The visit of Obama administration to Detroit this Friday can be an important development in restoring hundreds of millions of dollars in federal funds to the City of Detroit to alleviate the financial crisis facing the city. But this will not be the case if Obama’s officials choose to meet with and listen to Governor Snyder, EM Orr, Mayor Bing and other officials who have deliberately withheld federal funds from Detroit to further their agenda of privatization, union busting and subsidies for the banks. Here is a list of concrete ways the Obama administration can funnel needed funds to Detroit by executive order.

The visit of Obama administration to Detroit this Friday can be an important development in restoring hundreds of millions of dollars in federal funds to the City of Detroit to alleviate the financial crisis facing the city. But this will not be the case if Obama’s officials choose to meet with and listen to Governor Snyder, EM Orr, Mayor Bing and other officials who have deliberately withheld federal funds from Detroit to further their agenda of privatization, union busting and subsidies for the banks. Here is a list of concrete ways the Obama administration can funnel needed funds to Detroit by executive order.

Mich. Dept. Human Services head Maura Corrigan and Gov. Rick Snyder withheld federal funds from Detroit Human Services Dept. and forced its closure.

The Obama administration can order the release of hundreds of millions of dollars of CSBG funds to the City of Detroit, under the auspices of the City and administered by City workers. In October 2011, State DHS head Moira Corrigan illegally withheld these funds from Detroit in an effort to force the city to give up the right to administer the grants.

As a result, funds have been withheld from the neediest Detroiters for whom CSBG grants offer rental, heat, and food assistance. Bing and City Council unfortunately capitulated to Corrigan’s illegal acts. Restoring the CSBG grants to the administration of the city, by the same workers who effectively worked the program from years (perhaps minus a few rotten supervisors), would mean dozens of workers would be restored to the city’ workforce. Their wages and benefits would be paid out of the federal grant, helping to put a halt to the deliberately depleting of the pension fund by Snyder.

Similarly, the Obama Administration can restore the administration of the Detroit Headstart program to the City of Detroit, which administered it for over 40 years until Mayor Bing inexplicably and illegally ceded control to a Denver based outfit with the consent of the Obama administration. Restoring the administration of the Headstart program to the City of Detroit would immediately bring $25 million in funds to the city, and employ 40 city workers. Like with CDBG, their wages and benefits would be paid out of the federal grant, helping to put a halt to the deliberately depleting of the pension fund.

The Obama administration could order Snyder and the Michigan State Housing Development Authority (MSHDA) to immediately remove the impediments it has imposed on the release of the $500 million in federal Helping Hardest Hit Homeowner Funds to serve their purpose, helping homeowners remain in their homes. For example, 10,000 Detroit homeowners face losing their homes to tax foreclosures despite the availability of hundreds of millions of federal funds to pay delinquent property tax bills. Snyder’s and MSHDA’s deliberate withholding of these funds is contributing to the loss of homes, decline in neighborhoods and depletion of Detroit’s population and tax base. In addition, it is contributing to the City’s deficit as Detroit is paying $82 million in chargebacks to the County for lost value of tax foreclosed homes, which could be avoided if the Hardest Hit Homeowners Funds were released. Incredibly, in a recent deposition, Orr did not even know what chargebacks were despite their huge role in Detroit’s deficit.

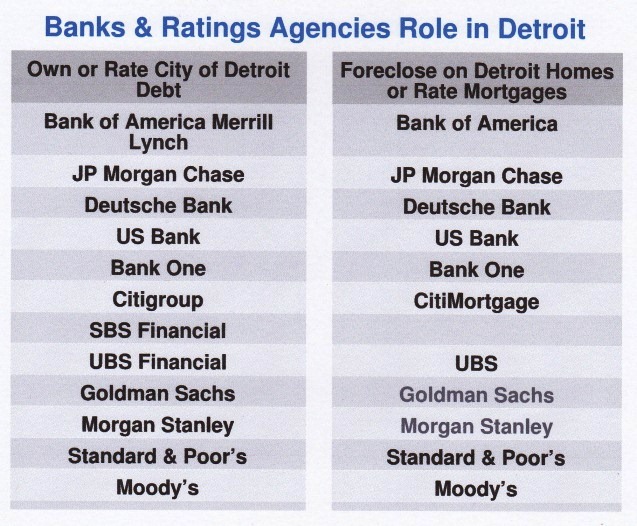

The Obama administration, through the Securities and Exchange Commission and the Justice Department, could order an investigation of the banks whose subprime lending practices in the city were the major factor in destroying the City’s tax base over the last decade. Similarly, the SEC and Justice Department could launch similar investigations to those carried out across the U.S. with regard to municipal bond practices of banks like Chase, UBS and Bank of America, Libor Manipulation by the banks with regard to Detroit’s bonds, and the use of the ISDA Fix by the banks to calculate termination fees on interest rate swaps. In addition the SEC and the Justice Department should investigate the role of the “ratings agencies”, Standard and Poors, Moody’s and Fitch, in encouraging sub-prime mortgage lending in Detroit, as well as “encouraging” the City to be placed in onerous interest rate swaps in 2005-2006, then lowering the City’s bond rating, placing these bond deals in default to benefit the banks who pay the agencies.

The Obama administration, through the Securities and Exchange Commission and the Justice Department, could order an investigation of the banks whose subprime lending practices in the city were the major factor in destroying the City’s tax base over the last decade. Similarly, the SEC and Justice Department could launch similar investigations to those carried out across the U.S. with regard to municipal bond practices of banks like Chase, UBS and Bank of America, Libor Manipulation by the banks with regard to Detroit’s bonds, and the use of the ISDA Fix by the banks to calculate termination fees on interest rate swaps. In addition the SEC and the Justice Department should investigate the role of the “ratings agencies”, Standard and Poors, Moody’s and Fitch, in encouraging sub-prime mortgage lending in Detroit, as well as “encouraging” the City to be placed in onerous interest rate swaps in 2005-2006, then lowering the City’s bond rating, placing these bond deals in default to benefit the banks who pay the agencies.

Whenever there is a State of Emergency is declared, it is the policy of the Secretary of Housing and Urban Development to place a 90 day moratorium on foreclosures and foreclosure-related evictions, which can be extended by executive order. Foreclosure moratoriums were put into effect after Katrina and the hurricane in New Jersey. The basis for placing an Emergency Manager and subsequent bankruptcy on Detroit was Snyder’s Declaration of a State of Financial Emergency. Based on this emergency declaration, HUD Secretary Donovan should immediately impose a moratorium on foreclosures and foreclosure-related evictions in the City of Detroit.

• In addition, because Fannie Mae and Freddie Mac, agencies of the federal government, along with HUD, own the vast majority of mortgage loans in Detroit, the Obama administration should stop all foreclosures and foreclosure-related evictions by these federal agencies. In addition, considering the fact that virtually all residential mortgages in Detroit are severely underwater, contributing to people just walking away from and abandoning their residences, the Obama administration should reduce the principal on all mortgage loans owned by Fannie Mae, Freddie Mac or backed by HUD, to the actual value of the home.

ISSUED BY MORATORIUM NOW! COALITION

http://www.moratorium-mi.org Call 313 744-7912

https://www.facebook.com/events/609208552455934/?ref_dashboard_filter=calendar