Detroit Mayor Mike Duggan unveils plans for Great Lakes Water Authority as (l to r) Macomb County Executive Mark Hackel, Oakland County Executive L. Brooks Patterson, and Wayne County Executive Robert Ficano listen Sept. 9, 2014.

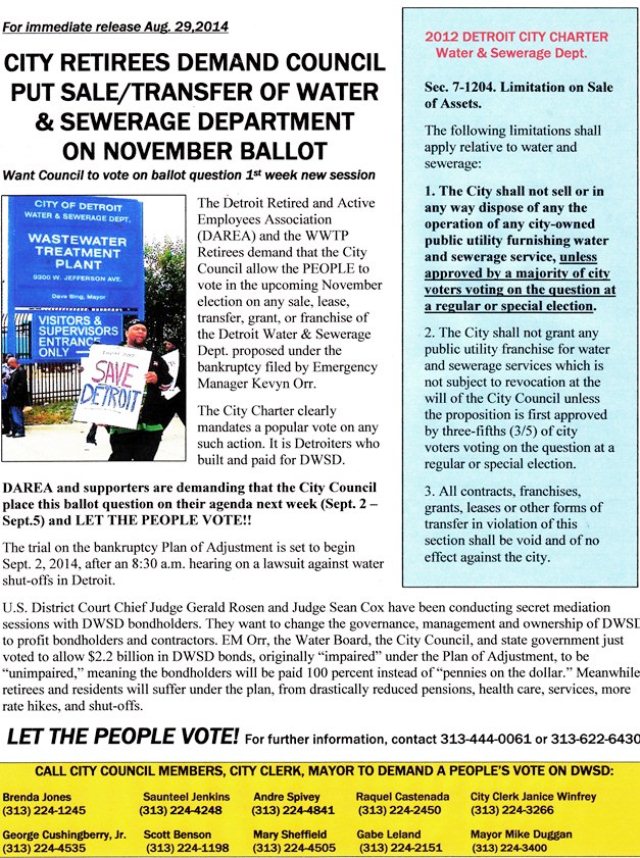

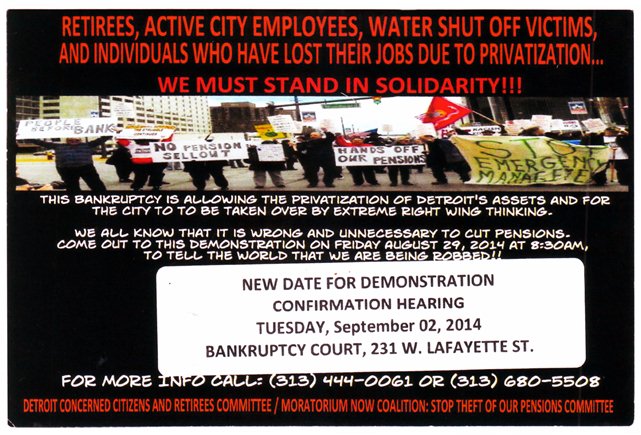

City retirees demand plan go on ballot for vote of the people

DWSD gets annual $50 million lease payments for 40 years, in exchange for GLWA control of multi-billion dollar six-county system

Detroit Water & Sewerage Dept. consigned to city limits

Banks, suburban pols profit from bonds, contracts; Wall Street celebrates

New regional water “affordability” plan will not bar shut-offs or lower rates for low-income households

