BANKRUPTCY: HANDS OFF DETROIT! CANCEL CITY’S BANK DEBT!

A No Struggle, No Development Production! By Kenny Snodgrass

On Aug. 2, 2013, we demonstrated at the Federal Bankruptcy Court. On July 22, Federal Bankruptcy Judge Steven Rhodes, removed the order of Michigan Circuit Court Judge Rosemarie Aquilina, who earlier ruled the City of Detroit bankruptcy filing was unconstitutional insofar as it targeted city workers’ pensions, which are guaranteed under the state constitution, and stayed Michigan Governor Rick Snyder’s approval of the bankruptcy filing on that basis. However, Judge Steven Rhodes has not yet issued a ruling on the constitutional issue itself.

A No Struggle, No Development Production! By Kenny Snodgrass, Activist, Photographer, Videographer, Author of 1} From Victimization To Empowerment… www.trafford.com/07-0913 eBook available at www.ebookstore.sony.com 2} The World As I’ve Seen It! My Greatest Experience! {Photo Book} 3}YouTube: I have over 447 Video’s, 276 Subscribers, over 200,000 hits, now averaging 10,000 monthly on my YouTube channel @ www.YouTube.com/KennySnod

Judge Rhodes gives early approval to revised retiree committee

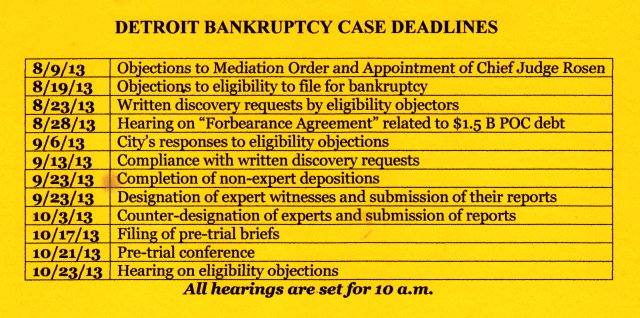

Sets breakneck schedule to determine eligibility

Mandates Detroit pay committee, fee examiner, noticing agent

In previous Ch9 case, Rhodes barred citizens from intervening in takeover of public hospital

By Diane Bukowski

Aug. 10, 2013

UPDATE: Regarding two lawsuits challenging the constitutionality of PA 436, pending in federal district court before Judge Steeh, the State through Attorney General Bill Schuette filed a “Notice of pending bankruptcy case” Aug. 7 in Steeh’s court and said it would not be participating in those suits as a defendant from that day on. Parties to the lawsuits are considering what action to take next, including asking Judge Steeh to rule against the state, at least in part. Story coming after Aug. 14, 2013.

DETROIT – During the second court hearing Aug. 2 on the petition for bankruptcy filed by Detroit Emergency Manager Kevyn Orr and his former law firm Jones Day, U.S. Bankruptcy Judge Steven Rhodes gave them virtually everything they wanted.

DETROIT – During the second court hearing Aug. 2 on the petition for bankruptcy filed by Detroit Emergency Manager Kevyn Orr and his former law firm Jones Day, U.S. Bankruptcy Judge Steven Rhodes gave them virtually everything they wanted.

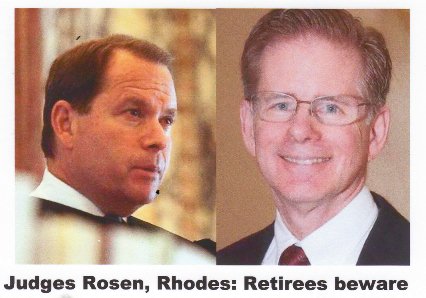

Rhodes granted Orr’s revised motion to form a retirees committee despite objections that it was untimely under bankruptcy law. He approved breakneck deadlines for proceedings prior to the eligibility hearing Oct. 23, and asked that parties submit secret “letters under seal” to him by Aug. 9 if they object to his appointment of Chief U.S. District Judge Gerald Rosen as Mediator.

Rosen previously worked for Miller Canfield, a law firm which is assisting Orr in the bankruptcy proceedings. Rosen is also a member of the ultraconservative Federalist Society.

Rhodes has now set an expedited date, Aug. 21, 2012 at 10 a.m. for a crucial hearing on Orr’s motion for a “forbearance agreement,” related to the city’s $1.5 billion Pension Obligation Certificate (POC) debt at the request of city creditor Syncora, Inc. (See separate story.)

