Will U.S. District Court Judge Friedman, hearing appeals, be likewise obligated?

Fraud included $1.5 B POC deal with criminal banks UBS AG, BOA, which grew to $28.2 B; trio knew of fraud

Should the entire fraud-based Detroit bankruptcy be annulled?

DAREA, others appeal city’s motion to dismiss cases

By Diane Bukowski

March 15, 2015

DETROIT – Are U.S. Bankruptcy Judge Steven Rhodes, U.S. District Court Chief Judge Gerald Rosen, Rhodes’ appointed mediator in the Detroit bankruptcy, and former Detroit Emergency Manager Kevyn Orr, guilty of federal felonies? They all failed to report criminal fraud involved in the $1.5 billion Pension Obligation Certificates deal of 2005-06, otherwise known as COPS, as well as the very filing of the city’s bankruptcy petition, based on fraudulent claims that the city was insolvent because it could not pay its entire debt, due over at least three decades, out of its current revenues.

DETROIT – Are U.S. Bankruptcy Judge Steven Rhodes, U.S. District Court Chief Judge Gerald Rosen, Rhodes’ appointed mediator in the Detroit bankruptcy, and former Detroit Emergency Manager Kevyn Orr, guilty of federal felonies? They all failed to report criminal fraud involved in the $1.5 billion Pension Obligation Certificates deal of 2005-06, otherwise known as COPS, as well as the very filing of the city’s bankruptcy petition, based on fraudulent claims that the city was insolvent because it could not pay its entire debt, due over at least three decades, out of its current revenues.

Will U.S. District Court Judge Bernard Friedman, currently hearing various appeals of the final bankruptcy plan of confirmation, be likewise responsible if such fraud is brought to HIS attention?

Cornell Squires, a member of the Legal Committee for the Detroit Active and Retired Employees Association (DAREA), and leader of the community group We the People for the People, thinks so. Squires has reviewed numerous federal statutes on bankruptcy fraud.

He has worked on such legal matters for years under the tutelage of the late, well-known activist attorney Leonard Eston, an associate of the late people’s attorneys Kenneth Cockrel, Sr. and Chokwe Lumumba. Squires and Eston did the research and were successful earlier in having Lumumba’s law license restored after it was illegally revoked because of his militant stances.

‘Criminal fraud the main issue on which bankruptcy can be overturned’

“Criminal fraud is the main issue upon which this bankruptcy can be overturned,” Squires said. “It was raised numerous times during the bankruptcy hearings by various objectors. Orr himself filed a lawsuit calling the COPS deal ‘void ab initio, illegal and unenforceable’ as part of the bankruptcy hearings, although he should have filed it in another court.

“He knew of problems with the COPS deal from the very first day he was appointed as EM,” Squires continued. “But he, Rhodes and Rosen never reported the likely fraud either to the U.S. Trustee or the U.S. Department of Justice as required by statute. Such a report would have brought the bankruptcy proceedings to a screeching halt.”

Squires said the real heist began March 1, 2o15, when city retiree checks were cut drastically, a cut that is expected to continue through 2023.

“How can retirees stand back when not only their pensions are cut, but the state raids their annuity savings accounts,” he asked. “That’s like them taking your ATM card and withdrawing your savings, and then adding interest.”

VOD reported March 16, 2013, “Detroit’s newly-appointed ‘Emergency Financial Manager’ Kevyn Orr was virtually speechless when VOD asked him what he would do about banks like UBS AG and others involved in the global ‘LIBOR’ interest rate-rigging scandal, as it relates to Detroit’s gargantuan debt load of more than $12 billion. . . . VOD cited to Orr the fact that UBS loaned the City of Detroit $1.5 billion in 2004 in a predatory “pension obligation certificates” scheme, before the global economic meltdown of 2008. The city later defaulted on the loan twice, causing its debt ratings to plunge and interest rates to skyrocket.”

‘I’m aware of those things’–Orr

Orr talks to media after creditors meeting May 14, 2013. At left are Vickie Thomas of WWJ and Diane Bukowski of VOD.

“I’m aware of those things,” was Orr’s only response to VOD’s questions, during a March 14, 2013 press conference held by Michigan Gov. Rick Snyder and former Detroit Mayor Dave Bing.

Later, Orr met with city creditors at the Wayne County Airport June 14, 2013. His proposal to creditors included a statement, ‘The City has identified certain issues related to the validity and/or enforceability of the COPS that may warrant further investigation.” Under Public Act 435 (Section), Orr was obligated to investigate any criminal fraud that contributed to the city’s debt, but never reported the results of any investigation to outside authorities.

