- “Report” focuses on payment of city’s debt

- Attacks City Charter, unions, suits filed against PA 4

- Malcolm X had the answer for Black majority cities like Harlem and Detroit

By Diane Bukowski

Analysis

February 26, 2013

DETROIT – The Detroit Financial Review Team, whose members are described in a VOD article published yesterday, issued a scathing report Feb. 19, alleging a mammoth financial hurricane is descending on the city. They called for the appointment of an emergency financial manager. Michigan Gov. Rick Snyder has said he will decide the matter this week, although he has 30 days.

The announcement was covered across the globe. Detroit is the world’s largest majority-Black city outside of Africa, and also has the highest poverty rate of any major U.S. city.

During a press conference Feb. 19, State Treasurer Andy Dillon, who led the team, said it had unanimously found “there’s a financial emergency in the city, with no plan in place to correct the situation.”

“The city has had deficits every year since 2005, masking those with long term borrowing,” Dillon said. “Under government accounting rules, long-term borrowings are deemed revenue. If this had not been done, the city’s accumulated deficit would have grown from $327 million to $937 million. Its long-term liabilities are approaching $14 billion.”

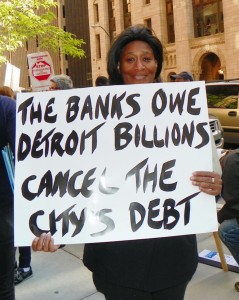

The major goal of a series of “emergency manager” acts has been to ensure that every penny of the debt cities across the country have been forced into by Wall Street before and after the global economic meltdown of 2008 gets paid. Many activists in the city have demanded a simple solution to this debt problem: declare a moratorium on Detroit’s debt, action which former Detroit Mayor Frank Murphy campaigned for during the Great Depression of the 1930’s.

The Financial Review Team “report” itself says, “The City has substantial long-term debt. As of June 30, 2012, such debt, exclusive of unfunded actuarial accrued pension liabilities and other post-employment benefits, exceeded $8.6 billion. However, upon inclusion of those other obligations, the City’s total long-term debt was $13.6 billion. (Total long-term debt is $14.99 billion depending upon whether $1.4 billion in pension system assets is, or is not, factored in the unfunded actuarial accrued liabilities.)”

Click on DFRT letter to RS and DFRT facts, figures to read what purports to be the Financial Review team report in full.

So Dillon included in his remarks Detroit’s “unfunded actuarial accrued pension liabilities and other post-employment benefits.” As noted in VOD’s article, “Detroit Financial Review Team Represents Global Banksters,” the state of Michigan itself does not declare those items in its annual statements, leading the Institute for Truth in Accounting to admonish Michigan as well as 45 other states for deceptive accounting practices.

Dillon said the Mayor and City Council face “serious hurdles” in addressing this pre-eminent problem of paying off the banks.

“These include the governance structure of the city, and impediments from the City Charter,” he said. “While we all know there is a financial strain on the city, there’s also not an ability or mechanism in place for city to address the finding of an emergency. . . For the past couple of hours, we’ve been reaching out to the Mayor, City Council members, and Lansing legislators to let them know our findings. Our relationship doesn’t have to be adversarial. Look at Pontiac and other cities [under EFM’s], we have partnerships with the managers there.”

State “partnerships” with emergency managers in Pontiac, Flint, Benton Harbor and elsewhere, all majority-Black cities, have in fact resulted in the sale of many of those cities’ major assets, in addition to lay-offs and service cutbacks, to pay off the banks.

(E.g. click on http://www.unitedwater.com/newscenter.aspx?id=6836 for article on privatization of Pontiac’s water department.)

Detroit Mayor Dave Bing issued a statement Feb. 20 subtly agreeing with Dillon’s allegations while saying the city does have a plan in place.

“To the contrary, my administration has worked diligently to develop and implement a restructuring plan for the City of Detroit,” Bing said. “In fact, our plan was reviewed and accepted by all stakeholders, including the State and the Financial Advisory Board [FAB]. We have the plan, but we face significant challenges executing it in a timely manner. We are hindered by several factors, including the City Charter, labor agreements, litigation, governmental structure, and a scarcity of financial and human resources. Further exploration of ways to mitigate these barriers for more timely implementation of my initiatives should be examined.”

The attack on the voter-approved Detroit City Charter, unions, and lawsuits filed by various entities against PA 4 and the consent agreement, particularly that filed by former Corporation Counsel Krystal Crittendon, is virtually a proto-fascist assault.

The attack on the voter-approved Detroit City Charter, unions, and lawsuits filed by various entities against PA 4 and the consent agreement, particularly that filed by former Corporation Counsel Krystal Crittendon, is virtually a proto-fascist assault.

The state’s demands come after Bing and the City Council majority have essentially bent over and let down their pants to comply with every state directive since a “Fiscal Stability [consent] Agreement” was reached April 4, 2012.

Thousands of city workers have been laid off, three federally-funded city departments have been shut down, and a Public Lighting Authority has been approved, which will result in the dismantlement of 40 percent of the city’s lighting infrastructure. Large swaths of city-owned land are being turned over to private corporations like Hantz Farms and Pulte Homes.

