Jones acquitted of gun counts, the only reason for murder charges

Role of Owens’ brother in Blake killing not accounted for

No forensic evidence

Killer cop Weekley’s trial postponed indefinitely

By Diane Bukowski

Analysis

February 21, 2014

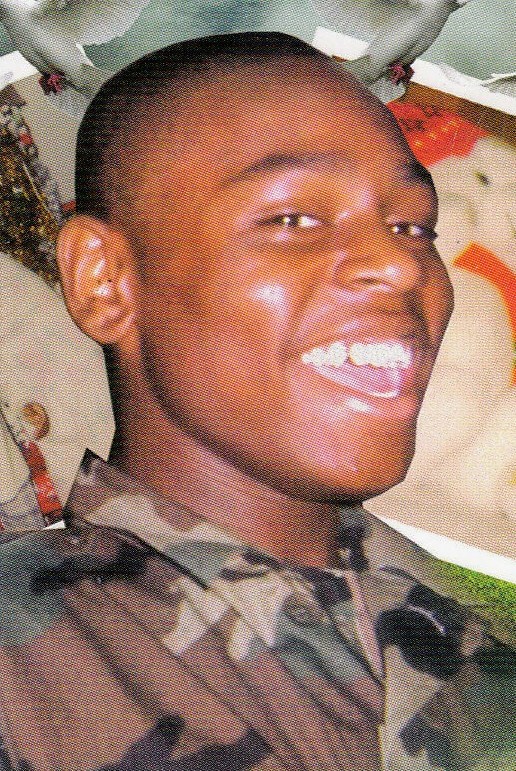

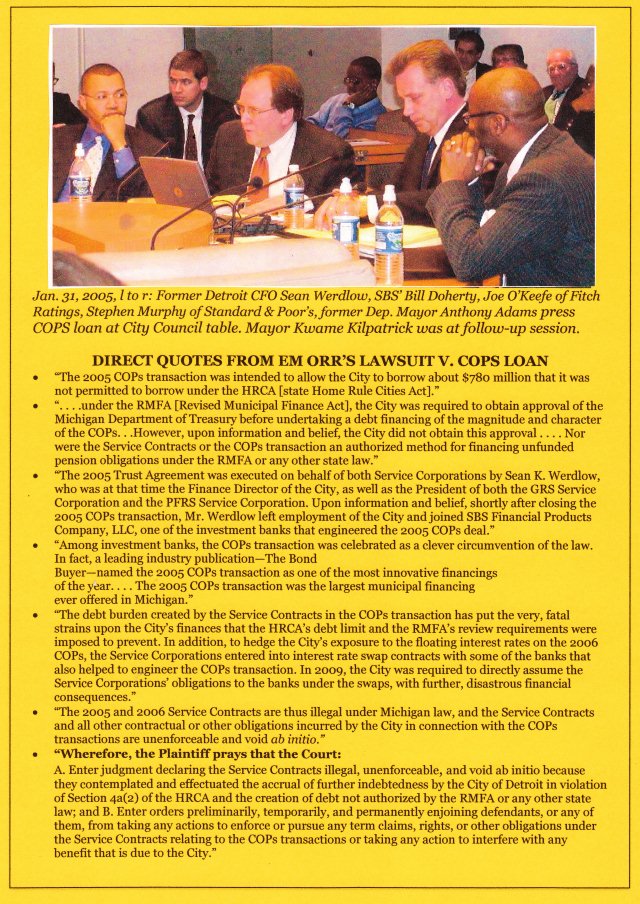

DETROIT – The fix was in from the moment Detroit Police Officer Joseph Weekley shot Aiyana Stanley-Jones, 7, in the head with an MP-5 sub-machine gun as she lay sleeping with her grandmother in the early morning hours of May 16, 2010, two days after Jerean Blake, 17, was killed.

That was clear during a press conference May 18, 2010, held by Atty. Geoffrey Fieger with Aiyana’s family present. The first question a reporter asked was, “Didn’t Charles give Chauncey the gun [in the killing of Jerean Blake]?” Since Jones was not charged until 17 months later, that question could only have come from a police leak aimed at justifying Aiyana’s killing.

Fieger, shocked, responded, “What has that go to do with it?”

Aiyana Jones’ family at Fieger press conference May 18, 2010: (l to r) Mark Robinson, Dominika Stanley-Jones, Charles Jones, Geoffrey Fieger, Mertilla Jones, LaKrystal Sanders

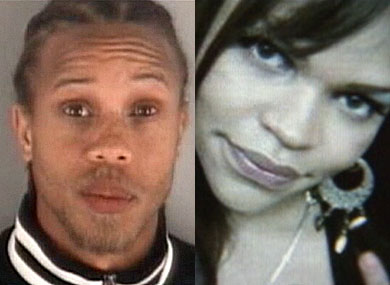

The beautiful little girl Aiyana, killed during an unnecessary military-style police raid staged for the benefit of viewers of A & E’s “The First 48,” is now forgotten, as the mainstream media reports the jury verdicts rendered against her father Charles Jones and her “uncle” Chauncey Owens on Feb. 13 in Blake’s killing.