Judge Rhodes (center), at Municipal Distress forum Oct. 10, 2012 with (l to r), Treasury official Ray Headen, perpetrator of numerous municipal takeovers. Edward Plawecki, Em trainers Douglas Bernstein and Judy O’ Neill (O’Neill was a co-author of PA 4), and most egregiously, Charles Moore of Conway McKenzie, a chief witness at the bankruptcy trial for Jones Day.

VOD repeatedly questioned Orr about the POC deal at press conferences, and reported it to the U.S. Department of Justice. VOD editor Diane Bukowski, among others, gave explicit testimony before Judge Rhodes as an official eligibility objector both to the POC deal and to Rhodes’ impartiality in the case. (See MDB objection from News article, MDB objection to 4th Amended Plan, and .) Rhodes hosted a forum Oct. 10, 2012 which advocated emergency manager laws and the use of bankruptcy against Detroit, a year before the bankruptcy trial began.

The State of Michigan under Governor Rick Snyder and Public Act 436 effectuated the emergency manager takeover of Detroit. It planned the filing of Detroit’s Chapter 9 bankruptcy as early as 2011, using the corporate crony law firms of Ernst & Young, Miller Buckfire/Stifel Financial, and Jones Day as consultants. There is no real question regarding how the state would vote.

Black community of Greenwood in Tulsa, Oklahoma burnt to the ground in 1921. Three hundred residents died, and hundreds of Black businesses were destroyed.

In a “quo warranto” motion challenging Rhodes’ authority filed Feb 24, community activist and paralegal James Cole, Jr. along with dozens of other plaintiffs, called for all of the judge’s actions to be declared “null and void ab initio.” They contended that Rhodes has judicially supported “parties/agents/carpetbaggers (the financial 1% leaders) that pursue a fast-track policy of plundering and pilfering the assets of Detroit’s Indigenous Citizenry under the bankruptcy fallacy and fiction. Click on DB James Cole petition to read filing.

The motion compares the dismantling of Detroit to the horrific, racist 1921 burning and looting of Greenwood, a prosperous community in Tulsa, Oklahoma known as “The Black Wall Street,” during which 300 Black residents were murdered.

After the conclusion of the bankruptcy, Rhodes admitted to WDET Radio that the POC deal, “. . . was structured to be an intentional evasion of the legal debt limits that municipalities by state law are required to stay within. It was too innovative, it was too creative and um that by itself should of been a red flag at the time.”

During a luncheon sponsored by Crain’s Detroit Business, he showed further evidence of his partiality in the case, as quoted in a brief filed with U.S. District Court Judge Bernard Friedman March 13, 2015 by the Detroit Active and Retired Employees Association (DAREA), advocating defined contribution instead of defined benefit plans for public employees:

“It flies largely under the radar and it doesn’t get a lot of attention and it doesn’t get a lot of management and I’m deeply concerned about that,” Rhodes said. “Because that’s money cities don’t have that they have promised to their retirees and I think that solution across the country, and including in Detroit, has to be at some point defined contribution (plans).

The brief adds, “Rhodes also ‘suggested Detroit missed a chance to get out of the pension business altogether during the bankruptcy,’ a proceeding which he claims ‘was as much a political case as a legal case.’ These comments are shocking and demonstrate a risk of hostility and bias motivating the underlying decisions, which simply underscores the importance of having an Article III court independently review these novel and complex legal questions.”

States, cities have $3.5 trillion in bond debt due to court sanction of practices violating state debt limits

Public Sector, Inc.’s Steve Malanga reported Feb. 4, 2014, “There’s a rich irony in the news that current Detroit officials are suing in bankruptcy court to renounce the pension debt transacted by the administration of Kwame Kilpatrick back in 2005.”

The claim of Detroit officials today, that the $1.44 billion in borrowing was illegal because Detroit used elaborate gimmicks to circumvent debt limits, echoes lawsuits filed by taxpayer groups in many state courts over the years to stop similar borrowing ploys.

“That states and cities have accumulated some $3.5 trillion in bonded debt is attributable in part to the willingness of state courts to brush aside these lawsuits and sanction some of the very same gimmicks that a federal bankruptcy court is now being asked to overturn.”

See http://www.publicsectorinc.org/2014/02/detroit-pension-borrowings-what-a-tangled-web/.

