Protesters confront Chase shareholders at annual meeting in Westin Book Cadillac May 19, 2015/Photo: Stephanie Gordon

Chase, 5 other global banks just pled guilty to felony rate-rigging, agreed to pay $9 billion in fines, but serve no jail time

Chase earlier paid a record $13 billion linked to sale of junk mortgages during housing bubble, another $4.5 billion settlement with institutional investors in those mortgages

Protesters say Chase crimes include slavery profits, foreclosures, water shut-offs, huge prison population, student loan debt

Retirees: Detroit bankruptcy appeal aided by May 8 Illinois Supreme Court ruling calling pension, annuity reductions violation of state constitution

By Diane Bukowski

May 20, 2013

Chase shareholders held their meeting at the Westin Book Cadillac in downtown Detroit, formerly home to Detroit Emergency Manager Kevyn Orr. Photo: Stephanie Gordon

DETROIT – As global banks including JPMorgan Chase pled guilty to felony market manipulation charges, agreeing to pay $9 billion in fines, protesters at Chase’s annual meeting in Detroit demanded prison for the banks’ executives, and billions in reparations to re-build the City of Detroit. Chase is the world’s largest investment bank.

Chase’s portion of the fines followed a record $13 billion settlement linked to its sale of junk mortgages during the housing bubble, and another $4.5 billion settlement with institutional investors in those mortgages. Protesters questioned why Detroit and other poor cities across the U.S. have seen none of those settlements, since Chase made its money off illegal practices foisted on homeowners, workers and taxpayers.

“Chase had the gall to hold its shareholders meeting in the city of Detroit, which has been devastated by home foreclosures, many by Chase,” Abayomi Azikiwe of Moratorium NOW! said. “They have bragged about investing in Capitol Park and the rest of downtown Detroit, but we want to know what Chase Bank is going to do for the people of Detroit.”

Abiyomi Azikiwe of Moratorium NOW! and Bill Davis, Pres. of the Detroit Active and Retired Employees Association, marched on Chase meeting. /Photo: Stephanie Gordon

The protesters confronted shareholders going into the meeting at the Westin Book Cadillac, former home to Detroit’s Emergency Manager Kevyn Orr. He and his banking and corporate cronies virtually dismantled the City of Detroit through an involuntary and likely criminal Chapter 9 bankruptcy.

Detroit is the poorest and largest majority-Black city in the U.S. An astounding 59 percent of its children are mired in poverty, with an overall rate of 39 percent. In January, Chase admitted that it profited from slavery in the U.S. after it bought out Bank One and Citizens Bank, said Azikiwe.

“From 1831 to 1865, 13,000 slaves were accepted as collateral for loans from these banks,” Azikiwe said, “but all Chase offered was an apology and a $5 million scholarship funds. Millions of our people are in prison, but how many bankers are in prison or on death row?”

Errol Jennings of the Russell Woods-Sullivan Area Association said banks made $6.4 trillion in profits, using today’s dollar value, during the slavery era, 40 percent from cotton.

Elder Helen Moore of the Keep the Vote No Takeover Coalition protested the devastation of Detroit Public Schools through bank debt that has drained district of per-pupil funding. In background is Rev. Bill Wylie-Kellerman. Photo: Stephanie Gordon

“They’ve been oppressing us ever since we set foot on U.S. soil,” he said. “The prison population right now is traded on Wall Street; how you do in middle school is being decided on Wall Street. They take our pensions and shut off our water because we got into a bad deal with derivatives. They caused the global economic crash of 2006-08, got $700 billion in our tax dollars to get bailed out, and now they’re growing at a faster rate than ever before. They tell us, ‘We don’t need you, we’ll take your houses, your water, kill your schools, and see to it that your children kill each other on the streets.’”

Protesters chanted, “The blight is Chase.”

Multi-billionaire Dan Gilbert, who has close ties to Chase, ironically heads the city’s “Blight Removal Task Force,” as he buys huge parcels of city land and drives out Black and poor residents. The recent re-development of Brush Park and the conversion of the Section 8 Griswold Apartments in Capitol Park to high-end condos called “The Albert” are only two examples.

Detroit “Mayor” Mike Duggan meets with Chase CEO Jamie Dimon Feb. 11, 2015. Photo: Daniel Mears, Detroit News

Detroit Mayor Mike Duggan met with Chase CEO Jamie Dimon Feb. 11, taking him on a tour of Eastern Market and lauding Chase’s support for Detroit. In early 2014, the global bank committed $100 million to support “economic development, blight removal and job training” in Detroit. Compared to the $2.6 trillion in assets the bank reported in 2014, that represents a demeaning drop in the bucket.

Many protesters carried signs denouncing water shut-offs in Detroit, which are scheduled to begin May 29.

