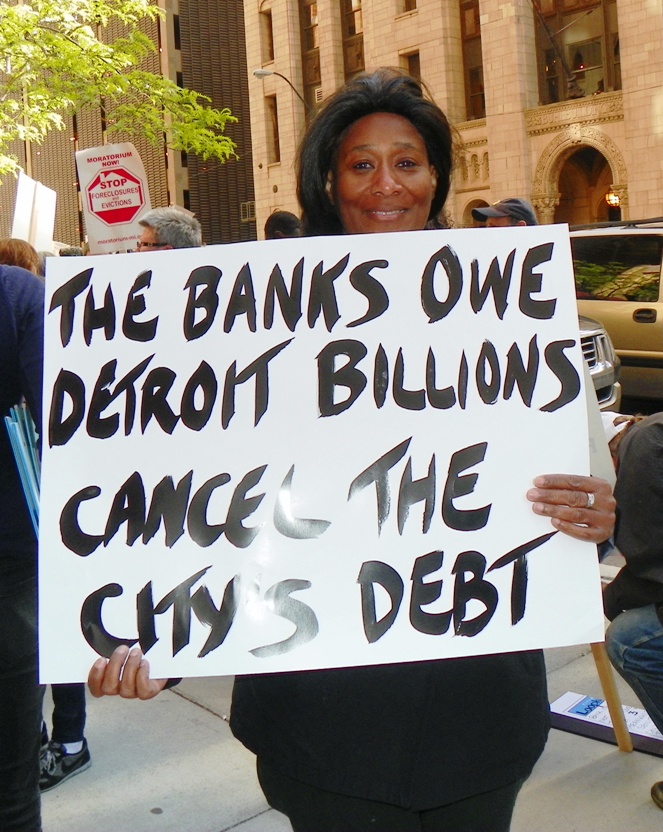

Moratorium NOW! demands debt cancellation outside EM creditors’ meeting June 14, 2013. Orr declared a phony moratorium in which defaulted debts will be paid off by insurers hired by the City of Detroit.

Wall Street creditors fully insured, will get paid

Orr, advisors declare State Constitutional pension guarantee invalid

Want residents, workers, retirees to take severe cuts

Drastic action by unions, peoples’ leaders needed

By Diane Bukowski

June 19, 2013 PART ONE OF VOD’S COVERAGE OF ORR ATTACK

Bruce Bennett of Jones Day, Kenneth Buckfire of Buckfire, and EM Kevyn Orr at press briefing before creditors’ meeting. Orr’s advisors came up with his proposal, at the expense of the city of Detroit, which hired them,

DETROIT – According to business analysts, the city’s pension funds and unions should not be fooled by Detroit Emergency Manager Kevyn Orr’s declaration June 14 that the city’s corporate creditors will make equal sacrifices under his plan, including a “moratorium” on $2.5 billion in “unsecured” debt service.

The plan also calls for investment of $1.25 billion in public services over a ten-year period, most of it in “public safety” (police and fire.)

In fact, according to reports from The Bond Buyer and Bloomberg, corporate creditors will get paid in full for any defaults, since the city PAID to insure their debt when they floated the bonds.

“The city has defined a way by which we will treat all creditors in a class equally,” Orr told reporters at a briefing before his meeting with creditors at Detroit’s Metro Airport. “If we don’t do this there is no way for the city to continue.” He claimed the city has a total of $17 billion in outstanding debt over the coming decades.

City of Detroit Proposal for Creditors

The full report can be read by scrolling through the Scribd above. For easier reading in larger print, page by page, hit the little rectangle at lower right.

In exchange for the “moratorium,” Orr wants the takeover of the city’s pre-eminent assets including the Detroit Water & Sewerage Department and Belle Isle, by a regional authority and the state respectively. He is also demanding cuts to retirees’ actual pensions as well as health care benefits, further elimination of city workers’ “headcount” without regard to the effect on the city’s tax base, and reduction of services including public lighting to conform with what he called the “reduced footprint” of city population.

Orr’s plan does not address what is OWED to the city, including approximately $800 million in corporate debt, as well as state payments that former City Corporation Counsel Krystal Crittendon estimated at over $300 million. His deficit figures and estimates for past and forthcoming years do not include funds the city borrowed to cover the deficits.

