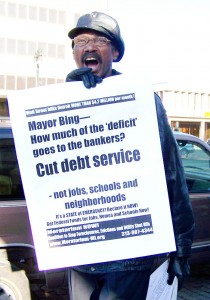

Moratorium NOW! coalition rallied last year to suspend city’s debt payments

JAN. 2 RALLY WILL ORGANIZE PARTICIPANTS TO GET SIGNATURES FOR REFERENDUM TO REPEAL PUBLIC ACT 4, FREEZING FURTHER ACTION

Dillon cites Detroit’s debt, names 60-day review team, says city officials

“either incapable or unwilling to manage its (sic) own finances”

TIME FOR WAR ON THE BANKS

By Diane Bukowski

December 27, 2011 (See upcoming VOD stories on Snyder’s appointment of financial review team and what a “consent agreement” means under PA4.)

LANSING – Michigan State Treasurer Andy Dillon made the main issue very clear in his Dec. 21 letter to Michigan Governor Rick Snyder, recommending escalation of the state’s war on Detroit. The letter announced the second step in the PA 4 takeover process, a formal 60-day review of Detroit’s finances, cutting in half the original 30-day review. Today, he named the review team.

Dillon told Snyder the CITY’S DEBT TO THE BANKS plays a prominent role in the alleged crisis. A banner headline in the Free Press blared, “DETROIT’S DEBT CRISIS EVEN WORSE THAN THOUGHT.”

“The city has a mounting debt problem,” Dillon said. “In 2010, annual debt service requirements exceeded $597 MILLION. “As of June of 2011, the long-term debt of the city exceeded $8 BILLION . . . However, if one includes the unfunded actuarial pension liability of $615 million (offset by an almost $1.4 billion pension asset) and the unfunded other postemployment benefit liability of over $4.9 billion, the city’s total long-term debt liabilities are over $12 BILLION, which does not include substantial sums of interest which are over $4.9 BILLION.”

Dillon said, “City officials are either incapable or unwilling to manage its (sic) own finances,” (without using spell-check, evidently), in the six page letter, which did not hold Wall Street accountable in any fashion.

(Click on Detroit_PreRev_12-21[1] to read Dillon’s Dec. 21 press release and on PrelimRevMemo12-21-11[1] to read his letter to Snyder.)

Dillon’s sneering comment on city officials typifies his and Snyder’s utter contempt for the Black elected leaders of Detroit and Michigan. They failed to honor a request from U.S. Congressmen John Conyers, Hansen Clarke, Gary Peters, and 63 other state and local officials that Gov. Snyder meet with them before taking further action against Detroit under Public Act 4. (Click on Conyers and elected officials letter to Snyder re EM).

The letter stressed that the duo appear to be targeting majority-Black cities in Michigan for emergency manager (EM) takeovers.

Snyder earlier responded to a question about the “appearance” of racism from Channel Four’s Devin Scillian on Flashpoint Dec. 18.

Snyder earlier responded to a question about the “appearance” of racism from Channel Four’s Devin Scillian on Flashpoint Dec. 18.

“It’s not racist, those cities have shrinking populations,” Snyder said,

He ignored the fact that the nation’s banks and mortgage companies targeted communities of color for criminal sub-prime loans. Later, when families could not pay their mortgages, they were evicted and often forced to leave their cities.

Considering Snyder and Dillon are moving towards the appointment of an emergency manager (EM), their stress on the city’s debt is telling. PA 4 says an EM shall be responsible for “The payment in full of the scheduled debt service requirements on all bonds, notes, and municipal securities of the local government and all other uncontested legal obligations,” among other matters.

Further coverage in the daily media has hypocritically blamed city officials for irresponsible borrowing, as the banks blamed homeowners for being foreclosed on, claiming they should have known they could not afford their sub-prime loans.

Neither has the daily media taken Wall Street’s ratings agencies to task for their practice of continually downgrading Detroit’s debt, which has allowed the banks to engage in outrageous usury. This has even included loans to the financially solvent Detroit Water and Sewerage Department. (Click on VOD article “Banksters plan to rob Detroit of $400 M under EM; already got $211.6 M on water bond sale at http://voiceofdetroit.net/2011/12/19/11652/.)

There are other factors cited in Dillon’s letter, but they generally consist of picayune technicalities, and pale in comparison to the role played by the city’s debt. The city’s expected deficit is currently $155 million, 26 percent of what it paid out to the banks this year.

MAKE THE BANKS PAY—START WITH UBS & US BANKCORP

Activists including this reporter have been pointing out this problem for at least two decades, as well as its OBVIOUS solution, summed up by tens of thousands of Occupy Wall Street protesters this year: MAKE THE BANKS PAY!

Activists including this reporter have been pointing out this problem for at least two decades, as well as its OBVIOUS solution, summed up by tens of thousands of Occupy Wall Street protesters this year: MAKE THE BANKS PAY!

UBS Financial and Siebert, Brandford, Shank, LLC are the bondholders on the largest one-time loan Detroit has taken out, almost $1.5 billion in pension obligation certificates in 2005.

UBS, the world’s second largest manager of private wealth assests, is based in Switzerland and operates in more than 40 countries. It has with over 2.2 trillion CHF (Swiss francs, equivalent to $2.34 trillion) in invested assets.

When the city defaulted on the loan in 2009, the bondholders agreed to have US Bank NA act as trustee to collect the city’s casino tax and state revenue-sharing income, to ensure payment of the debt. US Bank NA, a subsidiary of US Bancorp, the fifth largest bank in the country, got a service fee from the city for the favor.

That loan was highly controversial, with many in the community objecting.

