Questions legality of swaps, COPS deals; says city could be recover losses

Allows $120 M of Barclay’s loan for “quality of life” purposes, encourages continued “negotiation”

Objectors, retirees encouraged by delay in rush to cut pensions, assets

Jones Day now attacking Puerto Rico

By Diane Bukowski

January 18, 2014

DETROIT – A ray of hope pierced the gloom gathering around the city of Detroit Jan. 16 when U.S. Bankruptcy Court Judge Steven W. Rhodes unexpectedly shot down a proposal to pay off UBS AG and Bank of America for interest swap deals tied to the notorious $1.5 billion Pension Obligation Certificates loan (known as COPS), foisted on the city in 2005 and 2oo6.

The proposal would have cut off avenues for litigation to recover the city’s losses due to what many objectors termed the banks’ predatory and fraudulent practices. The swap deals have already cost Detroit over $300 million, while the outstanding debt on the COPS has risen to $2.8 billion.

Atty. Jerome Goldberg addresses rally against swaps deal prior to City Council hearing Oct. 21, 2013. The City Council also rejected the Barclay’s loan. Judge Rhodes cited Goldberg’s argument along with that of AMBAC attorney Caroline English as partially instrumental in his decision.

Barclay’s bank was to have been the bagman in the deal, involving a $165 million loan backed by 20 percent of the city’s income taxes as well as its utility, and casino revenues. That amount is 67 percent of the original $247 million swaps termination fee.

“This Court stated earlier and states again that it will not participate in or permit the city to perpetuate the very kinds of hasty and imprudent financial decision making that led to the disastrous swaps and COPS transactions,” Rhodes said during a 45-minute oral ruling. “They have already caused great harm to city creditors and citizens. One goal [of this bankruptcy proceeding] is to end such practices so city can move forward.”

Rhodes’ brief written orders are at DB order denying assumption motion and DB Rhodes order denying motion to assume reject. The entire ruling can be heard by clicking on http://www.mieb.uscourts.gov/sites/default/files/detroit/docket2492.pdf.

Rhodes did allow the city to move forward with $120 million of the loan proposed for alleged “quality of life” issues allowed by the Gaming Control Act, but said he would monitor that spending with regard to the use of casino taxes. He said, however, that other revenue streams used, including city income taxes, would not be subject to monitoring.

Rhodes did allow the city to move forward with $120 million of the loan proposed for alleged “quality of life” issues allowed by the Gaming Control Act, but said he would monitor that spending with regard to the use of casino taxes. He said, however, that other revenue streams used, including city income taxes, would not be subject to monitoring.

He encouraged the parties to continue to “negotiate” on the matter, but said he would “closely scrutinize” any plan of adjustment produced to deal with the city’s debts. His ruling was widely taken to mean that further delays would be necessary in the rush to cut city pensions.

Rhodes addressed arguments by Detroit Emergency Financial Manager Kevyn Orr and the Jones Day law firm, made on behalf of the city under Public Act 436, known as “the Dictator Act,” that litigation would be too costly and lengthy and would have only a “50/50” chance of success.

“The Court has determined the city is reasonably likely to succeed on its challenges [to the swaps and POC] under the state Gaming Control Act and the Bankruptcy Code, and . . . . under Public Act 34,” Rhodes said. Although Jones Day is representing the city, Rhodes posited arguments that could be made by “the city” as if referring to an independent city government.

Rhodes said he found it highly questionable whether the Gaming Act allowed the use of casino revenues to pay off Wall Street hedge bets such as the swap deals, as Detroit agreed to do after the global economy tanked in 2008 and it defaulted on the swaps and COPS. The gaming act says such revenues are to be used for items like public safety, street lighting, and other “quality of life” concerns.

PA 34 sets debt ceilings for municipalities. Rhodes said the swaps and COPS constituted an “end run” around Detroit’s debt ceiling through the use of separate “service corporations” set up to handle the loan. That contention was also made by Wallace Turbeville of Demos in a deposition submitted to Judge Rhodes, although Turbeville did not testify. (See Turbeville’s article on Orr’s ruling below this one.)

- Judge Rhodes speaks at one-sided forum on Chapter 9 and EM’s Oct. 10, 2012. He refused to publish VOD editor Diane Bukowski’s request to recuse himself due to this forum, but did respond with a six-page brief.

“The issue of the delay, the cost of litigation, the validity of the trap of the city’s casino revenues can be promptly resolved by the court,” Rhodes said. “It is less clear how long appeals [might take.] . . . The legal expenses of filing a lawsuit challenging the . . . . agreements, for filing a motion for a preliminary injunction, and for summary judgment would undoubtedly be substantial, but given the amount of money at stake, relatively insignificant.