By Diane Bukowski

September 9, 2014

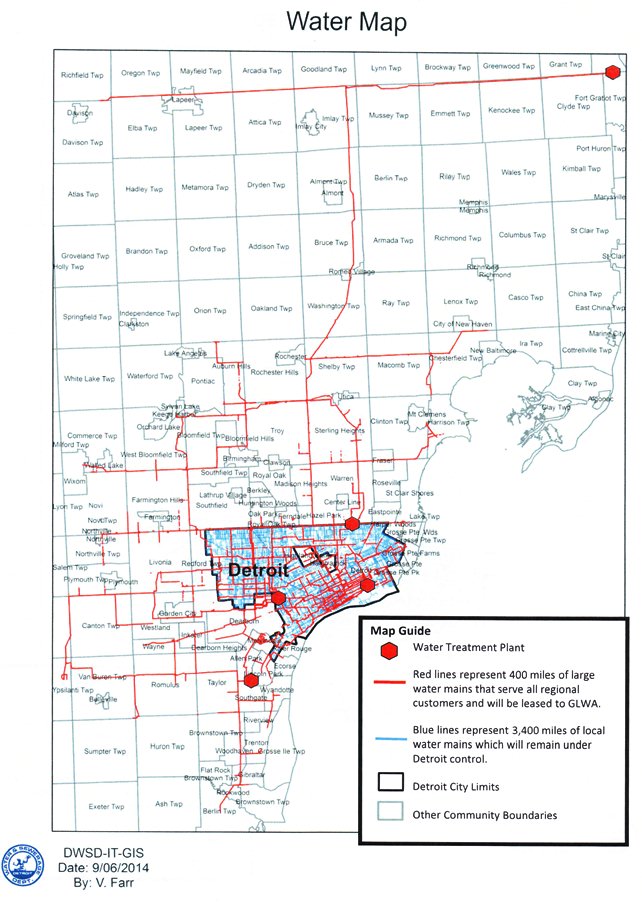

Duggan targets Detroit on map of DWSD, saying it will now operate only within city boundaries Sept. 9, 2014.

DETROIT – The all-white quartet of Detroit Mayor Mike Duggan and County Executives L. Brooks Patterson, Robert Ficano, and Mark Hackel today proposed the creation of a regional “Great Lakes Water Authority” (GLWA), to be up and running within “200 days.” They announced they had just signed a Memorandum of Understanding. Also signing were Emergency Manager Kevyn Orr and Michigan Governor Rick Snyder.

The GLWA would divest the City of Detroit, the largest major Black-majority city in the U.S., of its largest and most lucrative asset, the 150 year old, six-county Water and Sewerage Department (DWSD), the third largest in the U.S. In exchange, DWSD would receive $50 million a year “lease” payments for an initial period of the next 40 years, “extendable to at least match the terms of any outstanding bonds of the Authority.”

(Click on GLWA plan for packet given to media, and on http://www.dwsd.org/downloads_n/announcements/general_announcements/ga2014-09-09_regional_authority_MOU_executed.pdf to read full MOU.)

DWSD’s Lake Huron water treatment plant. DWSD is the third largest water utllity in the country. It provides water service to almost one million people in Detroit and three million people in 126 neighboring Southeastern Michigan communities throughout Wayne, Oakland, Macomb St. Clair, Lapeer, Genesee, Washtenaw and Monroe counties.

The lease payments would be used for “Detroit local system infrastructure improvements, debt service associated with such improvements, or the City’s share of the cost of common-to-all improvements.”

Under terms of the MOU, only DWSD, not the GLWA, would have “liability . . . for funding the City’s frozen General Retirement System (GRS) pension plan . . . and the City’s settlement of claims associated with the swaps for its Pension Obligation Certifications, and for payments relating to debt service on DWSD’s allocated share of liability on the new B Notes attributable to the GRS VEBA [employee health plan] and Pension Obligation Certificates.”

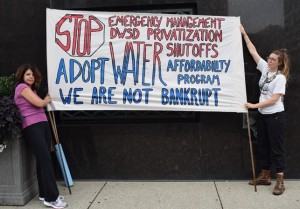

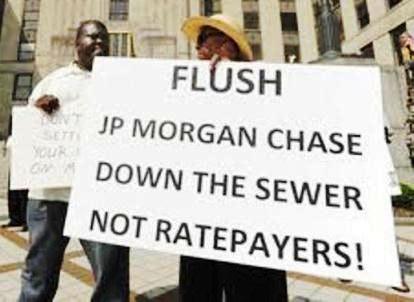

- Couple demands no privatization of water systems.

The officials at the press conference had claimed that the lease payments would go to the DWSD, not the city’s general fund as had been originally proposed, but it is clear from the above clause in the MOU that they would go largely to Wall Street.