“Why does Kevyn Orr continue to threaten to cut health care for seniors and retirees, but refuse to go after millions of dollars owed by millionaires and billionaires?” Crittendon asked in a release.

“Why is it that Kevyn Orr’s reports do not even mention a plan to evaluate the City’s continued practice of granting tax abatements, even though it can no longer afford to do so, or mention a plan to require the banks and mortgage companies which own thousands of parcels of abandoned and blighted properties to either rehabilitate, sell or demolish those properties?”

Orr’s explanation for the city’s dramatic drop in revenues says nothing about the 135,000 families in Detroit who have been forced out of their homes through predatory lending and fraudulent foreclosures, or the thousands of city workers who have lost their jobs through the years due to Wall Street threats to downgrade the city’s debt rating if they were not laid off.

Like a magician whipping the veil off a dove, Orr peremptorily canceled payment of $39.7 million due on $1.4 billion of the city’s “pension obligation certificates” debt to bankers USB AG and SBS Financial June 14. The POC’s are called “Certificates of Participation” (COPS) in Orr’s proposal.

The full 130-page “Proposal for Creditors” carries a significant note regarding that debt.

‘The City has identified certain issues related to the validity and/or enforceability of the COPS that may warrant further investigation,” says the report.

Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard & Poor’s push City Council to pass $1.5 Billion predatory loanfrom UBS AG in 2005. Should they go to jail for what was a clear conflict of interest? Why isn’t Kevyn Orr investigating them?

That statement implies that the entire debt owed to UBS AG and SBS may be null and void, not just the percentage due to interest rate-rigging in the global LIBOR scandal which has targeted UBS and virtually every other bank the city owes money to. UBS has also been fined $1.5 billion by the U.S. Department of Justice for fraudulent practices, while many have demanded instead that its executives be jailed.

In Detroit’s case, ratings agencies Standard and Poor’s and Fitch came to the Detroit City Council to push for the POC loan, threatening to downgrade the city’s debt rating if it didn’t pass, a complete conflict of interest. Later, they downgraded the debt rating anyway.

Then Detroit CFO Sean Werdlow took a high-level management position with SBS Financial, the minority partner in the deal, shortly thereafter. Was that his pay-off?

After first raising strong opposition to the loan, Detroit’s City Council caved unanimously, including the members known then as the “Fabulous Four,” Sharon McPhail, JoAnn Watson, Barbara Rose-Collins, and Maryann Mahaffey. What happened to cause them to change their minds abruptly?

In the Jefferson County, Alabama bankruptcy filing, JPMorgan Chase was forced to forego 70 percent of its debt claims because its officials allegedly bribed the county’s sewage administrators to get a contract.

A clause in Public Act 436, under which Orr is operating, says that he has the obligation to investigate criminal activity that may have led to the city’s financial crisis.

Asked about that clause after the creditors’ meeting, Orr referred only to current pension fund investigations by the federal government, which have resulted in indictments of pension officials, ignoring completely the criminal activities of banks and mortgage holders.

The Moratorium NOW! Coalition is demanding that he investigate these entities and even cancel the city’s debt to them. However, since Jones Day represents virtually all of the city’s bondholders as clients in other actions, such an investigation would obviously lead nowhere. Orr proved later that he has no such intention, telling union and pension representatives June 20 only that he is launching his own criminal investigation of the city’s pension funds.

