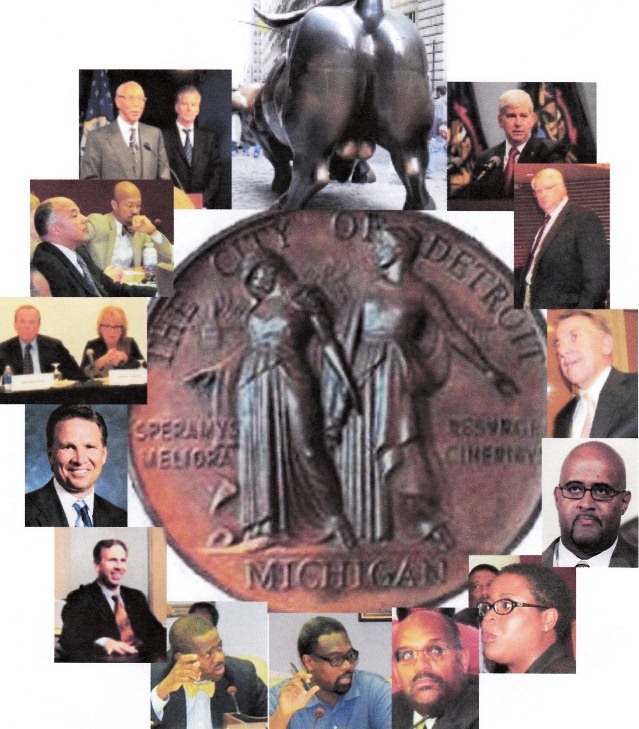

PARTICIPANTS IN RAPE OF DETROIT (from top clockwise): WALL STREET, MICH. GOV. RICK SNYDER, DETROIT PMD KRISS ANDREWS, MILLER CANFIELD ATTY. MICHAEL MCGEE, COUNCILMAN KEN COCKREL, JR, COUNCILWOMAN SAUNTEEL JENKINS, FISCAL ANALYST IRVIN CORLEY, COUNCILMEN JAMES TATE, ANDRE SPIVEY, MILLIMAN CEO STEVEN WHITE, STIFEL CEO RON KRUSJEWSKI, FAB LEADERS KEN WHIPPLE, SANDRA PIERCE, COUNCIL LEADERS GARY BROWN, CHARLES PUGH, MAYOR DAVE BING, STATE TREASURER ANDY DILLON.

Stifel Financial, being sued for securities fraud in cases across the U.S., will be city’s “investment banker,” sell assets

Other shady firms get millions to carry out de-structuring of city

Residents, workers to pay with huge wage, pension and benefits cuts, increased fees, loss of city assets including Belle Isle

Banks to profit from debt re-financing, no moratorium

January 15, 2013

By Diane Bukowski

Officers with the Detroit Police Department Gang Squad keep the peace as crowds wait outside Cobo Center in Detroit. Detroit residents were seeking applications for federal assistance money for the homeless. The city received nearly $15.2 million in federal dollars under the Homeless Prevention and Rapid Re-Housing Program, which is for temporary financial assistance and housing services to individuals and families who are homeless, or who would be homeless without this help. Photos taken on Wednesday, October 7, 2009. ( John T. Greilick / The Detroit News )

DETROIT – The Wall Street gang rape of Detroit, the nation’s poorest and Blackest major city, for its assets, resources, and $2.5 billion budget proceeded full speed ahead over the holiday break and into the New Year of 2013.

Participants in the rape (shown above) are Michigan Governor Rick Snyder, State Treasurer Andy Dillon, Mayor Dave Bing, Program Management Director Kriss Andrews, City Council Fiscal Analysis Director Irving Corley, and Council members Charles Pugh, Gary Brown, Kenneth Cockrel, Jr., Saunteel Jenkins, James Tate, and Andre Spivey.

The Council members are the Rogue Six who met with the Detroit News and Free Press prior to the holidays, purporting to represent the entire Council of nine members.

“You are by far the most fascist, tyrannical sitting body in history,” Valerie Glenn told the Six at the body’s first meeting of the year Jan. 8, 2013. “You are firing Krystal Crittendon, you are not protecting our assets, including Belle Isle, and you support the Emergency Manager laws.”

Valerie Glenn at City Council meeting Aug. 7, 2012.