Duggan said Detroit’s infrastructure will see immediate improvements under the GLWA, but neglected to mention the following proviso in the MOU:

“The Authority will finance Detroit local system improvements through the issuance of Authority bonds under the Revenue Bond Act, with the debt service to be allocated solely to Detroit local system ratepayers.”

Although all four of the officials denied there is any plan to privatize the GLWA or the DWSD, the actual MOU says the GLWA board could adopt a procurement policy “which will include the terms on which any aspect of the operations of either system may be privatized.” The world’s second largest water privatizer, Veolia, Inc., has already been hired by DWSD, allegedly as a consultant.

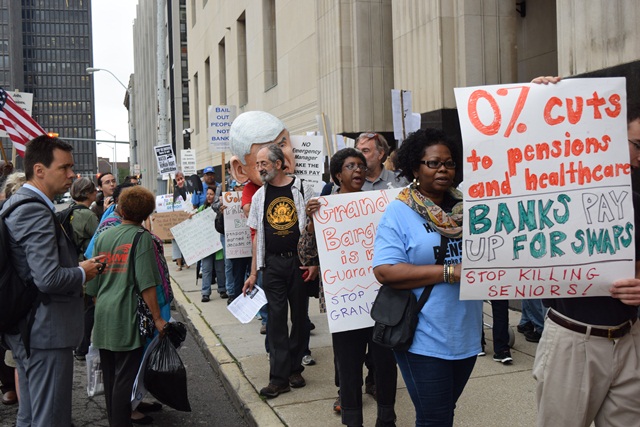

Protesters at opening of bankruptcy plan trial Sept. 2, 2014.

Wall Street celebrated the plan, according to Bloomberg.

“After the announcement, Detroit’s 5.75 percent sewer bonds due in 2031 climbed more than 5 percent to 111.7 cents on the dollar, according to data compiled by Bloomberg,” the newspaper wrote.

Wall Street ratings agencies had been steadily downgrading DWSD bond ratings, citing the enterprise agency’s association with the City of Detroit and the bankruptcy filing. Such downgrades increased interest rates on DWSD bonds. However, DWSD for years had AAA ratings.

- U.S. District Court Judge Sean Cox

Despite DWSD’s technical dissociation from Detroit’s general fund, the GLWA proposal resulted from months of mediation ordered by U.S. Bankruptcy Judge Steven Rhodes, who assigned U.S. District Court Chief Judge Gerald Rosen as mediator.

Rosen later brought in U.S. District Judge Sean Cox. Cox earlier handed over “supermajority” control of the Board of Water Commissioners, including awarding of contracts and setting rates, to the Counties in 2011. Both Rosen and Cox are members of the ultraconservative Federalist Society.

Duggan said the yearly lease payments would allow Detroit to repair water main breaks, which numbered 2,000 last year. According to a proposal summary, however, the money could also be used to buy up to $800 million in bonds for system-wide repairs.

“Somebody needs to go to jail, and somebody needs to go to hell,” reacted outraged city retirees, barred from attending the press conference at the Federal courthouse in downtown Detroit.

Detroit retirees (l to r) Belinda Myers Florence, Laverne Holloway, Cecily McClellan and Bill Smith discuss ramifications of GLWA plan after being barred from press conference.

“The people of Detroit should demand their right to vote on this, guaranteed in the City Charter,” said Bill Davis, who retired as Wastewater Treatment Plant (WWTP) shift supervisor after 34 years.

“The counties are buying into something they know nothing about, a system that because of Kevyn Orr’s mismanagement is operating with non-functional main sewage pumps, causing last month’s massive flooding. They claim they don’t have the money for repairs, well get it from the banks who are robbing us.”

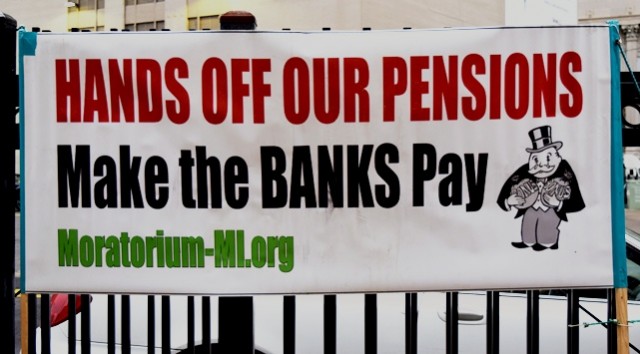

Orr’s recently announced DWSD debt “restructuring” includes full payment to the banks of $2.2 billion that had originally been considered “impaired,” with the city asking the banks to settle for less. Much DWSD debt is the result of predatory lending, including $537 million in illegal swaps.