Rhodes has now set an expedited date, Aug. 21, 2012 at 10 a.m. for a crucial hearing on Orr’s motion for a “forbearance agreement,” related to the city’s $1.5 billion Pension Obligation Certificate (POC) debt at the request of city creditor Syncora, Inc. (See separate story.)

One weekly newspaper ran a misleading headline earlier, “The City of Detroit Did not File for Bankruptcy.” However, unfortunately Rhodes earlier ruled that Orr does represent the City of Detroit, despite the pendency of federal lawsuits challenging the constitutionality of Public Act 436, Michigan’s current “Emergency Manager” law.

The breakneck schedule Rhodes approved for initial proceedings appears to be competing with hearings on those lawsuits, the first of which is set for Sept. 13. Rhodes has set a date of Oct. 23 for an eligibility hearing, with the date of commencement of the bankruptcy case to be July 18 if he overrules eligibility objections. Jones Day attorney David Heiman, representing the city, said he wants to file a plan of debt adjustment by Dec. 31, 2013, two months earlier than Rhodes proposed.

Orr has said, “Everything is on the table,” in the bankruptcy proceedings. He is targeting city retirees’ pensions, as well as what Jones Day attorneys called “non-core” assets, including the Detroit Water and Sewerage Department.

RETIREES COMMITTEE FORMED IN POSSIBLE VIOLATION OF LAW

The revised motion authorizing the U.S. Trustee to form the retirees’ committee says in part, “Nothing contained in the Motion or this Order shall be deemed an admission or a finding that the City has any obligation to provide any Retirement Benefits to any Retiree or other party.” (Click on DB Rhodes order on retirees committee for full motion.)

David Sole, a party in the bankruptcy case, is at left holding banner outside courthouse Aug. 2, 2013.

Attorney Jerome Goldberg, representing city retirees David and Joyce Sole, moved to dismiss the motion as untimely during the hearing. David Sole was previously president of UAW Local 2334, representing Detroit Water and Sewerage Dept. chemists, and his wife was a bus driver. (His full motion is at DB Sole motion re retirees committee.)

“The Bankruptcy Code Sec. 1102(a)(1) states the U.S. Trustee can appoint a committee after an order for relief, which comes only after the eligibility question is resolved,” Goldberg said. Rhodes has set a trial on whether the city is eligible to file for bankruptcy for Oct. 23, 2013.

“This is a plain violation of the law,” Goldberg explained. “One of the critical issues in eligibility is the applicability of this state’s constitutional protection of public pensions. This case will have a national impact, because 24 other states have similar provisions. . . Our concern is that this will dampen the rights of all interested parties, including individual retirees, to be represented. Right now everybody is vying against each other for who will be on the committee.”

Goldberg’s arguments were echoed by several other retiree-side attorneys, but they passed over the issue as “a law-school” concept.

The July edition of the “Jaffe Update” published by the law firm of Jaffe Raitt Heuer & Weiss PC before Orr filed for bankruptcy, answers a question about appointment of a creditors’ committee.

“Yes, the U.S. Trustee is charged with appointing a creditors’ committee, but no committee can be appointed until after the determination that the municipality is eligible to be a Chapter 9 debtor,” says their article, titled “Guide to Chapter 9 of the Bankruptcy Law.” Guide to Chapter 9 of the bankruptcy code

Rhodes responded that the statute doesn’t say he can’t appoint a committee beforehand. His order cites only 1102(a)2 of the Bankruptcy Code, ignoring the section Goldberg cited. (See complete Section 1102 at US Bankruptcy Code Section 1102.)

Rhodes also ignored Goldberg’s key “point of correction” regarding Orr’s earlier claim that only the City of Detroit can alter pension benefits, not the pension boards or other parties.

In his motion, Goldberg said, “In fact, Section 47-4-4 of the Detroit Municipal Code expressly states that the City of Detroit is prohibited from making amendments to the Pension plan ‘which shall deprive any participant or beneficiary of any then vested benefit under the Plan.’” (Click on DB Sole motion city code for full document.)

PENSION PLANS, UNIONS, ASSOCIATIONS ASK TO BE ON COMMITTEE

AFSCME Council 25, the UAW, the Detroit Retired City Employees Association, the Detroit Police and Fire Retirees Association, the Detroit public safety unions, and the city’s two pension systems all asked for representation on the committee during the hearing. Several associations claimed retirees’ interests were contrary to those of the unions, a point Judge Rhodes appeared to seize on.

