By Diane Bukowski

Feb. 17, 2013

DETROIT – The day before a state review team leaked information about a negative report on Detroit’s finances, the Moratorium NOW! Coalition filed suit on Feb. 14 in Wayne County Circuit Court demanding “release and copies of the City of Detroit’s bond issues and interest rate swaps with the banks.” The city’s debt totals $16.9 billion through 2032. It paid $597 million on that debt in the last fiscal year.

David Sole (r) holds sign while Rev. Charles Williams Sr. addresses rally against banks May 9, 2012.

“The lawsuit is to launch an independent review of the City’s massive debt service payments to the same banks which caused the financial crisis in the city with their racist predatory lending practices that resulted in 150,000 foreclosures from 2005-2010,” said Dave Sole, the named plaintiff in the suit, in a release.

“The Emergency Manager Act guarantees the banks ‘payment in full of the scheduled debt service requirements on all bonds, notes and municipal securities,’ even if it means selling city assets such as Belle Isle and the Water Department, laying off more workers, cutting more city services, or attacking the pension system for retirees. Governor [Rick] Snyder’s and Mayor[Dave] Bing’s ‘financial stability agreement’ incorporates these guarantees to the banks by giving the banks direct control the city’s finances.”

The Detroit Free Press reported Feb. 17 that the Financial Review Team completed its report Feb. 15.

“The report, which the state-appointed review team completed after meetings in Detroit on Friday, outlines monstrous debts and a chronic inability to reverse course, highlighted by infighting and disagreements between Bing and the council,” said the Free Press.

It added, “State officials and others would not release the full report before Snyder reviews it this week. The report is the culmination of weeks of the review team’s work scouring Detroit’s books after the governor ordered an emergency financial review of the city as it faced adding $90 million more to its accumulated deficit.”

Sole said the Moratorium NOW! Coalition is demanding a people’s audit of those same books and debts.

Joe O’Keefe of Fitch Ratings and Stephen Murphy of Standard and Poor’s at Detroit City Council table Jan. 31, 2004, foisting $1.5 billion loan on city.

“We are doing this to mobilize and educate the people regarding the role of the banks in destroying our city,” said Sole, a retired Detroit Water and Sewerage Department worker and union leader. “We are contacting other organizations and individuals to join in forming a broad coalition. This takeover of Detroit is the result of a conspiracy by ratings agencies such as Standard and Poor’s, which the Federal government has accused of fraud in a $5 billion lawsuit, and banks such as UBS, which foisted a $1.5 billion pension obligation certificate loan on Detroit in 2004 and just agreed to pay a $1.5 billion penalty for criminal interest-rate rigging in the LIBOR lawsuit. These loans and ratings downgrades have triggered defaults and financial penalties even including the Detroit Water and Sewerage Department, which is an enterprise agency.”

Sole said the group will be recruiting experts to analyze the documents once they are received. He first filed a Freedom of Information Act request for the documents in January, but despite a promise from the city that it would respond promptly, it has failed to do so.

With regard to the review team, Michigan Gov. Rick Snyder appointed it Dec. 18, under provisions of Public Act 72, the predecessor to Public Act 4, repealed by voters in November. He did so despite the Detroit City Council’s majority cave-in Dec. 11 to all demands by his and Dillon’s offices.

The Michigan Supreme Court on Jan. 13 refused to hear an appeal of a suit filed by Robert Davis against Detroit Public Schools Emergency Financial Manager Roy Roberts, which said that PA 72 is dead according to state law.

The legislature and Governor enacted another emergency manager law during its December lame duck session. It includes appropriations to pay EM’s, a provision which allegedly makes it exempt from voter repeal. It will take effect March 27, 2013.

In response to VOD’s request for a copy of the review team report, Snyder’s press secretary Sara Wurfel said, “[We] don’t have and haven’t seen [the] report, and my understanding is it’s not final yet either. Soonest slated to receive is Tuesday. Sorry, bottom line is that it’s certainly not appropriate for me to comment on anything Gov/we haven’t gotten or seen yet. RT [Review Team] hasn’t completed work by sending to the Governor either, which also makes any comment from me even more inappropriate and completely speculative.”

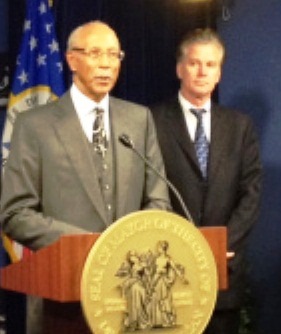

Ken Whipple (center) and Darrell Burks (rear) of Financial Advisory Board also sit on Financial Review Team. They are shown here announcing more furlough days for city workers.

VOD has nonetheless filed an FOIA for a copy of the report with the Governor and State Treasurer Andy Dillon, who heads the review team. Its other members are state Auditor General Thomas McTavish, Ken Whipple, board chairman of Korn/Ferry International; Darrell Burks, a senior partner with PricewaterhouseCoopers; Ronald Goldsberry of Deloitte Consulting; and Frederick Headen, a legal adviser for the state Treasury Department.

Whipple and Burks are also members of the Financial Advisory Board appointed under a Public Act 4 consent agreement with the city of Detroit. The FAB just imposed additional furlough days on unionized city workers, despite the fact that negotiations are ongoing with the city’s unions and that the continued existence of the FAB and the consent agreement are legally questionable.

Related documents and articles:

PR lawsuit for Detroit debt docs

http://voiceofdetroit.net/2013/02/06/usdoj-slams-standard-poors-with-5-billion-fraud-lawsuit/

http://voiceofdetroit.net/2013/01/18/the-gang-rape-of-detroit

http://voiceofdetroit.net/2013/01/14/banks-bailed-out-people-sold-out-in-u-s-settlements/

http://voiceofdetroit.net/2012/12/19/ubs-admits-fraud-in-1-5-billion-libor-rigging-settlement/