- Much of Detroit’s streets look like this one in Highland Park, which shows Cassandra Cabil at her home after Highland Park cut a deal with DTE to remove half the city’s street lights. Under a new Public Lighting Authority, 40 percent of Detroit’s street lights, many already gone, will also be permanently removed. The blame lies with Wall Street. Photo: Carlos Osorio

(VOD has taken the liberty of re-publishing this entire article, which clearly lays out the role Jones Day clients, including UBS AG, SBS Financial Services, BOA’s Merrill Lynch, and JP Morgan Chase, in what continues to amount to the gang rape of Detroit. Detroit’s City Council will vote Tues. April 9 on a costly “debt-restructuring” contract with Jones Day. Council members should read this and beware. The article confirms much of what VOD has already written over the last two years.)

By Darrell Preston & Chris Christoff – Mar 13, 2013 8:24 PM ET

By Darrell Preston & Chris Christoff – Mar 13, 2013 8:24 PM ET

The only winners in the financial crisis that brought Detroit to the brink of state takeover are Wall Street bankers who reaped more than $474 million from a city too poor to keep street lights working.

The city started borrowing to plug budget holes in 2005 under former Mayor Kwame Kilpatrick, who was convicted this week on corruption charges. That year, it issued $1.4 billion in securities to fund pension payments. Last year, it added $129.5 million in debt, 9.3 percent of its general-fund budget, in part to repay loans taken to service other bonds.

Detroit, which is trying to avoid becoming the largest U.S. municipal bankruptcy, struggles to serve residents after revenue declined when the auto industry collapsed and the city began to empty. Michigan ’s Republican governor, Rick Snyder, [has named] an emergency manager, who will have to address debt and derivatives taken on in the last eight years.

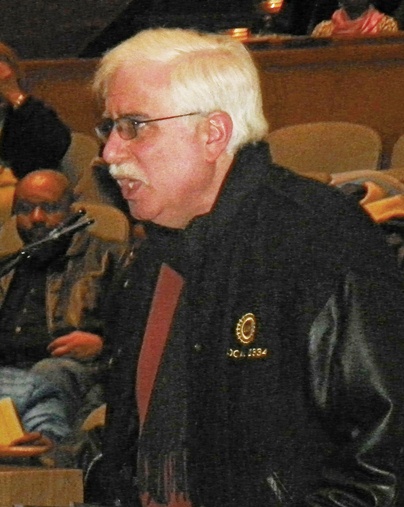

“We have no lights, no buses, poor streets and now we’re paying millions of dollars a year on our debt,” said David Sole, a retired municipal worker and advocate for Moratorium Now Coalition, a Detroit group that fights foreclosures and evictions. “The banks said they need to be paid first. But there is no money.”

The city, which peaked at 1.85 million residents in 1950, has lost more than a quarter of its population since 2000. The 700,000 inhabitants who remain endure unreliable buses, inadequate police and fire protection and broken street lights that have darkened entire blocks.

Covering Shortfalls

Banks including UBS AG (UBS), Bank of America Corp.’s Merrill Lynch and JPMorgan Chase & Co (JPM) have enabled about $3.7 billion of bond issues to cover deficits, pension shortfalls and debt payments since 2005, according to data compiled by Bloomberg. Liabilities rose to almost $15 billion, including money owed retirees, according to a state treasurer’s review.

The debt sales cost Detroit $474 million, including underwriting expenses, bond-insurance premiums and fees for wrong-way bets on swaps, according to data compiled by Bloomberg. That almost equals the city’s 2013 budget for police and fire protection.

The largest part is $350 million owed for derivatives meant to lower borrowing costs on variable-rate debt.

Municipal borrowers from the Metropolitan Water District of Southern California to Harvard University in Cambridge, Massachusetts, have paid billions to banks to end interest-rate swaps that didn’t protect them. In the bets, a municipal issuer and another party exchange payments tied to interest-rate indexes.

‘Pay Later’

“The banks promise to get you the money and say you can pay later,” said Greg Bowens, spokesman for Stand Up For Democracy, a Lansing group that campaigned last year to repeal the law allowing appointment of a financial manager. “They get their fees off the top, and you trust that they’re doing what’s in your taxpayers’ best interest.”

As banks were collecting fees from bonds, some targeted city homeowners with subprime loans that led to foreclosures, depressing real-estate values and tax revenue, Sole said. About one-quarter of Detroit’s housing units are vacant, according to Detroit Future City, a 50-year blueprint for recovery. In some areas, entire blocks are deserted. Properties have been stripped of plumbing, wiring and whatever can be sold.

The home town of General Motors Co. (GM) has been running general-fund deficits of $155.4 million to $331.9 million since 2005, when Kilpatrick was mayor, and has been firing workers to save money.

