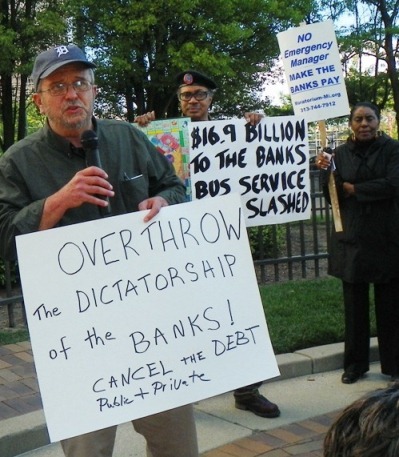

Bob Day (l) calls for end to dictatorship of the banks, who are behind demands that Corporation Counsel Krystal Crittendon end her legal fight against Detroit PA4 consent agreement.

Crittendon files for reconsideration of case vs. PA4 consent agreement

Supporters ask for turnout at City Council Tues. July 10 10 a.m.

By Diane Bukowski

July 6, 2012

DETROIT – The same day Detroit Corporation Counsel Krystal Crittendon filed a motion for reconsideration of her lawsuit asking to void the city’s Public Act 4 consent agreement, July 5, a group called “We the People for the People” filed a motion to intervene in her support. They are also asking Ingham County Circuit Court Judge William Collette to set aside his dismissal of Crittendon’s suit. Their motions are scheduled to be heard on Wed. Aug. 15 at 10 a.m. in Collette’s courtroom at the Ingham County Circuit Courthouse in Mason, Michigan.

Threats from Detroit Mayor Dave Bing, State Treasurer Andy Dillon, and Wall Street have deterred neither Crittendon nor “We the People.” These entities declared the people of Detroit would face dire consequences including withholding of state revenue-sharing funds if Crittendon exercised her constitutional right to participate in the judicial process.

“Please be advised that I, as corporation counsel, stand by my decision to have the courts determine the validity of the (financial stability agreement) as a good faith performance of my obligation to my client, the City of Detroit,” Crittendon told the City Council in a letter explaining her action.

Supporters from “Free Detroit-No Consent” are calling on people to pack Council chambers Tues. July 10 at 10 a.m. to support Crittendon. Several Council members have said they do not support her appeal. It is possible that another attempt to have Council vote to remove her is in the offing.

In his ruling dismissing her lawsuit, Ingham County Circuit Court Judge William Collette said Crittendon did not have standing to file. He did not address newly-revised City Charter language making her office an independent entity with the right to take judicial action, nor Crittendon’s claim that the state owes Detroit over $307 million.

James Cole, Jr., Leonard Eston, Cornell Squires, Clifford Stafford, and Tyrone Travis dispute his determination in their filings. In addition to Crittendon as Corporation Counsel, they say that as city taxpayers they have firm standing to sue.

“The money involved belongs to the city and its people,” Squires told VOD. “If we don’t get the money, it affects our service. We are the people suffering right now because of the consent agreement and because of Judge Collette’s ruling. Dave Bing isn’t going to represent us because he doesn’t have the guts, and he’s listening to the wrong attorneys. Crittendon was just doing her job following the Charter. What’s wrong with that?”

James Cole, Jr. who attended the hearing in front of Collette with a group from “Free Detroit, No Consent,” called Collette’s ruling “sua spontae.”

“That means he ruled without the real input of the complainants,” Cole explained. “It’s crazy that he pulled it off like that. It was plain error on his part.”

Cole said he wants to file a federal challenge to Collette’s ruling as well.

- James Cole, Jr. (r) with Cindy Darrah and Sandra Hines after June 13 hearing in front of Judge William Collette.

The pleading filed by “We the People” says, “On June 13, 2012, the Michigan Court of Claims by Judge William Collette erroneously dismissed this Civil Action by rendering an “arbitrary” “capricious” “unfounded” “harsh” “untenable” judicial decision that was inconsistent and clearly contrary with “Fundamental Fairness;” “Due Process of Law” and “Equal Protection of the Law.”

They cite legal precedents from Michigan courts including Maldonado v. Ford Motor Co., Barnett v. Hidalgo, and Vicencio v. Ramirez.

Crittendon contends in her suit that the state owes Detroit over $307 million, which would wipe out the city’s current deficit, and eliminate 2,566 layoffs and massive service cutbacks if paid. Michigan Gov. Rick Snyder and Dillon have refused to acknowledge the debts.

- Detroit COO Chris Brown, previously a DTE executive, consults with Atty. Michael McGee before Financial Advisory Board meeting June 28, 2012.