- Protesters in Birmingham, Ala. protest higher rates imposed in Jefferson County bankruptcy, even though Chase was forced to take 75% debt cut.

“The money used to unwind the swaps would almost cover the utility’s $571.7 million in planned capital spending for the five years through June 2016, according to bond documents.” said a 2012 Bloomberg News article titled, “Detroit Debt Shows Wall Street Never Loses on Bad Swaps.”

“Or it would be enough for the sewer system’s $519.8 million fiscal 2013 budget, with millions to spare.”

The swaps involved JPMorgan Chase, which Jefferson County, Alabama forced to take a 75 percent cut in its debt payments as part of their bankruptcy case. The County had filed suit previously due to evidence of bribery in sewerage contract awards. Sewerage rates, however, still increased dramatically.

-

Gov. Rick Snyder announces appointment of Kevyn Orr as EM March 14, 2013.

- Gov. Rick Snyder announces appointment of Kevyn Orr as EM March 14, 2013.

“This ends 40 years of conflict between the city and the suburbs,” Duggan said.

“It was a pretty remarkable accomplishment that we all came together in support of Governor Rick Snyder and Emergency Manager Kevyn Orr’s plan. The department has been under federal oversight since 1977, but it did not work. We have 2,000 water main breaks a year and constant rate hikes.”

Duggan lived in suburban Livonia until he moved to Detroit, a couple weeks short of the deadline for filing. He was barred from running by the Court of Appeals, but conducted a write-in campaign which the Court did not overturn.

He said Snyder’s top aide, Richard Baird, and U.S. District Court Judge Sean Cox, who succeeded Judge John Feikens as DWSD overseer, initiating suburban control of the Board of Water Commissioners, played major roles in brokering the deal.

The twelve-point proposal would be incorporated into yet another amended Plan of Adjustment for U.S. Bankruptcy Judge Steven Rhodes’ final okay, after the Detroit City Council and the County Commissions approve it, Duggan said.

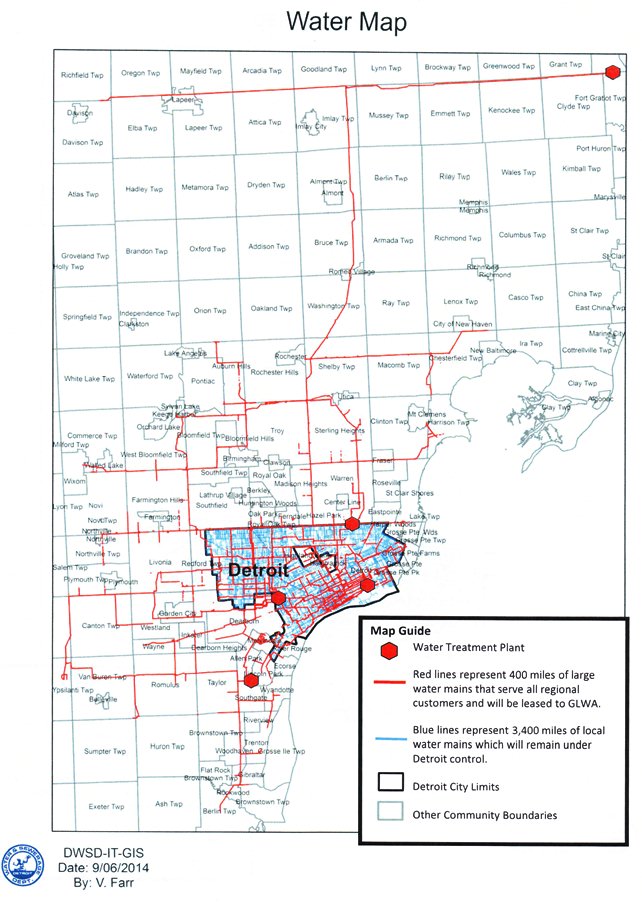

Red lines and boxes (water and sewer plants) depict proposed GLWA territory; blue lines within Detroit boundaries depict secondary mains to be under DWSD control.