Rhodes said he took into serious account arguments made by the objectors, citing specifically Caroline English of AMBAC and Jerome Goldberg, representing David Sole, a city retiree.

He referred to English’s citation of a Sixth Circuit Court of Appeals decision that the “bankruptcy court may not rubber stamp [a proposal], or rely on word that a settlement is reasonable. It has an affirmative obligation to apprise itself of the underlying facts and make an independent judgment as to whether the compromise is fair.”

He said Goldberg raised “a potentially broader series of claims—whether [the deals] were induced by fraud, subject to equitable subordination, or unconscionable.” It was unclear if he thought the city could pursue litigation regarding these matters.

During closing arguments Jan. 16, Goldberg said, “Kevyn Orr testified that the city drew up a complaint raising what I would call equitable issues, fraud, unjust enrichment, breach of contract, which they said they were ready to file if no agreement was reached. This indicates they believe they had a substantive complaint.”

He said UBS AG had already admitted to fraud in its $1.5 billion settlement of a U.S. Department of Justice lawsuit related to global bankers’ manipulation of the London Interbank Offered Rate (LIBOR).

Goldberg added, “Mr. Orr also testified that the counterparties had superior knowledge when they entered into the deal [and] misrepresented it as low risk. They did not explain to the city its potential dangers, that the city was a ticking time bomb for default based on lowering of its bond rating, and that the city’s CFO at the time, Sean Werdlow, took a job with a loan counterparty [Siebert, Brandford and Shank], five months later—raising a red flag.”

Goldberg argued further, “The U.S. Supreme Court has held that for many purposes, courts of bankruptcy are essentially courts of equity . . . .invoked to that end so that fraud will not prevail, substance will not give way to form—technical considerations will not prevent substantial justice from being done.”

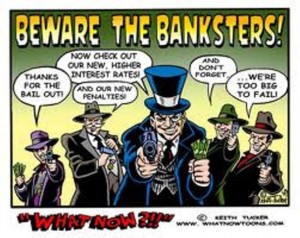

He said the swaps proposal could not be looked at without putting it in the broader context that the banks involved were among those which caused the global financial collapse of 2008, largely through subprime predatory lending policies. The federal government paid $1.7 trillion to bail out the same banks, he noted.

Neighborhood on Detroit’s east side. Atty. Goldberg said plaintiff David Sole’s east side block, thriving 10 years ago, now has only five families left, with a pack of wild dogs living in an abandoned house next to Sole’s.

“Detroit almost any more than any other city was devastated by the subprime lending policies of major banks,” Goldberg argued. “If there was any question that fraud was involved, a Senate Subcommittee report showed that between 2004 and 2o06, 73 percent of new mortgages written in Detroit were subprime . . . This resulted from 2005 to 2007 alone in 67,o00 mortgage foreclosures, and two-thirds of those of homes have stayed vacant. . . .The idea that the same banks who participated in these lending practices are now to be paid $165 million, with a pledge of 20 percent of income tax revenues, is inequitable and unconscionable.”

- One of a series of famed murals by Diego Rivera in the DIA. Rivera was a Communist who believed that working and poor people should take power from the rich.,

The next court hearing in the bankruptcy trial is scheduled for Wed. Jan. 22 at 10 a.m. in room 716 of the U.S. Federal Court at 231 W. Lafayette. It will consider a “Motion of Creditors for Entry of an Order Pursuant to Section 105(A) of the Bankruptcy Code Appointing and Directing the Debtor to Cooperate with a Committee of Creditors and Interested Persons to Assess the Art Collection of The Detroit Institute of Arts Based on Arms−Length Market Transactions to Establish a Benchmark Valuation Filed by Creditor Financial Guaranty Insurance Company (James, Mark).”

Much has been made of a proposal by private foundations to donate $330 million, allegedly to save both city pensions and art in the Detroit Institute of Arts. However, it appears that the real motivation here is to divest Detroit of its ownership of likely billions of dollars worth of world-class art, just as mediators are planning during meetings at Jones Days’ New York offices to divest the city of its ownership of the Detroit Water and Sewerage Department (DWSD).

- What would Dr. Martin Luther King, Jr. say about the unequal situation in which Detroiters find themselves today. Here he is shown addressing 1963 rally in Detroit.