Bing engaged the law firm of Miller, Canfield, Paddock and Stone to argue against Crittendon’s suit before Collette. Attorney Michael McGee of that firm, who admitted he helped draft Public Act 4, argued the case for the consent agreement before City Council on behalf of the Mayor’s office.

Bing has announced that he will no longer use Crittendon or the Law Department to represent the city, despite Charter Section 7.5.209, which says the Corporation Counsel is the legal counsel for the City.

“By filing this motion of reconsideration, on the last possible day to appeal Judge William Collette’s previous ruling, she keeps the legal challenge of the FSA [Financial Stability Agreement, as the consent agreement is titled] alive and she keeps Detroit’s financing at risk, making it harder for us to stabilize the city,” Bing said in a statement.

- Cecily McClellan (l), vice-president of APTE and now a leader of “Free Detroit-No Consent,” demonstrated with others against Mayor Dave Bing in 2010.

“Moreover, the corporation counsel’s lawsuit has already caused the city to pay higher interest rates on its borrowed money and damaged the city’s credit rating. It has caused our lenders to call in a portion of our short-term financing. And, it nearly caused the city to lose a $28-million revenue sharing payment this month, which was avoided only by the efforts of city Chief Financial Officer Jack Martin and the state Treasury Department.”

It was not Crittendon, however, but the three major credit ratings agencies, Standard and Poor’s, Fitch, and Moody’s, who downgraded Detroit’s bond ratings in the midst of the controversy.

Detroit attorney Bob Day earlier called such actions the “dictatorship of the banks,” since the banks finance the ratings agencies.

“This battle is going on in Montreal, Greece, Spain, France and everywhere,” Day said at a rally June 9 calling for a moratorium on Detroit’s $12.4 billion debt to the banks.

“People are saying to hell with the banks and their austerity programs,” Day told marchers in downtown Detroit. “The banks set our communities up for disaster, and when it all fell down, they didn’t get hurt. They got bailed out by our tax dollars. Meanwhile, hundreds of thousands of people are out of their homes, and the loss of tax revenues to our cities has brought in Public Act 4 and emergency managers, which guarantee that the banks will get paid first. This is nothing but a dictatorship of the banks.”

Moody’s explained its downgrade on June 14.

- Greeks expressed mass anger after Moody’s downgraded their credit rating again citing a risk of default despite an earlier debt write-off deal.

“Moody’s Investors Service has downgraded the City of Detroit’s (MI) General Obligation Unlimited Tax (GOULT) and Certificates of Participation (COPs) ratings to B3 from B2 due to recent events that have highlighted risks associated with the city’s illiquid cash position and lack of a clear political consensus to successfully implement the city’s Financial Stability Agreement (FSA).Concurrently, Moody’s has downgraded the city’s General Obligation Limited Tax (GOLT) rating to Caa1 from B3. The GO, COPs and GOLT ratings remain on review for possible downgrade pending completion of the sale of the Michigan Finance Authority’s Local Government Loan Program Revenue Bonds, Series 2012B (Second Lien) and Series 2012C (Third Lien), along with the release of the escrowed proceeds from a private placement loan with Bank of America Merrill Lynch (BAML)(long term rated Baa1/ratings under review for possible downgrade).

The loans cited are NOT related to the $137 million short-term loan the Michigan Finance Authority issued to the city under terms of the consent agreement.

“Moody’s also downgraded the ratings for the Detroit Water and Sewage Enterprise Revenue debt to Baa2 (Senior Lien) and Baa3 (Second Lien) as the risk of a city bankruptcy filing has incrementally increased in light of persistent liquidity pressures at the city level and ongoing political instability,” Moody’s said. “ This rating action also applies to the Sewage Disposal System Revenue and Revenue Refunding Senior Lien Bonds, Series 2012A. Ratings for the Detroit Water and Sewage Enterprise Revenue Bonds remain under review for possible downgrade pending the completion of the above referenced Michigan Finance Authority sale along with the release of the escrowed funds from the private placement with BAML.”

In past years, bond ratings for the Detroit Water and Sewerage Department (DWSD), which is currently being dismantled under U.S. District Court Judge Sean Cox’s oversight, have ranged around AAA. It is likely Wall Street wants to sever the DWSD from city ownership.

To read “We the People” lawsuit, click on Crittendon intervenor filings. To contact “We the People for the People,” call Cornell Squires at 313-460-3175.

THIS IS VERY IMPORTANT ??? ***Me KEITH D-II*** ***Love*Peace*Out***

http://www.youtube.com/watch?v=ski1CF1vgQw&feature=share