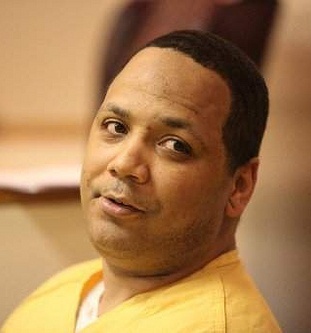

Aiyana’s father, who crawled through his daughter’s blood and brains as Special Response Team members swarmed through his mother’s home that horrible day, was convicted of second-degree murder and perjury but acquitted of being a felon in possession of a firearm and using a firearm during a felony, after nearly four days of jury deliberation.

“The theory of the prosecution is that my client possessed the gun, gave the gun to Mr. Owens, who used it in the killing,” Jones’ lawyer Leon Weiss said in published remarks, “That’s the reason they charged him with homicide. I think [the jury’s acquittal of Jones on the gun charges] gives us pretty good grounds for appeal.”

He told VOD later, “My appellate team is looking at all options. Unfortunately, Michigan case law is fairly clear that juries are allowed to come back with stupid, compromised and inconsistent verdicts. We will continue to fight for Charles at every turn.”

Owens was convicted of first-degree murder, using a firearm in a felony and being a felon in possession of a firearm after one day of deliberation, a Friday. Two of his jurors had told Wayne County Circuit Court Richard Skutt they needed to leave before the following Tuesday because they had vacation plans.

David Cripps, Owens’ attorney, said he also plans to appeal his client’s verdict. He presented testimony during the trial that another man, Sh’rron Hurt, Owens’ brother, killed Blake. Hurt, who testified against Owens, was at the scene of Blake’s killing, then hid the moped he was driving in a friend’s house across from the Jones residence, and fled to his “second” suburban home in Macomb County.

During Weekley’s trial on charges of involuntary manslaughter in June, 2013, which ended with a hung jury, several members of the SRT surveillance team testified that they saw Owens in the daytime outside the home at least twice, during which they could have easily arrested him. Instead, they waited until after midnight to stage their violent raid in view of “The First 48’s” TV camera.

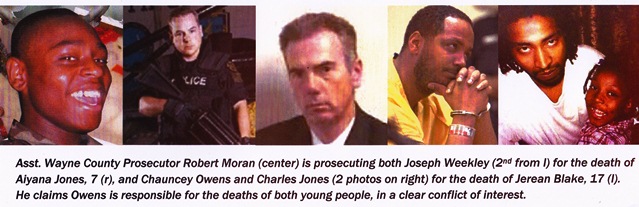

“If he would not have given him that gun, Je’Rean Blake would still be alive right now,” Assistant Wayne County Prosecutor Robert Moran said during closing arguments against Jones. Although Moran is also prosecuting Weekley for involuntary manslaughter, he blamed Aiyana’s death primarily on Owens and her own father, a glaring conflict of interest.

The mainstream media has ignored that issue to pursue its own agenda, in line with that of the police, insisting that Owens confessed that Jones gave him the gun, despite the lack of one shred of evidence in Owens’ court file, which VOD reviewed at length, that he ever said that. The only evidence VOD had not reviewed was the police videotape of Owens’ alleged confession.

VOD was the ONLY newspaper present nearly every day of the three-weeks long Owens/Jones trial. Print media, which reported largely on opening and closing arguments and the verdict, missed the showing of that videotape. So did the Jones jury, which was unfortunately excused for that part of the trial.

If they had been there, they would have heard Owens name ANOTHER man as the one who gave him the gun. This was only after another “First 48” star like Weekley, Sgt. Kenneth Gardner, broke him down during a manipulative interrogation by belatedly letting him know his niece had died. Owens then began rambling, telling several different stories. Despite Sgt. Gardner’s repeated efforts to get him to name Charles Jones, he recovered enough each time to adamantly state Jones was NOT involved, or at the very most, was only present at the scene, which is NOT a crime.

Owens later repeatedly refused to testify against Jones during Jones’ preliminary exam, despite losing his second-degree murder plea as a result.

The ONLY evidence presented against Jones at the trial was that of two disreputable “jail-house snitches,” and a recorded conversation between Jones and Aiyana’s mother Dominika Stanley-Jones.

- Jay Schlenkerman’s latest mug shot, from Charles Egeler Reception Center. He was sentenced to 6 to 10 years Feb. 6, 2014.

The snitches were Jay Schlenkerman, a serial woman-beater, drunk driver, and self-admitted perjurer, and Qasim Raqib, who signed a written pledge to give evidence in exchange against Jones and two other prisoners in exchange for lesser charges in the 2011 murder and dismemberment of a transgender teen.

