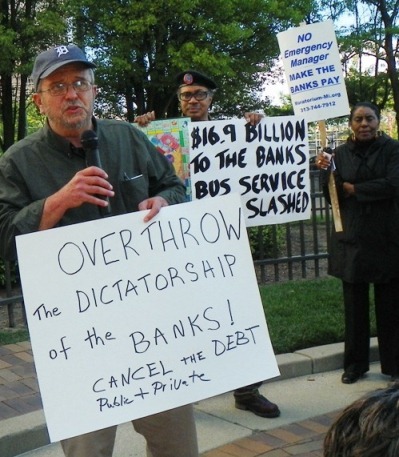

- UBS admits massive criminal fraud amounting to many billions of dollars, but the Detroit Free Press today featured a large photo of a 17-year-old Black youth from Detroit who has been charged with house break-ins. WHO IS THE REAL CRIMINAL HERE?

Swiss bank UBS’ fine is the second largest paid by a bank. Last week, Britain’s HSBC agreed to pay the largest penalty — $1.92 billion.

Reuters: By Katharina Bart and Tom Miles

December 19, 2012

(VOD editor: I have been on break for a short while, but stories from last week are coming. However, I had to post this one immediately. The City of Detroit borrowed $1.5 billion from UBS in so-called “pension obligation certificates” in 2004, despite strenuous opposition from the pension boards, the unions, and the community. Since then, the city has defaulted twice on that debt. UBS is largely responsible for Detroit’s deficit.

Baltimore and other cities across the U.S. are suing the banks involved in the LIBOR scandal (see VOD story links below). WHAT IS THE MATTER WITH DETROIT’S LEADERSHIP THAT IT HAS NOT JOINED THIS BATTLE AGAINST THE BANKS, BUT INSTEAD CONTINUES TO SLASH JOBS AND SERVICES FOR WORKING AND POOR PEOPLE?

As Councilwoman JoAnn Watson would say, WAKE UP DETROIT!

ZURICH — Swiss bank UBS was hit with a $1.5 billion bill and admitted to fraud Wednesday in order to settle charges of manipulating global benchmark interest rates.

The penalty agreed with U.S., U.K. and Swiss regulators is more than three times the $450 million fine levied on Barclays in June for rigging the Libor benchmark rate used to price financial contracts around the globe.

It is the second-largest fine paid by a bank and comes a week after Britain’s HSBC agreed to pay the biggest ever penalty — $1.92 billion — to settle a probe in the United States into laundering money for drug cartels.

“We deeply regret this inappropriate and unethical behavior. No amount of profit is more important than the reputation of this firm, and we are committed to doing business with integrity,” UBS Chief Executive Sergio Ermotti said in a statement disclosing the extent of the wrongdoing, which took place over six years from 2005 to 2010.

UBS said it will pay $1.2 billion to the U.S. Department of Justice and the Commodity Futures Trading Commission, $260 million to the Financial Services Authority and $64.5 million from its estimated profit to Swiss regulator Finma.

The FSA said at least 45 people were involved in the rigging, which took place across a range of Libor currencies.

A similar admission by Barclays in June touched off a political firestorm that forced its chairman and chief executive to quit.

Why do Council President Charles Pugh and Mayor Dave Bing continue to attack the people of Detroit instead of taking on the real criminals, the banks? Are they criminals themselves?

The Libor benchmarks are used for trillions of dollars worth of loans around the world, ranging from home loans to credit cards to complex derivatives.

Tiny shifts in the rate, compiled from daily polls of bankers, could benefit banks by millions of dollars. But every dollar a bank benefited meant an equal loss by a bank, hedge fund or other investor on the other side of the trade — raising the threat of a raft of civil lawsuits.

The steep fine for UBS comes despite the bank, since 2011, cooperating with law-enforcement agencies in their probes. The bank said it received conditional immunity from some regulators.

UBS has had a tough 18 months after suffering a $2.3 billion loss in a rogue trading scandal, management upheaval and thousands of job cuts.

Additional reporting by Martin De’Sapinto, Huw Jones; Sarah White; Steve Slater; writing by Alexander Smith.

Related VOD stories:

http://voiceofdetroit.net/2012/07/20/libor-scandal-could-turn-ugly-as-cities-begin-to-sue-banks/

Wall Street came to the Detroit City Council Jan. 31, 2004. Shown are then Detroit CFO Sean Werdlow, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard and Poors, and then Deputy Mayor Anthony Adams (under former Mayor Kwame Kilpatrick) putting the squeeze on City Council to approve $1.5 billion POC loan. PHOTP: DIANE BUKOWSKI