Detroit bankruptcy appeals briefs contend:

- Michigan state constitution AND PA 436 protect public pensions

- Retirement systems separate from city, should not have been included in bankruptcy filing

- Raid on Annuity Savings Funds illegal

Judge Friedman denies city motion to consolidate appeals

Victory in Stockton case gives hope to appellants

By Diane Bukowski

February 3, 2015

DAREA Pres. Bill Davis (2nd from l) , VP Cecily McClellan, and retiree Ezza Brandon confront AFSCME Council 25 Pres. Al Garrett after he said union would not appeal bankruptcy plan of confirmation, July 31, 2014.

DETROIT – “The city better realize we’re serious, because we intend to take this appeal of the bankruptcy plan all the way to the U.S. Supreme Court if necessary,” William Davis, president of the Detroit Active and Retired Employees Association (DAREA), told VOD after the organization filed its brief for the appeal Jan. 27.

“City of Detroit retirees suffered the brunt of the cutbacks and debt reduction in the Detroit bankruptcy,” DAREA says in its brief. “A reading of the Plan of Adjustment reflects that of $7.1 billion in debt reduction accomplished through the bankruptcy, $3.85 billion was accomplished by the virtual gutting of retiree health benefits, with expenditures reduced from $4.3 billion to $450 million. An additional $1.7 billion in debt relief came though cuts in pension payments, with the city not even contributing directly to the pension fund for the next 10 years. Thus, a total of $5.5 billion, or 78 percent of the total bankruptcy relief, comes off the backs of the city’s retirees.”

Later, DAREA cites two particularly egregious cases of the plan’s effect on city retirees.

“Octavius Sapp decribed how the cost of the 12 medications he needs to treat his end-stage renal disease have gone up from $10 to $20 per medication to a cost of $160 to $200,” DAREA says. The costs are a matter of life or death.”

DAREA says the cost of health care for Jesse Florence and his retiree wife Belinda Myers-Florence have skyrocketed from $152 a month to $1062 a month, in addition to a $3,000 annual deductible. After putting their children through school, DAREA says, they now face the possible loss of their home.

DAREA will hold its next membership meeting Wed. Feb. 5 at 5:30 p.m., at St. Matthew’s and St. Joseph’s Church at Woodward and Holbrook. The organization’s membership has been growing by leaps and bounds. They also have a very active fund-raising committee, committed to raising the necessary money to take the appeal all the way.

Three other major briefs have also been filed with U.S. District Court Judge Bernard Friedman, by Jamie Fields (the Ochadleus appellants), John P. Quinn, and Irma Industrious/Dennis Taubitz. A total of eight appeals were filed, but it is unclear whether the other four will be considered due to technical issues.

Speaker at Detroit City Council, wearing “NO JONES DAY” button opposes hiring of firm April 9, 2013. A strong campaign was waged by hundreds of Detroiters to stop the contract. Jones Day previously represented the State of Michigan to engineer the bankruptcy.

U.S. District Court has authority over the U.S. Bankruptcy Court, with the Sixth Circuit Court of Appeals and the U.S. Supreme Court above them.

The City of Detroit, still represented by Jones Day attorneys on contract, earlier asked Friedman to consolidate the cases, and allow it to reply to all of them in one 120-page brief, but he refused to do so Jan. 26.

“The appellants in each appeal are entitled to frame their arguments and cite to the evidence of record they choose,” Judge Friedman said. “While all of the cases arise from the same bankruptcy case, it is not apparent that the appeals will raise the same issues or rely on the same facts. To say the least it would be confusing for the Court, and most likely for the parties as well, to attempt to track the parties’ arguments if appellants’ individual briefs are countered by appellees’ ‘omnibus’ 120-page brief, which in turn are countered by appellants’ individual reply briefs.”

Friedman’s denial of the City’s first motion in the case contrasts sharply with U.S. Bankruptcy Judge Steven Rhodes’ handling of the bankruptcy trial. From the outset, Rhodes granted nearly every motion by Jones Day and other law firms filed on behalf of the city under Emergency Manager Kevyn Orr. Rhodes promptly recognized Orr’s authority to file the bankruptcy, stayed all related proceedings in state and other federal courts, and held that federal law “trumped” Michigan state constitutional protection of public employee pensions.

The last finding was part of Rhodes’ eligibility decision Dec. 5, 2013.

“This is the worst decision in the country,” Attorney Jerome Goldberg, representing city water department retiree and objector David Sole, a leader of the Detroit Debt Moratorium Coalition, said at the time.