The last contractor just demolished a section of buildings on the city’s near east side, claiming it was out of the generosity of their hearts. But thousands of Detroiters who were driven out of their choice riverfront, working-class homes during the Graimark debacle know that it was Pulte Homes which developed those properties.

Costly contracts have been let to Miller Canfield, Ernst & Young, and Miller Buckfire (Stifel) at Dillon’s demand, notwithstanding the fact that Kenneth Whipple, who sits on both the Review Team and the FAB, sits on Miller Buckfire’s advisory board as well. The Financial Review Team report specifically does not include as “revenue” the $137 million state loan to Detroit, most of which has Dillon has withheld to get his wishes. After 10 months, $80 million is still outstanding.

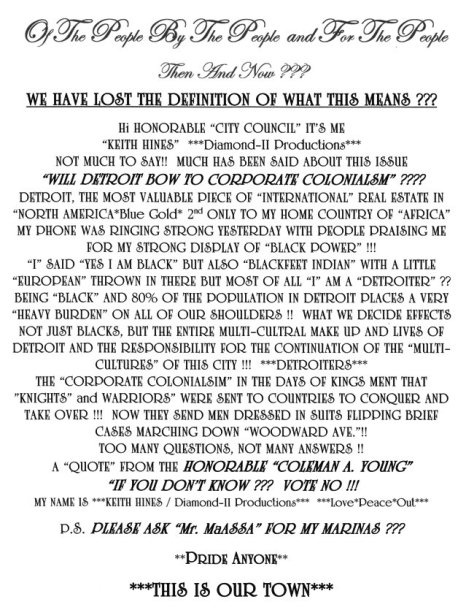

Massive resistance by Detroiters at City Council meetings, including 600 who turned out for the Hantz Farms hearing, has met with brutal treatment by police who have physically ejected many from Council meetings at the direction of Council President Charles Pugh. Most recently, Keith Hines of Diamond II Productions was literally dragged out. Previously, Rev. Charles Williams Sr. was attacked by three cops, and former Detroit School Board member Marie Thornton was manhandled.

KEITH HINES: WILL DETROIT BOW TO CORPORATE COLONIALISM:

With l that in mind, let’s look at some of the history leading up to this latest assault on the MAJORITY-BLACK City of Detroit.

With l that in mind, let’s look at some of the history leading up to this latest assault on the MAJORITY-BLACK City of Detroit.

First of all, Michigan voters overwhelmingly repealed the emergency manager law, Public Act 4, on Nov. 6. PA 4 repealed the previous emergency financial manager law, Public Act 72.

The state constitution says clearly, “Whenever a statute, or any part thereof shall be repealed by a subsequent statute, such statute, or any part thereof, so repealed, shall not be revived by the repeal of such subsequent repealing statute.” .

However, the Michigan Supreme Court refused to hear Highland Park School Board member Robert Davis’ appeal of a lower court decision which declared PA 72 was reinstated with the repeal of PA4. (This despite the fact that Supreme Court Chief Justice Robert Young cited the statute above during closing arguments on whether PA 4 should go on the ballot.)

Rev. Edward Pinkney of Benton Harbor is interviewed during protest against EM and Snyder May 7, 2011.

Now PA 72 includes a note, “THIS SECTION IS REPEALED BY ACT 436 OF 2012 EFFECTIVE MARCH 28, 2013,” eferring to the new EM law enacted by Snyder during the legislature’s lame duck session in December.

PA 72 spells out specific events which must take place to trigger a state financial review of a city’s finances. (Click on PA 72 conditions for review mcl-141-1212 to read all the circumstances.)

The Review Team identified Sections 12J and 12K as the violations in their final report, which is described as “supplemental” to the actual report, so far unseen.

Section 12J says, “The local government has violated the requirements of sections 17 to 20 of the uniform budgeting and accounting act, 1968 PA 2, MCL 141.437 to 141.440, and the state treasurer has forwarded a report of this violation to the attorney general.”

Noting this, VOD contacted Sara Wurfel of Michigan Gov. Rick Snyder’s office, Terry Stanton of Dillon’s office, and Joy Yearout of Attorney General Bill Schuette’s office to request a copy of that letter. So far, nothing has been produced.

Section 12K says, “The local government has failed to comply with the requirements of section 21 of the Glenn Steil state revenue sharing act of 1971, 1971 PA 140, MCL 141.921, for filing or instituting a deficit recovery plan.”

But the review team “report” says “On December 27, 2011, City officials filed an audit report that reflected a $196.6 million cumulative deficit in the General Fund, a $97.2 million cumulative deficit in the Transportation Fund, and a $17.1 million cumulative deficit in the Automobile Parking Fund. However, City officials did file, as legally required, an adequate or approved deficit elimination plan with the Department of Treasury.”

The 21-page “review” document begins with the statement, “This document is supplemental to our report of February 19, 2013, and is intended to constitute competent, material, and substantial evidence upon the whole record in support of the conclusion that a financial emergency exists within the City of Detroit.”