Chris Griffiths said, “This is a death threat to us, to eliminate democracy, sell our assets, bust our unions, and eliminate our vote. This is a plan for domination and dictatorship. I say to you will go down in history as responsible for resurrecting Hitler from the dead. Krystal Crittendon has done a wonderful job. She should be applauded for protecting the City Charter.”

Crittendon’s firing, done at the behest of Bing and Snyder, overshadowed a stunning “Joint Mayor and City Council Plan to Address the City’s Current Cash Flow Crisis by June 30, 2013,” never approved by Council, which Corley brought to the body that day. It says the administration in concert with the new Financial Review Team and others, is planning to implement:

- Increased fees for services, stepping up income tax collections, selling assets, etc. No mention of collection of $800 million corporations owe the city, and over $240 million the state owes Detroit. State Treasurer Andy Dillon has confirmed both amounts.

- At least 400 more city lay-offs.

- Additional 20 percent pay cuts for city workers on top of earlier 10 perent.

- Forty percent health care premium-sharing for active employees, 60 percent for retirees;

- Elimination of dental and vision benefits for active and retired workers;

- Unilateral imposition of new contracts June 30, 2013;

- Revisiting Belle Isle lease;

- Outsurcing vehicle maintenance and possibly law, IT, finance, DDOT;

- All recreation centers to be turned over to non-profits.

- Ten percent price reduction for vendors; decrease purchases by 10%;

- Long term debt-refinancing to reduce interest rates on outstanding debt (investment banker to be retained), POC [pension obligation certificates] swap restructuring, OPEB restructuring and pension restructuring. (VOD: Debt re-financing means higher interest rates for the banks. No mention is made of a moratorium on the city’s massive debt to the banks, or even negotiations to lower principal and interest payments.)

City Council Fiscal Analyst Irvin Corley.

Corley says the plan was concocted by a “working group including representatives of the Bing Administration, President Pugh, Pro Tem Brown, Councilman Cockrel, and Fiscal Analysis Division staff [during] the last few weeks to address the current cash flow crisis by June 30, 2013” to avoid appointments of either an emergency financial manager or an emergency manager, and to avoid bankruptcy. (Link to full report at end of story.)

Councilman Andre Spivey inadvertently gave the lie to Corley’s contention that only three Council members were involved, blurting out that he had spent his entire holiday break in the meetings. Jenkins and Tate were also likely involved, since they were part of the Rogue Six that met with the News and Free Press.

Detroit City Councilman Kwame Kenyatta.

Outraged, Council members JoAnn Watson, Brenda Jones and Kwame Kenyatta said no one had contacted them about the holiday meetings, although they were available to attend. Kenyatta said all actions by the group must therefore be nullified under the Open Meetings Act.

During the meeting, the Council Six approved contracts with five law firms and corporate restructuring entities, worth over $14 million. The re-structuring firms have little or no experience in the public sector.

The $1.8 million “investment banker’ contract is with New York-based Miller, Buckfire and Co., now a part of St. Louis, Missouri-based Stifel Financial.

“Miller Buckfire will act as the City’s investment banker and will provide financial advisory services, including possible strategic asset sales and related refinancing actions,” says Corley’s report.

Councilwoman JoAnn Watson pointed out that Miller Buckfire no longer exists.

“On Jan. 1, Miller Buckfire was wholly taken over by another firm, Stifel Financial, 100 percent,” Watson said. “They can’t even sign a contract. How can they restructure Detroit when they cannot restructure themselves?”

Andrews scoffed at Watson’s concerns, saying, “Jack [Martin, Detroit CFO], and I are in contact with them constantly. I don’t understand why that affects their ability to assist Detroit.”

(Bloomberg) Oct. 23, 2012 — Hunter Keay, an analyst at Stifel, Nicolaus & Co., talks with Bloomberg’s Mark Crumpton about US Airways Group Inc.’s decision to cut 1,000 jobs and the outlook for the airline industry, calling “head count reduction” an area of “low-hanging fruit.)

Due diligence on the administration and Council’s part would have disclosed the following about Stifel’s shady history.

Stifel execs on Wall Street, including CEO Ron Krusjewski (2nd from l). Business Insider said: “Stifel’s analysts made the worst [stock] calls for Bank of America, Cisco Systems, Coca-Cola, Intel, and Microsoft, which weighed heavily on their score. However, the firm had the most accurate analyst covering AT&T.”

