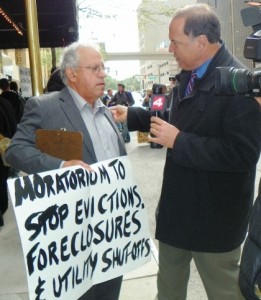

- Anthony King (center) lived in his home 41 years, caring for his parents before their deaths there. Members of Moratorium NOW!, other groups and his neighbors moved him back in March 11, 2009, but he eventually lost his home, as have millions of others across Detroit and the U.S. King is featured in Michael Moore’s movie, ‘Capitalism: A Love Story.” Photo by Diane Bukowski

By Jerry Goldberg January 14, 2013

By Jerry Goldberg January 14, 2013

Two settlements were announced Jan. 7 in ongoing legal actions against the major banks for abuses in placing millions of homes into foreclosure throughout the U.S. But both only help banks, not homeowners.

In one settlement, the Office of the Controller of the Currency (an agency of the federal Treasury Department) and Federal Reserve, in exchange for a meager payment of $8.5 billion by the banks, agreed to lift consent decrees under which they had placed major mortgage lenders. Under the decrees, the lenders were required to review 4.3 million foreclosures initiated in 2009 and 2010. The banks involved in the settlement were Aurora, Bank of America, Citibank, JP Morgan Chase, MetLife Bank, PNC, Sovereign, SunTrust, U.S. Bank and Wells Fargo.

The Office of the Controller had mandated independent foreclosure reviews of every foreclosure conducted or initiated in 2009 and 2010 for two reasons. One was due to massive abuses by the banks in placing homeowners not in default into foreclosure. The other was lenders’ failures in implementing federal programs mandating evaluations of homeowners for loan modifications under the Home Affordable Modification Program.

The Office of the Controller had mandated independent foreclosure reviews of every foreclosure conducted or initiated in 2009 and 2010 for two reasons. One was due to massive abuses by the banks in placing homeowners not in default into foreclosure. The other was lenders’ failures in implementing federal programs mandating evaluations of homeowners for loan modifications under the Home Affordable Modification Program.

Under the OCC Financial Remediation Framework of June 21, 2012, homeowners claiming servicing errors on their mortgages were to have their foreclosures suspended pending review, reversed if violations were discovered, and paid compensation ranging from $5,000 to $15,000 for those still in their homes and $125,000 plus lost equity to those who illegally lost their homes.

The U.S Government insures banks against losses when they make loans under their FHA program. When these loans go bad, the banks get their money back while the government takes ownership of the property. These government-owned properties are called HUD Homes – named after the department that handles their liquidation. In Detroit, over half the evictions being conducted are done by the government.

The OCC paid private contractors $1.5 billion to conduct reviews for the 495,000 homeowners who applied for them. Another 3.8 million homeowners eligible for review did not apply because they never received applications or because they were demoralized by the constant bad news they received from the banks. (http://www.huffingtonpost.com, Jan. 7)

Not one homeowner received the promised relief! And despite the published regulations, not one foreclosure was suspended pending reviews with lawyers representing the banks. The federal government continues to execute foreclosures in direct violation of its own regulations.

The settlement provides a pool of $3.3 billion in direct payments to eligible borrowers. This amounts to only $868 per homeowner, comparable to the meager payments extended to homeowners under the previous Attorney General/federal settlement announced several months ago. Another $5.5 billion will be allocated for loan modifications — probably to “incentivize” the same banks that refused to carry out the modifications in the first place — and for forgiveness of deficiency judgments on foreclosures that never should have happened.