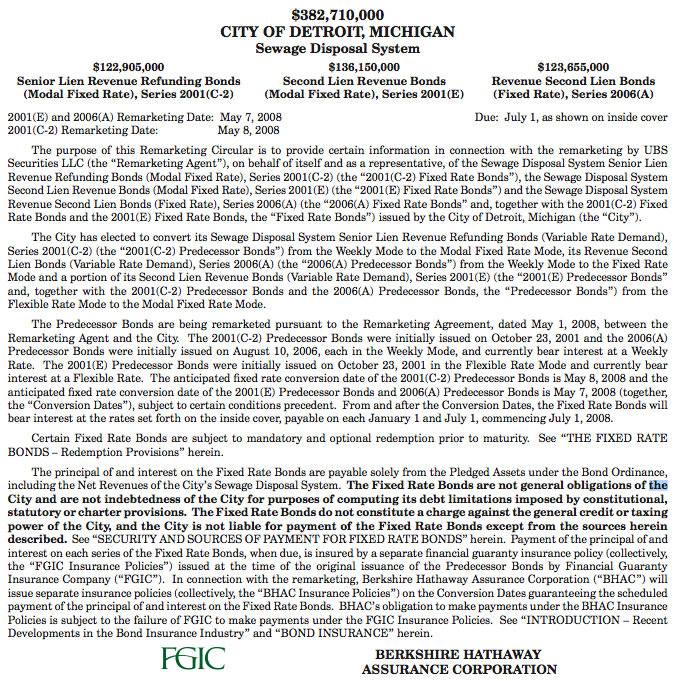

Regarding payment of the pension obligation certificates, the Bond Buyer reported, “The certificates, like nearly all of Detroit’s bonds issued before 2010, carry insurance by one of the six insurers. FGIC [Financial Guaranty Insurance Company] and Syncora Guaranty Inc. insure the pension COPs.”

“The company will pay such claims when, and in the amounts due, under and in accordance with the terms of its insurance policies,” FGIC said in a release. “The company continues to assess the situation in Detroit, Michigan.”

FGIC also insures DWSD bonds, as well as Jefferson County Alabama sewage bonds, where Syncora is also involved.

FGIC itself is facing an ongoing lawsuit in federal court in New York, a matter noted in the complete Proposal for creditors. The suit challenges MBIA Inc.’s division of its business into MBIA Insurance Corporation and National Public Finance Guarantee Corp in 2009, claiming the division was fraudulent under New Yorker Debtor and Creditor Law. See story at http://www.ft.com/intl/cms/s/0/de5e0e28-4dc6-11e0-85e4-00144feab49a.html#axzz2WoSl7FxY

MBIA earlier contracted with the City of Detroit in a $3oo million deal to take over its income tax collection functions while raking in part of the take. The contract failed miserably.

The City of Detroit defaulted twice before on the POC debt, resulting in the assignment of a trustee, US Bank NA also present at the creditors’ meeting, to take control of the city’s revenues from the casinos first to ensure the debt would be paid. Reports from US Bank NA are nowhere to be found on what they did with all that money. The Reuters report below might give some idea.

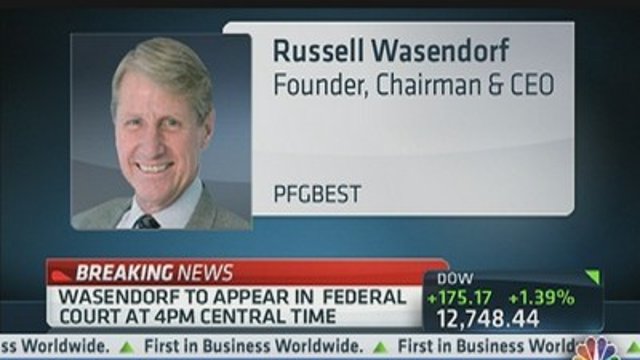

The Commodities Futures Trading Commission has sued Detroit creditor US Bank NA for complicity in the “Midwest Madoff’s” bilking of Peregrine customers.

The news agency reported June 5, “Regulators on Wednesday launched the first lawsuit against a bank tied to the blow-up of brokerage Peregrine Financial, alleging U.S. Bancorp knowingly let Russell Wasendorf Sr. use customer money held at the bank to fund his lavish lifestyle.

“Peregrine founder Wasendorf, who has been dubbed ‘the Midwest Madoff’ for his near two-decade long scheme, began serving a 50-year sentence in February for bilking $215 million from customers.

The lawsuit, brought by the U.S. Commodities Futures Trading Commission (CFTC), alleges a unit of U.S. Bancorp [US Bank NA] let Wasendorf secure loans and other funding against money it knew belonged to his brokerage’s customers.”

Perhaps Orr needs to be investigating what US Bank NA has done with Detroit’s casino taxes.

