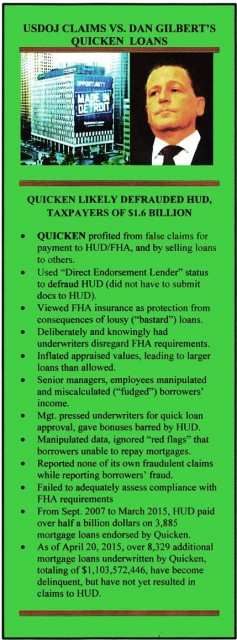

USDOJ says Gilbert’s Quicken Loans guilty of “hundreds of millions of dollars” in HUD mortgage insurance fraud, 40% of company’s loans

USDOJ says Gilbert’s Quicken Loans guilty of “hundreds of millions of dollars” in HUD mortgage insurance fraud, 40% of company’s loans

Detroit grandmother, community advocate Stafford unjustly convicted of charges in single mortgage she was not party to

By Diane Bukowski

March 17, 2016

Mary Stafford is currently in Michigan’s Huron Valley Women’s Correctional Facility for crimes she did not commit.

DETROIT – The justice system in this country is clearly fractured beyond repair. Though there are thousands of examples, including the fact that the United States has five percent of the world’s population but 25 percent of its incarcerated people, one case in Detroit stands out for its glaring contradictions related to race and class.

Mary Stafford, a Black 66-year-old Detroit grandmother on Social Security, and a long-time community advocate, is languishing behind the walls of the Michigan’s Women’s Huron Valley Correctional Facility in Ypsilanti, sentenced to one to 10 years by Third Judicial Circuit Court Judge Michael Hathaway on Feb. 19.

Her alleged crimes? “False pretenses” and “obstruction of justice” involving ONE mortgage loan which she did not even borrow. Wells Fargo Bank approved the loan in 2007 just before the global economy tanked due to the greedy corporate lending frenzy.

Dan and wife Jennifer Gilbert party with friends.

To justify exceeding a sentencing recommendation of 18 months probation, Hathaway compared Stafford’s alleged acts to “the excesses, fraud and greed of the mortgage banking industry, with dozens if not hundreds of mortgage bankers who should be in prison.”

Dan Gilbert, multi-billionaire owner of most of downtown Detroit, the Cleveland Cavaliers, and outstate gambling casinos, who basks in luxury and acclaim, is one of those mortgage bankers, says the U.S. Department of Justice (USDOJ).

The USDOJ is suing Gilbert’s company Quicken Loans, alleging it defrauded taxpayers of hundreds of millions of dollars by approving Federal Housing Authority (FHA) insurance for mortgages it knew were ineligible, involving 40 percent of its total loan output. The USDOJ contends the loan approvals resulted from management policies that arrogantly scorned HUD guidelines.

In an email, Quicken Loans Operations Director Mike Lyons called these “bastard loans . . . . plausible to the investor even though we know its creation comes from something evil and horrible,” says the USDOJ complaint.

In an email, Quicken Loans Operations Director Mike Lyons called these “bastard loans . . . . plausible to the investor even though we know its creation comes from something evil and horrible,” says the USDOJ complaint.

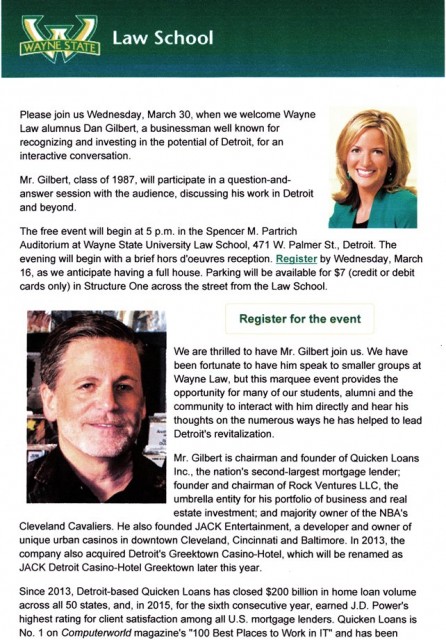

But Wayne State’s Law School is featuring Gilbert at a “marquee event” March 30. Law School Dean Jocelyn Benson gushed in a release, “We are thrilled to have Mr. Gilbert join us . . . .to hear his thoughts on the numerous ways he has helped to lead Detroit’s revitalization.”

Quicken Loans sought to outwit the U.S. government by filing a pre-emptive lawsuit in Detroit against the USDOJ, but U.S. District Court Judge Mark Goldsmith peremptorily dismissed it Dec. 31, 2015. The USDOJ says in its filings in the District Court of the District of Columbia that the lawsuit delayed its proceedings for nine months, but it is now moving forward.

Ironically, one of the claims the USDOJ makes in its lawsuit is that, “When Quicken suspected that a potential [individual] borrower had committed fraud or made a misrepresentation, Quicken was quick to notify HUD. However, Quicken failed to notify HUD of any loans with serious underwriting deficiencies committed by Quicken, even when it concluded internally that loan approval was not justified.”

The Wayne County Prosecutor’s Mortgage Deed Fraud Task Force clearly followed that example, targeting individuals like Mary Stafford instead of the predator banks and mortgage companies like Quicken Loans. Ironically, in Stafford’s case, Wells Fargo told VOD specifically that it had not sought prosecution of Mary Stafford or other parties with relation to the $395,000 and had sustained no losses after it foreclosed.