Bank of America & Fannie Mae settlement

In the second mortgage settlement, also revealed Jan. 7, Bank of America announced it would pay $8.5 billion to Fannie Mae to settle claims by the U.S. Justice Department that Bank of America and Countrywide, the notorious subprime lender taken over by Bank of America, had sold Fannie Mae and Freddie Mac 30,000 defective and fraudulent mortgages worth $1.4 trillion from Jan. 1, 2000, through Dec. 31, 2008. The $8.5 billion is a tiny fraction of the $300 billion that was lost on these mortgages as a result of Countrywide’s and Bank of America’s practices. (Deutsche Well, Jan. 7; huffingtonpost.com, Jan. 7)

In the second mortgage settlement, also revealed Jan. 7, Bank of America announced it would pay $8.5 billion to Fannie Mae to settle claims by the U.S. Justice Department that Bank of America and Countrywide, the notorious subprime lender taken over by Bank of America, had sold Fannie Mae and Freddie Mac 30,000 defective and fraudulent mortgages worth $1.4 trillion from Jan. 1, 2000, through Dec. 31, 2008. The $8.5 billion is a tiny fraction of the $300 billion that was lost on these mortgages as a result of Countrywide’s and Bank of America’s practices. (Deutsche Well, Jan. 7; huffingtonpost.com, Jan. 7)

Because Fannie Mae and Freddie Mac were completely taken over in 2008 by the federal government as part of the Housing and Economic Recovery Act, this settlement means that taxpayers will be responsible for $290 billion in losses not recovered from the banks.

Feds still bail out banks while people suffer

These new mortgage “settlements” reflect the collusion of the federal government with the banks in the housing debacle that continues to cost millions of working-class families their homes.

While the corporate-owned media try to make it sound like the foreclosure crisis has ended, as of the third quarter of 2012 there were 1.17 million homes in the foreclosure process. (dsnews.com, Dec. 21) In that quarter, mortgage servicers initiated 252,604 new foreclosures. More than 11 percent of all mortgages were delinquent, with 4.4 percent seriously delinquent, meaning 60 or more days past due. (OCC report, Dec. 21) A 1 percent seriously delinquent rate would have been considered a national crisis 10 years ago.

While the corporate-owned media try to make it sound like the foreclosure crisis has ended, as of the third quarter of 2012 there were 1.17 million homes in the foreclosure process. (dsnews.com, Dec. 21) In that quarter, mortgage servicers initiated 252,604 new foreclosures. More than 11 percent of all mortgages were delinquent, with 4.4 percent seriously delinquent, meaning 60 or more days past due. (OCC report, Dec. 21) A 1 percent seriously delinquent rate would have been considered a national crisis 10 years ago.

The federal government has fully nationalized the mortgage industry. Seventy-five percent of all mortgages originated since 2008 are guaranteed by Fannie Mae or Freddie Mac. The remainder of the loans are insured by the Federal Housing Agency. Private mortgage securitization has completely disappeared.

Taxpayers have already paid $180 billion to cover the losses on payments to the banks on failed mortgages insured by the government. According to the January 2010 Congressional Budget Office Report, the CBO estimates the tab for this taxpayer bailout as $389 billion, with many estimates much higher.

While the banks make record profits by servicing government-backed mortgages and selling them to borrowers at inflated interest rates, homeowners continue to be deprived of their homes by the callous and fraudulent practices of the bailed-out banks.

Homeowners, renters and all concerned activists must continue to organize and demand that the federal government put the people before the banks. We need a moratorium on all foreclosures and foreclosure-related evictions and an immediate reduction in principal, so mortgages reflect the true value of homes. With the federal takeover of the mortgage industry, President Barack Obama can implement these policies today through an immediate executive order.

Goldberg is a people’s attorney in Detroit who fights the banks in foreclosure cases, as well as a leading organizer in the Moratorium NOW! Coalition to Stop Foreclosures, Evictions & Utility Shutoffs.

This web site offers huge level of riches within the posts. Thanks for the excellent study…

Pingback: BANKS BAILED OUT, PEOPLE SOLD OUT IN US SETTLEMENTS – voiceofdetroit | Foreclosure Online News

Pingback: BANKS BAILED OUT, PEOPLE SOLD OUT IN US SETTLEMENTS – voiceofdetroit | snack news

Pingback: BANKS BAILED OUT, PEOPLE SOLD OUT IN US SETTLEMENTS – voiceofdetroit | Foreclosure News