- The South Florida Business Journal reported in April, 2012, “Florida regulators told Stifel, Nicolaus & Co. [a subsidiary of Stifel Financial] to “cease and desist” from violating securities laws pertaining to the sale of auction-rate securities (ARS) and to repurchase those securities from customers who were misled.

- In March 2012, Stifel paid a $350,000 fine to settle an action brought against it by the Financial Industry Regulatory Authority (FINRA), due to a fraudulent Ponzi scheme run in its home state of Missouri by one of its brokers. They also agreed to pay $250,000 plus interest in restitution to customers affected by the scheme.

- Students walked out of school in Wisconsin to protest union-busting and cutbacks during historic state uprising in 2010.

- In an ongoing 2011 case,’’ the Securities and Exchange Commission (SEC) charged Stifel with “defrauding five Wisconsin school districts by selling them unsuitably risky and complex investments funded largely with borrowed money,” totaling $200 million. “Stifel . . . . abused their longstanding relationships of trust with the school districts by fraudulently peddling these inappropriate products to them, Elaine C. Greenberg, Chief of the SEC Division of Enforcement’s Municipal Securities and Public Pensions Unit, said in a release. They were clearly aware that the school districts could ill afford to bear the risk of catastrophic loss if these investments failed,” as they did.

- In 2009, Indiana Secretary of State Todd Rokita, a Republican, brought an administrative complaint for securities fraud against Stiffel, charging that the firm failed to disclose risks on $55 miliion that 142 individuals in Indiana invested.

“A little child shall lead them”: Workers at Detroit’s Wastewater Treatment Plant struck Sept. 30, 2012 to protest Water Dept. giveaway, deep wage and pension cuts.

“Today, we are further in debt since state has been in city of Detroit,” Ed McNeil, executive assistant to Al Garrett, head of the state-wide AFSCME Council 25, told the Council. “You are paying $1.4 million for state officials [appointed under the consent agreement]. . . . I confronted Andy Dillon on the $800 million in receivables outstanding and he acknowledged it. But has anybody gone to get the money? You would rather lay off employees, and slash their wages and benefits. The Ernst Young contract started off at $4 million, it is now $7.8 million after five change orders. Now you’re going to give Miller Canfield another $20 million, and the State Treasurer is holding our escrow money unless we agree to these contracts.”

Ernst & Young, as VOD has repeatedly pointed out, is being sued by the states of New York and New Jersey for losses they sustained due to the collapse of Lehman Brothers, which triggered a global economic meltdown in 2008. Ernst & Young, which now maintains a glitzy office building in downtown Detroit, was the bookkeeper for Lehman Brothers.

Ernst & Young, as VOD has repeatedly pointed out, is being sued by the states of New York and New Jersey for losses they sustained due to the collapse of Lehman Brothers, which triggered a global economic meltdown in 2008. Ernst & Young, which now maintains a glitzy office building in downtown Detroit, was the bookkeeper for Lehman Brothers.

“By the end of January, Miller Canfield should complete its legal analysis on retiree healthcare,” Corley says in his report regarding Miller Canfield. “At minimum, Miller Canfield needs to review all labor contracts/ordinances that possibly impact the provision of retiree healthcare and retiree benefits. There is Michigan case law where retiree healthcare is protected. Private sector employers have been successful in eliminating retiree health benefits but this process has only begun taking root. in the public sector in recent years. Stockton, CA was able to eliminate retiree healthcare recently but through bankruptcy proceedings.”

(VOD: NOTE WHAT NEGATIVE CONSEQUENCES A MUNICIPAL BANKRUPTCY FILING, ADVOCATED BY SOME DETROITERS, COULD HAVE.)

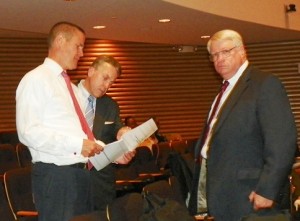

Atty. Michael McGee of Miller Canfield (center) plots out details of CET, imposed city contract, with (l) now disappeared COO Chris Brown and (r) PMD Kriss Andrews, before June 28, 2012 Financial Advisory Board meeting.

Miller Canfield has already been well-exposed as a co-author of Snyder’s Public Act 4, and the city Consent and Milestone Agreements. It also represented the city AND the state in negotiating the April state loan of $137 million to Detroit, a conflict of interest which caused the Council at first to vote down its contract 8-1 Nov. 20, only to later reverse itself and approve it Dec. 11.