Suburban officials have already pointedly declined Orr’s proposal that Detroit be paid $9 billion for DWSD, just as they declined to finance the original construction of the six-county facility through the 2oth century. It was city of Detroit taxpayers who paid for billions in bonds to build DWSD. Union officers and city administrators have said it is highly likely that water and sewerage rates will increase under any privatized structure set up during the bankruptcy proceedings,

Detroit’s Chapter 9 proceedings are unique in that the city’s assets are being attacked. Chapter 9 does not allow such attacks unless the debtor, in this case the City of Detroit as represented by Kevyn Orr under PA 436, consents. A lawsuit challenging the constitutionality of PA 436, Detroit and Michigan NAACP et al, was assigned to U.S. District Court Judge Bernard Friedman in December, but no hearings have yet been set. U.S. District Judge George Caram Steeh was set to proceed on that lawsuit, as well as another, filed by Phillips et al, early in 2013.

Rhodes blocked action on those lawsuits by extending bankruptcy protection not only to officials of the debtor, the City of Detroit, but also to state officials including Gov. Rick Snyder and others, in a unique ruling not duplicated elsewhere in the country. He agreed to hear the Phillips lawsuit because the plaintiffs voluntarily deleted Detroit from its subject matter, but the state of Michigan has appealed that order.

Shown above is a tribute to Lolita Lebron, one of the Puerto Rican heroes who stormed the U.S. Congress with guns to demand independence for their country. Jones Day had better remember this tradition.

Meanwhile, Jones Day has turned its attention to Puerto Rico as the next candidate for its devastating “restructuring plans,” according to the following story from Bloomberg.

Puerto Rico to Get Spotlight From Jones Day at Meeting

By Michelle Kaske and Steven Church

By Michelle Kaske and Steven Church

Jan 16, 2014 11:58 AM ET

Jones Day, the law firm shepherding Detroit through bankruptcy, is extending its restructuring skills to Puerto Rico with a seminar on the $70 billion market for commonwealth debt.

The firm plans to brief investors today in New York on Puerto Rico’s fiscal outlook and the “possible paths going forward,” according to an invitation to the event. The seminar follows similar meetings last year with investors to assess the benefits and risks of Puerto Rico securities.

The three major rating companies grade Puerto Rico one step above junk, with a negative outlook. Moody’s Investors Service Dec. 11 warned that it may cut the island to speculative grade within 90 days. Puerto Rico officials plan to sell bonds this month or in February.

“There are a number of clients and friends of the firm that are interested in the topic,” Bruce Bennett, a Jones Day attorney who is helping lead Detroit’s $18 billion bankruptcy, said in an interview. The briefing “is forward-looking and not in response to any near-term developments,” he said.

Puerto Rico’s fiscal health affects the $3.7 trillion municipal market because 70 percent of U.S. local-debt mutual funds held commonwealth securities as of Jan. 9, according to Morningstar Inc. The funds own about $14 billion of the debt sold by the U.S. territory and its agencies, according to Morningstar. The securities are tax-exempt nationwide.

Below Grade

Puerto Rico debt trades below its investment-grade ratings.

Tax-free general obligations maturing in July 2041 traded today with an average yield of 8.59 percent, data compiled by Bloomberg show. That exceeds the 6.7 percent yield on a Standard& Poor’s index of high-yield munis with an average maturity of 20 years.

While the commonwealth isn’t eligible to file for bankruptcy, a default could surpass Detroit’s record bid for Chapter 9 protection in July.

Along with Bennett, Jones Day partner Beth Heifetz and Timothy Coleman, head of Blackstone Group LP’s restructuring and reorganization group, are scheduled to speak at the meeting, according to the invitation.

Governor Alejandro Garcia Padilla, who took office a year ago, has said the island of 3.6 million people will repay its obligations on time and in full. Puerto Rico’s 14.7 percent jobless rate in November was higher than in any U.S. state.

Payment Promise

“We made significant progress in implementing our fiscal and economic development plans in 2013, and are determined to continue that progress in 2014,” Jose Pagan, interim president of the Government Development Bank, and Treasury Secretary Melba Acosta said in a statement regarding reports of today’s meeting.“Puerto Rico will take every step necessary to continue honoring its obligations.”

Commonwealth officials aren’t involved in the Jones Day meeting and didn’t call for it, according to the statement.

In November, Cadwalader, Wickersham & Taft LLP, a New York-based law firm that advises on distressed munis, held a conference on Puerto Rico, said a person who attended.

In October, bankers at Citigroup (C) Inc. and Morgan Stanley (MS)made private presentations to investors in New York, according to people who attended. Lazard Capital Markets LLC said it hosted a similar meeting that month.