(VOD filed Freedom of Information Act requests for the ACTUAL review on Feb. 15, but so far, not surprisingly has heard nothing from the state within and since the five days they are given to respond under state law.)

The review team purports to have “poured” in depth over the city’s finances. However, most of the figures in the report are taken directly from city financial statements and audits. The team says they did this “pouring” during a series of meetings, for instance:

“On December 20, 2012, Review Team members Andy Dillon, Darrell Burks, Ronald E. Goldsberry, Frederick Headen, and Thomas H. McTavish conducted a series of meetings in the City of Detroit with Linda Bade, City Assessor; Charles Pugh, City Council President; Gary Brown, City Council President Pro Tem (by conference telephone); Kenneth V. Cockrel, Jr., Councilmember; Irvin Corley, Jr., Fiscal Analyst, Fiscal Analysis Division (City Council); Mary Anne Langan, Deputy Fiscal Analyst, Fiscal Analysis Division (City Council); Mark Lockridge, Deputy Audi-tor General; David Whitaker, Director, Research and Analysis Division (City Council); Jerry Pokorski, Financial Consultant; Jack Martin, Chief Financial Officer; William Andrews, Program Management Director; Cheryl Johnson, Finance Director and City Treasurer; Gaurav Malhotra and Daniel Jerneycic, of the certified public accounting firm Ernst & Young; Donald Austin, Fire Commissioner; Edsel Jenkins, Deputy Fire Commissioner; Chester Logan, Interim Police Chief; Charles Wilson, Chief of Staff; Todd Bettison, Commander, Communications Operations; Scott Hayes, Director, Technology Services Bureau; Tina Tolliver, Second Deputy Chief, Budget Operations; Patrick Aquart, Human Resources Director; and Lamont Satchel, Labor Relations Director; Dave Bing, Mayor; and Kirk Lewis, Deputy Mayor and Chief of Staff.”

WHEW! What a day! One wonders how thorough could any of those meetings have been, and why didn’t the Review Team meet with the other six members of the Detroit City Council? It appears likely that the meetings were conducted so the Review Team could give orders to the City officials involved.

Later, the following two series of meetings took place which included representatives of Miller Buckfire, which counts Review Team and FAB member KennethWhipple among its advisory board members. Whipple was even present in the Feb. 1 meeting.

“On January 16, 2013, Review Team members Andy Dillon (by conference telephone), Darrell Burks, Ronald E. Goldsberry, Frederick Headen, and Thomas McTavish (by conference telephone), met with William Andrews, Program Management Director; Jack Martin, Chief Financial Officer; David Brayshaw, of First Southwest Company; Lamont Satchel, Labor Relations Director; Suzanne Taranto, Milliman Company; Cheryl Johnson, Finance Director and City Treasurer; Donita Crumpler, Manager, Debt Management Division; Gaurav Malhotra, of the certified public accounting firm Ernst & Young; and Kenneth A. Buckfire, of Miller Buckfire and Company.

“On February 1, 2013, Review Team members Andy Dillon, Ronald E. Goldsberry, Frederick Headen, Thomas McTavish (by conference telephone), and Kenneth Whipple met with Lamont Satchel, Labor Relations Director; William Andrews, Program Management Director; Jan Anderson, Program Management Deputy Director; Jack Martin, Chief Financial Officer; Gaurav Malhotra, Daniel Jerneycic, and Juan Santambrogio, of the certified public accounting firm Ernst & Young, and James Doak, of Miller Buckfire and Company.

So much for impartiality and thoroughness. And from where did First Southwest pop up?

Bloomberg Business says, “First Southwest Company (FSC) is an investment banking and financial advisory firm. The firm provides private placement, underwriting of public offerings of debt or equity securities, mergers and acquisition, divesture, debt refinancing, and valuation advisory services. . . . FSC was founded in 1946 and is headquartered in Dallas, Texas. It has more than 20 offices in United States. First Southwest Company operates as a subsidiary of PlainsCapital Bank.”

First Southwest is also a founding member of the Bond Dealers Association. Getting ready to issue some more debt and slurp up some huge interest rates, are we? Thought Detroit’s problem was that it already has too much debt.

First Southwest is also a founding member of the Bond Dealers Association. Getting ready to issue some more debt and slurp up some huge interest rates, are we? Thought Detroit’s problem was that it already has too much debt.

“Headquartered in Dallas, PlainsCapital Corporation is one of the largest independent financial institutions in the U.S. with 330 locations in 42 states and over 3,700 employees,” says Wikipedia. But wait, other reports say Hilltop Holdings just acquired PlainsCapital.

So where’s the cowboy with the ten-gallon hat associated with this deal, riding in from Dallas, and what does he have to do with the interests of the people of Detroit? We’ll wait and see. It is more than evident that all these big fish gobbling up smaller fish are intent on gobbling up Detroit and its people as well, by any means necessary.

Let’s conclude by listening to Malcolm X’s version of “By Any Means Necessary,” given to the people of Harlem, another Black city like Detroit.

Super analysis !!! Incredible how the State of Michigan demands fiscal accountability from Detroit yet does not have the same!