Detroit EM Kevyn Orr, Jones Day, global banks dismantle nation’s largest Black majority city while profiting from billions in debt. Clockwise l to r: Rec. Dept., D-DOT, Public Lighting, retirees’ pensions, Water and Sewerage Department, Belle Isle

COPS “A ticking time bomb”

Orr claims litigation “too lengthy and costly”

Tries to gloss over evident bribery by UBS AG/SBS of former city CFO Sean Werdlow, Kilpatrick administration

By Diane Bukowski

ANALYSIS

January 12, 2014

DETROIT – The city could recover over $2.8 billion from the banks involved in the mammoth “Pension Obligation Certificates” (COPS) deal of 2005-06, and more on a related swaps deal, if it pursued litigation challenging what Detroit Emergency Manager Kevyn Orr admitted Jan. 3 were likely unlawful and fraudulent transactions.

“They were a ticking time bomb,” Orr testified that day during a special bankruptcy trial hearing. For the first time, he admitted that the $1.44 billion COPS, foisted on the city in 2005-06, with the related swaps totaling $475 million, were likely scams which exposed Detroit to tremendous financial risk. He admitted that the banks and Wall Street ratings agencies pushing them were duty-bound to explain their risks to city officials, but said they did not do so. The COPS, with related interest and other fees, now amount to at least $2.8 billion.

At the trial, which is set to wrap up tomorrow, U.S. Bankruptcy Judge Steven W. Rhodes is considering whether to approve a modified proposal to borrow $165 million from Barclays, a UK-based bank, to pay Swiss-based UBS AG and the Bank of America to terminate only the swaps at a discounted rate, ignoring the COPS.

All the banks involved have been charged in global venues with criminal and civil transgressions related to the LIBOR and ISDAfix rates, predatory lending, and other mammoth white-collar scams.

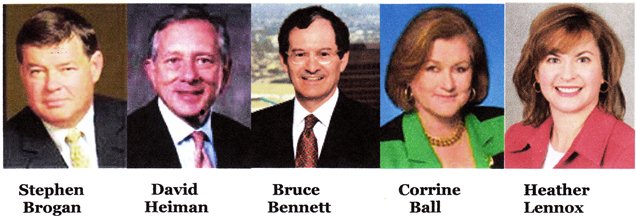

“Jones Day is not the City of Detroit” — Rev. Bill Wylie-Kellerman; part of Jones Day Detroit bankruptcy team.

Orr said Jones Day, as the city’s attorneys under Public Act 436, along with the city’s PA 436 investment banker Miller Buckfire, drafted possible litigation against the banks involved, which was shown to the mediators, to get the banks to back down slightly on their demands for termination payments. He also claimed that he spoke with the Securities and Exchange Commission about a possible criminal investigation of the deal, with unknown results.

Orr testified regarding the possible outcomes of litigation against the COPS and swaps.

“The upsides were as great as invalidating the entire transaction, recovering all payments made over the years, even recovering damages, invalidating the swaps,” he said. “It perhaps would have allowed the city to recover the millions or hundreds of millions of dollars it had paid over the years. The downside was that if we did not prevail, the swap contract would have been validated, the city would have had [to pay] hundreds of millions to the swap counterparties, and incur out of pocket litigation expense, also possibly that of the counterparties.”

VOD has questioned Orr repeatedly about the COPS transactions since the day of his appointment. VOD editor Diane Bukowski, who has covered the COPS deal since Jan. 2005 beginning at the City Council table, filed an amended objection on the COPS with Rhodes. Rhodes later expressly threw it out by refusing to address it.

- (L to r) Jounalists Vickie Thomas of WWJ and Diane Bukowski of Voice of Detroit question Kevyn Orr after meeting with creditors June 14, 2013.

Rhodes and Orr appear to be conspiring to bury the COPS question in a rush to carry out plans by the Jones Day law firm to use Chapter 9 to savage public pensions and city assets. Orr said litigation on the COPS and swaps would be “too lengthy” and costly, ignoring the huge sums already spent on Jones Day and other city “consultants.” He said success was debatable because city officials and attorneys had approved the deals after extensive legal analyses, debate, and passage of city ordinances. He also contended that the city initially profited from the deals, prior to the global economic crash of 2008.