Wells Fargo itself has been charged by the USDOJ with similar mortgage crimes, as well as others. It clearly did not want to bring further attention to one of many predatory loans it approved.

Wells Fargo itself has been charged by the USDOJ with similar mortgage crimes, as well as others. It clearly did not want to bring further attention to one of many predatory loans it approved.

In contrast to Mrs. Stafford’s quiet life as a homemaker and caregiver to numerous relatives and neighborhood children, Gilbert has flourished to mainstream media acclaim. As a mayoral appointee, he heads the Detroit Blight Task Force, which is demolishing thousands of homes across the city at inflated prices. Many were foreclosed as a result of Quicken Loans’ fraudulent actions.

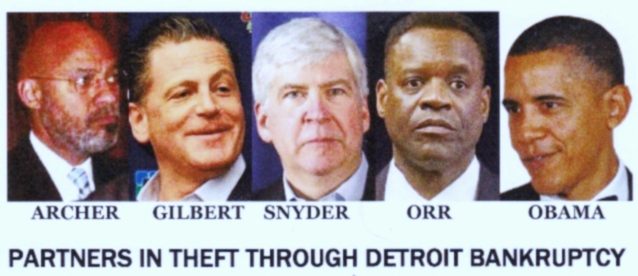

He also accompanied former Detroit Mayor Dennis Archer to Washington, D.C. to meet with top aides to U.S. President Barack Obama to discuss Detroit’s future after bankruptcy. Neither President Obama nor former U.S. Attorney General Eric Holder ever responded to a request from U.S. Congressman John Conyers (D-Detroit) that the Justice Department investigate Public Act 4 (predecessor to the current Emergency Manager Act) as a violation of the U.S. Voting Rights Act.

Now the most dire consequences of Michigan’s EM law have been laid bare in world-wide coverage of the irreversible lead poisoning and outright murder of the people of Flint. The Flint water crisis follows the scurrilous Detroit bankruptcy, which has robbed the people of Detroit of most of their major assets, caused huge public job losses, impoverished retirees, while banks and corporations recovered 95.9 percent of their debt. Detroit’s debt is now projected to rise to 300 percent of what it was in 2013.

Now Gilbert is being held up as an example for Wayne State Law School students, alumni and the community-at-large by Dean Benson and WSU. Perhaps this is why the Staffords had continuing problems finding warrior attorneys with principles who were not frightened of Judge Hathaway, and willing to fight the injustice perpetrated on their clients. What are today’s lawyers learning in this city’s law schools?

The State Appellate Defender’s Office has now been assigned to deal with Mary Stafford’s appeal, through prominent attorney Valerie Newman. Judge Hathaway earlier denied Stafford’s motion for an appeal bond, claiming that she had no likelihood of prevailing on appeal despite blatant irregularities at her trial.

Judge Michael Hathaway

They included Judge Hathaway asking expert defense witness Rick Woonton, ON THE RECORD, if he thought the Staffords were guilty; instructing the jury that they could find them guilty of “aiding and abetting” unnamed parties; conducting an ex parte discussion with another defense witness, and comparing Mary Stafford to arch criminal Bernie Madoff. Stories linked below tell the details of the trial.

Her husband and supporters are hoping for an emergency writ from the appeals court to free her while her appeal is pending.

***********************************************************************************

Send letters of support to Mrs. Mary Stafford, #972040, 3201 Bemis Road, Ypsilanti, MI 48197-0911. She can also be reached by signing up for JPay, at www.jpay.com . Emails and funds can be sent through JPay, as well as photos and Ecards.

Funds for Mary’s legal defense can be sent to https://www.crowdrise.com/vindicatingmaryoffalsechargesbygovernmentterrorists5

***********************************************************************************

Related documents:

http://voiceofdetroit.net/wp-content/uploads/Quicken-Loans-USDOJ-lawsuit-1.pdf

http://voiceofdetroit.net/wp-content/uploads/UNITED-STATES-OF-AMERICA-v-Quicken-Loans-Inc.pdf Federal Docket re: Quicken Loans

http://voiceofdetroit.net/wp-content/uploads/USDOJ-opposition-to-QL-renewed-motion-to-transfer.pdf

http://voiceofdetroit.net/wp-content/uploads/Quicken-Preemptive-Suit-dismissal.pdf

Related stories re: Quicken Loans, Dan Gilbert

U.S. Atty: Quicken Loans shouldn’t get venue change http://www.detroitnews.com/story/business/2016/03/10/quicken/81587510/

http://voiceofdetroit.net/2013/09/11/dennis-archer-former-consultant-to-detroit-lender-ubs-ag-meets-with-top-obama-aides-execs/ (along with Gilbert)

Related stories re: convictions of Clifford and Mary Stafford:

#JailDanGilbert, #FreeMaryStafford, #ExonerateCliffordStafford, #ShameonWayne, #StopWallStreetmortgagefraud, #Banksnottoobigtojail, #unjustconviction, #biasonthebench, #Beatbackthebullies, #StandUpNow, #StopthewaronBlackAmerica, #DetroitFightBack, #RecuseMichaelHathaway

Omg watch