“Save Detroit’s children! Don’t shut off their water!” they chanted.

JPMorgan Chase cost the Detroit Water and Sewerage Department $537 million in illegal interest rate swaps. Under the city’s bankruptcy provisions, DWSD will now control only a small part of the city’s water mains, while the Great Lakes Water Authority will control and profit from all water and wastewater treatment plants in the six counties originally under DWSD jurisdiction, as well as water mains and the remaining infrastructure.

Protesters said Chase is largely responsible for pending water shut-offs in Detroit, due to $537 million in illegal interest rate swaps it foisted on DWSD. Photo: Stephanie Gordon

The DWSD workforce has been drastically cut and union representation essentially busted. The remaining workers have been forced to reapply for their jobs regardless of seniority and other union contract provisions.

“Over 200,000 people have fled Detroit after our communities were devastated by predatory mortgages and foreclosures that resulted in the global economic crash of 2008,” Pat Driscoll of Detroit Eviction Defense said.

Cheryl West, evicted last week from her home of 60 years, during protest at Wayne Co. Treasurer’s office March 31, 2015.

“People that took these predatory loans were in fact eligible for other loans. As of 2012, half of the foreclosed homes were owned by banks like Chase, who have not paid their property taxes. But this year the residents left in Detroit face the largest tax foreclosure crisis in history. Over 11,000 homes, about 33,000 people, face eviction, people like Cheryl West, who lived in her Detroit home for 60 years and was evicted last week. Detroit’s homeowners haven’t been bailed out like the banks were after the 2008 crash.”

Driscoll announced that a coalition of groups led by the Michigan American Civil Liberties Union (ACLU) just sent a scathing letter to Wayne County Treasurer Raymond Wojtowicz demanding an immediate moratorium on tax foreclosures, in part because homeowners have been paying illegal tax rates for at least the last 20 years.

The groups, including Moratorium NOW!, the Russell Woods-Sullivan Association, the Detroit People’s Platform, the Sugar Law Center, and others, said the following in part:

“A moratorium on tax foreclosures is necessary where the local government has violated its statutory duty to assess property values, leading to unwarranted taxes based on grossly inflated home values before the Great Recession.

Instituting a moratorium on tax foreclosures of occupied homes is not only the right policy decision; it is required as a matter of law. Michigan law obligates local assessing units to determine property values on a yearly basis in order to ensure that residents pay taxes based on the actual value of their home.”

Yvonne Williams-Jones, DAREA officer, attended protest. She retired after 34 years with the City of Detroit.

Bill Davis and Yvonne Jones of the Detroit Actives and Retired Employees Association(DAREA) registered their outrage at what has been done to Detroit. (This reporter apologizes for her confused note-taking: their comments are combined here.)

“We must defend our home! Our home is Detroit! These devils have taken our health care and cut our pensions. Detroit is now a great city if you’re a white billionaire like Dan Gilbert, Mike Illitch, and Roger Penske. We can’t even go to Belle Isle anymore because Penske wanted it for his Grand Prix. We have to fight back, we have to take the water department and Belle Isle and the city back! The people can make a difference, whenever we show up and stand up and act up. No justice, no peace!”

They said DAREA has an ongoing appeal of the bankruptcy confirmation plan currently being heard in the U.S. District Court, despite threats by former Detroit Emergency Manager Kevyn Orr that retirees could not appeal a thing.

Justice Lloyd Karmeier of Illinois Supreme Court wrote passionate defense of his state’s pension systems, declaring reductions unconstitutional May 8, 2015.

DAREA’s appeal is likely to be given a huge boost by an Illinois Supreme Court ruling on May 8. The Court held unanimously that Public Act 98-599, which drastically reduced the pensions and annuities of public workers across the state, was unconstitutional and therefore unenforceable.

The Illinois constitution’s pension protections clause is very similar to Michigan’s. It provides: “Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.” Ill. Const. 1970, art. XIII, § 5.

The Illinois decision is striking in its passion for upholding the will of the people as expressed in the constitution they enacted, in this case, the 1970 Illinois State Constitution.

“The people of Illinois give voice to their sovereign authority through the Illinois Constitution,” the ruling, authored by Justice Lloyd Karmeier, declared. “It is through the Illinois Constitution that the people have decreed how their sovereign power may be exercised, by whom and under what conditions or restrictions. Where rights have been conferred and limits on governmental action have been defined by the people through the constitution, the legislature cannot enact legislation in contravention of those rights and restrictions.”

The lawsuits filed by five pension systems in the state predominantly addressed the reduction of annuity payments to workers, also the most damaging provision of the Detroit bankruptcy plan. However, the Illinois court held that the annuity reductions could not be severed from the entire act, and therefore struck down all portions of the act.

