- Detroit water department workers and their supporters march outside Coleman A. Young Center Aug. 2: SAVE WATER DEPT! SAVE DETROIT! STRIKE!

By Diane Bukowski

August 13, 2012

DETROIT — Michigan Governor Rick Snyder and Detroit Mayor Dave Bing, aided and abetted by the local daily media, are constantly insisting that Detroit’s Public Act 4 “Fiscal Stability (consent) Agreement” (FSA) is solidly in place despite the suspension of PA 4.

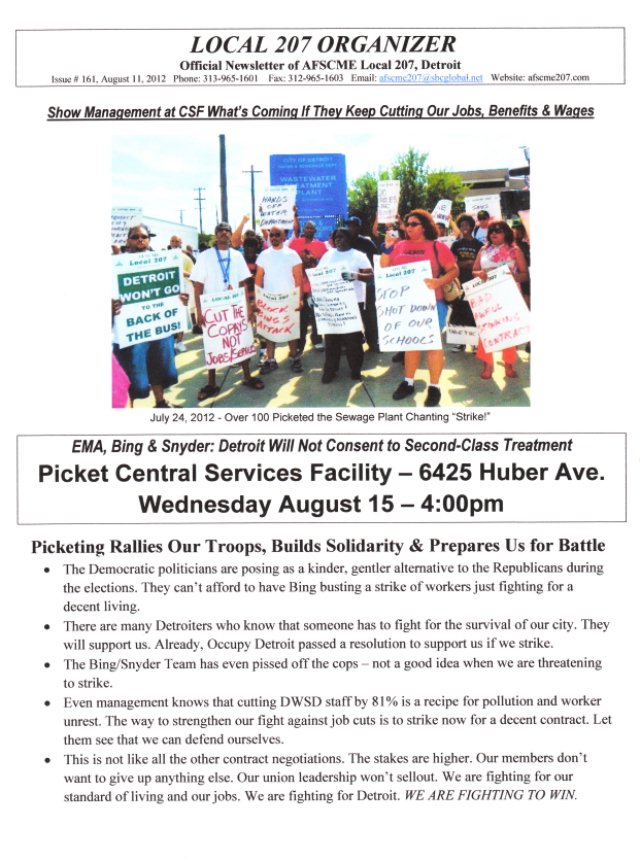

- Local 207 is mobilizing for a city-wide strike to save Detroit. This protest Aug. 2 was the second in a series planned across the city.

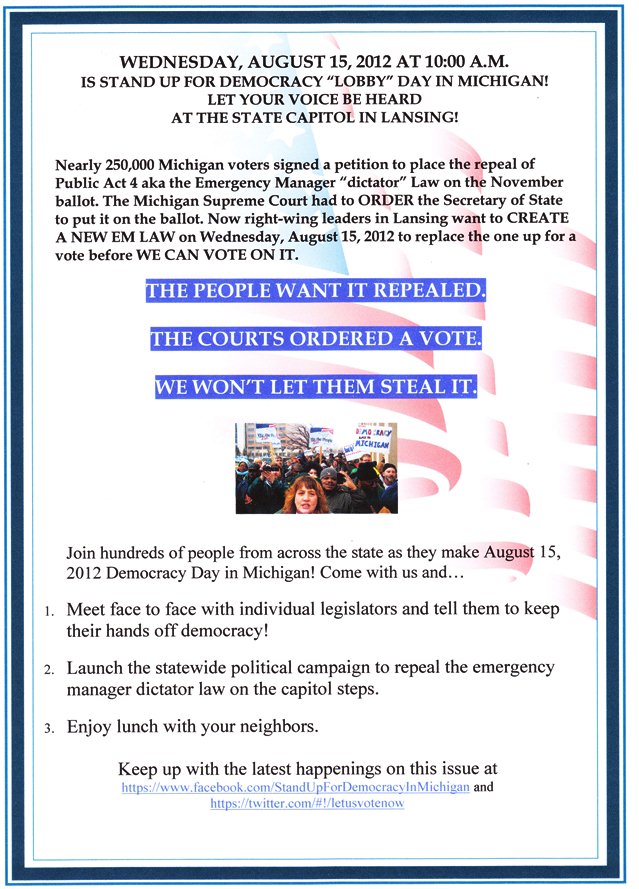

The State Board of Canvassers voted to place a measure that would repeal PA 4 on the ballot Aug.8, after the Michigan Supreme Court ordered them to do so. The Act is thus null and void until a popular vote in November, according to state law.

