From Rev. Edward Pinkney, Pres. Benton Harbor -Twin Cities NAACP

- Rev. Edward Pinkney (center top in cap) with supporters at court hearing in Detroit on his lawsuit against the Michigan chapter of the NAACP, on April 11, 2012.

(VOD ed: Rev. Pinkney, along with other leaders of militant chapters of the NAACP, has recently come under severe attack by the Michigan chapter of the NAACP. The state chapter purported to hold an election to oust him, in conjunction with Whirlpool Corporation, which has devastated Benton Harbor, a majority-Black city that is the poorest in the country.)

August 25, 2012

A little over a month ago, I alerted folks that Wells Fargo is a lead sponsor of the NAACP’s 101st annual convention.

The sponsorship came within weeks of the NAACP dropping its racial discrimination lawsuit against the subprime mortgage lender.

While patting itself on the back for getting Wells Fargo to commit to doing what the bank says it is already doing, the NAACP refuses to disclose the details of their “partnership.”

- Memphis Mayor A.C. Wharton Jr. commemorating MLK Day 2011; he has since agreed to NAACP lawsuit settlement with Wells Fargo.

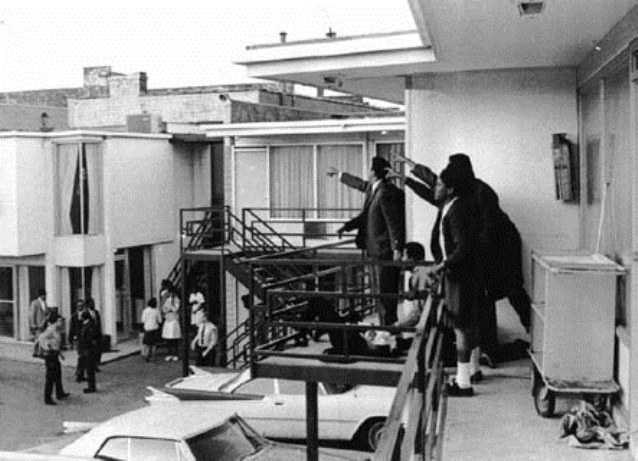

A number of cities, including Memphis and Baltimore, are suing Wells Fargo for its predatory lending practices. Tellingly, Memphis Mayor A. C. Wharton Jr. announced the lawsuit in front of the National Museum of Civil Rights at the Lorraine Motel.

The New York Times reports:

The NAACP should be shouting about Wells Fargo’s lending practices from the rooftop of the Lorraine Motel. Instead, the nation’s oldest and largest civil rights organization is being sponsored by the predatory lender.“Not so long ago, Memphis, a city where a majority of the residents are black, was a symbol of a South where racial history no longer tightly constrained the choices of a rising black working and middle class. Now this city epitomizes something more grim: How rising unemployment and growing foreclosures in the recession have combined to destroy black wealth and income and erase two decades of slow progress.

The mayor and former bank loan officers point a finger of blame at large national banks — in particular, Wells Fargo. During the last decade, they say, these banks singled out blacks in Memphis to sell them risky high-cost mortgages and consumer loans.

The City of Memphis and Shelby County sued Wells Fargo late last year, asserting that the bank’s foreclosure rate in predominantly black neighborhoods was nearly seven times that of the foreclosure rate in predominantly white neighborhoods. Other banks, including Citibank and Countrywide, foreclosed in more equal measure.”

In addition to being a lead sponsor of the NAACP’s upcoming convention, Wells Fargo was a co-sponsor of the Leadership 500 Summit held last week in Florida.

The summit featured a workshop on maintaining and building wealth. I wasn’t there but it’s safe to assume the Wells Fargo representative did not acknowledge the bank’s role in destroying black wealth in Memphis and cities across the country.

For NAACP Leadership 500 Program including ad for Wells Fargo, click on http://www.l500.org/.

While the NAACP provides Wells Fargo with a platform to try to bamboozle black folks, the national leadership continues to stonewall questions about their financial arrangement.

The NAACP must be transparent with the African American community. It should start by answering the questions posed by bloggers and others:

- How do the “fair mortgage lending principles” differ from Wells Fargo’s Responsible Lending Principles for Consumer Credit?

- Was a formal partnership agreement signed? If so, how will it be enforced?

- How will the NAACP secure remedies for those who have already lost their homes due to predatory lending?

- Does the NAACP have the resources to examine the lending practices of the fourth-largest U.S. bank with more than 27,000 employees?

- How will the NAACP be able to manage Wells Fargo’s behavior more effectively than the Treasury and Housing and Urban Development departments, and the Office of the Comptroller of the Currency?

During last week’s summit, NAACP President and CEO Benjamin Todd Jealous said the organization is moving in a new direction.

Transparency would be a step in the right direction. So far, it is the road less traveled.

Read earlier VOD story on Wells Fargo’s involvement in drug trafficking at http://voiceofdetroit.net/2011/11/23/banks-financing-drug-cartels-admitted-in-wells-fargo-deal/.