Detroit Residents Say No To Bankruptcy! Federal Judge Rhodes Say Yes! – – A No Struggle, No Development Production! Published Dec. 3, 2o13

By Kenny Snodgrass, Activist, Photographer, Videographer, Author of

1} From Victimization To Empowerment… www.trafford.com/07-0913 eBook available at www.ebookstore.sony.com

2} The World As I’ve Seen It! My Greatest Experience! {Photo Book}

YouTube: I have over 486 Video’s, 343 Subscribers, over 219,000 hits, now averaging 10,000 monthly on my YouTube channel @ www.YouTube.com/KennySnod

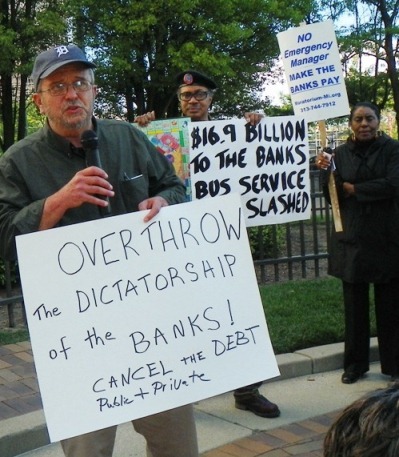

Protesters rally outside federal courthouse Oct. 23, 2013 at start of eligibility trial (AP Photo/Paul Sancya)

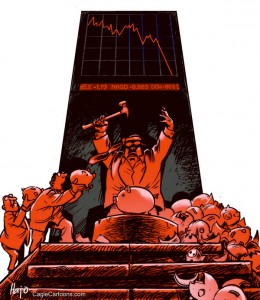

Judge Rhodes hits pension rights, declares EM law PA 436 constitutional

Retirees, residents, workers stunned; cities across U.S. in danger

Pension systems, unions request immediate appeal to 6th Circuit Court

Detroit Debt Moratorium calls for mobilization in the streets

December 7, 2013

Analysis

By Diane Bukowski

U.S. Bankruptcy Judge Steven Rhodes at Oct. 10, 2012 forum on Chapter 9 bankruptcy and EM’s, dominated by pro-EM speakers including Charles Moore of Conway McKenzie, chief witness at eligibility trial. Rhodes refused to recuse himself despite clear conflict of interest.

DETROIT – Detroiters reacted with horror and outrage to U.S. Bankruptcy Court Judge Steven W. Rhodes’ ruling on the city’s eligibility for Chapter 9 bankruptcy, handed down orally Dec. 3 and in writing Dec. 5. In his opinion, Rhodes for the first time nationally threw a dagger directly into the heart of state-protected workers’ pension rights.

He also upheld the constitutionality of Public Act 436, the state’s hated “emergency manager” (EM) law, arrogating to himself what objectors have said belongs in the realm of U.S. District and other higher level courts.

His ruling was so severe that even the city’s mainstream newspaper, The Detroit Free Press, published an editorial, “Snyder Must Uphold State Constitutional Protection of Pensions.”

- The 1963 Michigan Constitution was written at the Lansing Civic Arena. This Michigan Legal Milestone plaque was first dedicated in 1989.

“The City of Detroit made promises to its workers, promises it can no longer keep,” wrote the Freep’s editorial board. “And in 1963, the residents of Michigan chose to approve a constitution that protected pensions. Gov. Rick Snyder took an oath to uphold that constitution. And now he must. That’s the thing about oaths. You have to keep them, even when it’s difficult, or inconvenient. Or not politically expedient.” http://www.freep.com/apps/pbcs.dll/article?AID=2013312050030

The Freep even called on Snyder to “pick up the tab for the pension debt” if Michigan Attorney General Bill Schuette fails in his appeal of the ruling.

RHODES: ‘FOREGONE CONCLUSION’

The ruling was the direct outcome of a years-long conspiracy among the banks holding Detroit’s debt, the U.S. government, Michigan Gov. Rick Snyder, and Detroit EM Kevyn Orr, with Judge Rhodes himself a key plotter.

Banks UBS AG and Siebert Brandford and Shank, with help of (l to r) former Detrot CFO Sean Werdlow, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard and Poor’s, and former Deputy Mayor Anthony Adams foist disastrous $1.44 billion POC loan on City Council Jan. 31, 2005. Werdlow then joined Siebert as top manager in Nov. 2005. The debt later ballooned to $2.28 billion after 2008 global economic crash. Cancel the criminal debt!