Killing Fields

Last year, it cut police staffing by 11.6 percent to 2,836, according to budget documents. Killings spiked. Detroit had 411 homicides last year, up 9 percent from 2011.

Stephen Murphy of Standard and Poor’s (r) and Joe O’Keefe of Fitch Ratings sell Detroit City Council on %1.5 billion UBS AG loan in 2004.

On March 11, Kilpatrick, a Democrat, was convicted on corruption and fraud charges. He and co-conspirators executed a “wide-ranging racketeering conspiracy involving extortion, bribery and fraud,” U.S. Attorney Barbara McQuade said in a statement.

Kilpatrick’s attorney, James Thomas of Detroit, declined to comment.

While his client ran Detroit, the city embarked on two of its most expensive bond issues, first paying $46.4 million in fees to UBS and others to borrow $1.4 billion for pension obligations.

A year later, the city paid $61.8 million, including insurance costs, for UBS to sell $948.5 million in bonds, replacing two-thirds of the debt sold the previous year.

Some pension debt traded at about 65 cents on the dollar in the most recent trade Feb. 12, according to data compiled by Bloomberg.

Wrong-Way Bets

Detroit also entered into swaps contracts with UBS and SBS Financial Products Co., which serves as a counterparty on swaps transactions.

Detroit also entered into swaps contracts with UBS and SBS Financial Products Co., which serves as a counterparty on swaps transactions.

The arrangements are a bet on the direction of interest rates and can raise costs if they move unexpectedly.

Rates fell, leaving a liability of $439 million on June 30, 2012, according to a city report. That has fallen to about $350 million as rates went back up, said Jack Martin, Detroit’s chief financial officer.

The borrowing “likely contributed to our current problems,” said Martin, who took his job in May, 2012. “It was the way people did business back then. We are where we are now and working hard to right the ship.”

The city makes periodic swap payments from money generated by casinos.

Public Interest

Wall Street firms could end the deals and call for full payment because Moody’s Investors Service last March cut unlimited general-obligation bond ratings to B2, five levels below investment grade, according to the city’s 2012 financial statement. In November, Moody’s cut the rating again, sending it down two levels to Caa1.

The cuts mean there is “significant risk in connection with the city’s ability to meet the cash demands” under the swap, according to Detroit’s financial report.

The city has been talking with holders of its swaps, the report said. Martin said no negotiations are occurring.

“I don’t think we’re going to have any problems with the counterparties wanting to get those dollars any time in the near future,” said Martin. “We believe, and they believe, it would not be in the city’s best interest, and wouldn’t be in their best interest either.”

Banks have been reluctant to negotiate lower termination payments for many municipal governments. Last year, Detroit’s water and sewer utility borrowed to pay more than $300 million to unwind swaps.

‘Liquidity Problems’

Karina Byrne, a spokeswoman for Zurich-based UBS, declined to comment on the deals. Elizabeth Seymour, a spokeswoman for New York-based JPMorgan, also declined to comment on them, as did Thomas Butler, an SBS spokesman who works for New York-based Butler Associates LLC.

After the pension bonds, the city continued to issue general-obligation bonds and short-term debt totaling about $1.3 billion, according to data compiled by Bloomberg.

The city ran into “liquidity problems,” according to the 2012 financial statement. Because of low ratings and deficits, it was unable to borrow and turned to the Michigan Finance Authority, which arranged a $129.5 million bond issue underwritten by a Bank of America unit.

Costing $1.6 million in fees, part of the proceeds went to repay the unit for an earlier $80 million loan — and part of that loan had been used to service other debt, according to the financial statement.

William Halldin, a spokesman for Charlotte, North Carolina- based Bank of America, declined to comment on the deal.

Debt Hangover

An emergency financial manager will have to handle the legacy of Detroit’s borrowing. Snyder said March 1 that the official would try to restructure long-term debt and renegotiate payments.

Striking new terms would be difficult, said Rick Frimmer, a corporate and municipal restructuring specialist with Schiff Hardin LLP in Chicago who represents some of the debt holders. Temporary changes may be possible, he said, such as waiving payments or default terms.

The city has advisers working on a plan to deal with the debt, in part by reducing retiree health-care liabilities, said Martin. He declined to comment on fees negotiated before he joined the administration.

“I’m sure the fees and interest rate are what most other local units or school districts would have to pay,” Martin said.

To contact the reporters on this story: Darrell Preston in Dallas at dpreston@bloomberg.net; Chris Christoff in Lansing at cchristoff@bloomberg.net

To contact the editor responsible for this story: Stephen Merelman at smerelman@bloomberg.net