Just before the POC lawsuit was filed, Orr testified before Rhodes, “There were theories that both the underlying COPS and swaps were void ab initio for different periods, fraudulently produced . . .It was my understanding that the city did not have the authority to enter into the underlying COPS of 2005-06 because state law prohibited further indebtedness. . . .[and that the casino] revenue stream was an improper way to pay the swaps.”

Orr is following by adoring media members as he leaves bankruptcy court after testifying Sept. 30, 2014. The mainstream media was highly influential in pushing the fraudulent Detroit bankruptcy.

He continued later, “There were a number of legal theories. The general basis was that the counterparties to the swaps [UBS AG, BOA] had superior knowledge to the city, that they represented to the city that [the deal was] low-risk, beneficial, when they knew or should have known that it was potentially volatile. They designed more or less a ticking time bomb, by designing the termination fee to be linked to credit ratings.”

In fact, the global economy crashed in 2008 as a result of criminal practices by mortgage lenders, among other factors. Detroit defaulted on the POC debt for the first time in 2009.

Orr left banks out of POC lawsuit

Yet, when Orr did sue regarding the POC debt, he designated the defendants as the fraudulent paper corporations which had been created by the parties, including Wall Street bond ratings agencies Standard and Poor’s and Fitch Ratings, and UBS AG and Merrill Lynch (BOA). The deal by-passed the state debt limit as well as city voters’ rights to approve or disapprove bond issues. Orr later withdrew the lawsuit as part of a lucrative settlement with the banks and their insurance companies, FGIC and Syncora.

“These banks did not simply provide interest rate swaps,” DEMOS senior analyst Wallace Turbeville wrote in March, 2014. Rhodes cleverly barred Turbeville from testifying during bankruptcy proceedings. “UBS was the also ‘senior managing underwriter’ of the infamous 2005 pension funding deal to which the swaps were attached that raised $1.4 billion to fund the city’s future liability to pensioners. And Merrill was in the managing underwriter group. . .

“UBS and Merrill very likely were central, if not dominant, players in coming up with the “certificates of participation” structure of the massive deal in 2005. For all the public knows they may have cooked up the idea and sold it to the city administration.”

Turbeville admonished, “But the city has not gone after the banks. In fact, in its recent proposed settlement of the related derivatives transactions, it has agreed not to sue UBS or Merrill for their roles in the COPs deal. The two banks must have considered liability for the COPs a real possibility since they bargained for this release. . .”

Detroit CFO Sean Werdlow, SBS/BOA blatant bribery

Detroit’s former CFO Sean Werdlow, now the COO of SBS Financial, a prominent lender to Detroit backed by Merrill Lynch (BOA), was subpoenaed to bring documents on the POC deal to the bankruptcy hearing and to testify, again making Judge Rhodes aware of the shady deal, and making himself part of the bankruptcy fraud.

Detroit’s former CFO Sean Werdlow, now the COO of SBS Financial, a prominent lender to Detroit backed by Merrill Lynch (BOA), was subpoenaed to bring documents on the POC deal to the bankruptcy hearing and to testify, again making Judge Rhodes aware of the shady deal, and making himself part of the bankruptcy fraud.

Detroit Free Press business writer John Gallagher said of an unrepentant Werdlow’s talk to a Wayne State University audience after he testified, “Werdlow said the 2005 deal was prompted by a ‘rogue’ pension system and that without the deal Detroit city government would have gone bankrupt years ago.”

He quoted Werdlow, “We would have been having this discussion in this auditorium back in 2005 but for that transaction.”

In 2005, Werdlow brought S&P and Fitch Ratings to the council table to persuade them to vote for the risky, likely fraudulent transaction in 2005, then later that year became a top official with lender SBS Financial. Fraud? Bribery? Both are cited in federal statutes regarding bankruptcy. Certainly worthy of investigation, an investigation that never happened during the bankruptcy hearings.

In the Eighth Amended Plan of Confirmation, Rosen negotiated, and Rhodes approved settlements of billions of dollars paid to the insurers of the COPS parties, FGIC and Syncora, in cash and in city revenues from the Joe Louis Arena and other riverfront property and the Grand Circus Park garage. This was despite their knowledge of the fraud involved.

Werdlow’s boss Mayor Kwame Kilpatrick went to prison for 28 years for stealing far less than the money involved in the POC deal, which skyrocketed to $2.8 billion including interest and default penalties.