Orr said the default on the June 14 bond payment will constitute a “termination event,” as did his appointment as Emergency Manager. This means that Wall Street can call in the entire amount of the debt owed. Orr is using the termination events as a cudgel to exact compliance from the city’s pension funds and unions, implying that Chapter 9 bankruptcy will result. Under federal law, public pensions are not specifically protected.

Invitees to the creditors’ meeting included representatives of numerous insurance companies. (Click on Creditors meeting invitees June 14 2013 for full listing from Bill Nowling, Orr’s press representative.) They included FGIC, Syncora, and FGIC’s former parent company MBIA, Inc., all involved in insuring the pension obligation debt.

Three of the six insurers who wrap the city’s debt pledged to cover missed payments, Bloomberg Businessweek reported. Nuveen Asset Management is the second largest holder of Detroit debt, overseeing at least $190 million of all types of debt.

“John Miller, co-head of fixed income at Nuveen in Chicago, said he’s comfortable holding uninsured Detroit general obligations, some of which have seen yields rise to a record 16 percent,” said Bloomberg June 13. “In Jefferson County, Alabama, which reached a deal last week to exit bankruptcy, investors will get back about $1.8 billion of $3.1 billion. The uninsured bonds ‘are speculation about the ability of the emergency manager to succeed with what he’s charged with doing’ Miller said by telephone. He cited the state’s emergency-manager law, which calls for full repayment of the scheduled debt service on all muni debt.”

Orr said in his report that the city also has the option of raising taxes to cover general obligations bonds,

In anticipation of Orr’s cancellation of the POC debt payment, Standard & Poor’s downgraded the city’s debt rating to D June 12.

Standard & Poors at opening of NASDAQ. Wall Street ratings agencies are paid by the banks they rate.

Bloomberg reported, “Detroit, the Michigan city that’s on the brink of bankruptcy, had its general-obligation bond rating cut four levels by Standard & Poor’s to CCC- from B. The so-called superdowngrade of more than three levels is based on recent announcements from the city’s emergency financial manager that Detroit may take steps to adjust payments to bondholders, as well as immediate plans to meet with bondholders to discuss the city’s financial condition and resources, S&P said today in a report.”

Downgrades to Detroit’s debt rating only increase the amount of interest paid on outstanding as well as future debt. Orr said interest rates will not be subject to the moratorium.

Standard and Poor’s is being sued by the U.S. Department of Justice for fraudulent practices, including conspiracy with the banks it rates to jack up their profits. Wall Street ratings agencies have incurred wrath globally after they downgraded the debts of entire countries in Europe and elsewhere to force concessions from the workers and poor.

Meanwhile, Orr denied that the state Constitution protects public employees’ pensions, and said that changes could be negotiated with pension funds or brought to the state’s reactionary legislators.

“We don’t view Article 9 Section 24of the State Constitution as a guarantee,” Orr said.

His stance and that of his right-wing law firm Jones Day runs afoul of every interpretation of state constitutions in bankruptcy cases nationally, including those in California, where Stockton, Vallejo, and have filed Chapter 9 cases.

The entire question at stake in the Stockton bankruptcy is whether federal law, which does NOT guarantee public employee pensions, can trump state law in a Chapter 9 filing. California’s Constitution has definitive protections for public pensions.There has been no definitive decision on that matter yet.

Article 9, Section 24 of Michigan’s Constitution section reads:

“The accrued financial benefits of each pension plan and retirement system of the state and its political subdivisions shall be a contractual obligation thereof which shall not be diminished or impaired thereby. Financial benefits arising on account of service rendered in each fiscal year shall be funded during that year and such funding shall not be used for financing unfunded accrued liabilities.”

Attorney Michael Van Overbeke, spokesperson for the Detroit General Retirement System (DGRS), which represents non-uniformed employees and retirees, said, “We disagree completely with [Orr’s] contention. The State Constitution since 1963 has guaranteed pension benefits for public retirees. In order to change the Constitution, a general vote of the people must be held.”

Attorney Michael Van Overbeke, spokesperson for the Detroit General Retirement System (DGRS), which represents non-uniformed employees and retirees, said, “We disagree completely with [Orr’s] contention. The State Constitution since 1963 has guaranteed pension benefits for public retirees. In order to change the Constitution, a general vote of the people must be held.”

