Lawsuit says Countrywide removed all controls and issued ‘disastrously bad loans and stuck taxpayers with the bill.’

The U.S. government has sued Bank of America for “brazen” mortgage fraud, saying its subsidiary Countrywide cost Fannie Mae and Freddie Mac more than $1 billion.

“The fraudulent conduct alleged in today’s complaint was spectacularly brazen in scope,” Preet Bharara, the U.S. Attorney for the Southern District of New York, said in a statement. “As alleged, through a program aptly named ‘the Hustle,’ Countrywide and Bank of America made disastrously bad loans and stuck taxpayers with the bill.

As described, Countrywide and Bank of America systematically removed every check in favor of its own balance – they cast aside underwriters, eliminated quality controls, incentivized unqualified personnel to cut corners, and concealed the resulting defects. These toxic products were then sold to the government-sponsored

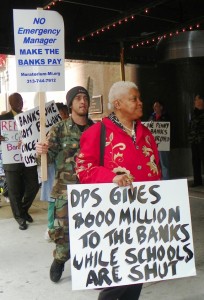

During a nation-wide day of protest against Bank of America May 9, 2012, protesters in Detroit marched from BOA offices to the Coleman A. Young Municipal Center to demand that BOA and other banks cancel the city’s debt since they had destroyed Detroit’s neighborhoods through fraudulent practices.

“According to the complaint, the “Hustle” (HSSL, for High-Speed Swim Lane) was a program designed to process loans at high speed, with no regard for whether customers could pay them back. “Brazen” is a good description. To keep questions from being raised, Countrywide removed loan underwriters from the process, putting decisions in the hands of less qualified processors – though processors had previously not been considered knowledgeable enough to answer customer questions.

The suit included seven examples of loans that clearly looked fishy. In one, a borrower in Miami claimed to be an airline sales rep earning $15,500 per month. In fact, the borrower earned $2,666 per month working at a temp agency, The Associated Press reported. That borrower defaulted on the loan in less than a year.

The result of “the Hustle” was “thousands of fraudulent and otherwise deceptive mortgage loans sold to Fannie Mae and Freddie Mac.” Subsequent defaults on those loans cost the two government-supported

Countrywide initiated its “Hustle” program in 2007 after default rates nationwide began rising and Fannie and Freddie tightened requirements for loans they would back. Bank of America bought Countrywide in 2008, and the Hustle program continued through 2009.

This is the first civil fraud suit filed by the Justice Department over loans sold to Fannie Mae or Freddie Mac. Earlier this month, the U.S. government sued Wells Fargo, accusing the company of lying about mortgages it asked to be insured by the Federal Housing Administration.

In a statement reported by The New York Times, Bank of America spokesman Lawrence Grayson said the bank “has stepped up and acted responsibly to resolve legacy mortgage matters; the claim that we have failed to repurchase loans from Fannie Mae is simply false.” The spokesman added: “At some point, Bank of America can’t be expected to compensate every entity that claims losses that actually were caused by the economic downturn.”

Before and since its demise, Countrywide has been accused of being one of the worst players in the mortgage crisis. The Center for Responsible Lending produced a white paper in 2008 titled “Unfair and Unsafe: How Countrywide’s irresponsible practices have harmed borrowers and shareholders.”

Former Countrywide CEO Angelo Mozilo agreed last year to a record penalty of $67.5 million in a case brought by the Securities and Exchange Commission. The SEC accused Mozilo and other executives of misleading investors as the subprime mortgage business unraveled.