Bing told the Associated Press Aug. 12 that the suspension of PA 4 “shouldn’t change” what Detroit has already done under the FSA. That includes his shutdown of three federally funded departments, the unilateral imposition of a “City Employment Terms” edict on Detroit’s unionized workers, plans for thousands of lay-offs including 81 percent of the Detroit Water and Sewerage Department work force, and plans to lease Belle Isle to the State.

Regarding changes in four other cities and three school districts since the suspension of PA4, he told the AP, “They had an emergency manager. We have a financial agreement. That’s the difference. That’s a big difference.”

- Marchers blasted Bing during his 2010 State of the City address.

The city’s Corporation Counsel, attorneys for Stand Up for Democracy, members of Free Detroit-No Consent, city workers, and even Wall Street’s Fitch Ratings Agency disagree strongly with the Snyder-Bing stance.

The City Council is set to hold a special closed session Tues. Aug. 14 at 9:45 a.m. on specific matters related to the consent agreement. They will consider two Law Department opinions issued on the administration’s transfer of funds and equipment in the Detroit Workforce and Health and Wellness Promotion departments to private entities. Public comment is scheduled prior to the closed session.

(Click on CC Special Session -08-14-12 to view Council agenda, and on http://voiceofdetroit.net/2012/08/11/did-city-directors-steal-fed-for-private-agencies/ for earlier VOD story.)

- Detroit Corporation Counsel Krystal Crittendon

“Without an enabling statute, the State and City are not authorized to vitiate provisions in a home rule charter, which have been adopted through a vote of the people,” Corporation Counsel Krystal Crittendon told the Council in a formal opinion April 1.

“Although the city may enter into the proposed Agreement [FSA], the City Council should be cognizant of the possibility that the Agreement may be invalid if the petitions to repeal Public Act 4 are certified, or Public Act 4 is repealed. Further, although the City may enter into the proposed Agreement, the City Council should be cognizant of the potential legal challenges that may arise concerning the proposed Agreement.”

Crittendon cited numerous sections of the FSA which are enabled only through PA 4. She noted that even PA 4 does not authorize the establishment of the nine-member corporate-controlled Financial Advisory Board appointed under the FSA. Lawyers for the city’s unions have argued the city has no right to abrogate collective bargaining agreements, pursuant to state statutes not overturned by PA 4.

- Attorney Butch Hollowell (l) with City Councilwoman JoAnn Watson and Detroit NAACP head Wendell Anthony demand PA 4 go on ballot at Court of Appeals.

“Clearly, the financial stability agreement was negotiated within the Public Act 4 context,” Attorney Melvin “Butch” Hollowell, one of four lawyers who represented Stand Up for America, initiator of the PA 4 referendum, told the AP. “There is no court that wouldn’t understand that. You can’t put illegal provisions in a contract and expect them to hold up. . . . My sense is probably the actions going forward are under serious legal question. You can no longer impose your will by dictatorship.”

At a Council session Aug. 6, members of Free Detroit No Consent called on the Council to undo the harm they have already done by voting for the FSA. Many of the five Council members who voted for it have since expressed dismay at its consequences. Council President Charles Pugh has said he would not have voted for it if he had known it would mean union-busting.

- Free Detroit-No Consent truck outside CAYMC Aug. 7, 2012.

“I urge you to pass not a resolution but an ordinance pursuant to the Michigan Supreme Court decision,” Valerie Glenn of Free Detroit-No Consent said. Meanwhile U-Haul trucks ready to evict the Financial Advisory Board and officials including Project Manager Kriss Andrews circled the building with huge signs declaring “MOVE OUT NOW.”

Dr. Gloria House read parts of the group’s letter to the Council.

- Dr. Gloria House, Edith Lee Payne and Valerie Green asked City Council to undo the damages done by the consent agreement, during session Aug. 7, 2012.

“We in Free Detroit No Consent are confident that the people will vote to repeal Public Act 4 in November,” she said.

“In the intervening weeks, we call for the suspension of all measures that have been initiated by the emergency manager of Detroit schools and by the City Council through the Consent Agreement and the Financial Advisory Board. These decisions, which have violated the rights of workers to collective bargaining, allowed the dismantling of city agencies which provide health and welfare support to thousands of citizens, and fostered total chaos and demoralization in our public education system, must be reversed.”

She asked the City Council to take action to “undo the mistake it made by entering into the Fiscal Stability Agreement.”

Detroit City Council took oath to uphold the City Charter during their swearing-in ceremony.

