rates has led to intense public scrutiny of Barclays’ practices, procedures and management and possible misconduct by other financial institutions.”

The Sedgwick attorneys also say that Japan has imposed sanctions on Citigroup and UBS, accusing them of “asking other banks for an advantageous rate in violation of Japan’s Financial Instruments and Exchange Act.”

UBS settled $18 billion in US DOJ tax cheat charges for $780 million; got $74.5 billion Fed Reserve bailout, $800M AIG taxpayer bailout

While bludgeoning the City of Detroit to pay back the $2 billion POC deal, UBS was exposed as a haven for wealthy tax cheaters by the US DOJ. UBS allegedly helped its U.S. clients hide $18 billion in income in 19,000 secret Swiss bank accounts. It paid a paltry $780 million fine to prevent an indictment that FINMA, the Swiss regulatory agency, said “would have threatened its existence.”

That did not stop the U.S. Federal Reserve from bailing it out after the 2008 global banking meltdown to the tune of $74.5 billion.

“Federal Reserve data showing UBS AG and Barclays Plc ranked among the top users of $3.3 trillion from emergency programs is stoking debate on whether U.S. regulators bear responsibility for aiding other nations’ banks,” according to a Dec. 2010 Bloomberg News article.

“UBS was the biggest borrower under the Commercial Paper Funding Facility, with $74.5 billion overall, more than twice as much as Citigroup Inc., the top U.S. bank recipient, according to the data released yesterday. London-based Barclays Plc took the biggest single amount under another program that made overnight loans, when it got $47.9 billion on Sept. 18, 2008.”

UBS also raked in $800 million as a silent partner in the taxpayer bailout of insurance giant AIG, according to CNN.com.

MAKE UBS PAY! POC deal likely the largest factor in Detroit debt crisis

Although some have reported that Baltimore stands to gain only small amounts from its lawsuit against UBS and other financial giants, Detroit’s POC deal with UBS ranks as one of the largest in history.

- Michigan State Treasurer Andy Dillon at second meeting of Financial Advisory Board June 28, 2012 in WSU Law School’s Spencer Partrick Auditorium.

That deal has come back to haunt the city repeatedly. In 2009 alone, the city appropriated funds to pay $106, 911, 659 for that year’s “POC Swap Hedge Payment.” Continued threats of default have been used to pressure the city to cede control of large parts of its income.

Wall Street downgrades of the city’s debt rating have forced the city to pay hundreds of millions more in interest rates on new loans, including on Detroit Water and Sewerage Department bonds. DWSD is an enterprise agency separate from the city’s general fund which has previously received AAA ratings on its debt, but Wall Street is using the general fund downgrade to bleed more money out of Detroit, the poorest major city in the U.S.

Currently, City Corporation Counsel Krystal Crittendon is deciding whether to appeal a lawsuit to overturn the April 4 consent agreement. US Bancorp and State Treasurer Andy Dillon have threatened to withhold not only income from a $137 million loan guaranteed by state revenue-sharing funds and made part of the consent agreement, but also other state revenue-sharing payments.

It is the global banks, and in particular UBS, which have put Detroit under this yoke of slavery. When will city leaders stand up to them, at least by joining in the anti-trust lawsuit initiated by the City of Baltimore? Then they can declare a moratorium on the city’s debt to the banks as former Detroit Mayor Frank Murphy proposed during the Great Depression of the 1930’s, so that the city’s people can be provided with homes, health care, food, jobs, and the other necessities of life.

(Copies of this article are being sent to Mayor Dave Bing, the City Council, Corporation Counsel Krystal Crittendon, COO Chris Brown, PMD Kriss Andrews, CFO Jack Martin, the Financial Advisory board, Treasurer Andy Dillon, Gov. Rick Snyder, US Attorney General Eric Holder, and US President Barack Obama with requests for their comments and action.)

Related links:

http://voiceofdetroit.net/2012/07/20/libor-scandal-could-turn-ugly-as-cities-begin-to-sue-banks/

http://voiceofdetroit.net/2012/07/18/war-on-city-workers-wrong-dirty-and-low-down/

Click on the following PDF’s of other related articles:

DETROIT POC DEAL STORIES FROM MICHIGAN CITIZEN BY DIANE BUKOWSKI, BANKOLE THOMPSON

Libor manipulation probe and litigation update Sedgwick LLP

Banks get paid while Detroiters lose MC

UBS END GAME The Federal Reserve is now bailing out the world

UBS received 800 million in US bailout

Links to LIBOR lawsuit documents will be included once they are downsized to fit this site.

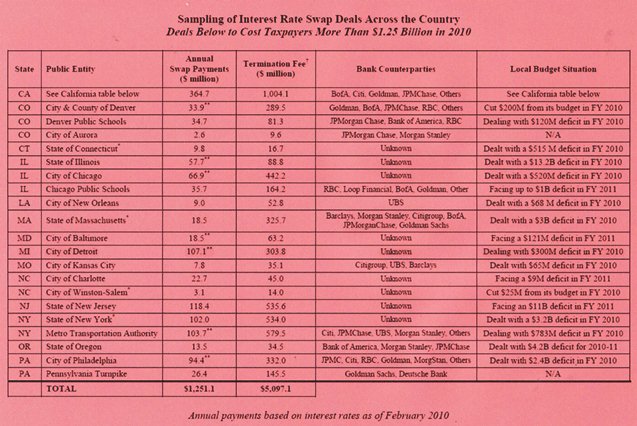

Also read 2010 Wall Street Journal article, “Interest Rate Deals Sting Cities, States” by clicking on INTEREST RATE DEALS STING CITIES, STATES, which details efforts some cities were making at the time to re-negotiate deals after the market went south in 2008. Below is chart from SEIU study cited in the article, which shows Detroit paid $107.1 million in questionable nterest rate swaps in 2010, the fourth highest amount in the country, despite the fact that Detroit was not even among the country’s 10 largest cities. Click on SEIU Study Interest Rate Swaps to download this two-page report.

Hmmmmmmm. Some very compelling reading. Maybe a little over the top on the “banks as evil” thing but I certainly think someone f***ed up big time and or was greedy, venal and corrupt. I recently retired from City of Detroit after 25 years as an accountant in the Finance Department. I worked hard, tried to do my job and as far as I know did nothing even approaching crossing the line. But I and 20,000 or so other retirees stand to lose pensions and benefits promised us by the State of Michigan Constitution and Mr. Werdlow who I think should join his ex boss Kwame in Federal prison along with his new wife who just happens to be one of the principals in Siebert Shank Investments (a coincidence? I doubt it). The just bought a $2.5 million home in a posh Detroit suburb. Together they could have grossed as much as $3 million from the swaps deal. and as supposed finance and investment professionals they had at least a fiduciary duty to know that the swaps deal did not pass the “smell test”—If it looks like horse manure and smells like horse manure it is horse manure. They should have taken one look at the deal and run the other way. Mr. Werdlow and his new wife should both go to prison—and no conjugal visits either. Enough said.

Pingback: Voice of Detroit requests investigation by US Dept. of Justice, no response yet » Cancel Detroit’s Debt To The Banks!

Pingback: Wall Street vs. Woodward Avenue? (or, will Detroit’s Emergency Manager address predatory interest rate swaps?) « metropolitan history