THE PLOT AGAINST PENSIONS

The Pew-Arnold campaign to undermine America’s retirement security – and leave taxpayers with the bill

• News Release

• What the Media Are Saying

This report evaluates both the general state of the national debate over pensions and the specific effects of the partnership between the Pew Charitable Trusts’ Public Sector Retirement Systems Project and the Laura and John Arnold Foundation.

This report evaluates both the general state of the national debate over pensions and the specific effects of the partnership between the Pew Charitable Trusts’ Public Sector Retirement Systems Project and the Laura and John Arnold Foundation.

Full report at Plot-Against-Pensions-final

Here is a summary of the report’s findings:

Finding: Conservative activists are manufacturing the perception of a public pension crisis in order to both slash modest retiree benefits and preserve expensive corporate subsidies and tax breaks.

- 1214 Griswold Apartments developers linked to Detroit multi-billionaire Dan Gilbert grin at United Community Housing Coalition Director Ted Phillips as he assures City Council, voting on a tax abatement for the developers, that displaced Black, senior and disabled Sec. 8 tenants will be taken care of.

States and cities have for years been failing to fully fund their annual pension obligations. They have used funds that were supposed to go to pensions to instead finance expensive tax cuts and corporate subsidies. That has helped create a real but manageable pension shortfall. Yet, instead of citing such a shortfall as reason to end expensive tax cuts and subsidies, conservative activists and lawmakers are citing it as a reason to slash retiree benefits.

Finding: The amount states and cities spend on corporate subsidies and so-called tax expenditures is far more than the pension shortfalls they face. Yet, conservative activists and lawmakers are citing the pension shortfalls and not the subsidies as the cause of budget squeezes. They are then claiming that cutting retiree benefits is the solution rather than simply rolling back the more expensive tax breaks and subsidies.

- City Council gave Detroit billionaire Mike Illitch a new tax-free Red Wings hockey stadium and adjacent private developments at a cost of at least $881 million, 61 percent publicly-funded. An estimated $536 million would come from tax increments including school, library, city, county and state taxes.

According to Pew, public pensions face a 30-year shortfall of $1.38 trillion, or $46 billion on an annual basis. This is dwarfed by the $80 billion a year states and cities spend on corporate subsidies. Yet, conservatives cite the pension shortfall not as reason to reduce the corporate subsidies and raise public revenue, but instead as proof that retiree benefits need to be cut.

Finding: The pension “reforms” being pushed by conservative activists would slash retirement income for many pensioners who are not part of the Social Security system. Additionally, the specific reforms they are pushing are often more expensive and risky for taxpayers than existing pension plans.

Whether “cash balance” schemes or 401(k) style defined contribution plans, many of the pension “reforms” being championed by conservative activists risk incurring more costs and increasing risks for taxpayers.

Finding: The Pew Charitable Trusts and the Laura and John Arnold Foundation are working together in states across the country to focus the debate over pensions primarily on slashing retiree benefits rather than on raising public revenues.

Pew’s Public Sector Retirement Systems Project and the Laura and John Arnold Foundation are working in tandem on public pension policy to manufacture the perception of crisis and press for cuts to guaranteed retirement income. This campaign has played an integral role in states passing legislation that cuts guaranteed retirement income – all while those states preserve more expensive corporate subsidies.

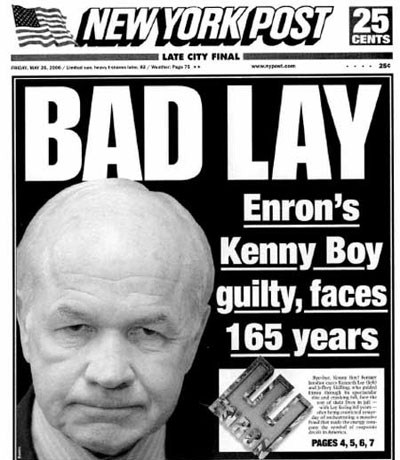

Finding: The Laura and John Arnold Foundation is run by conservative political operatives and funded by an Enron billionaire.

John Arnold is an Enron billionaire whose only major experience with pension management was his role in a company that decimated public pension funds. Well-known conservative political operatives and consultants run his foundation.

John Arnold is an Enron billionaire whose only major experience with pension management was his role in a company that decimated public pension funds. Well-known conservative political operatives and consultants run his foundation.

Finding: The techniques used by conservative activists to gain public support to privatize the public pensions that public workers have instead of Social Security are, if successful, likely to be used in efforts to privatize Social Security in the future.

The current campaign to slash public pension benefits has relied on many of the same PR strategies as President Bush’s earlier campaign to privatize Social Security. In that sense, the campaign against public pensions is an exercise in perfecting methods that manufacture the perception of a crisis – and then result in cuts to guaranteed retirement income. If the state-based crusade against public pensions is successful, it will probably fuel a renewed effort to privatize Social Security.

About the Report

This report was commissioned by the Institute for America’s Future (IAF), a nonpartisan 501(c)(3) research and education institution devoted to new thinking and progressive economic ideas. This report benefited from resources, information, data and research from (among others) the National Public Pension Coalition, the Center for Economic and Policy Research, the Institute for Taxation and Economic Policy, the Center for American Progress, the Economic Policy Institute and Good Jobs First.

