- Protesters at Bank of America Aug. 19, 2013 joined retirees’ march outside bankruptcy courtroom the same day in downtown Detroit. Bank of America is a major creditor in Detroit’s bankruptcy, but protesters said it helped cause the city’s economic decline through predatory lending, fraudulent mortgages and illegal foreclosures and evictions.

By Nate Raymond

Mon Sep 23, 2013 2:45pm EDT

NEW YORK (Reuters) – Bank of America Corp heads to trial this week over allegations its Countrywide unit approved deficient home loans in a process called “Hustle,” defrauding Fannie Mae and Freddie Mac, the U.S. government enterprises that underwrite mortgages.

In what would be the government’s first financial crisis case to go to trial against a major bank over defective mortgages, jury selection is set to begin in federal court in New York on Tuesday, barring a last-minute settlement.

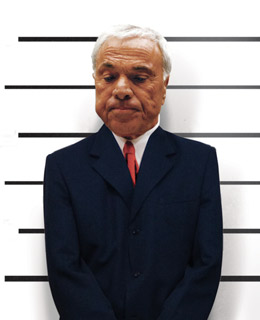

Angelo Mozilo co-founded Countrywide in 1969 and built it into the largest mortgage lender in the U.S. Countrywide wasn’t the first to offer exotic mortgages to borrowers with a questionable ability to repay them. In its all-out embrace of such sales, however, it did legitimize the notion that practically any adult could handle a big fat mortgage. In the wake of the housing bust, which toppled Countrywide and IndyMac Bank (another company Mozilo started), the executive’s lavish pay package was criticized by many, including Congress. Mozilo left Countrywide last summer after its rescue-sale to Bank of America. A few months later, BofA said it would spend up to $8.7 billion to settle predatory lending charges against Countrywide filed by 11 state attorneys general.–Time Magazine photo and caption.

The trial is also a reminder of the billions of dollars in legal liabilities Bank of America has incurred as a result of its 2008 acquisition of Countrywide Financial Corp, which became a poster child of the mortgage meltdown.

The U.S. Justice Department filed the civil lawsuit in 2012, blaming the bank for more than $1 billion in losses to Fannie Mae and Freddie Mac, which bought mortgages that later defaulted. Since then, new evidence and pre-trial rulings by U.S. District Judge Jed Rakoff have pared the case back.

Bank of America has said the lawsuit’s claims are “simply false” and that it “can’t be expected to compensate every entity that claims losses that actually were caused by the economic downturn.”

A spokesman for the bank declined comment ahead of the trial, which is expected to last five weeks.

‘HIGH SPEED SWIM LANE’

The government lawsuit stems from a whistleblower case brought by former Countrywide Financial Corp executive Edward O’Donnell.

It centers on a program called the “High Speed Swim Lane” – also called “HSSL” or “Hustle” – that government lawyers say Countrywide initiated in 2007 as mortgage delinquency and default rates began to rise and Fannie and Freddie tightened underwriting guidelines.

Rebecca Mairone, a key figure in Countrywide’s fraudulent mortgage practices, now works for J.P. Morgan Chase.

Countrywide pushed to streamline its loan origination business through the program, eliminating loan quality checkpoints and paying employees based only on the volume of loans they produced, according to the lawsuit.

The result was “rampant instances of fraud and other serious loan defects,” including in the mortgages sold to Fannie and Freddie, despite assurances Countrywide had tightened underwriting guidelines, the Justice Department said.

The process was overseen by Rebecca Mairone, a former chief operating officer of Countrywide’ s Full Spectrum Lending Division. The Justice Department added her as a co-defendant in January.

Mairone left Bank of America in mid-2012 and is now a managing director at JPMorgan Chase & Co.

Marc Mukasey, a lawyer for Mairone at Bracewell & Giuliani, said in an email it was “a shame the government is wasting time and money on a case that is utterly devoid of merit.”

Fannie and Freddie’s estimated “gross loss” on loans in the Countrywide program was $848.2 million, according to court papers. The “net loss” – the loss caused by the portion of loans the Justice Department says were materially defective – was $131.2 million.

While the jury will determine if the bank is liable, any penalty would be up to Rakoff, a judge well-known for his rulings in financial crisis cases.

March in the Detroit neighborhood of the Cullors family, which faced eviction by BOA, on Nov. 10, 2012.

In 2010, Rakoff rejected a $33 million settlement between Bank of America and the U.S. Securities and Exchange Commission over claims it did not properly disclose employee bonuses and financial losses at Merrill Lynch, which it acquired at the end of 2008.

The bank ultimately agreed to a renewed settlement paying $150 million in an accord Rakoff “reluctantly” approved. In November 2011, he rejected a $285 million settlement between the SEC and Citigroup Inc, challenging the long-standing practice of settlements without admissions of wrongdoing.

In the “Hustle” case, Rakoff dismissed claims against the bank under the False Claims Act but allowed the case to instead proceed under a provision of the Financial Institutions Reform, Recovery and Enforcement Act, a 1989 federal law passed after the savings-and-loan crisis.

The law, which provides a longer statute of limitations of 10 years, has become the basis of several government civil lawsuits over the financial crisis.

The case is U.S. ex rel. O’Donnell v. Bank of America Corp et al, U.S. District Court, Southern District of New York, No. 12-01422.

(Reporting by Nate Raymond; Editing by Eddie Evans and Grant McCool)

This web page is known as a walk-by for all of the data you wished about this and didn’t know who to ask. Glimpse right here, and also you’ll definitely uncover it.

I need a lawyer to contact us, to file an action againist Indy Mac Mortgage Services & Deutsche Finanical Trust… failing to file Federal Hamp Guidlines and foreclosing on our Home in Long Island..