“Detroit keeps exclusive control of the local water and sewer system in DWSD, under the authority of the Mayor and City Council,” the plan says. “The Detroit local system is made up of 3,400 miles of local water mains serving the neighborhoods of Detroit.”

DWSD would thus be carved down into a system that exists only within city boundaries. But even the department’s assets within those boundaries, including its wastewater and freshwater treatment plants, and its major water mains, would operate under the Authority’s control, as shown in the diagram above. The red lines indicate GLWA operated plants and mains.

WWTP workers struck Sept. 30, 2012, declaring on sign, “The battle for Detroit begins here and now.” The strike was sabotaged by top leaders of AFSCME Council 25; now they are left with the theft of DWSD. Most DWSD workers are Black.

Nine hundred of 1400 DWSD workers would become GLWA workers, including those at the Detroit Wastewater Treatment Plant, with their union contracts transferred under successor clauses. Duggan said he met with union leaders at 7:30 a.m. about the proposal, and planned to meet with Wastewater Treatment Plant workers themselves later today.

- Lakita Thomas, Secretary-Treasurer AFSCME Local 207.

Lakita Thomas, secretary-treasurer of AFSCME Local 207, which originally represented most WWTP workers, said Duggan refused to negotiate with them at the 7:30 a.m. meeting.

“They’re giving the Department away, and the GLWA will maintain control of the money,” Thomas said. “DWSD takes in billions a month. [DWSD director] Sue McCormick has been designing it to fail. They’ve been having contractors repair water main breaks and piping, but they don’t know what they’re doing and our people have to come after them to fix things. The contractors are the ones causing the sinkholes. We get no raises, but the contractors get six and seven-figure amounts. They’ve been suspending our people and writing them up on dumb charges, and they threaten them if they expose the real problems.”

Under McCormick, the Board of Water Commissioners hired EMA, Inc., a consultant which recommended the elimination of 81 percent of the DWSD workforce. According to Local 207 Vice-President Mike Mulholland, EMA now runs the WWTP and is largely responsible for the lack of maintenance of the crucial sewage pumps. He earlier said that not only has WWTP deterioration caused the recent floods in Detroit, the outflow of raw sewage into the Detroit River also contributed to the contamination of Lake Erie, which resulted in last month’s water emergency in Toledo.

- Union members demand jobs for Detroit youth, not contractors, during May 27, 2010 protest.

“As a Detroiter, I’m against giving anything more to the suburbs flat out,” Mulholland told VOD.

“They’re calling it a lease, but we’ve lost control. From my standpoint as a long-time DWSD worker and senior union officer, this further breaks up DWSD, disempowers the workers, and sets it up for privatization. Veolia is already here, ready to take over. They’re doing this under the political cover of bankruptcy; they don’t legally have to do it. But what is currently legal is wrong. Anything we do now to fight for the workers, especially Black workers and residents, will be illegal, but we must stand up and fight back.”

Duggan claimed that new repairs to Detroit’s DWSD infrastructure will provide “thousands of jobs” for Detroiters, but Davis estimated that 90 percent of the contractors working on street mains and other repairs are suburban whites. The MOU says only, “The Authority shall make every effort to employ individuals and contract with vendors from throughout the service areas,” in other words the entire six-county region.

Water Department unions announce lawsuit challenging Cox’s order handing control of BOWC to suburbs, attacking workers’ rights, in 2011.

Thomas said that during the session, the union refused to drop a Michigan Council 25 lawsuit against Cox’s Nov. 2011 order, which essentially wrested control of the Board of Water Commissioners and the Department away from Detroit, and outlined blanket attacks against union contracts and protections. That lawsuit is still pending before the Sixth Circuit Court of Appeals, having been filed two years before Orr petitioned for bankruptcy. (Click on Cox-Co-25-motion-to-intervene-11-14-11 to read lawsuit.)

