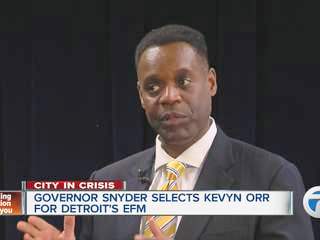

- Citgroup lawsuit involves 7 other Jones Day clients

(VOD—According to federal court records, this ongoing lawsuit includes numerous clients of Jones Day, Detroit EFM Kevyn Orr’s law firm, as plaintiffs, although the firm did not handle this particular litigation. In addition to Citigroup, which has now settled, other defendants in the case, which are Jones Day clients or subsidiaries of them, include:

-

Detroit EFM Kevyn Orr said at press conference that there is a “firewall” between Jones Day and its clients as relates to City of Detroit debts, and that he is no longer with the firm. However, he failed to disclose that Jones Day has been tapped to be Detroit’s re-structuring counsel.

Banc of America Securities, LLC

- Barclay’s Capital Inc.,

- Deutsche Bank Securities Inc.

- Goldman Sachs & Co.

- JPMorgan Chase & Co.

- Morgan Stanley & Co. Inc.,

- UBS Securities LLC

A list of Jones Day clients (at least some, since it does not include UBS, which is cited elsewhere on the Jones Day website) is available by clicking on JONES DAY CLIENT LIST.).

By Zeke Faux and Patricia Hurtado – Bloomberg

Mar 19, 2013

Citigroup Inc. (C), the third-largest U.S. bank by assets, agreed to pay $730 million to settle claims it misled debt investors about its condition during the financial crisis.

The deal would resolve a lawsuit by investors who bought Citigroup bonds and preferred stock from May 2006 through November 2008, the New York-based lender said yesterday in a statement. The accord requires court approval and would be covered by existing litigation reserves, the bank said.

Citigroup is among the Wall Street firms still dealing with the fallout from the crisis, when the bank almost collapsed amid losses tied to subprime mortgages and took a $45 billion bailout. The company has repaid the rescue. Last year, the firm agreed to pay $590 million to settle a lawsuit brought by stock investors who said they’d been misled.

“At the time they were selling these securities, in reality Citigroup was effectively insolvent,” Steven Singer, a partner at Bernstein Litowitz Berger & Grossmann LLP who represented the debt investors, said in a phone interview.“They were presenting the company to be in substantially stronger financial position than it in reality was.”

Citigroup said in the statement that it still denies the allegations and agreed to the settlement to avoid the cost and uncertainty of litigation. Shannon Bell, a spokeswoman for the bank, declined to comment further in a phone interview.

Corporate Bonds

The lawsuit was filed in federal court in Manhattan in 2008, with investors claiming Citigroup misled purchasers of 48 issues of its corporate bonds. Plaintiffs in the case include the Louisiana Sheriffs’ Pension and Relief Fund, Minneapolis Firefighters’ Relief Association and the City of Philadelphia Board of Pensions and Retirement.

Citigroup’s bonds dropped as losses piled up during the collapse of the U.S. mortgage market. Its $4 billion of 10-year notes, issued in November 2007, slid as low as 79.7 cents on the dollar in 2008, according to data compiled by Bloomberg. The firm lost more than $29 billion in 2008 and 2009.

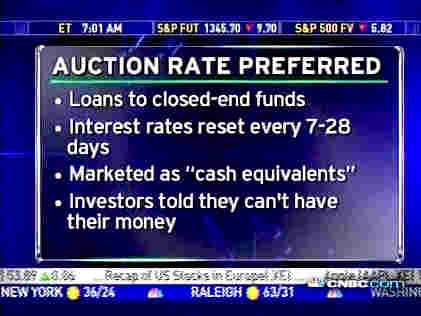

In 2010, U.S. District Judge Sidney Stein denied part of a motion by Citigroup to dismiss the case. Stein threw out claims that involved alleged lack of disclosure about auction-rate securities and part of the plaintiffs’ case related to structured investment vehicles.

In 2010, U.S. District Judge Sidney Stein denied part of a motion by Citigroup to dismiss the case. Stein threw out claims that involved alleged lack of disclosure about auction-rate securities and part of the plaintiffs’ case related to structured investment vehicles.

The 10-year notes climbed above face value to 118.6 cents yesterday, the data show. Citigroup’s stock has gained about 17 percent this year and was little changed in after-hours trading yesterday, following the settlement’s announcement.

The plaintiffs said in a memorandum of law to the court that they “have concluded that the terms and conditions” of the accord “are fair and reasonable and in their best interest.”

The case is In Re Citigroup Bond Litigation, 08-cv-09522, U.S. District Court, Southern District of New York (Manhattan).

To contact the reporters on this story: Zeke Faux in New York at zfaux@bloomberg.net; Patricia Hurtado in New York at pathurtado@bloomberg.net

To contact the editors responsible for this story: Michael Hytha at mhytha@bloomberg.net; David Scheer at dscheer@bloomberg.net