He said public workers are not investors like corporations and banks, but worked for their pension benefits. If the pension benefits were not there, they would have been paid higher salaries. Public employees also match their employers’ contributions through their own annuity plans.

Regarding the proposal’s contention that the DGRS and Police and Fire Retirement Systems (DPFRS) are vastly more underfunded than the systems’ own auditors have said, Van Overbeke said the pension systems have been given no figures to show that.

The Milliman company, also hired by the city, has so far issued two reports contending severe underfunding, but they have been shown to no one. VOD never received a response to its Freedom of Information Act request for the first report, despite the fact that it was commissioned with public funds.

DRGS’ own auditor, Gabriel, Roeder and Smith, gave it a clean bill of health and noted that it is proper practice when another company audits a system for that company to consult with the auditor in place, which has not been done.

Van Overbeke said that if Orr tries to cut pensions and benefits for retirees, or change the composition of the pension board or even take it over as sole trustee under PA 436, “appropriate action” will be taken by the pension fund.

He said however, that the fund would be willing to sit down and “negotiate” over matters like governance changes.

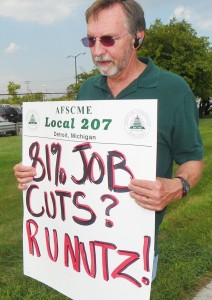

Mike Mulholland, Vice-President of Local 207 of the American Federation of State, County and Municipal Employees (AFSCME), which represents water and public lighting department workers, denounced Orr’s plan to regionalize the Detroit Water and Sewerage Department and separate it from Detroit after the meeting.

“You can be assured that if and when an authority takes over, privatization will run rampant,” Mulholland said. “It’s been going on in the department. Jobs of building attendants and groundskeepers have recently been outsourced. The jobs of workers at the new dewatering sludge facility will not be city jobs.”

He criticized the top leadership of AFSCME Council 25, which sabotaged a wildcat strike in September, 2010, for not organizing the membership to take militant direct action against such a grave attack on the city’s most valuable asset. Mulholland himself, like former Local 207 President John Riehl, both militant leaders of the strike, came under a veiled attack by Council 25 to oust them, even as DWSD is being taken from under the noses of Council 25 President Al Garrett and other top leaders who were in the creditors’ meeting.

“There comes a time when you’re right against the wall and they’re beating you to death,” Mulholland said. “That is when you have to fight. At this point, strike action is the only answer, the wider the better, not only for our workers, but for the City of Detroit. The UAW took huge historic concessions in the GM and Chrysler bankruptcies. At some point, the unions will cease to exist as viable entities, except as dues-collecting bodies. If that happens, it will be a terrible loss to the working class as a whole. The workers right now are in shock just like the rest of the City of Detroit. Getting them to rise up out of their fog of fear to regain their self-respect is difficult given the sell-out of our strike by the top dogs.”

Regarding what happened among the union leaders present at the creditors’ conference, Mulholland said, “People were right on the verge of jumping out of their seats. Nobody wants to see Orr’s plan happen, even the leaders of Council 25. Orr made it clear that he will remove the pension boards under PA 436, but said the pension boards can still negotiate with him. By that time, he will be the only representative of the pension boards.”

As organizers of the June 22 “Freedom Walk” in honor of Dr. Martin Luther King, Jr.s’ historic march in Detroit June 23, 1963 prepare for the event, they had best examine their consciences. Sponsors include the NAACP and the UAW, as well as corporations like GM which have devastated Detroit with plant closings. Many will attend this march in honor of the great Dr. King, but Dr. King must be turning over in his grave to know that the erstwhile inheritors of his heroic and radical legacy have failed to come to the rescue of the largest Black majority city in the world outside of Africa, through the types of militant actions he advocated, including the Montgomery bus boycott and the massive strike of Memphis sanitation workers, during which he gave his life.

Pingback: EM ORR'S PLAN FOR DETROIT: PHONY DEBT MORATORIUM, THEFT OF … | Mock

Pingback: EM Orr’s plan for Detroit: phony debt moratorium, theft of city assets including water, Belle Isle, pensions » Cancel Detroit’s Debt To The Banks!