Orr did not explain what “legal analysis” allowed Detroit’s former Chief Financial Officer Sean Werdlow to take a top level management job with Siebert, Brandford and Shank (SBS), UBS’ partner in the COPS deal, nine months after Council approved the deal in 2005. Werdlow was in that position in 2006 when the deal was re-negotiated to cover 30 instead of 14 years, and is now COO of SBS.

- Former Detroit CFO Sean Werdlow and former Mayor Kwame Kilpatrick accept Bond Buyer award for POC deal.

U.S. Bankruptcy Court Judge Steven W. Rhodes’ head popped up as Orr attempted to gloss over the CFO issue, failing to name Werdlow. Rhodes demanded his name. It will be enlightening to see how Rhodes rules after eliciting this apparently undisputable evidence of bribery of a city official. Such bribery similarly led to a 75 percent cut in Montgomery County, Alabama’s debt payments to JPMorgan Chase on water department bonds in that government’s bankruptcy case.

“There were theories that both the underlying COPS and swaps were void ab initio for different periods, fraudulently produced,” Orr testified. “It was my understanding that the city did not have the authority to enter into the underlying COPS of 2005-06 because state law prohibited further indebtedness. . . .[and that the casino] revenue stream was an improper way to pay the swaps.”

Detroit defaulted on the COPS and swaps after the global economic crash of 2008, caused primarily by predatory and fraudulent mortgage loans. It faced a termination event that would have cost $400 million, so then Detroit Mayor Kenneth Cockrel, Jr. and Auditor General Joe Harris cut a deal with Wall Street. They agreed to turn over the city’s casino revenues to a trustee, the U.S. Bank of North America, which has been paid a fee to set aside $4 million a month to ensure payment of the debt. It is that deal which is being challenged during this portion of the bankruptcy trial.

“The Revised Municipal Finance Act 34 of 2001 was violated because the city [used] an end run around that law by interposing service corporations and service contracts [to effectuate the POC loan],” Orr said. “My understanding was that that under Act 34, the city had reached its debt limit. It could not do [more] borrowing, so it created a structure whereby the service corporations were put between city and borrowers. The issue was whether the service corporations were independent, whether they insulated the city from Act 34—or whether they were an instrumentality of the city. If they were not acting legitimately, the city was the borrower. Therefore the whole structure fell. The underlying COPS were of no effect, void ab initio.”

“The Revised Municipal Finance Act 34 of 2001 was violated because the city [used] an end run around that law by interposing service corporations and service contracts [to effectuate the POC loan],” Orr said. “My understanding was that that under Act 34, the city had reached its debt limit. It could not do [more] borrowing, so it created a structure whereby the service corporations were put between city and borrowers. The issue was whether the service corporations were independent, whether they insulated the city from Act 34—or whether they were an instrumentality of the city. If they were not acting legitimately, the city was the borrower. Therefore the whole structure fell. The underlying COPS were of no effect, void ab initio.”

Orr contended on the other hand that such service corporations have been used by other cities and that they were approved by the city’s legal analysts and the City Council.

Wallace Turbeville, senior analyst at Demos, who Judge Rhodes barred from testifying at the trial, raised the service corporation issue in a special report on the Detroit bankruptcy in November, 2013. Turbeville also noted that the POC’s were used as a substitute for voter-approved bonds, constituting an end run around the right of the city’s residents to decide its level of indebtedness.

Rhodes said he barred Turbeville, a former Wall Street banker, from testifying because he wanted to wrap up the trial by Jan. 6, saying he (Rhodes) “would not be available” after that day. Meanwhile, the major cold vortex and snowstorms which hit the Midwest intervened, shutting down the courts for the rest of that week. So Rhodes has now scheduled final arguments for Mon. Jan. 13, still not allowing Turbeville’s testimony, as requested by Attorney Jerome Goldberg on behalf of city retiree David Sole.

Orr testified regarding claims that fraud was involved in the deals.

“There were a number of legal theories,” Orr said. “The general basis was that the counterparties to the swaps had superior knowledge to the city, that they represented to the city that [the deal was] low-risk, beneficial, when they knew or should have known that it was potentially volatile. They designed more or less a ticking time bomb, by designing the termination fee to be linked to credit ratings.”

- Snake oil salesmen: Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard and Poor’s sell Detroit City Council on POC deal Jan. 31, 2005/Photo Diane Bukowski

In December, 2005, Standard and Poor’s, which had advocated for the POC loan under threat of further debt ratings downgrades, downgraded the city’s debt anyway, and thousands of city workers were laid off despite former Mayor Kwame Kilpatrick’s assurances that approval of the COPS deal would forestall such actions. Further downgrades since then have left Detroit with the lowest debt rating of any major city in the country.