This report was commissioned by the Institute for America’s Future (IAF), a nonpartisan 501(c)(3) research and education institution devoted to new thinking and progressive economic ideas. This report benefited from resources, information, data and research from (among others) the National Public Pension Coalition, the Center for Economic and Policy Research, the Institute for Taxation and Economic Policy, the Center for American Progress, the Economic Policy Institute and Good Jobs First.

The author, David Sirota is a journalist, nationally syndicated newspaper columnist and the bestselling author of Hostile Takeover (2006), The Uprising (2008) and Back to Our Future (2011). Sirota’s research assistant on this project was journalist Zaid Jilani.

http://ourfuture.org/plotagainstpensions

ALEC and TIAA-CREF JOIN THE ASSAULT ON PUBLIC PENSIONS

October 21, 2013

The right-wing American Legislative Exchange Council has jumped into the conservative effort to dismantle public pension systems in a big way, making it one of its top 2014 legislative priorities, a public pension advocacy group has warned.

The National Public Pension Coalition, which represents public sector employees, in a statement today flagged ALEC’s entry into the public pension battle as a threat to the financial security of millions of state and local public employees.

It’s an escalation of the campaign against public pensions highlighted in the Institute for America’s Future Report, “The Plot Against Pensions.” That report focuses on the work of a foundation founded by John Arnold, a former Enron executive, and a public pensions project of the Pew Charitable Trusts to promote the notion that there is a public-pension “crisis” that can only be solved by substituting these pension programs for programs that shift risks to workers, eliminate benefit guarantees and create new profit streams for Wall Street money managers. “Studies” that take advantage of the Pew reputation as a reputable, unbiased source of information have encouraged several states to take actions to privatize their retirement systems that, as the report points out, leaders in some of those states have already begun to regret.

ALEC set the stage for its own intervention into the public pension debate with a report in August that encouraged states to convert their public pension (“defined benefit”) plans into 401(k) plans or other “defined contribution” plans. The report said that the “unfunded liabilities” incurred by state pension plans could range anywhere from “$750 billion to more than $4 trillion.” To address the shortfall, the report concludes, “There is ample evidence to suggest that legislators should move from defined-benefit systems to properly designed alternatives, such as defined-contribution, cash-balance, or hybrid plans.”

That report was followed by a paper issued earlier this month by TIAA-CREF Institute, the research arm of the Teachers Insurance and Annuity Association–College Retirement Equities Fund, which markets the kind of plans that ALEC wants states to move to. That paper was written by an associate of the Laura and John Arnold Foundation, and asserts that a defined-contribution plan is not necessarily more expensive for workers and taxpayers than a defined-benefit pension plan.

That assertion has not been borne out by many of state states that have switched to defined contribution plans. “When states have adopted pension overhaul legislation, they have found that it came at a significant cost,” according to the National Public Pension Coalition statement. “Alaska and Michigan went down that road and saw their pension debts increase. West Virginia adopted a 401(k)-like plan for public employees in 1991, but reversed course in 2006 after a report found that public employees had such low incomes in retirement that they were eligible for means-tested public programs, driving up costs to the state.”

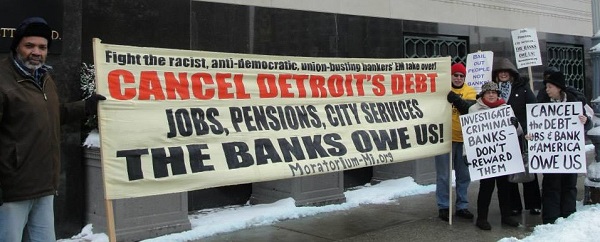

Also, the Plot Against Pensions report notes that in Rhode Island, which Arnold and ALEC hold up as their model for how the system should be remade, costs were driven up so much by fees to Wall Street money managers that even the business-friendly Forbes magazine called it “just a blatant Wall Street gorging.”

Absent from the ALEC report, as well as from the materials Arnold and Pew have sent around the country, is the fact that the amount of money needed to close any shortfalls in the pension systems and give them long-term sustainability could be easily raised by closing tax loopholes to corporations and the wealthy. Pew’s Public Sector Retirement Project estimates that public pensions face a 30-year shortfall of $1.38 trillion, or about $46 billion a year. (Notably, ALEC’s report does not offer a time frame for its shortfall estimates that would put the numbers in proper context.) That $46 billion compares to the estimated $80 billion a year that states and cities spend on corporate subsidies, many of which provide no demonstrable economic benefit beyond those receiving the subsidy.

Not only is securing a decent retirement for state workers, using funds that are often invested in projects that serve the public interest, a more efficient use of tax dollars than many of these tax giveaways to the wealthy, but a key argument ALEC and other conservatives use to justify dismantling public pensions has it exactly backwards. The ALEC report notes that most private companies have shifted from pensions to 401(k) plans, and questions why public employees should retain a benefit that private sector employees have all but lost. As employees who lost as much as 25 percent or more of their 401(k) balances as a result of the 2008 recession could attest, we should be fixing, not destroying, public pensions and holding those up as a model for how we can help restore retirement security to private sector workers.

http://ourfuture.org/20131021/alec-and-tiaa-cref-join-the-assault-on-public-pensions