Jan. 31, 2005 (l to r) then Detroit CFO Sean Werdlow, Joe O’Keefe of Fitch Ratings, Stephen Murphy of Standard & Poors, and Deputy Mayor Anthony Adams tout POC deal to City Council. The following week, despite strong opposition from the retirement systems, unions and others, the Council caved and voted unanimously for the deal.

Rosen and Rhodes liquidated Detroit assets, opportunities for youth

After all, the bankruptcy affects not only retirees, but current workers who are taking daily wage cuts and have lost their health care benefits, as well as residents of Detroit, especially its youth.

DWSD’s Lake Huron water treatment plant. DWSD is the third largest water utllity in the country. It provides water service to almost one million people in Detroit and three million people in 126 neighboring Southeastern Michigan communities throughout Wayne, Oakland, Macomb St. Clair, Lapeer, Genesee, Washtenaw and Monroe counties.

After secret mediation sessions run by Rosen, many held in New York City, Rhodes signed off on a likely criminal deal to steal Detroit’s largest asset, the Water & Sewerage Department, and hand it over to a regional authority, in violation of the Detroit city charter which requires a vote of the people before any DWSD asset can be sold or transferred. For decades, DWSD provided a wonderful opportunity for union jobs for the city’s youth, particularly in the lucrative skilled trades.

Rhodes also approved the “Grand Bargain,” whose provisions, among others, gave away billions of dollars in DIA city-owned art to a bank trust.

Detroit has essentially been de-constructed and given away under a bankruptcy plan involving fraud. This was done with the complete knowledge of the bankruptcy conspirators. The only solution is to restore Detroit’s assets, and make the nation’s largest Black-majority city WHOLE.

Fraudulent bankruptcy petitions

Wallace Turbeville, a Senior Policy Analyst at the DEMOS think tank, and a former Goldman Sachs banker himself, said in a Nov. 2013 report that Detroit essentially was not eligible for bankruptcy.

“Detroit’s emergency manager, Kevyn Orr, asserts that the city is bankrupt because it has $18 billion in long-term debt. However, that figure is irrelevant to analysis of Detroit’s insolvency and bankruptcy filing, highly inflated and, in large part, simply inaccurate. In reality, the city needs to address its cash flow shortfall, which the emergency manager pegs at only $198 million, although that number too may be inflated because it is based on extraordinarily aggressive assumptions of the contributions the city needs to make to its pension funds.

Municipal bankruptcies are about cash flow—a city’s ability to match revenue against expenses so that it can pay its bills. Under Chapter 9 of the United States Bankruptcy Code, a municipality is eligible to file bankruptcy when it is unable to pay its debts as they come due.”

Orr and his boss, Michigan Gov. Rick Snyder, were well aware that the City of Detroit had only a small cash flow problem in 2013, when the bankruptcy was filed. In fact, the city’s Comprehensive Annual Financial Report for 2013 showed it had just a $138 million deficit.

Snyder and Orr both knew that the State of Michigan owed Detroit at least $220 million related to an earlier revenue-sharing agreement. They were also aware that the state had deliberately cut Detroit’s statutory revenue-sharing by $732 billion over the previous ten years.

Orr and the other witnesses called by Jones Day during the bankruptcy hearing, none of them qualified as experts, falsely stated that the city’s total debt was $18 billion, improperly including DWSD enterprise agency debt as well as the Retirement Systems’ Unfunded Accrued Actuarial Liability (UAAL) as part of the total. DWSD debt is backed by the system’s revenues, whereas the UAAL of the pension systems is backed by continual payments from city workers, the city itself, and investments, and paid off over decades.

Bankruptcy mediator Judge Gerald Rosen (bottom l), grinning up at Mich. Gov. Rick Snyder, with EM Kevyn Orr in background.

But Orr conspired with Snyder, mediator Rosen, and others to come up with a confirmation plan that eliminated city payments to the pension systems until at least 2023, deliberately crippling them, and additionally conspired to hand DWSD with virtually all its revenues over to a regional Great Lakes Water Authority.

Orr himself admitted the day that the bankruptcy was confirmed, “What happened here in Detroit was a combination of leadership from the governor’s office — people forget that this process began in 2010 and 2011 and its culminating now, leadership from the legislature, tolerance and leadership from city officials, and the different set of rules and laws that applied in this case, as well as from the foundations and the DIA founders who brought in a significant sum of money to address those concerns.”