“Was the city’s bankruptcy filing a foregone conclusion?” Rhodes asked during his oral summary. “Yes it was, for a long period of time. . . .The Court must conclude that the bankruptcy filing by the City of Detroit was a foregone conclusion during all of 2013.” (See article below with key elements from Rhodes’ decision and related factors he failed to cite.)

In his opinion, Rhodes overruled an objection requesting an investigation of apparent blatant criminal fraud by global banks involving the city’s $2.28 billion Pension Obligation Certificates (POC or COPS) debt. He earlier refused to recuse himself for chairing an Oct. 2012 forum on Chapter 9 and Emergency Managers. All but one of the forum’s six speakers were active supporters of the state’s EM laws. They included accountant Charles Moore of Conway McKenzie, a chief witness for Orr during the trial. No one from Detroit’s pension systems, unions, or community-at-large spoke.

Forum on Ch 9 and EM’s Oct. 10, 2012: Frederick Headen of state treasury, participant in dozens of takeovers; Atty. Edward Plawecki, Judge Rhodes, Attys. Douglas Bernstein and Judy ONeill, both EM trainers, with O’Neill a co-author of PA 4, Accountant Charles Moore of Conway McKenzie, a chief witness for Orr at the eligibility trial who admitted that his claim of $3.5 billion pension underfunding was never finalized.

“This is the worst decision in the country,” said Attorney Jerome Goldberg, who represents city water department retiree and objector David Sole, a leader of the Detroit Debt Moratorium Coalition.

“It gives the green light for municipalities all over the U.S. to take similar actions,” Goldberg explained. “Judge Rhodes bought the arguments of Jones Day attorneys [hired under state control to represent the city] lock, stock and barrel. He made no mention of the global banks’ role in the destruction of Detroit. He summed up the malevolent character of his decision at its end, where he said that retirees, who have worked all their lives for their pensions, should now look to charitable institutions and social services to survive.”

The cities of Stockton and San Bernadino CA, which have so far preserved California Public Employees Retirement Systems (CalPERS) pensions in their plans of adjustment due to state constitutional protections similar to those of Michigan’s, may now re-consider. The judges in those cases did not make a ruling on pension rights in their eligibility decisions, leaving that to be worked out in the plan of adjustment.

Protester outside Detroit Mayor Dave Bing’s State of the City address. Bing tried three years ago to take over the city’s pension funds.

“Even though Stockton left its CalPERS payments untouched and made debt-restructuring deals with most of its other creditors in October, the city still hasn’t reached agreement with one major lender, Franklin Templeton,” the Sacramento Bee reported. “The Detroit decision could give the Franklin firm an opening to demand that Stockton officials treat CalPERS like every other creditor . . .”

For a plan of adjustment to be approved under bankruptcy, the majority of creditors must agree, or the bankruptcy judge can exercise the so-called “cram-down” provisions of Chapter 9 to force a resolution.

Goldberg, who told VOD earlier that he thought Rhodes would not rule on the pension issue until the “plan of adjustment” phase of the bankruptcy proceedings, said it is clear that the battle for retirees and for the city of Detroit itself will have to be fought in the streets.

“The rights of working and poor people have never been determined in the courts,” Goldberg added. “The struggle isn’t over. It’s time for mass mobilization.”

Darrell Freeman is Captain of Engine 59 (Active) of the Detroit Fire Department and President of the Phoenix, which represents Black city firefighters. He is 49 and has been a firefighter for 29 years.

“We pretty much knew that the bankruptcy was going to happen,” Freeman said. “But we weren’t expecting the Judge’s ruling on our pensions or his statement upholding the Emergency Manager Act. Nobody is looking at how firefighters have given their lives for the city. I have put in 29 years and still to this day we are keeping our part of the bargain by doing our job, even though health care benefits have been eliminated for anyone who retires before the age of 55. We don’t get Social Security when we retire—what about our future, our families, our kids? It seems like no one cares about us. Hopefully the U.S. Supreme Court will see things differently.”

The Emergency Medical Services unit of the Fire Department includes Emergency Medical Technicians (EMT’s) and Paramedics.

Chokwe Lumumba (l), famed Detroit revolutionary activist, now Mayor of Birmingham, Ala, with Cornell Squires (r) at court hearing.

Cornell Squires began working there in 1981 as an EMT. He was forced to take a leave due severe stress in 1993, in part related to retaliation for reporting inadequate EMS trucks and equipment. He is still fighting for his vested pension, after being denied duty disability retirement three times and then denied non-duty disability.