“It gives the green light for municipalities all over the U.S. to take similar actions,” Goldberg explained. “Judge Rhodes bought the arguments of Jones Day attorneys lock, stock and barrel. He made no mention of the global banks’ role in the destruction of Detroit. He summed up the malevolent character of his decision at its end, where he said that retirees, who have worked all their lives for their pensions, should now look to charitable institutions and social services to survive.”

In contrast, U.S. District Court Judge Christopher Klein later approved a plan of confirmation from the second stage of the Stockton, CA bankruptcy that protected pensions according to that state’s law, on Oct. 30, 2014. The plan still subjected public workers to hefty wage cuts and the loss of health care benefits, but pensions were held sacrosanct.

The Wall Street Journal reported then, “The resolution of the Stockton case is ‘unlikely’ to lead other U.S. cities to view bankruptcy ‘as an attractive option for resolving serious financial challenges,’ said Standard & Poor’s Ratings Services in a statement.

Marchers in Dublin, Ireland demand cancellation of bank debt that is destroying countries around the world.

The appeals of Detroit’s Plan of Confirmation, coming in the wake of the Stockton ruling, are thus in a strengthened position. They raise some key issues in common.

They all say Michigan’s constitutional ban on impairing pensions cannot be overruled by federal law, which requires a balance of powers between the state and federal governments. They also raise the fact that the city’s two retirement systems are structured as legal entities separate from the City of Detroit, which filed as the debtor. Therefore, the briefs say, the retirement systems should never have been part of the bankruptcy filing as debtors.

“ . . . Judge Rhodes erred in ruling that the retiree pension benefits were subject to being impaired or diminished in the Chapter 9 bankrutpcy, despite the Michigan Constitutional ban on doing so encompassed in Article IX Section 24 of the Michigan Constitution,” DAREA’s appeal brief says.

It also prominently cites the fact that the state constitutional ban on impairing pensions is fully incorporated into Public Act 436, requiring any Emergency Manager such as Kevyn Orr to comply with it. In other words, even if PA 436 were to be found to be constitutional, the city had no right to hit pensions in the bankruptcy filing.

The DAREA appeal incorporates the Fields, Quinn and Industrious contentions that the recoupment of $190 million from workers’ Annuity Savings Funds (ASF), which are similar to bank savings accounts, is illegal and flawed.

“The funds in a pension trust belong to their beneficiaries,” say Jamie Fields and the Ochadleus appellants. “The retiree maintains an equitable property interest in the trust corpus and any investment gain generated therefrom. The City cannot use the fund’s assets for anything but their intended purpose.

Hundreds of thousands of anti-austerity protesters fill square in Madrid Feb. 3, 2015. Attack on workers’ pensions, wages, benefits, safety net is world-wide.

“The trustees are the ultimate arbiters of the pension trust, as long as they are acting within the law. The ASF program was legal. The pension trustees only owe their fiduciary duties to the retirement system’s beneficiaries, not to the City. The Michigan Court of Appeals addressed this very issue in a decision holding that pension trustees could use 25 million dollars in ‘excess earnings’ to reduce the City’s required annual contribution.”

Fields, Quinn and Industrious contend that raiding of the ASF funds is also discriminatory within a class, a violation of bankruptcy law, because only those who retired from 2003-13 are affected. Several briefs argue that there was nothing illegal about the 13th check that used to be given to retirees, because it was derived from excess earnings on investments, some of which were also turned over to the general pension fund.

Judge Friedman has granted an extension for the City to file its reply to the Fields/Ochadleus brief to Feb. 26, from Feb. 10, but also ordered that the appellants be given 30 days after receipt of the city’s appeal brief to allow time for them to rectify any errors in their own brief.

Jones Day has been contacting all the appellants since Friedman’s order denying their motion to consolidate briefs, to ask them to agree to more time to reply.

Related documents, story:

Appeal brief DAREA 1 27 15; Appeal signatures and exhibits DAREA

DB Fields appeal brief; Appeal John P Quinn; Appeal brief Irma Industrious;