A recording of a jail-house conversation between Jones and Aiyana’s mother Dominika Stanley-Jones, in which Jones remarked that it was the anniversary of “the day I got my daughter killed,” was also played.

Jones’ mother Mertilla Jones said her son felt it was his fault because he had asked Aiyana to move to the side of the couch by the door to sleep. There are of course numerous interpretations that can be made of a bereaved parent’s statement; survivor’s guilt plays a large role in most deaths of loved ones.

There was absolutely NO forensic evidence presented during the entire trial: the gun, the second bullet which did not hit Jerean, fingerprints, vehicles, a store videotape, or videotapes taken by A&E of witnesses identifying Owens in a photo line-up. It was clear from day one that the prosecution and police were intent on fingering Owens and Jones to justify the cold-blooded slaughter of a little child.

- Roberto Guzman (center) with the late Kevin Carey (l) and members of the Detroit Crime Lab Task Force.

Paralegal Roberto Guzman, who has worked on behalf of dozens of prisoners appealing their cases, remarked on the contrast between the charges brought against Jones and Owens, and those against Weekley.

“What no one in that prosecutor’s office is able (or willing) to answer is why was Weekley undercharged with involuntary manslaughter, despite overwhelming evidence of premeditation and deliberation, elements for first degree murder! DPD and the raid team prepared, rehearsed, and discussed going into that home before the invasion. That is premeditation! Weekley also deliberated the pros and cons before and after he fired his gun, lying as he did on Mertilla Jones. DPD tried to do damage control and clean that lie up after the State Police crime scene results and the second autopsy came back seriously refuting Weekley’s lie that he accidentally shot the gun after grandma struggled with him over the weapon. Liars and killers! That’s what they are. You or I under similar factual scenarios would have been charged with MURDER.”

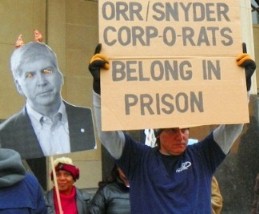

Weekley walks free, at home in Grosse Pointe Park, on personal bond to this day, nearly four years after he killed a little girl. A preliminary hearing for his re-trial was scheduled for Feb. 28, but Wayne County Prosecutor Kym Worthy’s office just announced, “ Joseph Weekley – Detroit Officer charged in connection with the death of Aiyana Stanley-Brown, who was fatally shot during a police raid. The judge is not available on the originally scheduled date of 2/28/14. A new date has not been announced by the court at this time.”

Even Aiyana’s name has been forgotten.

Weekley’s trial was repeatedly postponed earlier by Wayne County Circuit Court Judge Cynthia Gray Hathaway, who said several times from the bench that the Owens/Jones trial should proceed first.

Charles Jones faces sentencing March 13, and Chauncey Owens March 14. Aiyana’s family, meanwhile, has been torn apart by unimaginable grief and sorrow since her death and the charges brought against her father. Her great-aunt, who was present in the room during the police raid, died shortly afterward, as did another sister of Mertilla Jones. The family has suffered a host of illnesses, police harassment and arrests of its younger male members, among numerous other misfortunes.

Blake’s mother Lyvonne Cargill, reacted to the verdicts in published remarks, saying, “I’m just happy now. I can smile and sleep now.”

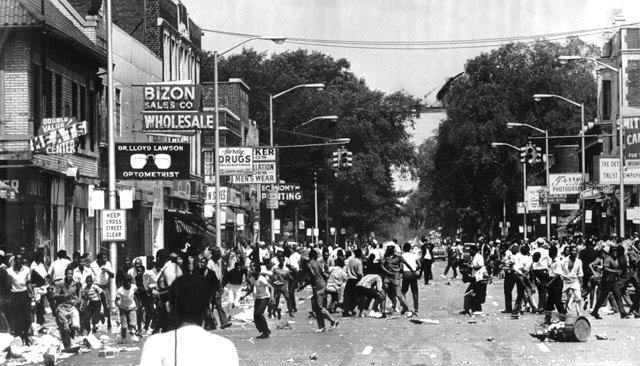

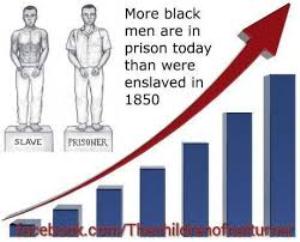

Angelo Henderson, the talk show host who repeatedly featured her on his show to push the police version of events, passed away two days after the Owens/Jones verdicts were given, at the age of 51 on Feb 15, 2014. Henderson and many others in the media falsely tried to equate the growing murderous menace of a police state with the violence born of oppression, poverty and despair in the Black community.

Related articles:

http://voiceofdetroit.net/2014/02/10/who-killed-detroits-jerean-blake-17-and-aiyana-jones-7/