“EMS technicians and paramedics suffer more injuries and heart attacks from stress than any other classification I know of,” Squires said. “Many die before they are even eligible to retire. I myself know more than ten who have died before retirement, including Kenny Parker, who hired on with me.”

Parker was a union steward with the International Union of Operating Engineers Local 547 and a co-founder of the Coalition to Stop Privatization and Save Our City in the 1990’s. Another co-founder of that Coalition, Al Phillips, President of AFSCME Local 457 (Detroit Health Department) died of a heart attack at the age of 57 in 1994 while fighting privatization there.

REACTION OF AFSCME ATTORNEY SHARON LEVINE TO RHODES RULING

A Detroit WXYZ TV report in August featured William Hardman, who suffered a heart attack taking a heart attack patient to the hospital, and survived only because he himself was at the hospital. EMS worker Lee Hardy testified on behalf of the prosecution at the trial of police officers Walter Budzyn and Larry Nevers after they beat Black Detroiter Malice Green to death in 1992. He was constantly harassed by police afterwards and eventually left the job as well.

Detroit casino workers are worried about their jobs since retirees make up a large portion of casino customers.

“Others have had heart attacks in their 40’s,” Squires, himself a heart attack victim since he left the job, said. “Two workers I know had to have their knees replaced. Getting more trucks is all well and good, but after all these years saving people’s lives, who’s going to save our lives?”

Casino workers discussing the ruling as they waited in line at a downtown credit union expressed concern for their jobs as well, saying retirees from the city and elsewhere spend a large amount at Detroit’s three casinos. Other residents pointed out that a loss of pension benefits to those living in the city will result in an increase in home foreclosures, evictions, poverty and crime. A state Secretary of State worker said workers there are fearful as well.

Attorneys for AFSCME, which represents the majority of city workers, and the pension funds, among others, have filed motions for leave to appeal the eligibility ruling directly to the Sixth Circuit Court of Appeals, arguing that a speedy appeals process would benefit both sides.

“The Court held that the City of Detroit is eligible to be a Chapter 9 debtor and can seek to discharge accrued pension benefits in a plan of adjustment,” wrote Attorney Robert Gordon of Clark Hill on behalf of the retirement systems.

“The Court’s eligibility ruling is exceptionally important and warrants certification for a direct appeal to the Sixth Circuit. . . Swift resolution of whether the City may proceed in Chapter 9 bankruptcy is of paramount importance to the City, the State, the public, and those municipal employees and retirees whose livelihoods depend on the accrued pension benefits that they earned and that the City seeks to discharge in bankruptcy.”

Judge Rhodes has not yet ruled on whether he will authorize certification to the Sixth Circuit Court.

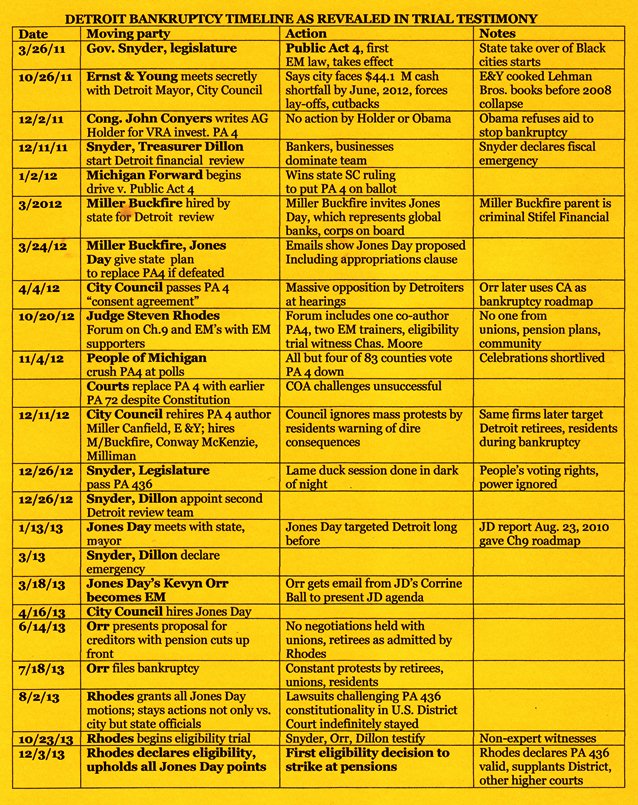

The path to Detroit’s bankruptcy began years before, with a report on the coming necessity for municipal Chapter 9 filings written by Jones Day partners in 2010. (Click on Jones Day white paper on Chapter 9.) Following is a broad timeline showing the introduction and role of its key planners.