Related documents:

Illinois Supreme Court pension ruling

Recent related stories:

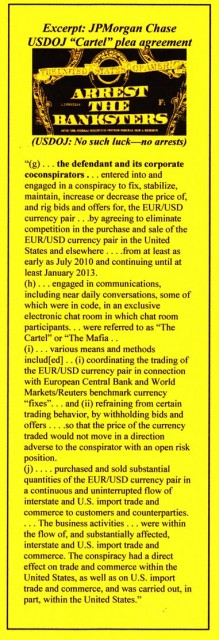

Six Banks to Pay $9 Billion, Five Guilty of Market Rigging

JPMorgan Chase, Citicorp, Barclay’s, RBS plead guilty to felonies, no jail time slated

Banks operated private chat rooms for members of the “Cartel”

USDOJ, Fed Reserve file charges

By David McLaughlin, Tom Schoenberg, and Gavin Finch

May 20, 2015

Six of the world’s biggest banks will pay $5.8 billion [through U.S. Department of Justice settlement] and five of them agreed to plead guilty to charges tied to a currency-rigging probe as they seek to wind down almost half a decade of enforcement actions.

Citicorp, JPMorgan Chase & Co., Barclays Plc and Royal Bank of Scotland Plc agreed to plead guilty to felony charges of conspiring to manipulate the price of U.S. dollars and euros, according to settlements announced by the Justice Department in Washington Wednesday. The main banking unit of UBS Group AG agreed to plead guilty to a wire-fraud charge related to interest-rate manipulation. The Swiss bank, the first to cooperate with antitrust investigators, was granted immunity in the currency probe.

The four banks that agreed to plead guilty to currency charges are among the world’s biggest foreign-exchange traders. They were accused of colluding to influence benchmark rates by aligning positions and pushing transactions through at the same time. Traders who described themselves as members of “The Cartel” used online chat rooms to discuss their positions before the rates were set and suppress competition in the market, the Justice Department said.

All of the banks that pleaded guilty said they received needed waivers from the Securities and Exchange Commission to continue managing mutual funds and raise capital quickly, a person familiar with the matter told Bloomberg.

“Brazen Collusion”

The scheme was a “brazen display of collusion,” Attorney General Loretta Lynch said in a statement. “This Department of Justice intends to vigorously prosecute all those who tilt the economic system in their favor, who subvert our marketplaces, and who enrich themselves at the expense of American consumers,” she said.

The accords bring the total fines and penalties paid by the five banks to resolve the currency investigations to about $9 billion, the Justice Department said.

In the settlement with the Justice Department, Citicorp parent Citigroup Inc. will pay $925 million, the highest of the banks penalized. Barclays agreed to a fine of $650 million. JPMorgan will pay $550 million, and Royal Bank of Scotland Group Plc agreed to a $395 million fine. UBS will pay $203 million.

Separately, the Federal Reserve imposed fines of more than $1.6 billion on the five banks for “unsafe and unsound practices.” London-based Barclays will pay an additional $1.3 billion as part of settlements with the New York Department of Financial Services, the Commodity Futures Trading Commission and the U.K.’s Financial Conduct Authority.

Terminate Employees

As part of its settlement with New York banking superintendent Benjamin Lawsky, Barclays agreed to terminate eight employees engaged in currency trading between London and New York.

The Fed also fined Bank of America Corp. $205 million for failing to detect and address conduct by traders who discussed the possibility of entering into agreements to manipulate currency prices, according to a statement.

The Fed also fined Bank of America Corp. $205 million for failing to detect and address conduct by traders who discussed the possibility of entering into agreements to manipulate currency prices, according to a statement.

“The resolution will come out of our existing reserves,” said Lawrence Grayson, a spokesman for Charlotte, North Carolina-based Bank of America.

The penalties represent the first criminal resolutions in a two-year currency probe, which is ongoing, said Andrew McCabe, assistant director in charge of the Federal Bureau of Investigation’s Washington Field Office.

Other firms, including Deutsche Bank AG and HSBC Holdings Plc are still under investigation. Cases against individual traders also may be forthcoming, people with knowledge of the probe have said.

“Calculated Move”

The settlements show the eagerness of bank executives to end one of the last big legal cases dogging the industry. Scandals involving the aggressive sale of mortgage bonds and interest-rate rigging helped reinforce the view that some firms are too big to manage properly and should be broken up.

“This is a very calculated move to get the Justice Department off their backs, because otherwise this could go on for years,” said Phillip Phan, a professor at the Johns Hopkins Carey Business School. “In a way, there’s anonymity in the crowd — you don’t know who’s more guilty than others.”

Although UBS wasn’t charged for currency manipulation, the government said the Swiss bank engaged in deceptive currency trading and sales practices after it settled a previous investigation in the manipulation of the London interbank offered rate in 2012. The conduct violated the non-prosecution agreement with the Justice Department.