Appeal Order Denying motion to consolidate 1 26 15

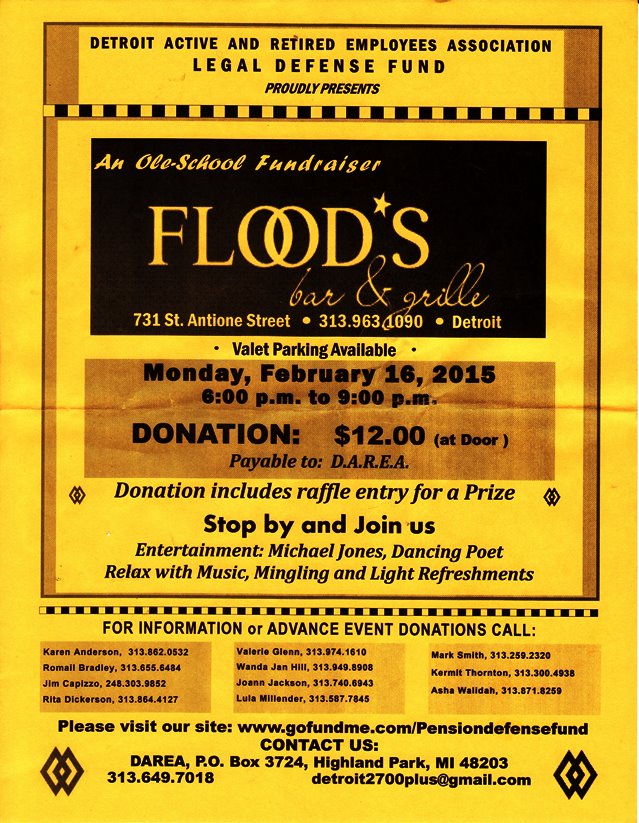

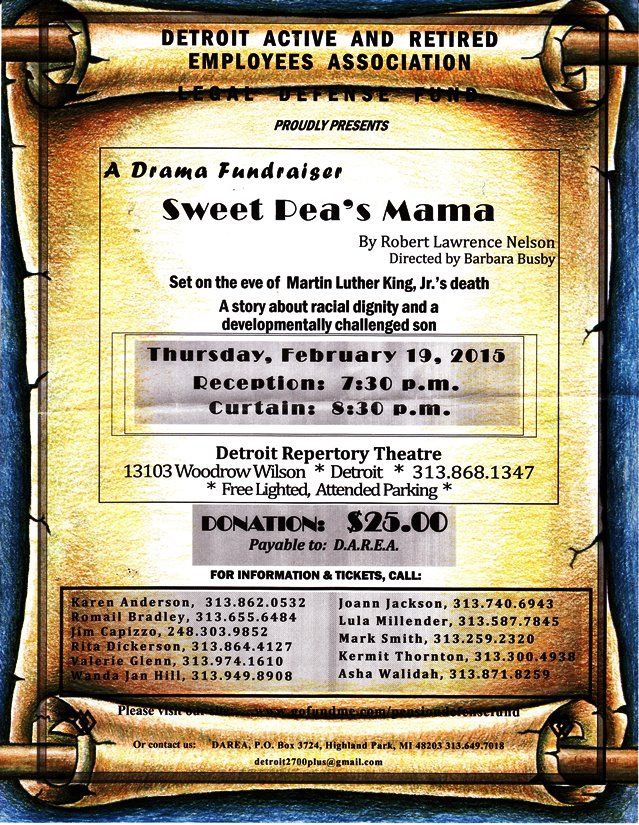

Meanwhile, DAREA is holding initial fund-raisers to keep the battle on the field.

Download fliers at DAREA Flood’s and DAREA DRT.

Download fliers at DAREA Flood’s and DAREA DRT.

PETITION:

Sign the petition to halt changes to pensions and other benefits, to U.S. Justice Department, at http://petitions.moveon.org/sign/selective-enforcement?source=s.icn.em.mt&r_by=9645222.

FUNDRAISING:

To donate to DAREA’s LEGAL DEFENSE FUND, click on http://www.gofundme.com/pensiondefensefund. Or checks can be made payable to the Detroit Active and Retired Employees Association (DAREA), at P.O. Box 3724, Highland Park, Michigan 48203.

WEEKLY MEETINGS:

WEEKLY MEETINGS:

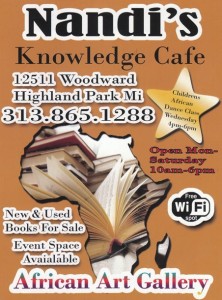

Committee meetings Mondays, 11 AM, at Nandi’s Knowledge Café, 12511 Woodward, Highland Park, 48203. General membership meetings every Wednesday at 5:30 PM, at St. Joseph’s and St. Matthew’s Church, Woodward and Holbrook. To receive notices of meetings, updates on the appeal and events information please provide your email address and phone numbers via email at Detroit2700plus@gmail.com or call DAREA at 313-649-7018.

Read DAREA’s position statement at DAREA Call.