It therefore holds out some hope for counteracting the GLWA takeover. AFSCME and the UAW earlier pledged to give up other appeals of Judge Rhodes’ bankruptcy eligibility decision pending at the Sixth Circuit if the city’s Plan of Adjustment is confirmed with the “Grand Bargain” in place.

- City retiree Ezza Brandon was one of dozens of retirees who picketed AFSCME Co. 25 headquarters last month for the union leadership’s agreement to the Plan of Adjustment.

City retirees picketed outside AFSCME Council 25’s headquarters in Detroit when they discovered the monumental sell-out.

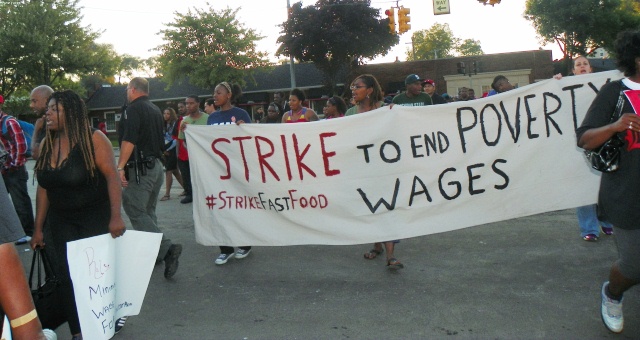

“It’s happening to thousands and thousands of workers everywhere,” one protester said. “Where is our union leadership’s compassion, why aren’t they fighting? How are the unions even going to survive if they don’t stand up? Do they suddenly have a ‘new purpose’ for existing?”

The GLWA would essentially be controlled by the Governor’s office. It would be run by a six-member board, with a five member super-majority required to approve contracts, rates, budgets, and other financial matters. Two members would be appointed by Detroit’s mayor, one by the governor, and one each by the three county executives.

- Macomb County Executive Mark Hackel.

However, if a county commission does not buy into the authority, the Governor would appoint someone to occupy that position.

Macomb County Executive Mark Hackel said there is some reluctance on the part of his officials to agree to the plan, and that he does not like the provision regarding Snyder’s appointment powers. All three counties had filed objections to the Plan of Adjustment, but Ficano and Patterson said they would withdraw their counties’ objections if their commissions approve the GLWA.

“It took 15 months of intense bargaining and negotiations resulting in the Memorandum of Understanding which we signed this morning,” Patterson said. “It goes against my DNA, but many Oakland County residents looked at DWSD as a cash cow for the City of Detroit because revenues from the department’s rates were being used for the city’s general fund.”

Patterson’s statement on that was a blatant falsehood. As an enterprise agency, DWSD revenues by law are mandated to benefit only DWSD, not Detroit’s general fund. An original proposal for the $50 million a year to go to Detroit’s general fund to aid in the bankruptcy case was apparently a sticking point at least for Patterson. Under the GLWA, however, all revenues go for water and sewerage purposes, leaving open the question of why it should even be involved in bankruptcy discussions.

- Oakland Co. Executive L. Brooks Patterson.

Patterson also said he feared that Judge Rhodes would “cram down” terms of the deal if it was not agreed to by the parties, and would not be as “conscious” as they are.

The reference to his “DNA” was ironic. Several years ago, he likened Black women members of the Detroit City Council to “monkeys in a zoo.” He also represented anti-school busing Ku Klux Klan members, arrested in the early 1970’s after they attacked protesters against Irene McCabe, another anti-busing agitator, in Oakland County.

The proposal sets a 10-year limit on rate increases of four percent, but Patterson made clear that customers’ bills could increase far beyond that if the local communities involved attach additional charges, a situation which has always existed.

Generally, suburban officials have ignored that reality when criticizing Detroit’s control of DWSD, using rate increases to whip up their constituents’ hostility toward the city.

- Lame duck Wayne County Executive Robert Ficano.

As for Ficano, tied to numerous corruption cases involving his officials, he expressed support for the plan, not surprisingly, since many aspects derive from EMA, Inc. proposals to cut 81 percent of DWSD staff and cross-train the others.