Note that Detroit’s Chapter 9 filing would not have been possible without the intervention of an Emergency Manager, which is why Jones Day worked with Miller Buckfire and the state as early as March, 2012 to ensure the passage of PA 436 in the event PA 4 was defeated in the Nov. 2012 referendum, as it indeed was. Emails showed that Jones Day raised the idea of including an appropriations clause to ensure that PA 436 would be referendum-proof.

Other cities and entities which have filed, including Stockton, CA and Montgomery County, ALA, have so far left pensions intact. In Stockton, some corporate creditors have taken up to 50 percent cuts in debt payments; in Montgomery County, which earlier sued Chase Bank over fraudulent loans to its water system, Chase was forced to forego payment of 75 percent of its debt.

RHODES’ DETROIT BANKRUPTCY RULING: KEY ELEMENTS V. REALITY

By Diane Bukowski

December 7, 2013

(Click on DB eligibility ruling 12 5 13 to read 150-page written opinion.)

DETROIT’S ECONOMIC DECLINE

Protest demanding that the banks and corporations pay for city services, cancellation of debt May 9, 2012 in downtown Detroit.

RHODES: Population 1.85 million in 1952, building half the world’s cars. Since then, dwindling population, employment, revenues, decaying infrastructure, excessive borrowing, mounting crime rates, spreading blight. No basic police, fire EMS services; government wasteful and inefficient.

REALITY: The auto companies’ abandonment of the city; privatization of public services and profiteering by contractors; state destruction of school system; state revenue sharing slashed; corporate tax bills not paid estimated at over $800 million; corporate tax abatements. Role of banks: massive predatory lending and illegal foreclosures destroying neighborhoods; predatory lending to city itself accompanied by Wall Street ratings agencies’ debt downgrades, which have allowed banks to charge progressively higher interest rates on money city borrow.

WALLACE TURBEVILLE, SENIOR FELLOW AT DEMOS IN NOV. REPORT: “The City of Detroit’s bankruptcy was driven by a severe decline in revenues (and, importantly, not an increase in obligations to fund pensions). Depopulation and long-term unemployment caused Detroit’s property and income tax revenues to plummet. The state of Michigan exacerbated the problems by slashing revenue it shared with the city. . . . In addition, Wall Street sold risky derivatives financial deals to the city, which now threaten the resolution of this crisis.” (Turbeville is to testify at Dec. 17 trial on Barclay’s loan, at the invitation of objector David Sole and his attorney Jerome Goldberg. See Demos report at Demos Detroit bankruptcy report.)

THE CITY’S DEBT

RHODES: City claims $18 billion debt: $3.5 billion in unfunded pension obligations; $5.7 billion retiree health benefits; $1.43 billion “for certificates of participation (COPS) related to pensions;” $346.6 million for swaps related to COPS; $651 million general obligation bonds; $300 million in worker-related expenses and lawsuits.

Objectors say much lower pension underfunding amount [under $100 million] No proof submitted. Unnecessary to resolve pension issues because any figure in range plus other liabilities would make city eligible for Ch. 9. . . .

Morningstar, independent investment research firm, says Detroit retirement systems are 91.4 percent funded, second highest level in country.

RHODES ON COPs (PENSION OBLIGATION CERTIFICATES) DEBT

. . . . the City estimates that as of June 30, 2013, the following amounts were outstanding: $480,300,000 in outstanding principal amount of $640,000,000 Certificates of

Participation Series 2005 A maturing June 15, 2013 through 2025; and

$948,540,000 in outstanding principal amount of $948,540,000 Certificates of

Participation Series 2006 A and B maturing June 15, 2019 through 2035. (Rhodes left out interest amount owed, which brings POC debt to $2.28 billion.)

REALITY:

Former State Treasurer Andy Dillon, who helped engineer takeover of Detroit, testified that he has no final figures to counter retirement systems’ actuarial reports.

Charles Moore of Conway McKenzie, chair of the shadowy “Pension Task Force,” and former State Treasurer Andy Dillon testified there has been no final determination by anyone other than the pension plans’ actuaries Gabriel, Roeder and Smith (GRS), including outside consultant Milliman, Inc., of any amount of pension underfunding. Proof WAS submitted: GRS 2012 reports are part of trial record. Additionally, the 2013 report released by independent investment research analyst Morningstar finds that Detroit pension plans are 91.4 percent funded overall, with $643.75 million Unfunded Acrued Actuarial Liabilities (UAAL). Of twenty top cities, Detroit has the second highest level of funding, exceeded only by Washington, D.C. (Click on Morningstar cities pension 1311 for full report; see page 11 for Detroit figures.)