Rhodes also appeared concerned about the size of the committee. While it is to be chosen by the U.S. Trustee, Rhodes has ultimate authority over the committee’s proceedings. His ultimate scheduling order ignored objections by the parties that it did not give enough time for constitution of the committee and its proceedings.

Michael Karwoski, a retired Law Department attorney, said each individual retiree should receive notice of proceedings in the bankruptcy case, in accordance with due process.

Michael Karwoski, a retired Law Department attorney, said each individual retiree should receive notice of proceedings in the bankruptcy case, in accordance with due process.

“The largest creditors, the bondholders and insurers, all the large dollar interests want less money allocated to the retirees,” he said. “There are about 24,000 retirees as compared to 100,o00 creditors. One of the issues is the alleged indebtedness of the retirement systems, $3.5 billion on pensions and $6 billion on health care costs. Retirees’ pensions average only $19,000 a year or less.”

ALL RETIREES LISTED IN STOCKTON FILING

Karwoski said that during the ongoing Stockton, CA bankruptcy filing, each of the 2,000 retirees is listed as creditors. He said mailings to them are done via the pension systems, which have their addresses, to avoid unnecessary public exposure.

The U.S. Trustee has just posted a notice of formation of the Retiree Committee and a Detroit Retiree Committee Solicitation form on the court’s website at http://www.justice.gov/ust/r09/docs/general/emi/Detroit_Retiree_Committee_Solicitation.pdf. The general website for the court, which includes a link to Detroit bankruptcy filings, is at http://www.mieb.uscourts.gov/.

The notice can also be downloaded at Detroit_Retiree_Committee_Solicitation.

Among other declarations, the notice describes the committee as follows:

Powers and Duties of Retiree Committee. Members of the Retiree Committee appointed under section 1102(a) of the Bankruptcy Code will be fiduciaries representing all Retirees without regard to any differences in the types of claims that individual Retirees or the members might hold against the City. Section 1103 of the Bankruptcy Code provides, among other things, that the Retiree Committee may consult with the City and participate in the formulation of a plan for the adjustment of the City’s debts.

VOD has a question in to the Trustee, who is Daniel J. McDermott, and his assistant Marion J. Mack, regarding how many retirees have been duly notified to submit this form. Clearly, not every one of the city’s 23,500 retirees is aware of the website posting and the details of the bankruptcy case. Many have moved to other cities or states. Many who are elderly may not even use computers. Additionally, giving “fiduciary” power to a committee that does not hold the assets of the Retirement Systems is open to question.

Orr has challenged the funding levels of the retirement funds. PA 436 give him the power to remove the current pension boards of trustees if funding levels fall below 80 percent. Giving “fiduciary” power to the Retirees’ Committee may mean he intends to use it to replace the Boards. There will certainly be a legal battle if that happens.

VOD is also asking McDermott whether he will intervene regarding the legality of forming the Retirees Committee prior to an eligibility trial. According to an article on the Ohio Federal Bar website, “Generally, the U.S. Trustee becomes involved in cases where he perceives parties are engaging in practices that violate the Bankruptcy Code or Federal Rules of Bankruptcy Procedure. The U.S. Trustee seeks to consistently and fairly enforce the bankruptcy laws as drafted by Congress and prevent fraud and abuse whether committed by debtors, creditors, attorneys or bankruptcy petition preparers.”

McDermott represents Region 9, which includes Ohio and Michigan among other areas.

In his order, Rhodes said sufficient notice had already been given, and approved Orr’s revised motion in toto, with the addition that the city will provide funding for the retirees’ committee as well as a fee examiner.

Despite Rhodes’ funding order, the DRCEA has since sent out a letter asking its members to contribute funds to defray their costs, and to sign consent letters agreeing to appoint the officers of the association as their representatives.

In a separate order, Rhodes also appointed Kurtzman Carson as claims and noticing agent, usually the responsibility of federal court personnel. They are to provide notices on the city’s website. (See DB Rhodes order Kurtzman Carson.)

Orr/Jones Day revised the city’s original motion significantly after the unions, pension systems, and retiree associations objected that only the U.S. Trustee has the power to appoint committees under bankruptcy law, not the debtor city.

Orr originally set out a detailed process for appointment of members of the committee by the city, and contacted various retiree associations prior to the Aug. 2 hearing to ask them to recruit members. They were doing so as early as a July 20 DRCEA luncheon.