Another elephant in the room is a contract with Seattle-based Milliman, Inc. for a total of $332, 500, “to evaluate pension and health care cost reduction alternatives.”

Milliman is one of the largest actuarial and business consulting firms in the world. with revenues of $676 million in 2010. It operates 54 offices worldwide with 2,500 employees.

Milliman has done several national studies on public pension plans, claiming in one issued Oct. 15, 2012, that “the aggregate funded status of the 100 largest U.S. public pension plans is nearly $300 billion worse than what the plans state in their annual reports,.” Another report, however, basically says the plans are adequately managed.

Milliman has done several national studies on public pension plans, claiming in one issued Oct. 15, 2012, that “the aggregate funded status of the 100 largest U.S. public pension plans is nearly $300 billion worse than what the plans state in their annual reports,.” Another report, however, basically says the plans are adequately managed.

However, according to a Maryland Appeals Court, Milliman itself was responsible for underfunding the Maryland State Retirement System.

On July 20, 2011, an appeals court for the state of Maryland upheld an earlier decision by the State Board of Contract Appeals, “which determined that Milliman, Inc., . . had breached contracts to provide actuarial services to the Maryland State Retirement System . . . allegedly resulting in approximately $73 million in losses to the System.”

Retired teachers from Maryland at Lobby Day 2011.

In Milliman v. State Retirement, 25 A.3d 988 (2011) 421 MD. 130, the COA agreed with the state board that Milliman “had understated the contributions required to fund three of the State’s ten retirement and pension systems because of the actuary’s misinterpretation of a particular data code. . . .and that the System was entitled to recover ‘$34.2 million in contributions that would have been received but for Milliman’s errors, and $38.8 million in lost income that would have been earned on those contributions.’ ”

In conjunction with the Milliman contract, says Corley, “the Administration is requesting that your Honorable Body pass a resolution indicating the City should move away from its current structure of providing retiree health care toward an alternative model structured to better match the provision of retiree health care benefits with the City’s ability to pay the benefits in a sustainable fashion.”

Joint Mayor and City Council Plan 1 7 13

http://www.bizjournals.com/southflorida/news/2012/04/25/florida-regulators-tell-stifel.html

http://www.ibj.com/securities-firm-balks-at-fraud-charge/PARAMS/article/7489

http://www.huffingtonpost.com/2012/07/27/stockton-bankruptcy-retiree-health-care_n_1712260.html

http://letters.ocregister.com/tag/public-pensions/

Jan. 13, 2013. Members of Free Detroit-No Consent picketed the home of the Council Member Andre Spivey, who broke ranks with council members who voted against the Consent Agreement to vote for the discharge of Corporation Counsel Krystal Crittendon, which required six votes, and the contracts discussed in this article. They first went to his church, St. Paul’s, at Chene and Hunt, but a minister there announced Spivey called him at 8 a.m. that morning to say he had the flu. However, no one appeared to be home during this protest. Spivey recently bought this home at 4303 Yorkshire, moving there from the west side to be able to run for Council in District 4. A Lexus parked in the back sported a sticker for University Liggett School in Grosse Pointe Woods. Spivey’s home is in East English Village, which borders the Grosse Pointes.

I read the entire piece and there is no mention of Monica Conyer’s contributions. You did, however, manage to get “Shrek’s” picture in. Thanks for the “real” story?

I live in Atlanta, GA. I visit my relatives who have generally been forced out of a decaying city. Sterling Heights, Macomb County, etc. benefit from my relatives’s talents. Is Kenny Cockrell the same one from the ’70’s? Is this the son, or the father?!

The current Kenneth Cockrel Jr is nothing like his father. He seems to forget what roots his father had in community.

Kenneth Cockrel, Sr., an activist from the 60’s through the 80’s in Detroit, died in 1990. He had much earlier divorced Kenneth Cockrel, Jr.s’ mother. But Kenneth Jr. as well as Cockrel Sr.s second wife, Sheila Murphy Cockrel, both played on Cockrel Sr.s popularity in the community to get elected to the Council. Many have told them their father and husband is likely “turning over in his grave” at their policies.

I miss the old Detroit, although I have not lived there in 40 years. So happy that I discovered your publication.

Excellent investigative work. Where are Andy Dillon and Mike Duggan in this?