Wayne County under the Ficano machine first hired EMA, Inc. in 2008, in a contract involving Downriver Wastewater Treatment Facilities Operation and Management, despite EMA’s known history of sabotaging sewerage operations in Toronto, where understaffing caused massive flooding in 2012, and in New York City, according to county worker Jackson Anderson.

“Ficano’s people are running the City’s Water Department (James Fausone, water board chair, Matthew Schenk, DWSD COO, Woolfson, etc.),” Anderson said in an earlier VOD commentary. “How can you justify a $48 million NO-BID CONTRACT to EMA based on a 90-day self-serving review?”

The GLWA proposal creates a $4.5 million Water Residential Affordability Program (WRAP), not only for Detroit residents but for the entire region covered by the GLWA. It does not include a moratorium on water shut-offs, or a true “water affordability” program that would set rates according to a household’s income.

Protesters block entrance to contractor Homrich facility to stop water shutoffs last month. They sustained nine arrests.

Duggan compared the WRAP to the $200,000 which the City of Detroit has collected in donations so far for its “Water Affordability Plan,” but neglected to mention that WRAP covers a much larger area.

Judge Rhodes is still to rule on a lawsuit asking for a temporary restraining order on water shut-offs in Detroit, after a hearing set for Sept. 17. He ordered mediation on that matter in addition to the DWSD mediation.

If the results of the DWSD mediation are any indication, the shut-offs mediation cannot be expected to yield any more than the plan the City of Detroit has already put in place. It does not bar shut-offs, although in the United Kingdom and other countries, water shut-offs are outlawed as a threat to public health and safety.

(The statement below from the People’s Water Board is being republished here; it does not mean their organization necessarily supports all the contents of the story above.)

PEOPLE’S WATER BOARD STATEMENT ON CREATION OF REGIONAL WATER AUTHORITY

People’s Water Board Coalition Calls Regional Water Authority an Assault Against Democracy and the Human Right to Water

Community calls for protection and representation for all region’s residents

Detroit, Mich. – The People’s Water Board decried Mayor Mike Duggan’s plan to create a regional water authority as undemocratic and a threat to the human right to water for many in the region. We have access to the largest body of surface freshwater in the world, so it would seem abundance and access should not be an issue. However the manner of governing this valuable resource as responsible environmental stewards for the world has left many communities without trust.

Detroit, Mich. – The People’s Water Board decried Mayor Mike Duggan’s plan to create a regional water authority as undemocratic and a threat to the human right to water for many in the region. We have access to the largest body of surface freshwater in the world, so it would seem abundance and access should not be an issue. However the manner of governing this valuable resource as responsible environmental stewards for the world has left many communities without trust.

The deal was negotiated behind closed doors without any input from the public and is the next step on the pathway to privatization. It takes away the rights of both the Detroit City Council and the citizens of Detroit to have input on big decisions impacting the system.

“Suburban customers should not be fooled into thinking that this deal gives them more control or influence over the water system,” said Lynna Kaucheck of the People’s Water Board. “The new authority will be made up of unelected officials who are accountable to no one. People need to know that this deal doesn’t take privatization off the table.”

- There is a global campaign to dump Veolia contracts because of the company’s connection with Israeli apartheid actions against the Palestinians. See link below,

Veolia Water North America, the largest private water company operating in the United States, has been hired to evaluate the management of the system and clearly has a vested interest in privatization. Privatization typically results in skyrocketing rates, decreased service quality and the loss of jobs. In fact, corporate profits, dividends and income taxes can add 20 to 30 percent to operation and maintenance costs, and a lack of competition and poor negotiation skills can leave local governments with expensive contracts.

In the Great Lakes region, large private water companies charge more than twice as much as cities charge for household water service. This is not the solution for Detroit or the region.

“The regionalization plan is unacceptable. We need a system that is accountable and transparent and that works for all its customers,” said Tawana Petty of the People’s Water Board. “We want an elected board of water commissioners. We want to reduce costs for the region through bulk purchasing and resource sharing. And we want to implement the Affordability Plan as passed by Detroit City Council in 2005. Detroit and suburban leaders need to protect residents and democratize the system.”