Prophetically, Agnes Hitchcock of the Call ‘em Out Coalition said, “The state took over the schools to control a $1.5 billion construction bond proposal. Now it looks like we’re telling them that the city is a good thing to take over as well.”

Then Mayor Kwame Kilpatrick and his Chief Financial Officer Sean Werdlow got representatives of Standard and Poor’s and Fitch Ratings to the Council table to lobby for the loan. Kilpatrick threatened to lay off 2,000 city workers if it did not pass.

Agnes Hitchcock (r) presents memorial plaque to Call 'em Out member Jimmie Thornton's family; many militant activists such as Thornton have spent their lives fighting this system.

The City could have borrowed only the amount it needed to make its payments to the pension funds that year, but Standard and Poor’s Stephen Murphy, Kilpatrick and Werdlow insisted that the city borrow the entire amount outstanding over the coming years, despite the huge risk involved.

UBS, a Swiss bank, indirectly profited from the U.S. government bail-out of the banks to the tune of $5 billion. AIG Insurance paid UBS, a creditor, that amount after AIG went bankrupt. It came out of the $150 billion in federal TARP funds AIG got from taxpayers. It has never been paid back.

At the time, UBS owed the U.S. $780 million in fines for helping wealthy taxpayers hide over $14 billion in income to evade taxes. It paid the fines out of its AIG TARP funds. UBS later got another $200 million from the Federal Reserve Bank.

http://www.revengeis.com/2009/04/ubs-uses-tarp-funds-to-pay-fine-for-promoting-us-tax-evasion

US Bankcorp got $6.6 billion in taxpayer bailouts, which it has repaid, but it raked in profits on the loan of $334,220,416 (see http://projects.propublica.org/bailout/list).

So why should UBS and US Bankcorp continue to profit from Detroit’s debt, when they have already been so generously treated by the taxpayers of Detroit and the U.S.?

Politicians, both Democratic and Republican, have refused to demand that the banks pay. Many others appear to think that making demands on the banks is totally unimaginable.

However, the demand for the banks to hold off on the city’s debt payments has been done before, HERE IN DETROIT.

MAYOR FRANK MURPHY, U.S. REP. CLARENCE MCLEOD (DETROIT) FOUGHT FOR DEBT MORATORIUM

MAYOR FRANK MURPHY, U.S. REP. CLARENCE MCLEOD (DETROIT) FOUGHT FOR DEBT MORATORIUM

During the Great Depression, while Frank Murphy was Mayor of Detroit, the city came to a point where it could not pay its debt to the banks, a situation cities across the country faced. City employees were not being paid at all. Many were collapsing on the job because of hunger, not to mention the tens of thousands of Detroiters who were out of work. Murphy initiated a scrip program to help pay workers, and a city welfare agency for the poor. He pleaded unsuccessfully with the state to help provide additional relief.

He and U.S. Congressman Clarence McLeod (R- Detroit) also fought for the right of the cities to declare a 10-year moratorium on their debt to the banks, with two-year extensions possible. The seenario they advocated involved cities going before federal courts to request the moratorium.

In his book Frank Murphy, the Detroit Years, Sidney Fine says, “At the request of Mayor Murphy of Detroit, following a Conference of the US Conference of Mayors, the Norris-McLeod Bill for a municipal debt moratorium was introduced in the House of Representatives on Feb. 28, 1933. It was meant to provide for the ‘temporary relief of insolvent municipal corporations and to preserve the taxable values of property therein.’

“The Norris-McLoead bill . . . did not contemplate repudiation of any principal or interest, or any reorganization or refunding, or any new loan by the RFC [Reconstruction Finance Corporation]. As a matter of fact, it was the type of law which some believed could have been passed by any state, for it did not impair the obligations of contract, but merely gave immediate temporary relief by suspending for a time a number of wasteful and expensive court actions. (HB 14789, SB 5699, 72nd Congress, 2nd session).”

The bill later died in session, and was replaced by a watered-down version which became the National Municipal Debt Adjustment Act. That U.S. Supreme Court later struck that down as unconstitutional.

Meanwhile, Murphy pulled out all stops to get the city’s bondholders to agree to a voluntary moratorium.

“Unwilling to accept the conditions stipulated by the bankers, Murphy told the bondholders that, although he had always insisted that the city must meet its financial obligations, he also had to insist that the ‘people be provided a government first,’’ Fine says. “The bondholders quickly withdrew most of the conditions to which Murphy had objected, and a tentative agreement was reached . . .”

Later, when that collapsed, the City Council itself eliminated the city’s interest payments on the debt to the banks on from Detroit’s annual budget, with one Council member declaring he would go to jail to support his position. Murphy eventually vetoed that action as illegal.

During the remainder of that decade, however, a massive movement of poor and working people rose up against the country’s financial czars, threatening revolution, occupying plants, moving people back into foreclosed homes, and holding massive hunger marches. It scared the pants off the ruling class to the point where it made major concessions, including Social Security, the WPA, and numerous other federal relief programs.

World War II intervened, pumping huge amounts of money into the nation’s economy from military manufacturing, and reviving the declining capitalist system for a time. Jobs became plentiful, mainly for the white working class, and never-ending prosperity appeared to be on the horizon.

Now, however, the world economic crisis is far more serious, portending a general global collapse of the banks and other institutions. Many Third World countries have called for the actual cancellation of their debts to world financial institutions.

WAR against the banks,, stock markets, and rating agencies is essential if working and poor people are going to survive in THIS era. The Occupy Wall Street movement has neightened consciousness about the capitalist system—it is time to raise the MINIMIAL demand for a moratorium on Detroit’s debt to the banks again, and build the massive movement needed to win it.

For more information, contact the Moratorium NOW! Coalition at 313-319-0870,