UBS Markups

UBS traders and sales staff misrepresented to customers on certain transactions that markups were not being added, when in fact they were, using hand signals to conceal the markups, the Justice Department said in its statement. A UBS trader also conspired with other banks acting as dealers in the spot market by agreeing to restrain competition in the purchase and sale of dollars and euros, the government said. UBS’s collusive conduct occurred from October 2011 to at least January 2013.

Bank executives expressed embarrassment and frustration over the conduct, pointed a finger at a few bad apples and vowed to do better.

“The conduct of a small number of employees was unacceptable and we have taken appropriate disciplinary actions,” UBS Chief Executive Officer Sergio Ermotti and Chairman Axel Weber said in a statement.

JPMorgan said in a statement that the conduct underlying the antitrust charge against the bank is “principally attributable” to a single trader, who has since been dismissed.

“The conduct described in the government’s pleadings is a great disappointment to us,” said Chairman and CEO Jamie Dimon. “We demand and expect better of our people. The lesson here is that the conduct of a small group of employees, or of even a single employee, can reflect badly on all of us.”

Operations Continue

Shares of both JPMorgan and Citigroup slid 0.8 percent at 12:05 in New York. UBS climbed 3 percent, RBS rose 1.8 percent, Barclays advanced 3.4 percent.

Shares of both JPMorgan and Citigroup slid 0.8 percent at 12:05 in New York. UBS climbed 3 percent, RBS rose 1.8 percent, Barclays advanced 3.4 percent.

JPMorgan and Citigroup said they don’t anticipate a material impact on operations or their ability to serve clients.

The Justice Department had been aiming to extract pleas from the banks’ parent companies, people familiar with the talks had said. In its announcement, the department characterized the companies entering pleas as “parent-level.”

Drexel Case

Citicorp, the unit agreeing to plead guilty, is wholly owned by parent Citigroup Inc. Citicorp, in turn, contains the company’s main banking subsidiary, Citibank NA, which held 74 percent of Citigroup’s assets at year-end. Royal Bank of Scotland Plc is a unit of Royal Bank of Scotland Group Plc.

JPMorgan Chase Chairman, President and CEO Jamie Dimon presents his driver’s license to Justice Department security officer G. Rocher, as he arrives at the Justice Department in Washington. (AP Photo/Manuel Balce Ceneta)

The guilty pleas by Citicorp and JPMorgan are the first in criminal cases by major U.S. banks since Drexel Burnham Lambert admitted to six counts of mail and securities fraud in 1989. They follow pleas last year by the bank subsidiary of Zurich-based Credit Suisse Group AG for aiding tax evasion and BNP Paribas SA for violating U.S. sanctions. This year, a Deutsche Bank unit pleaded guilty for its role in manipulating interest rates.

The foreign-exchange investigation began after Bloomberg reported beginning in June 2013 that traders were colluding to manipulate benchmark currency rates and profit at clients’ expense. Their efforts were focused on the WM/Reuters 4 p.m. fix, used to value trillions of dollars of investments worldwide and to determine the price some companies and fund managers pay to swap currencies.

The foreign-exchange investigation began after Bloomberg reported beginning in June 2013 that traders were colluding to manipulate benchmark currency rates and profit at clients’ expense. Their efforts were focused on the WM/Reuters 4 p.m. fix, used to value trillions of dollars of investments worldwide and to determine the price some companies and fund managers pay to swap currencies.

In October of that year, regulators around the world announced they were opening formal probes. Within weeks, more than 25 foreign-exchange traders at banks including Citigroup, JPMorgan and Barclays were fired, suspended or put on leave.

What began as a narrow inquiry into rate-rigging was broadened into a wider examination of the industry. In recent months, authorities have looked into practices including banks charging excessive commissions, sales staff passing on tips to favored clients and traders.

Related documents:

Six Global Banks to pay USDOJ release

To purchase Brandon Garrett’s book, “Too Big to Jail,” click on http://www.hup.harvard.edu/catalog.php?isbn=9780674368316

To read about JPMorgan Chase as ringleader of banks just sued, and its ties with British Petroleum, click on http://prepperchimp.com/2014/12/31/the-rigging-triangle-exposed-the-jpmorgan-british-petroleum-bank-of-england-cartel-full-frontal/

Chase has abused my family for over 5 years and the State, Federal and Local Governments did nothing….They threatened my children when i was not behind on payments they reversed and lost payments that were paid ahead in an effort to, “force a foreclosure” and they continue this behavior while my elected officials and the government office charged with enforcing laws ignores their violations of current laws, consent orders and regulations…..Makes me wonder if Chase is the Criminal or my Government.