2005-06 COPS, with interest now figuring in at $2.28 billion since 2008 global economic crash, are NOT tied to pensions; retirement systems were not underfunded at the time, Wall Street simply tricked the city into making a risky bet for its own profit by borrowing 30 years of pension obligations at one fell swoop, at a fixed lower-than-market interest rate. During the 2008 crash, however, rates crashed far below that figure, and the city lost the bet.

Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard and Poor’s finagle the City Council into approving pension obligation certificates loan in 2005.

Loans of questionable legality were not set up by pension systems, but secured by separate “Service Corporations” set up for that purpose. They were vehemently opposed by pension boards, unions, retirees. Even Kevyn Orr in his “Report to Creditors of June 14, 2013” says ‘The City has identified certain issues related to the validity and/or enforceability of the COPS that may warrant further investigation.”

Lenders were UBS AG, global bank facing billions in fines and criminal charges for interest-rate rigging, and Siebert, Brandford & Shank. Detroit CFO Sean Werdlow, point man in the deal made in Feb. 2005, hired by Siebert in Nov. 2005, still there. In a highly unusual move deserving of legal scrutiny, Wall Street ratings agencies Fitch Ratings and Standard and Poor’s abetted Werdlow at the Council. VOD editor Diane Bukowski filed an objection calling for a criminal investigation. Rhodes did not respond to this objection in his opinion. In a footnote, he said, “Nevertheless, the Court is satisfied that this opinion does address every argument that is worthy of serious consideration. To the extent an argument is not addressed in this opinion, it is overruled.”

Debt amount invalidly includes DWSD: Rhodes additionally does not address objectors’ contention that $5.7 billion of the debt as cited by the city belongs to the Detroit Water & Sewerage Department, an enterprise agency. It is revenue-backed and does not constitute a debt of the city.

TURBEVILLE: Turbeville says that the main issue in Detroit’s eligibility for bankruptcy is not the purported $18 billion in debt, a figure he considers inflated, but simply a $198 million cash flow shortfall.

Interest rate “drop” resulted from global predatory lending meltdown of 2008. Chase just paid $13 BILLION to the USDOJ, admitting its guilt in the catastrophe. The banks owe Detroit far more.

RHODES ON SWAPS: Some of the COPs paid a floating interest rate. To protect the Service Corporations from the risk of increasing interest rates, they entered into hedge arrangements with UBS A.G. and SBS Financial [Siebert, Brandford and Shank] converting the floating interest rates into a fixed payment up to a certain amount. . . .In the event of a default by the City, the Swap Counterparties could demand a potentially enormous termination payment. In 2008, interest rates dropped dramatically. As a result, the City lost on the swaps bet. Actually, it lost catastrophically . . . . The bet could cost the City hundreds of millions of dollars. The City estimates that the damage will be approximately $45,000,000 per year for the next ten years.

REALITY: The 2008 drop in interest rates was a direct result of the global economic meltdown which began with the collapse of Lehman Brothers and was directly due to long-time predatory mortgage lending by banks in the U.S. and globally. Ernst & Young (E&Y) the accounting firm which handled Lehman Brothers’ books, faces lawsuits by the states of New York and New Jersey over their losses in the crash. However, E & Y was retained by the city of Detroit in 2011, when it met in secret session with the City Council and ended up declaring the city would run out of cash by the end of that fiscal year. Gustav Mulhatra of E & Y was a chief witness at the eligibility trial. Rhodes admitted his testimony on the city’s economic state and that of Charles Moore of Conway McKenzie and Kenneth Miller of Miller Buckfire, all city consultants. Rhodes admitted they did not qualify as “expert” witnesses.

BANKS INCLUDING BARCLAY’S AND UBS AG RAKED IN ILLEGAL PROFITS BY INTEREST-RATE RIGGING INVOLVING $800 TRILLION IN LOANS AND SECURITIES.

Trial on Orr’s proposal to borrow $3.46 million in “post-petition financing” from UK-based Barclay’s to pay off the swaps, committing 20 percent of Detroit’s revenues from income and casino taxes for the next ten years, is set for Dec. 17, 2013. Barclay’s is one of the chief perpetrators in the global LIBOR scandal, involving interest-rate rigging by the banks sitting on the London-Interbank Offered Rate board since at least 1991. (See story to come.)

