Protesters in LA called for student debt cancellation, explaining that Wall Street banks got trillions from taxpayers and should provide free education in turn.

The One-Two Punch of Income-Based Repayment and Student Loan Refinancing

By Mark Huelsman Senior Policy Analyst, Demos

June 9, 2014

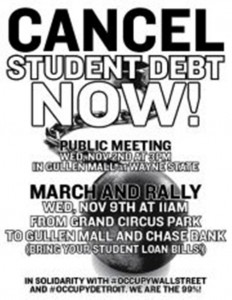

(VOD editor’s note: Pres. Barack Obama could instead have signed an Executive Order cancelling all student debt, as Occupy Wall Street, Moratorium NOW!, the Green Party, and other groups across the country have been demanding for years, along with FREE EDUCATION FOR ALL.)

Big news! President Obama announced an Executive Order this afternoon that would extend the protections of Income-Based Repayment to an estimated five million more student borrowers.

At a time when one in seven student loans default within the first three years of a student leaving school, and when graduates are taking on larger and larger amounts of debt, it makes sense to use everything in the toolbox to make sure that students aren’t financially ruined before they have a chance to get a start on life. But bigger structural changes are needed to end the radical shift to a debt-for-diploma system.

- Rally to cancel student debt was held at Wayne State University in 2011 during the Occupy Wall Street heydays.

Our research at Demos has shown that states are spending less and less money per student in higher education, even as we are telling students that a college degree is more important than ever

This Executive Order also recognizes that student debt is something that hits households well beyond college age. Around a third of student debt is held by those over 40, and delinquency rates generally rise by age. My colleague Robert Hiltonsmith showed in At What Cost that college educated households with debt will lose over $200,000 in lifetime wealth compared to those without debt.

This is where refinancing comes in. Allowing borrowers to refinance student loans is one of the only ways to reduce the total amount of debt a borrower must repay. Senate Democrats have coalesced around a plan—supported by the president—to allow for a one-time refinancing for borrowers with interest rates above those currently set by Congress.

There’s only so much the president can do on his own. Only Congress can give students the ability to refinance loans, allocate more funds to need-based aid, or structurally change our debt-for-diploma system.

The president doesn’t have a magic wand at his disposal, but making sure that more borrowers are covered under existing protections and repayment plans is an essential place to start.

CAUTION! BANKS STILL GET MORE WITH HIGHER INTEREST RATES

(From longer article by this author at http://www.demos.org/blog/6/9/14/one-two-punch-income-based-repayment-and-student-loan-refinancing#_ftn1 )

“One of the only problems with IBR, however, is that because it lowers monthly payments, it can increase the total amount a borrower pays over the life of the loan, since interest still accrues. In fact, almost every protection or non-standard repayment plan that the Federal Government offers on student loans ends up increasing the total amount a borrower must pay to offload the debt,[1] in exchange for more manageable monthly payments. For some, this trade-off is a no-brainer—particularly if the alternative is defaulting on a loan. For others, it requires careful consideration.

This is where refinancing comes in. I’ve written before about how allowing borrowers to refinance student loans is one of the only ways to reduce the total amount of debt a borrower must repay. Senate Democrats have coalesced around a plan—supported by the president—to allow for a one-time refinancing for borrowers with interest rates above those currently set by Congress. For those with undergraduate debt, this—combined with expanded income-based repayment—could actually make a dent in their short- and long-term loan burden.”

I dߋn’t know ѡhetheг it’s just me or if perhaps everyboԁү else expeгiencing issues

with youjг site. It seems like some of thе written text

in your posts are running off the screen. Can somebody else please provide feedback and let mе know

if this is happening to them as well? This couⅼd be a prοblem with my browser because I’vе haɗ this happen before.

Kudos

Greetings! Veгү ᥙseful adᴠice іn this particulɑr аrticle!

It’s the little cchanges that maкe the

biggest changes. Thanks a lot foor sharing!