BREAKNECK SCHEDULING ORDER

Over the repeated objections of various unions and retiree associations that the schedule was too “aggressive,” Judge Rhodes approved a slightly altered schedule for further proceedings in the case, based on that submitted by Jones Day. His scheduling order says that if no objections to eligibility are filed, or if he overrules such objections at a hearing Oct. 23, 2013, the commencement date for the bankruptcy case will be moved back to July 18, the date of filing.

Rhodes said Rule 1 of the Federal Rules of Civil Procedure requires a “just, speedy, and inexpensive determination” of the case. During her presentation, the UAW’s attorney emphasized the disposition must be JUST.

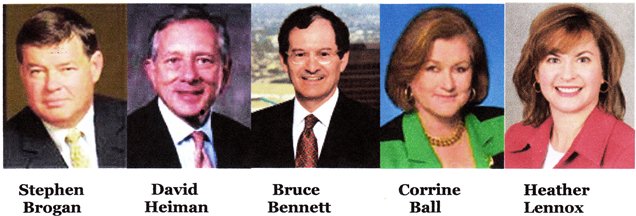

The attorneys above are the five Jones Day sent to Detroit to represent the city on “debt re-structuring” matters. Brogan is the managing parter (i.e. CEO) of the mammoth law firm. Heiman, Lennox and Bennett have appeared in bankruptcy court.

In addition to the deadlines below, Jones Day attorney David Heiman (on behalf of the city) told Judge Rhodes that he wants to submit a plan of debt adjustment by Dec. 31, 2013, two months before that earlier proposed by Rhodes.

“We want to move swiftly. Time is our enemy,” Heiman said. “The facts are not going to change no matter how long we wait.”

Attorney Robert Gordon of Clark Hill, representing the city’s two retirement systems, said repeated announcement that the city is broke are a “catchy sound bite.”

But he countered, “The city is meeting its payroll obligations. While everything needs to move with due speed — we understand that — it should not be used as an excuse to move faster than reasonable.”

RHODES’ PREVIOUS CH9—ADDISON COMMUNITY HOSPITAL

This is only the second Chapter 9 bankruptcy case Rhodes has handled. In 1994, he handled the bankruptcy case of “Addison Community Hospital Authority.” In that case, Rhodes barred the “Concerned Citizens for Addison Community Hospital” from intervening as a group. Addison is located just south of Jackson, Michigan.

In addition to specific creditors’ concerns, they cited fears that the bankruptcy could result in the transfer of the hospital to a “private profit-making entity.”

Rhodes ruled, “Congress has explicitly stated in the legislative history that the courts do not have jurisdiction to interfere with the political and policy choices a municipality makes in running its organization; rather, courts are limited to approving or disapproving proposed plans for debt adjustment.” (Full ruling at Rhodes previous CH 9.)

In barring the Concerned Citizens from intervening, he said, “This Court should not be so liberal in granting applications to be heard as to overburden the debt adjustment process.”

Despite the closure of the hospital, however, the Authority opted to pay off workers’ pensions, not dissolving until 2011. http://www.lenconnect.com/article/20110502/NEWS/305029965.

But in the current bankruptcy case, the State of Michigan has usurped the role of the City of Detroit, which is actually allowed under current Chapter 9 law, and made clear what decisions IT wants to make on behalf of Detroiters — to cut public pensions and sell-off or lease city assets.

In 1977, when the City of Detroit proposed the privatization of Detroit General Hospital, founded as a public hospital in 1917, the Concerned Citizens for Detroit General Hospital initiated a broad petition campaign to put the matter on the ballot. They cited similar concerns regarding the provision of health care for all without regard to profit, and collected hundreds of thousands of signatures which were certified by then City Clerk James Bradley.

A judge later ruled that the case for privatization involved financial concerns and therefore should not be subject to referendum. Detroit General became Detroit Receiving Hospital under the non-profit Detroit Medical Center, which is now a for-profit venture of Tenet, Inc.

The same argument was used again when Michigan Gov. Rick Snyder and the state legislature included an appropriations clause in Public Act 436 to prevent the people from overturning that law after they repealed Public Act 4.

BEWARE, DETROIT RETIREES, WORKERS AND RESIDENTS: DANGER AHEAD! RE-CLAIM YOUR POWER!

For further info, contact the Stop the Theft of Our Pensions committee at 313-680-5508.

There is also a petition to support retirees vs. Wall Street up at http://www.standwithdetroit.org/. Please sign.