Orr admitted that the banks involved have been charged globally with massive civil and criminal transgressions.

“It is fairly well publicized about LIBOR, that UBS AG reached a multi-country settlement with the United States Justice Department,” Orr said. That settlement was for $1.5 billion. The Securities and Exchange Commission has sued UBS AG separately for $5 billlion.

Orr said fraud claims would also involve “costly and expensive litigation,” amounting to “millions or tens of millions,” including likely trips overseas.

He said fraud claims also arose with regard to the use of the city’s casino revenues under the state’s Gaming Act, which limited the revenues to services like public safety, education, and improvements in the quality of life, not as collateral for an unrelated debt. He said, however, that both the city’s legal department and the State Gaming Board found no problems with such use of the revenues, and that the state said the parties did not have to apply for a license.

He said the City Council earlier classified casino revenue as excise taxes, making it “special revenue” protected by bankruptcy law.

In the end, Orr said, if litigation were to be pursued, the “single largest most secure source of revenue for city would have been imperiled, we would have not had stability in the city’s finances and ability to plan strategically for the city or in any other matter. Someone said about war that the best laid plans go to hell. Litigation sometimes takes on a life of its own. Part of the risk I was trying to assess—if we pursued it, what was the probability that we were going to be able to stabilize city’s finances during the course of litigation.”

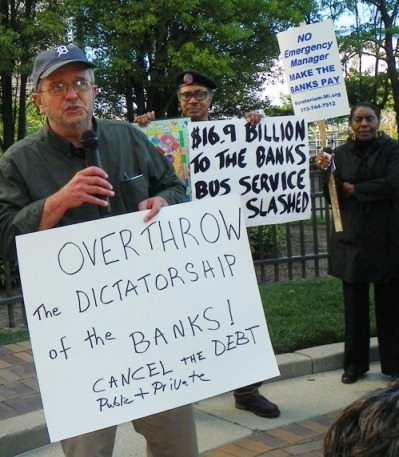

Meanwhile, in just the short period since Orr took dictatorial control of Detroit in May, 2013, he has “stabilized” the city’s finances in the fashion desired by the banks. The country’s largest Black majority city is being dismantled, divested of its most valued asset, the Detroit Water and Sewerage Department, the third largest in the country, its beautiful Belle Isle, the largest urban island park in the country, its public workforce, the chief opportunity for the future of the city’s youth, and the livelihood of its retirees, who face the possibility of devastating cuts in their pensions, and have already been subjected to the loss of substantially all their health care benefits.

It is time not for “stabilization,” but a massive uprising by the people of Detroit and their supporters across the world.

RECENT RELATED STORIES;

http://voiceofdetroit.net/2014/01/12/city-bankruptcy-one-of-many-attacks-on-detroiters/

Related document:

Demos Detroit bankruptcy report highlighted

Pingback: Overkilling Qimonda Re: Bankruptcy and Intellectual Property Litigation | Business Lawyer Bankruptcy

Litigation by the city would be an easy win had the Obama DOJ prosecuted the TBTF for all of the frauds they committed. Now it’s too hard, according to Orr, who’s there to insure that the banks win and the city and pensioners lose.

Good reporting and explanations! You truly are the Voice of Detroit.

Very good information! For one, we did not participate in the election, reflecting the number of registered voters in the city. Many of stayed home. Why? Once huge reasons that is not talked about! We do not have confidence in the election department, or the city clerk to operate conduct a fair and honest election. We do not feel our vote being counted for the candidate we select. Many of us believe the official in Detroit city government are not legally elected based on the election fraud uncovered during the recount of the August 6, 2013 mayoral primary. Every other word when referencing Detroit city officials, past and present, is the word fraud! Wayne County Board of Canvassers flatly refuse to investigate the fraudulent ballots, as told by the Michigan Attorney General in a letter admonishing the board, a failure to investigate the fraudulent ballots that placed Mike Duggan in the Mayors office. Michigan, especially Detroit, is known throughout the nation as a Model of Corruption. From the Governor to Wayne County, to the city council to the legal counsel to our once trusted organizations like the NAACP. All tainted! All showing a conflict of interest! All showing clear evidence of corruption!