If the bankruptcy process was pre-ordained in 2010 (when Jones Day published its infamous White Paper on raiding pensions through bankruptcy), then Orr fraudulently filed bankruptcy on July 17, 2013, signed off on by Gov. Snyder. The bankruptcy ship sailed long before any petition was filed, and before any court hearings were held. Detroit was targeted as the largest Black majority city in the country, to become a model for what Wall Street would do to other cities and states.

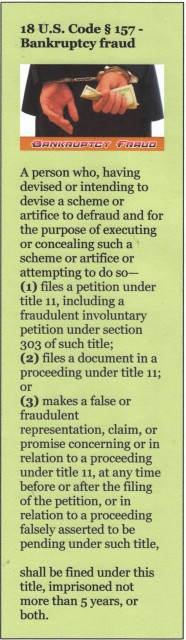

According to 18 U.S. Code 157, Snyder, Orr, Rhodes, and Rosen all need to be jailed for at least five years for KNOWINGLY submitting a fraudulent bankruptcy petition, and making false, fraudulent statements about Detroit’s debt throughout the bankruptcy proceedings.

VOD: On Friday, March 13, the Detroit Active and Retired Employees Association (DAREA) filed the following documents with U.S. District Judge Bernard Friedman, responding to the city’s motion to dismiss their appeal of the bankruptcy plan of confirmation. Judge Friedman issued the attached scheduling orders giving the city 30 days to respond.

DAREA corrected response and brief filed 3 13 15.compressed

DAREA exhibits for corrected response and brief 3 13 15

DAREA Friedman scheduling order 1

DAREA Friedman scheduling order

DETROIT ACTIVE & RETIRED EMPLOYEE ASSOCIATION (DAREA) NEXT MEETING WED. MARCH 18 @ 5:30 P.M. ST. MATTHEWS/ST. JOSEPH CHURCH WOODWARD AND HOLBROOK

PETITION: Sign the petition to halt changes to pensions and other benefits, to U.S. Justice Department, at http://petitions.moveon.org/sign/selective-enforcement?source=s.icn.em.mt&r_by=9645222.

FUNDRAISING: To donate to DAREA’s LEGAL DEFENSE FUND, click on http://www.gofundme.com/pensiondefensefund. Or checks can be made payable to the Detroit Active and Retired Employees Association (DAREA), at P.O. Box 3724, Highland Park, Michigan 48203.

“Hands off my Pension” T-shirts are available for $10 each. The fundraising committee will continue to sponsor events to cover what is anticipated will be substantial legal fees.

WEEKLY MEETINGS: To receive notices of meetings, updates on the appeal and events information please provide your email address and phone numbers via email at Detroit2700plus@gmail.com or call DAREA at 313-649-7018.

Read DAREA’s position statement at DAREA Call/.

(VOD will be posting a story on Tom Barrow’s talk on the bankruptcy, given at a previous DAREA meeting, which stressed the utter racism behind it, shortly.)

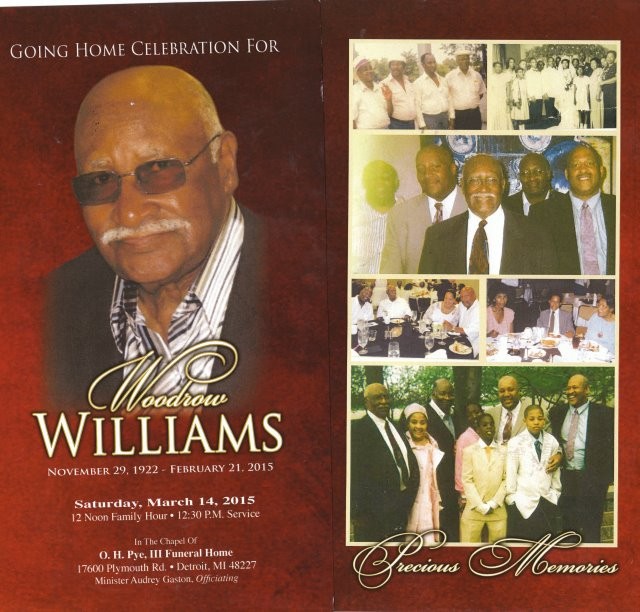

Below is the obituary for the father of one of the retirees’ beloved leaders, Hassan Aleem. Together with Carl Williams and dozens of endorsers, they filed hundreds of objections to the fraudulent Detroit bankruptcy plan. Aleem’s father, Woodrow Williams, to whom he was very close, died in a car accident at the age of 87. Our hearts are with our brother Hassan during this time of sorrow.