The People’s Water Board advocates for access, protection, and conservation of water, and promotes awareness of the interconnectedness of all people and resources.

People’s Water Board Coalition protest outside Water Board Building,

The People’s Water Board includes: AFSCME Local 207, Baxter’s Beat Back the Bullies Brigade, Detroit Black Community Food Security Network, Detroit Green Party, Detroit People’s Platform, Detroiters Resisting Emergency Management, East Michigan Environmental Action Council, Food & Water Watch, FLOW, Great Lakes Bioneers Detroit, Matrix Theater, Michigan Coalition for Human Rights, Michigan Emergency Committee Against War & Injustice, Michigan Welfare Rights Organization, Rosa and Raymond Parks Institute, Sierra Club, Sisters of Mercy, Voices for Earth Justice and We the People of Detroit. September 10, 2014 Contact: Lynna Kaucheck, Food & Water Watch, (586) 556-8805 Tawana Petty, People’s Water Board, (313) 433-9882

Some recent and previous articles related to this story:

http://electronicintifada.net/blogs/nora/los-angeles-activists-put-veolias-complicity-israels-human-rights-violations-spotlight

http://voiceofdetroit.net/2014/09/06/racist-bankruptcy-plan-hearing-sanctions-theft-of-detroit/

http://voiceofdetroit.net/2014/08/31/march-vs-detroit-bankruptcy-sept-2-retirees-demand-council-put-water-dept-sale-on-ballot/

http://voiceofdetroit.net/2014/08/26/detroiters-ask-judge-to-bar-water-shut-offs-until-lawsuit-resolved-hearing-tues-sept-2/

http://voiceofdetroit.net/2014/08/21/near-catastrophic-failure-of-detroit-sewage-pumps-caused-detroit-floods-toledo-water-crisis-city-retirees-say/

http://voiceofdetroit.net/2014/08/13/detroit-retirees-water-affordability-plan-make-the-banks-pay-press-conference-wed-aug-13-3-pm/

http://voiceofdetroit.net/2014/08/07/retiree-groups-unions-to-nix-detroit-bankruptcy-eligibility-appeals-at-6th-circuit-after-trial/

http://voiceofdetroit.net/2014/07/31/retirees-picket-afscme-for-withdrawing-detroit-bankruptcy-appeal/

http://voiceofdetroit.net/2012/10/01/ema-which-proposed-dwsd-cuts-tied-to-ficano-heise/

http://www.freep.com/article/20120710/NEWS02/207100354/Ficano-s-ex-appointees-get-six-figure-jobs-at-Detroit-water-department

http://voiceofdetroit.net/2012/09/09/board-passes-48-m-5-yr-ema-contract-to-cut-81-of-detroit-water-workforce/

http://voiceofdetroit.net/2012/08/22/toronto-under-water-sewage-in-wake-of-ema-plan/

http://voiceofdetroit.net/2011/11/16/union-challenges-cox%e2%80%99s-water-dept-takeover-order/

http://voiceofdetroit.net/2011/11/10/cox-axes-detroiters-control-over-water-department/

http://voiceofdetroit.net/2011/02/13/judge-cox-mayor-bing-suburban-leaders-conspire-in-water-takeover-violate-city-charter/

http://voiceofdetroit.net/2011/02/13/judge-cox-mayor-bing-suburban-leaders-conspire-in-water-takeover-violate-city-charter/

http://voiceofdetroit.net/2011/01/26/stop-takeover-of-detroits-water/

By Steven Church – Sep 15, 2014

By Steven Church – Sep 15, 2014 While the settlement with Syncora may help speed Detroit’s record municipal bankruptcy to completion, FGIC remains a significant obstacle, as it faces claims on about $1.1 billion in pension debt it insured. The city planned to almost wipe out that debt, offering holders only about 10 cents on the dollar.

While the settlement with Syncora may help speed Detroit’s record municipal bankruptcy to completion, FGIC remains a significant obstacle, as it faces claims on about $1.1 billion in pension debt it insured. The city planned to almost wipe out that debt, offering holders only about 10 cents on the dollar.