In addition to possible legal challenges from the Council, the City Charter gives it the power to put the decision back in the hands of the people, where many have said it should have been in the first place.

- Andrew Daniels-El (r) with city charter during Call ’em Out rally to save water department Jan. 28, 2009. Agnes Hitchcock, Local 207 President John Riehl on stage.

Sec. 3.105 of the Charter says, “The City Council may submit, by resolution adopted not less than seventy (70) days before any election or special election, any proposal to the voters of the city.”

Thus the Council still has time to submit a proposal to voters asking them to affirm or negate the FSA Nov. 6. Such a move would cut short the long-drawn out legal process that PA 4 advocates have counted on to dismantle Detroit.

Even Fitch Ratings recognized the impact of the suspension of PA 4 on the FSA.

- Fitch Ratings said PA 4 repeal may nullify Detroit consent agreement.

“As Detroit’s fiscal stability agreement has several features that rely on the existence of PA 4, most notably the ability to suspend collective bargaining, the repeal of PA4 could weaken or nullify the agreement,” Fitch Ratings said in a statement after the state Supreme Court ruling.

During the Council session Aug. 7, Tyrone Travis of Free Detroit, and the Coalition to Stop Privatization and Save Our City, called on the people themselves to take action.

- Tyrone Travis and Valerie Burris of Free Detroit No Consent address city council Aug. 7 in opposition to consent agreement.

“They are treating Detroiters like N’s,” Travis said. “I call on Detroiters not to vote for any bonds, and on elected officials to put any taxes to the state in escrow. Then prepare to shut the city down. They have condemned us to slavery and our children to prison.”

Valerie Burris said, “We can take our power back. The Detroit Free Press and News websites are full of racist comments from suburbanites against our city. The city has been overtaken by corporate rulers putting public power in private hands.”

- Water department workers and supporters at CAYMC Aug. 2, 2012.

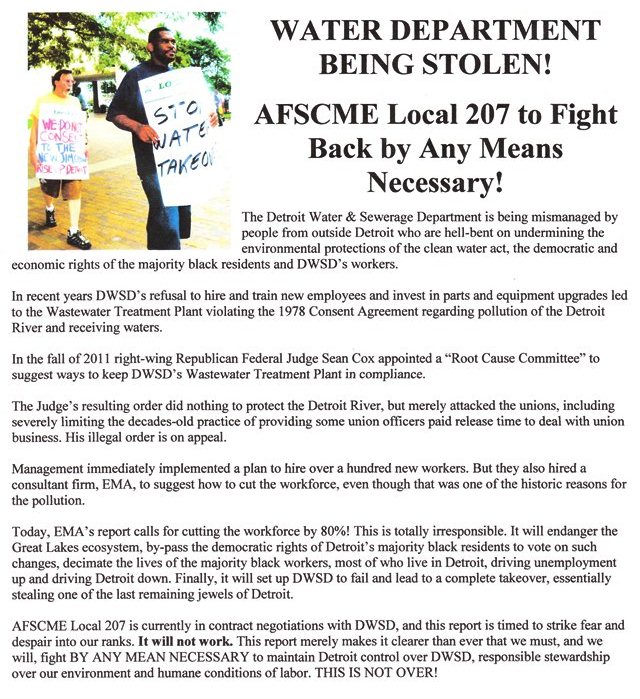

On Aug. 2, city water department workers and their supporters marched again in front of the Coleman A. Young Municipal Center. Members of Local 207 of the American Federation of State, County and Municipal Employees (AFSCME) are mobilizing for a city-wide strike against the city’s proposals in DWSD, by DWSD workers as well as the rest of the city. (See Local 207 newsletter below this story.)

Meanwhile, the Metro Times published an article Aug. 8 blaming global banks for the distress of cities like Detroit, but only advocating bankruptcy as a solution. Many activists are calling instead for a moratorium on Detroit’s $12.6 billion debt to the banks, which have already profited from trillions in taxpayer bail-out dollars.

Detroiters campaign for moratorium on city’s debt to the banks May 9, 2012 at CAYMC.

The city of Detroit’s Assessors office is out of paper. Completely out of paper. They need paper to make the city’s cheddar, so to speak. The division cannot function without paper. You might think it is a small thing, but what business can function without paper?

The city of Detroit’s Assessors office is out of paper. Completely out of paper. They need paper to make the city’s cheddar, so to speak. The division cannot function without paper. You might think it is a small thing, but what business can function without paper?