RHODES:

• THE BANKRUPTCY COURT HAS THE AUTHORITY TO DETERMINE THE CONSTITUTIONALITY OF CHAPTER 9 OF THE BANKRUPTCY CODE AND PUBLIC ACT 436;

• CHAPTER 9 DOES NOT VIOLATE THE U.S. CONSTITUTION

• PUBLIC ACT 436 DOES NOT VIOLATE THE MICHIGAN CONSTITUTION

Several objecting parties challenge the constitutionality of chapter 9 of the bankruptcy

code under the United States Constitution. Citing the Supreme Court’s decision in Stern v. Marshall, 131 S. Ct. 2594 (2011), these parties also assert that this Court does not have the authority to determine the constitutionality of chapter 9.

Several objecting parties also challenge the constitutionality of P.A. 436 under the

Michigan Constitution. Some of these parties also assert that this Court does not have the authority to determine the constitutionality of P.A. 436.

The Official Committee of Retirees filed a motion to withdraw the reference on the

grounds that this Court does not have the authority to determine the constitutionality of chapter 9 or P.A. 436. It also filed a motion for stay of the eligibility proceedings pending the district court’s resolution of that motion. In this Court’s denial of the stay motion, it concluded that the Committee was unlikely to succeed on its arguments regarding this Court’s lack of authority under Stern. In re City of Detroit, Mich., 498 B.R. 776, 781-87 (Bankr. E.D. Mich. 2013).

REALITY

Gail Wilson (second from left), a member of the Retirees Committee, with son Leamon E. Wilson, leave funeral of their husband and father, longtime militant AFSCME Local 312 president Leamon Wilson.

EM Kevyn Orr requested the establishment of the Official Committee of Retirees, despite the existence of the city’s elected pension boards and unions which represent the retirees. However, the committee as represented by Dentons LLP and other law firms turned around and adamantly opposed Rhodes’ right as a l0wer-level bankruptcy judge to decide the matters cited above. It did not challenge the constitutionality of the Chapter 9 bankruptcy code as such. It said “. . . if Chapter 9 is as broad as the Emergency Manager [Kevyn Orr] contends, then Chapter 9 is unconstitutional and the City cannot be a debtor in Chapter 9.” In his opinion, Rhodes several times sets out his presumptions as to how the Michigan State Supreme Court and higher level federal courts would rule on the constitutional questions, while holding city retirees and residents captive in his lower level court.

Two federal lawsuits pending in front of U.S. District Judge George Caram Steeh, filed by Phillips et al (parties from across the state) and the NAACP were stayed by Rhodes’ order. He then granted the Phillips motion for relief from stay if they excluded Detroit since it was in bankruptcy court; the plaintiffs did so, indicating that once arguments on PA 436 were fully played out in Steeh’s court, a separate motion could be filed in Rhodes court regarding Detroit’s situation. Snyder et al appealed even that decision, saying that no lawsuit against Gov. Snyder or other state officials should be brought on behalf of ANY residents of Michigan as long as the Detroit bankruptcy case is pending.

THE TENTH AMENDMENT CHALLENGES TO CHAPTER 9 ARE RIPE FOR DECISION AND THE OBJECTING PARTIES HAVE STANDING

RHODES: The United States argues that the creditors who assert that chapter 9 violates the Tenth Amendment as applied in this case lack standing and that this challenge is not ripe for adjudication at this stage in the case. 19 The Court concludes that the objecting parties do have standing and that their challenge is now ripe for determination.

RHODES: The United States argues that the creditors who assert that chapter 9 violates the Tenth Amendment as applied in this case lack standing and that this challenge is not ripe for adjudication at this stage in the case. 19 The Court concludes that the objecting parties do have standing and that their challenge is now ripe for determination.

REALITY: Rhodes invited the U.S. in to testify about the constitutionality of Chapter 9, which was never contested as a whole by the objectors. Here he overrides their opinion that the issue of the right to public pensions under state law, which the Tenth Amendment to the Constitution in turn protects, is not ripe until a move has actually been made to cut pensions. Setting himself above even the federal government itself, Rhodes was clearly anxious to make a name for himself by being the first Chapter 9 bankruptcy judge to declare pensions fair game during the eligibility phase.

Thank you for this comprehensive and accurate document.